Fixed Income Outlook in 5 Charts

By Rob Williams, Director of Research

The main factor for markets now is the path of US inflation. The Fed remains hyper focused on bringing down inflation and has shown little appetite to consider wider market volatility, deteriorating conditions, or stresses on the global economy caused by a rising US dollar. Until inflation starts to show signs of cooling (2-3 months of consecutive negative surprises) or there are some serious financial stability concerns, the Fed will continue to tighten financial conditions.

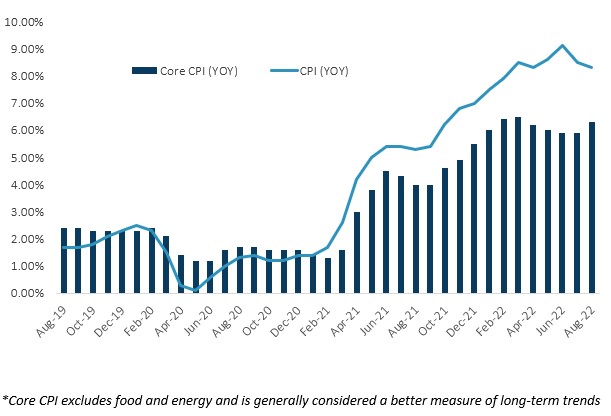

1) The Fed Will Continue Hiking. The most recent Consumer Price Index (CPI) print surprised to the upside and was an indicator that prices and inflation are still too high for the Fed’s liking. While the labor, manufacturing, and rental markets are showing progress, gasoline prices have started to tick higher.

Consumer Price Index

Source: Sage, Bloomberg

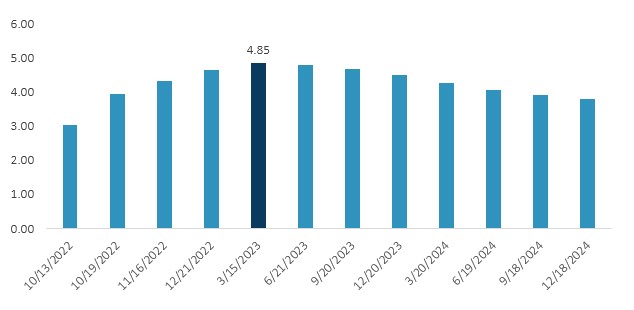

2) Markets Are Pricing in a Higher Terminal Fed Funds Rate. Real interest rates continue to rise and have surpassed their post-Great Financial Crisis high. SOFR futures is an indicator of the market’s expectations for Fed policy. SOFR futures are pricing a peak policy rate in Q2 next year of 4.75% to 5%. The good news is that the market is largely pricing in this terminal rate.

Secured Overnight Financing Rate (SOFR) Futures Curve

Source: Sage, Bloomberg

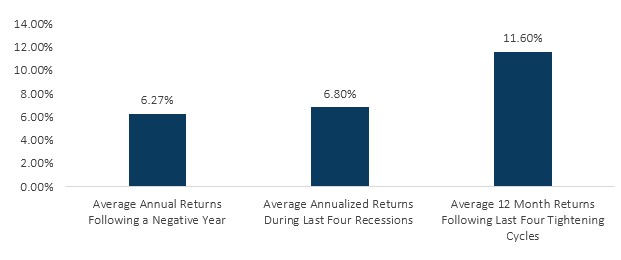

3) Looking Past the Near-Term for Fixed Income. Slowly moderating inflation and pockets of strength in the economy will likely keep the Fed hiking rates into year-end. As a result, rates and fixed income returns will continue to feel pressure in the near-term. Beyond that, historically, we are approaching a strong period for fixed income. The periods following Fed cycles, negative bond market years, and recessions have all seen strong fixed income returns.

Bond Market Returns Over the Coming 12 Months

Source: Sage, Bloomberg

*Average returns following a negative bond market have been on average 6% (assumes -10% in 2022) *Recessions are usually associated with positive bond market returns (+6.8% on average for the last four) *Bond markets typically rally post-Fed cycle, anticipating cuts (+11.8% in the 12 months following the last four cycles)

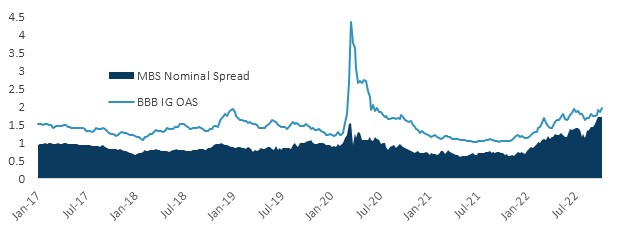

4) Spreads on Mortgage-Backed Securities are on Par with BBB Corporates. The national average rate on a 30-year mortgage is now over 7%, which is the highest in 20 years. MBS spreads have widened to a level not seen since the depths of the Great Financial Crisis and provide an attractive entry point.

MBS Nominal Spread vs. BBB Corporate OAS

Source: Sage, Bloomberg

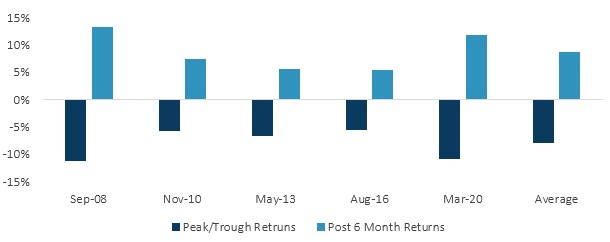

5) Municipal Bonds Are a Defensive Play. Municipal fund outflows have reached a record $100 billion YTD, which has resulted in significant volatility and negative returns. Municipal yields have repriced higher along with Treasuries and provide a very attractive entry point. Also keep in mind that the worst drawdowns in munis over the last 20 years have been short-lived and painful, with an average drawdown of 8%; however, these periods have consistently been followed by strong rebounds of nearly 9%.

Municipal Drawdowns and Rebounds in the Last 20 Years

Source: Sage, Bloomberg

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.