By Doug Sandler, CFA, & Kevin Nicholson, CFA

SUMMARY

- Multiple crosscurrents are creating volatility, in our view.

- We see near-term pressure to the downside.

- However, we expect stocks to be by year-end than the current level on the S&P 500.

Stock Market Volatility to Remain High, But We Believe Investors Will Be Rewarded for Their Endurance.

We expect equities to be rangebound with near-term pressure to the downside. We continue to prefer domestic equities over international markets due to the US’ better economic footing. We also anticipate the leadership tug-of-war between growth stocks and value stocks to continue until inflation and interest rates stop rising. Additionally, fixed income is becoming more attractive from a nominal yield perspective, but inflation-adjusted (real) yields remain deeply negative, which is why we remain underweight the asset class.

Unlike 2021, where economic tailwinds outweighed economic headwinds; financial markets are grappling with multiple crosscurrents in 2022 leading to significant financial market volatility. Over the coming months we anticipate more of the same, as outlined in RiverFront’s 2022 Outlook: Riding the Recovery. We believe that those who can endure the volatility will be rewarded by year-end. The tailwinds and headwinds along with our conclusions are summarized below.

Tailwinds: Strong Economic and Earnings Growth

- Economies are re-opening as COVID-19 cases recede: COVID-19 cases are declining in the US and the rest of the world. Lower instances of new cases are allowing economies to re-open and begin getting back to normal. This was evidenced in the Eurozone’s Q4 GDP, which was up 4.6% over 2020 and surpassed its previous high made in Q3 of 2019.

- Corporations are adapting to inflation and stock markets are discounting the heightened risk: We believe US corporations are some of the best adapters in the world and this ability is on display in their latest earnings reports. Over 60% of S&P 500 companies have reported Q4 2021 earnings thus far, with 76% beating estimates.

- Investors are also adapting to rising inflation by becoming more pessimistic and demanding higher returns from stocks: The valuation of the S&P 500 has dropped roughly two multiple points since the beginning of the year and is currently trading at times 2022 estimated earnings of $222.13.

- Credit spreads remain behaved: Economic weakness is often foreshadowed in the bond market where investors tend to be more risk averse. Credit spreads – which are the additional premium a bond investor demands over Treasuries to offset the risk of default – have only widened modestly and have remained relatively behaved throughout 2022.

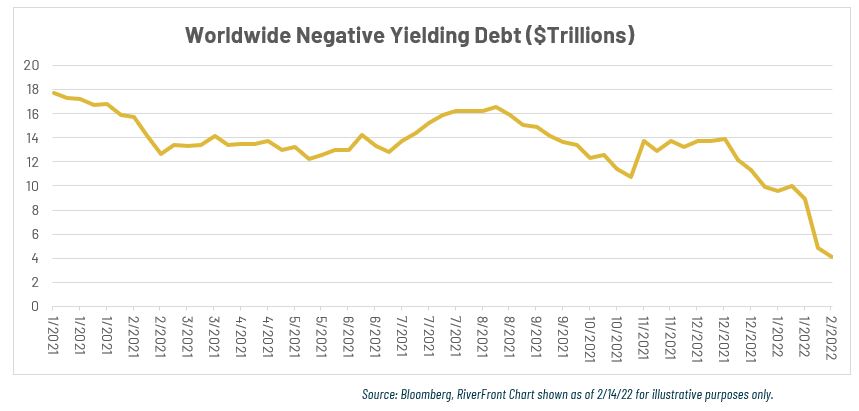

- More options for savers: As central banks throughout the developed world consider interest rate hikes, longer term interest rates are rising. As a result, the amount of negative yielding debt has been dramatically reduced from nearly $18T to $4T. This means more government debt paying interest which lessens the punishment to traditional ‘savers’ in our view. (See chart, below).

Headwinds: High Inflation and Rising Interest Rates

- Inflation remains high: The Consumer Price Index (CPI), which was reported last week, rose 7.5% on all goods and 6% on core goods (ex-food and energy). The report surprised investors who had expected some cooling of inflation after the holidays and the COVID-19 Omicron variant-related slowdowns.

- The risk of a policy mistake is rising: In our view, the Federal Reserve (Fed) is being too slow to respond to rising inflation and will need to raise rates more significantly than we originally thought. The flattening yield curve, which represents the difference between short and long-term rates, combined with the fact that the Effective Federal Funds (Fed Funds) futures market is now pricing in a eflects this concern. Persistent inflation will force the Fed to be more pre-emptive and less data dependent, meaning they will have to hike rates at consecutive meetings without having the luxury of hiking and waiting to see how the data comes in before making the next hike.

- Fed uncertainty and rising interest rates may cap the upside for stocks in the short-term: Until the Fed begins to act on March 16th, we believe that the upside for US stocks may be capped. Stocks may also be capped in the short run as the yield on the 10-year Treasury Note, approaches 2%, and more competitive with dividend yields, which remain below 1.5%. Historically, dividend yields have been inferior to bond yields since dividends and stock prices have the potential to rise. Therefore, we do not expect the yield differential to be a long-term concern.

- Geopolitical Risks Rising: The standoff between Russia and the West regarding a possible Ukrainian invasion is causing additional volatility in markets and placing further upward pressure on commodity prices. While we believe Russia has ultimately more to lose than gain by an invasion, this headline risk will likely be with us for the foreseeable future.

Conclusions

- Still bullish: We remain cautiously optimistic on global stock markets in 2022 because we believe that companies can continue to grow earnings faster than inflation.

- Volatility not going away: Stocks will likely be range-bound over the next few months with near term pressure to the downside as inflation and interest rate headwinds dominate headlines, in our view.

- Flexibility is key: Flexibility in Allocation (stocks vs. bonds), Weightings (underweight or overweight) and Selection (growth vs. value) will be important drivers of returns as the market navigates these cross currents.

- Message for different investor types:

- Distribute and Sustain: We believe one of the most common mistakes that ‘distribute’ and ‘sustain’ investors make is to abandon their investment plan when volatility rises. This mistake can be particularly costly in a range-bound market, since the opportunity to ‘sell low’ and ‘buy high’ occurs more frequently. We believe range-bound markets call for a lighter touch, where smaller and more frequent portfolio adjustments are made, rather than wholesale changes. For example, our more risk averse, short-horizon portfolios have reduced risk recently, but remain slightly overweight stocks relative to their baseline benchmarks. They have also increased their exposure to value stocks relative to growth stocks over the past 12-18 months.

- Accumulate: For those investors in the accumulate stage of their investing lifecycle, we think volatility should be seen as a window of opportunity to acquire stocks. For example, our long-horizon portfolios have not only been increasing their exposure to value stocks over the past 12-18 months, they also recently took advantage of the market’s weakness to add additional exposure to mega-cap technology stocks.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

All charts shown for illustrative purposes only. Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For each outcome category (accumulate, sustain, and distribute) RiverFront’s portfolio management team has assigned one or more RiverFront product(s) based on their assessment of the product’s investment objective as it relates to a typical client’s return and risk objectives when seeking investment outcomes of accumulating wealth, sustaining wealth and distributing wealth. The team has also designated RiverFront product alternatives for those clients looking to take more or less risk with the outcome category. The ‘more aggressive’ (or more risk) alternatives will generally have greater equity and international exposure as well as longer time horizon targets, while those designated as ‘more conservative’ (or less risk) will have fewer equities, a lower exposure to international and shorter time horizon targets. Since the risk assessments are dependent on the outcome category selected, RiverFront products may fall in multiple categories. All investments carry a risk of loss and there is no guarantee that an investment product or strategy will meet its stated objectives.

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Changes in the CPI are used to assess price changes associated with the cost of living. The CPI is one of the most frequently used statistics for identifying periods of inflation or deflation.

The federal funds rate is the target interest rate set by the Federal Open Market Committee (FOMC). This is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero).

Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2038215