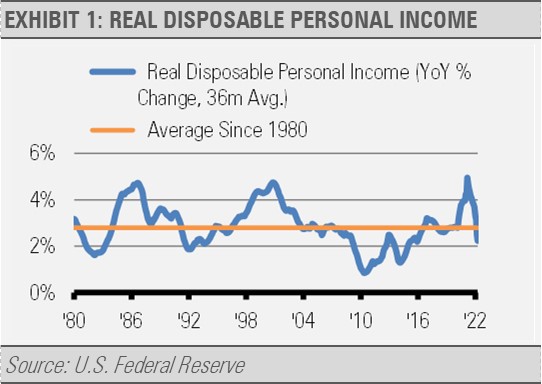

Though we are experiencing many global economic headwinds and challenges at this time, our outlook for the U.S. remains optimistic. Households are a key driver for the U.S. economy, and they are in great shape overall. For example, real (inflation-adjusted) disposable income continues to grow on average over time. After spiking with the COVID related government stimulus, growth in real disposable income has fallen to just below the average level since 1980 on a rolling 36-month basis. We like to use moving averages to smooth out what can be a volatile dataset. Growth in real disposable income remains above the lowest levels seen in the early 1980s, early 1990s, and after the Global Financial Crisis.

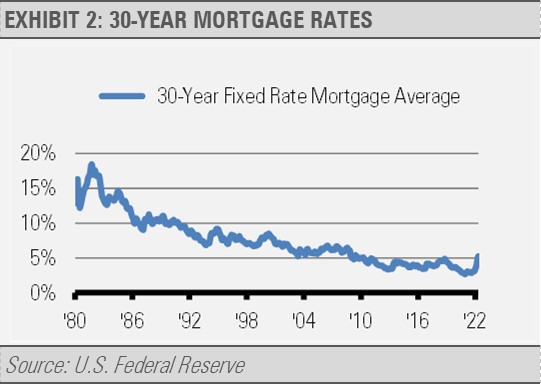

We think that the annualized rate of headline inflation is peaking, and the tight labor supply should keep household incomes growing. Moreover, though mortgage rates have jumped recently, they are coming off exceptionally low levels. Rates today are still low by historical standards and well below where they were during the mid-2000s housing boom.

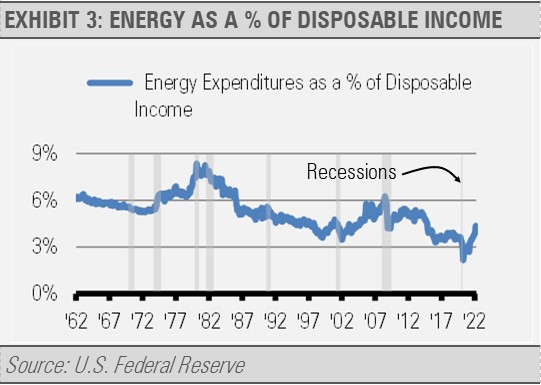

Also, while energy prices have moved higher, household spending on energy relative to disposable income remains well below the levels we experienced during previous oil price spikes, including the higher prices we saw in 2014 and 2008, as well as the early 1980s. In short, though energy prices have increased recently, household spending on energy has not kept up with the increases in disposable income.

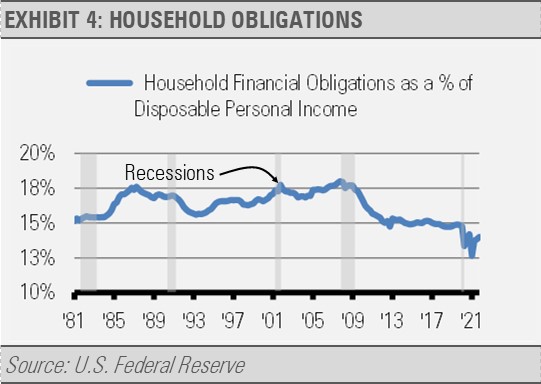

As a result of these factors and others, household financial obligations as a percentage of disposable income remains at a rate well below those seen over the last 40 years.

With income growth solid and households still flush with cash despite spiking inflation, the U.S. consumer continues to be an area of strength for the global economy.

On top of strong household finances overall, industrial production and trade data have also improved lately. Therefore, we expect the current economic growth cycle to continue even as the U.S. Federal Reserve tightens policy.

INVESTMENT IMPLICATIONS

We have positioned our Strategies accordingly to reflect our base-case scenario of continued U.S. economic growth. Financial markets are likely adjusting to higher interest rates based on persistent economic growth and inflation. We think that the environment has created attractive opportunities in certain areas of the equity markets. Our current exposures favor U.S. financials, health care, and small cap value stocks, along with global natural resource companies, which we think can be a great hedge against inflation. Additionally, higher long-term interest rates make intermediate and longer duration fixed income more attractive in our opinion. Lastly, we are holding more cash than usual in most of our Strategies. Increasing cash has provided a bit of a short-term cushion against volatility while we look for good valuation opportunities to potentially accelerate returns during a recovery.

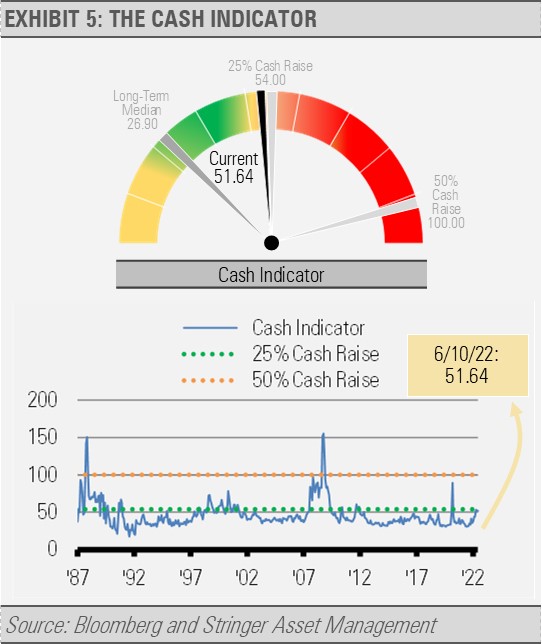

THE CASH INDICATOR

The Cash Indicator (CI) has been useful for helping us judge potential volatility. Though the CI spiked recently, it did not remain above the first level of significance long enough to signal a large reduction in equity risk in favor of cash. While the CI remains elevated, it has fallen back from its recent highs as equity market fear has eased.

The current environment has exacerbated the already significant headline risk that we are experiencing. The CI can be a valuable tool in helping advisors and investors differentiate between high volatility environments and a systematic market breakdown. We have found that having a plan in case of an emergency may provide both perspective and a behavioral relief valve to help bridge temporary volatility, increase confidence, and stay on course. We continue to closely monitor the CI and would be happy to discuss the process.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.