By Komson Silapachai

The last FOMC meeting in December solidified the Fed pivot, indicating several rate cuts for this year and revealing an economic forecast that was a “Goldilocks” scenario: good-enough economic growth, falling inflation, and the intention to ease policy into those conditions. In response, financial assets staged a rally across equities and fixed income.

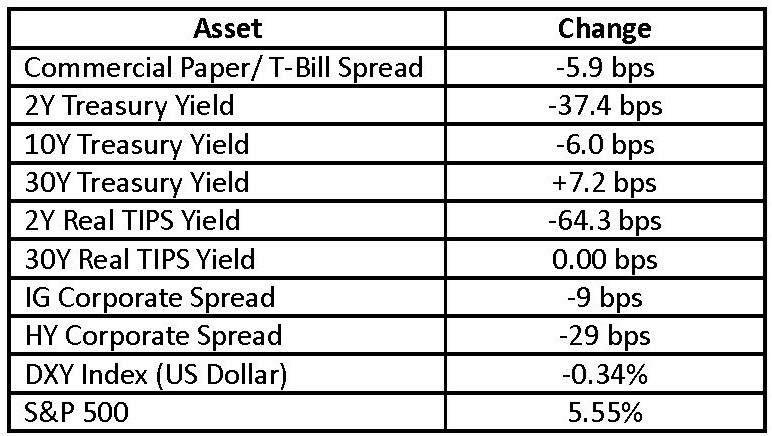

The picture is a mirror image of the tightening of financial conditions given the bond selloff that happened in the third quarter. Financial conditions are a collection of asset prices and interest rates that have the potential to affect the real economy, and are typically comprised of money market rates, bond yields, credit, and equity prices. Here is the performance of the most common market-based components of financial conditions since the December FOMC decision:

The Change in Financial Conditions Indicators Since the December FOMC Meeting

Source: Bloomberg, Sage as of 1/26/2024

The biggest beneficiary of the Fed pivot has been short-term interest rates, particularly real yields. As real yields should represent the expectation of future Fed policy rates, it makes sense that 2-year real-yields have rallied by 64 basis points in a little over a month. Corporate bond sectors continue to grind tighter, with the spread on investment grade corporate bonds now standing at 93 basis points over treasuries, which we believe provides very little room for error over the next 12 months.

How has economic data evolved since the last meeting?

- The latest GDP print capped off a solid year for US economic growth, with GDP up 3.3% for the fourth quarter (versus 2.0% expected) and 3.1% for the year.

- Nonfarm payrolls grew by 216k jobs in December while the unemployment rate stayed put at 3.7%, lower than consensus expectations. To add uncertainty to the labor outlook, there was a 71k downward revision for jobs in prior months, as well as a decline in temporary hiring for the eleventh straight month. Job openings also continued to decrease.

- Inflation was also a mixed bag: CPI came in above expectations for December, growing at a 3.4% rate (versus 3.2% expected), and up 3.9% excluding food and energy, which is well above the FOMC’s target. However, producer prices rose by much less than expected.

All in all, data continues to paint a mixed picture for the economy, and conditions haven’t changed enough to throw the FOMC off its policy path, so there is no expectation of a shift in policy during the meeting this week; however, investors will be watching closely for any signaling around the possibility of a March cut.

Given the dovish message by the FOMC in December, as well as concerns around financial stability, we believe the Fed stays the course with a focus on preserving the labor markets and remaining on track to cut rates at some point in the first half of this year if inflation continues to trend lower. However, much of these expectations have been reflected in market pricing, which informs our caution in taking on substantial credit risk right now.

For more news, information, and analysis, visit the ETF Strategist Channel.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.