By Brendan Ryan, CFA

For the past few quarters, our positive firm view on the homebuilding sector has been in large part due to the idea of “interest rate lock-in” for existing homebuyers. Put simply, homeowner’s existing mortgages are too attractive to part with, constricting overall housing inventory and making homebuilding companies one of the only sources of supply in the market. While this example may be the most obvious within our economy, we believe the idea extends to corporations as well and offers good reason to believe the Federal Reserve’s oft repeated notion that interest rates have “long and variable lags.”

Although inflation has fallen precipitously of late, the economy has thus far been able to avoid much in the way of a noticeable economic slowdown despite substantially higher interest rates. All else equal, higher interest payments should equal less productive economic activity, yet so far that hasn’t been the case. There may be no other point in history where such a large cohort of existing debt was financed at rates far below prevailing rates. Mortgages are the overwhelming majority of household debt in the U.S., and they remain fixed at low levels for all but the marginal buyer. Any new consumption that is sensitive to interest rates – homes, autos, etc – should be seeing an immediate impact (and they generally are[1]), but other forms of household consumption may well be relatively unaffected by higher rates. The same might be said for the behavior of U.S. Corporations-while marginal financing costs have exploded higher, their existing debt remains locked in at low rates. While new, debt-funded investments may look relatively unattractive, the effect of higher rates on their existing businesses should be relatively muted.

[1] Zillow sales data showed a decline of -30.1% for the trailing twelve months ended July 31st, bested only by June 2023 and May 2023 as the worst trailing twelve-month period on record. Auto sales have continued to increase as inventories fell and remain at historically low levels, total sales remain below pre-covid levels. The price of used cars, which increase when new car inventories are low have fallen -8.7% year over year in July, per the Bureau of Labor Statistics (BLS) July CPI report – indicating demand for autos in aggregate may be waning.

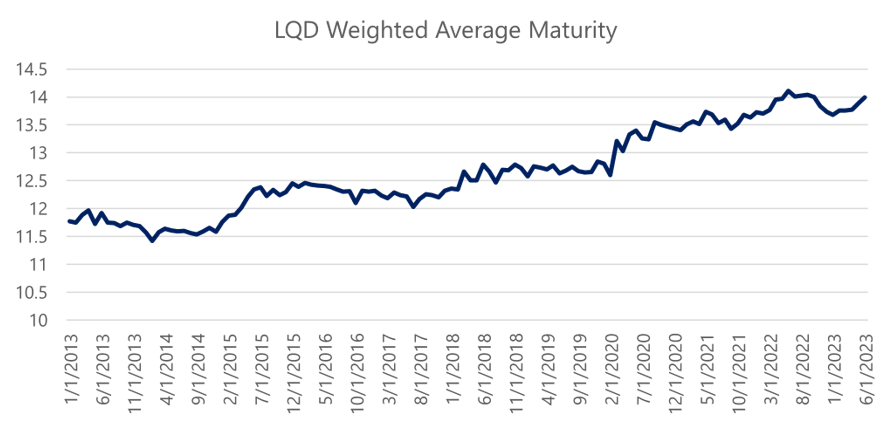

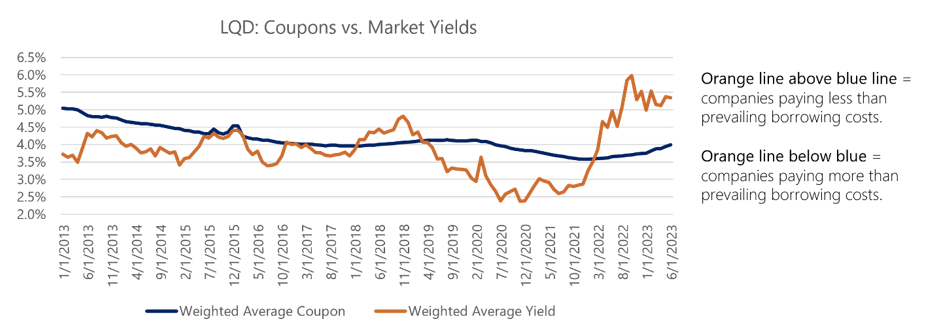

Source: Bloomberg data for LQD ETF 12/31/2012 – 6/30/2023

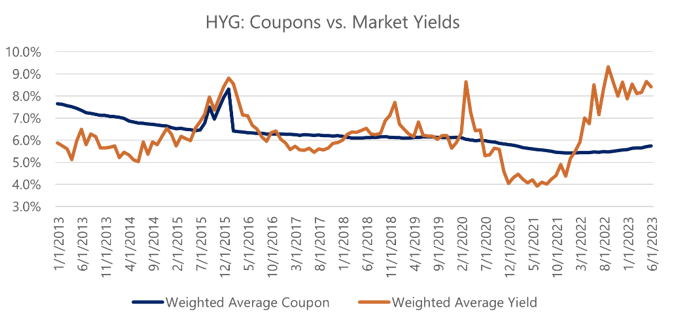

2. Non-investment grade borrowers aren’t given the ability to extend maturity the way investment grade borrowers are, but both issuers are paying much lower interest on the debt they raised than prevailing market rates.

Source: Bloomberg data for LQD and HYG ETF 12/31/2012 – 6/30/2023

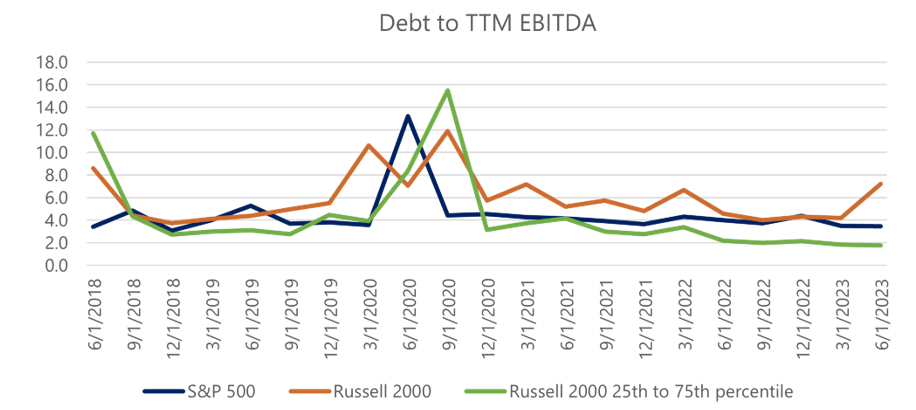

3. Most companies, especially the largest ones, had relatively low levels of debt coming into the higher rate regime of 2022. Only the most desperate companies are increasing their leverage in the current interest rate environment.

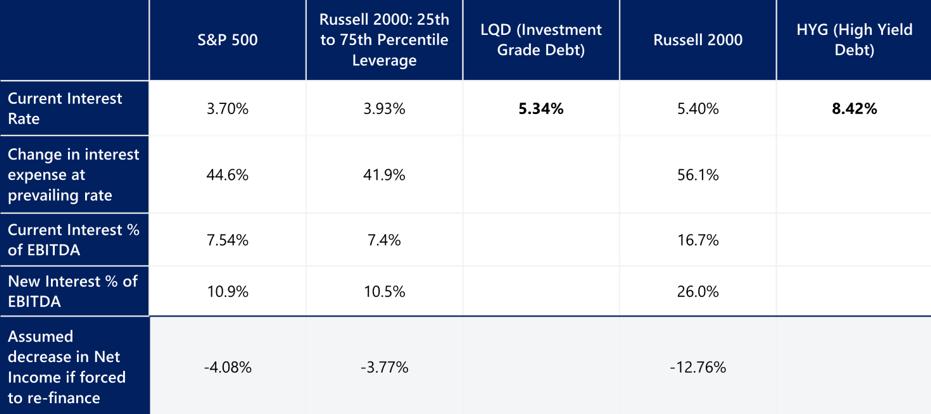

Source: Bottom up company data retrieved from Bloomberg and aggregated by Beaumont Capital Management for dates 12/31/2016 to 6/30/2023

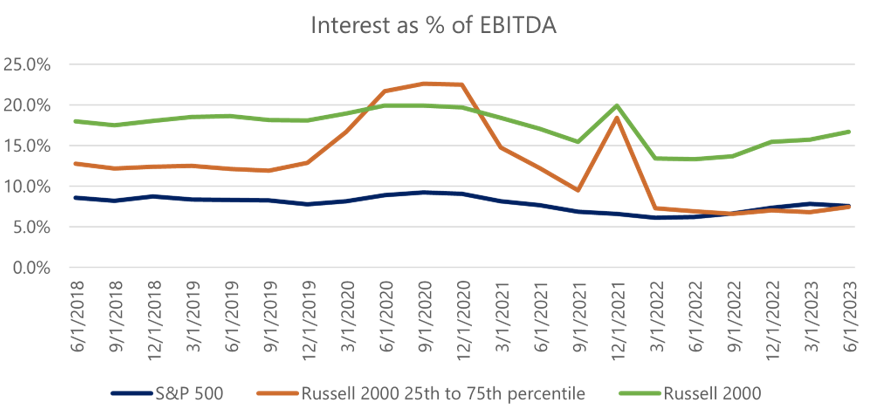

4. Therefore, higher rates are not yet impacting profits.

Source: Bottom up company data retrieved from Bloomberg and aggregated by Beaumont Capital Management for dates 12/31/2016 to 6/30/2023

How long can companies go on unaffected by higher interest rates?

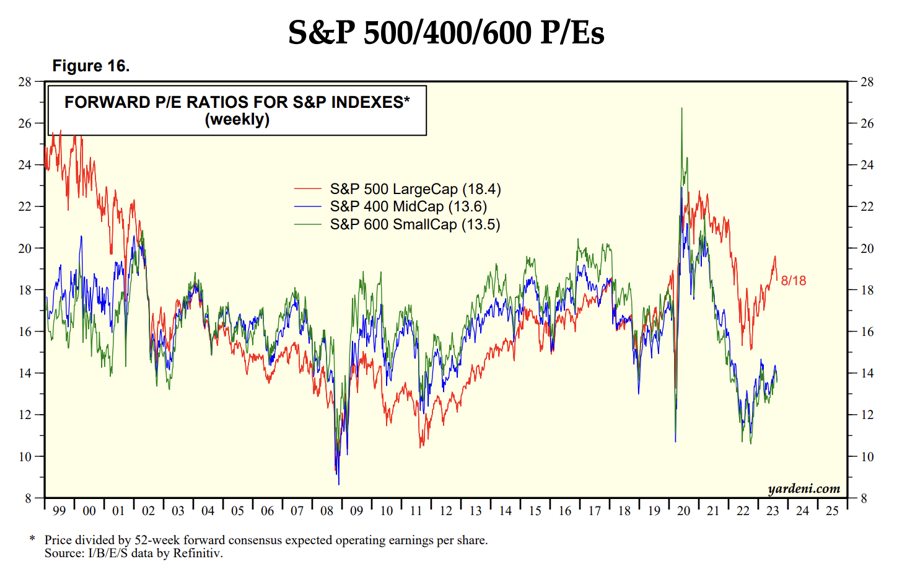

For the biggest and most profitable companies refinancing risks look relatively low. Their average maturity is still over a decade out[2] (assuming they are investment grade). If S&P 500 companies were forced to re-finance all their debt at prevailing investment grade rates, we estimate Net Income would fall 4%, and their EBITDA would still cover interest payments nearly 10 times over. There would be other negative consequences such as lower investment or less leveraged returns of capital, but for the most part this would be a small speedbump. For the least-levered small-cap companies the estimated impact is similar. However, for the rest of the public (and presumably private) business landscape the impact would be substantially larger. Companies which require on-going capital or those with stretched balance sheets may soon be impacted in a major way. The Russell 2000 as a whole would see an immediate earnings hit of almost 13%, and the worst interest coverage of recent memory with interest payments exceeding 25% of EBITDA or under 4x coverage, on par with what the S&P 500 saw at the depths of the financial crises. [3]

[2] The average maturity of investment grade corporate debt per the ETF, LQD is 13.99 yrs per Bloomber data

[3] Yardeni.com – S&P500 financial ratios. Data shows interest coverage of just below 4x in 2007/2008.

Many of these more levered companies are high yield borrowers and have much shorter leashes on their debt maturities. It is easy to see a scenario in which a large cohort of the weakest companies are forced to restructure in relatively short order. While we remain at a very low base, chapter 11 filings have risen 68% so far in 2023.[4]

As it often does, the market seems to appreciate this risk with Small-Cap equities trading at historically anomalous discounts to Large-Cap equities.

[4] Bankruptcy filings surge in first half of 2023 in US, Epiq says | Reuters

It is unlikely that the market is fully discounting the further reaching economic impact of the harsh actions required by any affected companies such as layoffs and massive reductions in spending. For this reason, we would agree with the sentiment that interest rate increases do have lagged effects and would caution that simply because there hasn’t yet been damage doesn’t mean we shouldn’t be cautious of the longer-term impacts of keeping rates high, especially now that inflation has been subdued.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosures:

Copyright © 2023 Beaumont Capital Management LLC. All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Beaumont Capital Management. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Beaumont Capital Management.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

The charts and infographics contained in this blog are typically based on data obtained from third parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk. Diversification does not ensure a profit or guarantee against a loss.

Please contact your BCM Regional Consultant for more information or to address any questions that you may have.

Beaumont Capital Management LLC

125 Newbury St. 4th Floor, Boston, MA 02116 (844-401-7699)

For more news, information, and analysis, visit the ETF Strategist Channel.