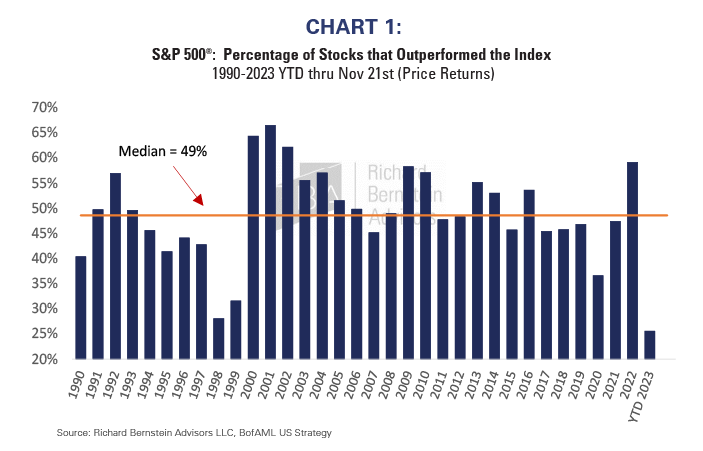

Whether famous or infamous, the Magnificent 7 stocks have been 2023’s stock market story. They have dominated indices to the point that some Large Cap Growth Funds no longer qualify as diversified portfolios under the 1940 Act, and they have dominated market performance so much that markets have the narrowest leadership since the Technology Bubble (see Chart 1)

Narrow leadership is typically the result of deteriorating fundamentals in the broader market. When the profits cycle decelerates, investors gravitate to the fewer and fewer companies that can maintain growth during an increasingly adverse backdrop. Leadership narrows as fundamentals deteriorate, and growth becomes scarce.

With that in mind, the Magnificent 7’s significant outperformance might be justified if they were truly unique. Unfortunately, that is not the case. Rather, it increasingly seems investors’ enthusiasm for these seven stocks is a reflection of today’s speculative, momentum-driven market. But investors’ myopia has resulted in tremendous opportunities elsewhere.

There are more than 7 growth opportunities in the world…

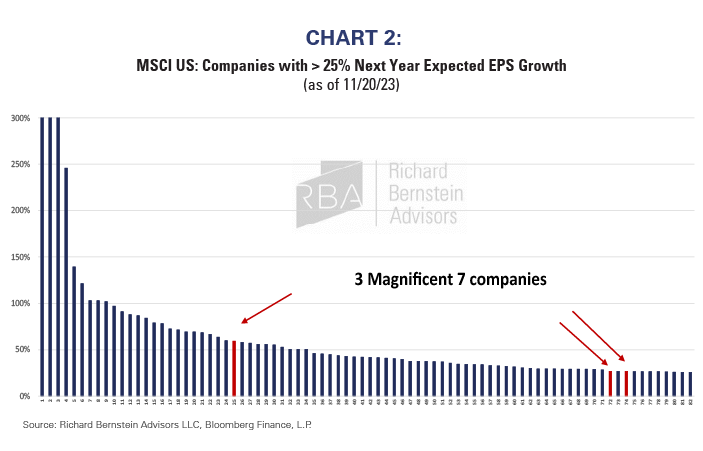

In order to determine if there really are more than 7 growth stories in the equity markets, we did a screen of US companies having forecasted year-to-year earnings growth of 25% or more. 25% is an arbitrary, but widely accepted growth hurdle often used by growth investors.

As shown in Chart 2, 82 US companies passed our growth screen, which certainly demonstrates the universe of growth stocks is much larger than the Magnificent 7. More importantly, only 3 of the Magnificent 7 companies actually passed the screen and they ranked only #25, #72 and #74. It’s pretty clear there is nothing particularly unique about the Magnificent 7’s fundamentals. Rather, price momentum and excitement around the story alone seems to be luring investors to the stocks.

…and they’re not even predominantly mega caps…

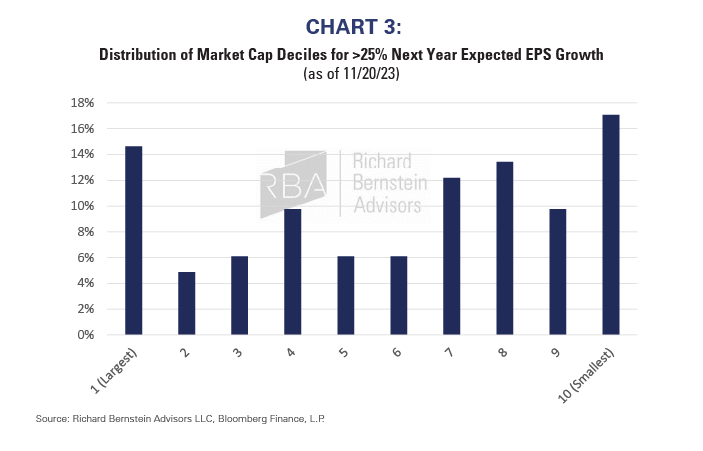

Investors are currently concentrating mostly on the largest stocks, and some do indeed pass our screen, but there are two critical points embedded in Chart 3:

First, our analysis suggests that investors’ myopic focus on the Magnificent 7 may be causing them to ignore other large cap growth stocks. The median year-to date performance of the remaining 79 stocks that passed our screen was just 7%, highlighting the neglect of other stocks with similar earnings growth momentum.

Second, smaller stocks within the MSCI US universe comprise nearly 60% of the growth stocks passing our screen. These stocks seem to be more fertile ground for growth than the mega caps.

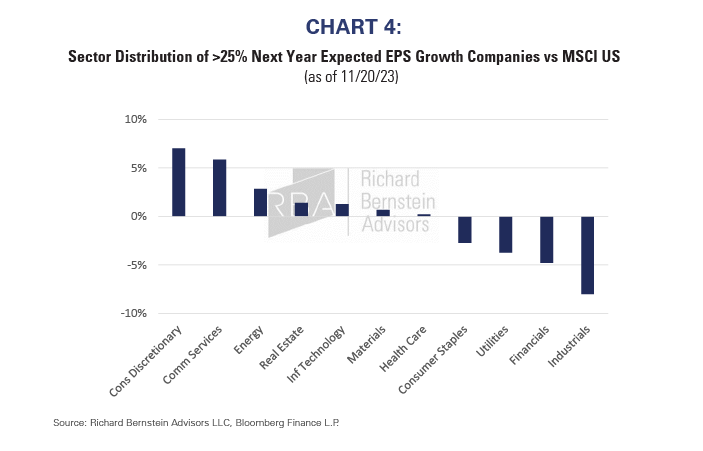

…and they’re not all Tech!

Growth opportunities exist in sectors other than Technology. Chart 4 shows the sector composition of the companies that passed our growth screen relative to that within the MSCI US Index. Traditional growth sectors, like Consumer Discretionary and Communications, are overweighted in our screen, but Energy actually ranks higher than does Technology, and Real Estate and Materials are nearly identical to Tech.

Overweight “everything else”

Investors focus on this narrow group of stocks and their resulting dominance in major cap-weighted indices has caused an extreme lack of diversification in many classic investment vehicles. RBA’s role since inception has been to provide diversification and exposure to ignored investment opportunities.

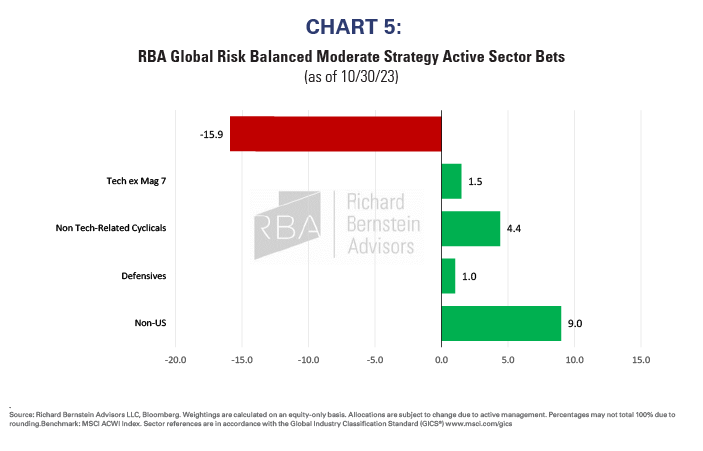

The Magnificent 7 don’t appear as unique as their outperformance would suggest. At the same time, other sectors’, sizes’ and countries’ (i.e., everything else) fundamentals appear under-appreciated. We continue to believe that “everything else” presents a once-in-a-generation investment opportunity. Chart 5 represents the diversification we offer in that our portfolios are significantly underweight the Magnificent 7, but overweight just about “everything else”.

Investors seem to be shunning the benefits of diversification to trade individual stocks. History suggests that isn’t a prudent decision for building wealth.

For more news, information, and analysis, visit the ETF Strategist Channel.