By: BCM Investment Team

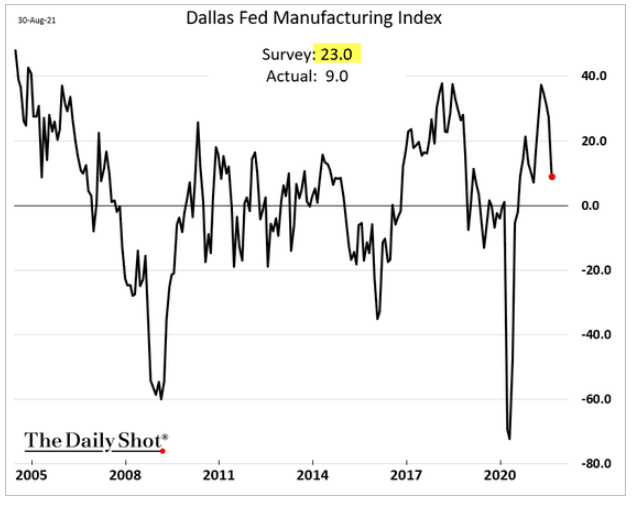

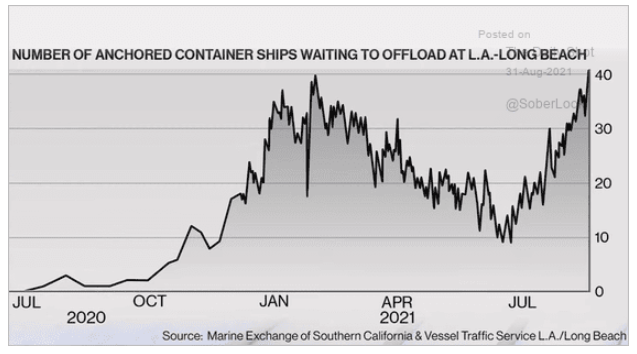

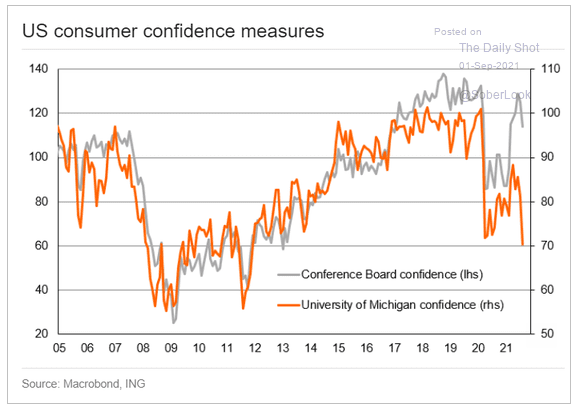

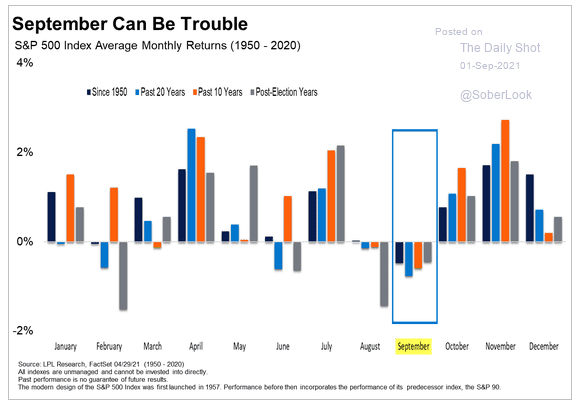

Manufacturing activity is slowing across the U.S. as the nation grapples with the Delta variant and significant supply-chain bottlenecks; the latest survey out of the Dallas Fed dramatically underperformed market expectations and traffic backups at West Coast ports are at multi-year highs. These concerns, among others, are weighing down consumer confidence—but not necessarily the S&P 500® Index. Could that change as we move into September? Comments out of Jackson Hole last week allayed any fears of a Fed taper kicking off in the immediate term, but with such a heavy balance sheet will the effects be any less dramatic a few months down the road? Finally, as inflation heats up in Germany—and across the Eurozone as a whole—manufacturing activity is slowing across Asia. China appears to be bearing much of this burden, experiencing nearly zero manufacturing growth in August as export orders slump and manufacturers cut staff. Will conditions grow worse as companies grapple with the sweeping new government regulations?

Quick editorial note: In observance of the holiday weekend and the approaching end of summer, Fireside Charts will be posting with some reduced frequency over the next two weeks. While we won’t be following our typical 3x/week schedule, we won’t be disappearing completely so keep an eye on your inbox for insights from our PM team.

- All but one of the regional Fed manufacturing surveys has shown retrenchment. Perhaps the Dallas Fed’s was exacerbated by weather and Covid:

- Do any have computer chips?

- Consumer confidence is taking another hit due to the Delta outbreak:

- Consumer confidence and the S&P are usually more correlated:

- ‘Tis the season:

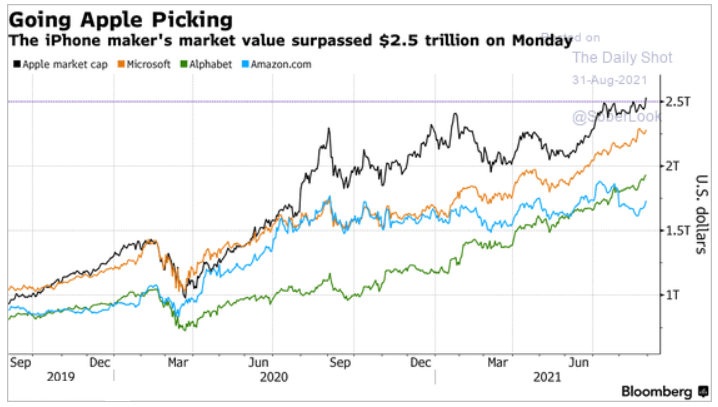

- The big get bigger:

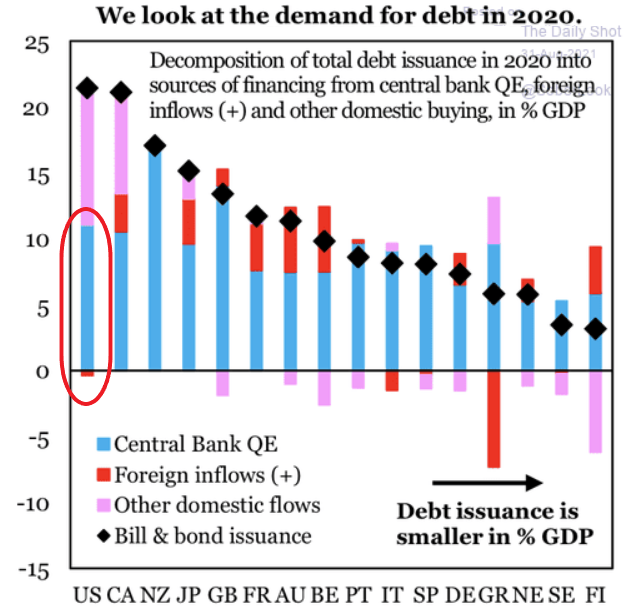

- When ~1/2 the demand for our Treasury bonds is from the Fed, how can the Fed taper? This is before the $1.5 trillion infrastructure and the $3.5 trillion social bills:

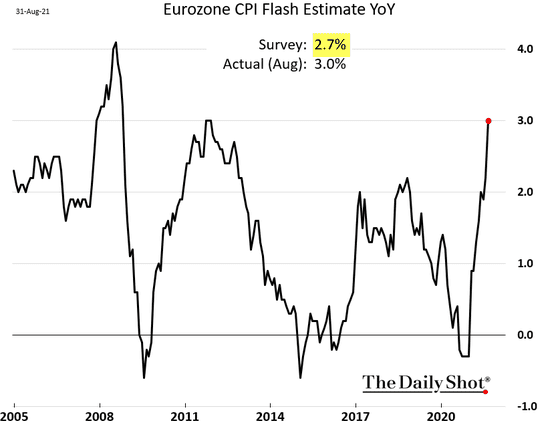

- Germany’s inflation continues to climb despite the majority of its yield curve being in negative rate territory:

- Will Europe’s inflation be transitory as well?

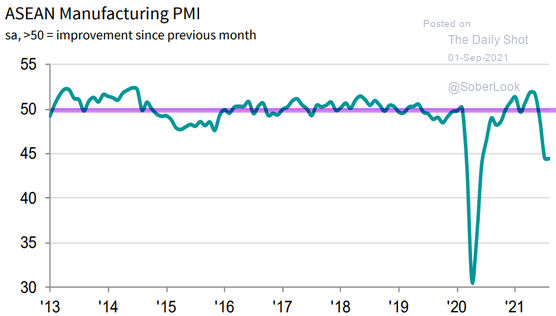

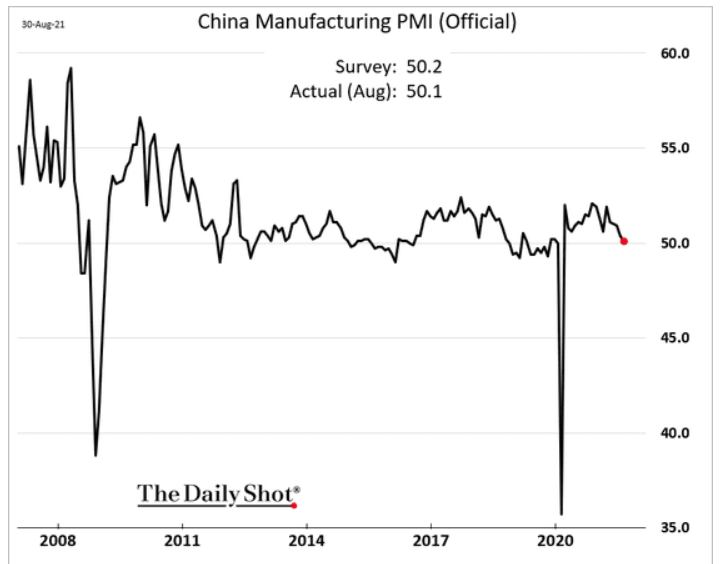

- The Covid outbreak in Asia and the resulting shutdowns, etc. is showing up in their manufacturing PMIs:

- China’s official PMI is back to pre-pandemic levels and is barely positive:

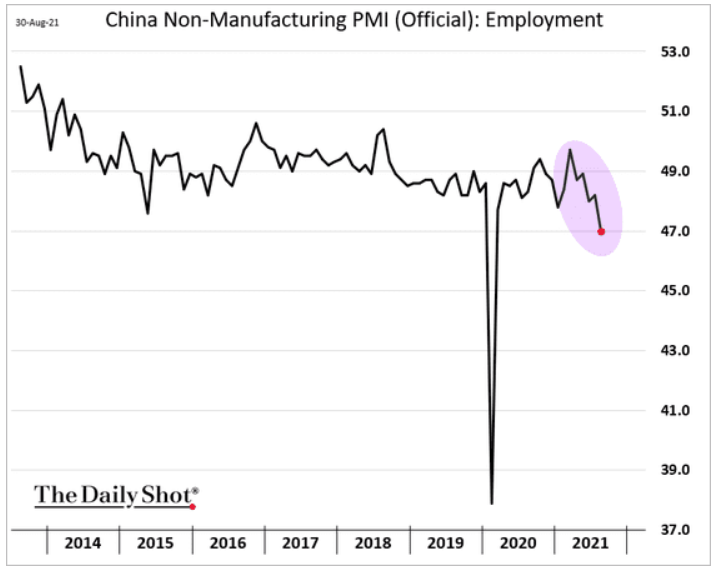

- Government crackdowns and Covid closures are not helping as China’s Services actually shrank last month:

This article was contributed by Beaumont Capital Management Investment Team, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.