Cash Indicator: Markets are functioning properly, but we expect continued volatility.

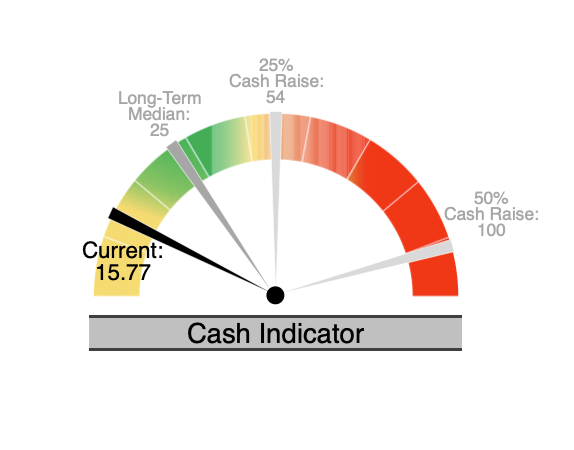

Our proprietary Cash Indicator (CI) provides insight into the health of the market by monitoring the level of fear using equity and fixed income indicators. This warning system is designed to signal us to either a 25% or 50% cash position to potentially protect principle and provide liquidity to reinvest at lower and more attractive valuations.

The CI is well below its long-term historical median. At this level, the CI suggests that markets are not sufficiently pricing in risk and are vulnerable to a downside surprise.

Strategic View: Fixed income valuations remain attractive, as do equities except the few that have rallied recently.

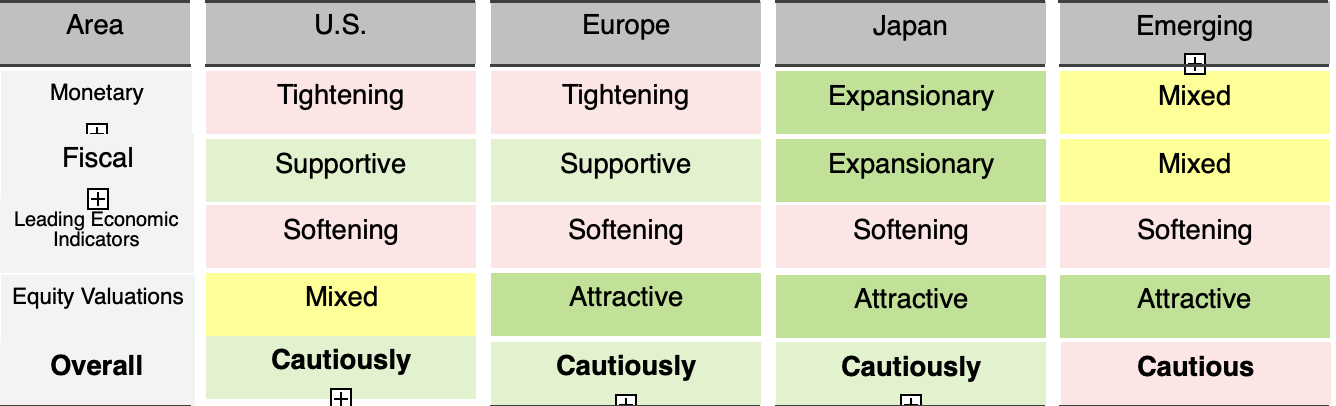

Equity Valuations: Large Cap U.S. equities look expensive, but this is primarily due to the appreciated prices of a few large companies. As a result, we think that attractive valuations may be found in areas of the U.S. equity market that have lagged in recent months as well as in foreign equities.

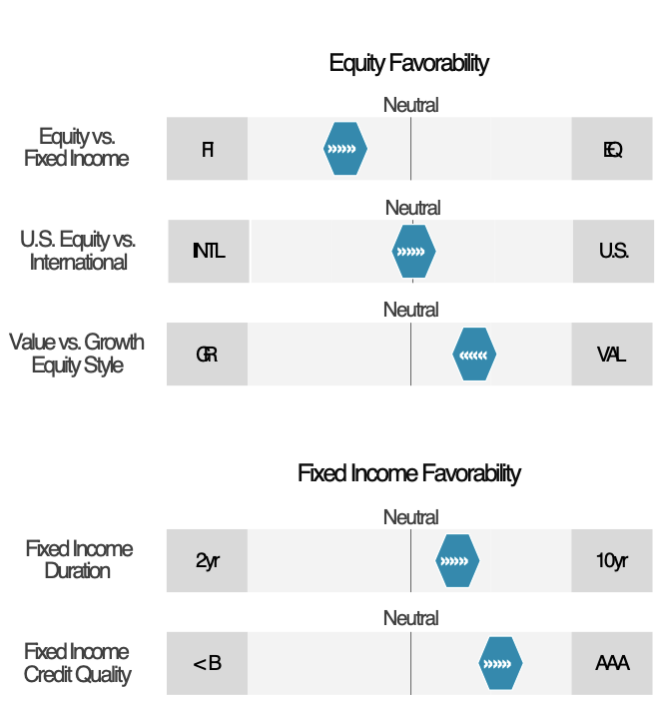

Equity Favorability: We continue to favor defensive equities as we expect global economic and market challenges ahead. We find these areas even more attractive as they have been largely ignored in recent months.

Fixed Income Valuations: With the yield curve persistently inverted and broad money growth falling, we expect headline inflation and long-term interest rates to decline over the next year. The 10-year Treasury yield looks attractive when over 3% while short-term interest rates should stabilize.

Fixed Income Favorability: We remain overweight U.S. Treasuries and have moved from floating rate to fixed rate at the short end of the yield curve while still favoring interest rate sensitivity. We are underweight credit risks as we expect those areas to underperform in a challenging environment.

Tactical View: We favor defensive equity, fixed income, and alternative investments.

We recently increased our equity income exposure as that area has declined in value this year, yet it should perform relatively well in the environment we expect ahead. We also added to Japan as its monetary policy backdrop remains constructive and fundamentals have improved. Additionally, we moved from floating rate to fixed rate short-duration U.S. Treasuries as we think the U.S. Federal Reserve is close to the end of its interest rate hiking cycle. Our work suggests that the next big moves for interest rates will be lower and not higher. With the very narrow rally in domestic equities this year, we are finding a broad array of other attractive investment opportunities including in the healthcare sector, Treasury bonds, MLPs, and equity options overlay strategies.

| Equity |

U.S. » equity income*, health care*, technology* Global » dividends, infrastructure, Japan*, low volatility*, quality* |

| Fixed Income |

short and intermediate-duration asset-backed and mortgage-backed securities, short, intermediate, and longer-duration Treasuries*, taxable munis* |

| Alternatives |

managed futures, master limited partnerships (MLPs)*, equity option overlay strategies* |

*areas that we are tactically emphasizing

Global Broad Outlook: We remain cautious about the global economy and markets as economic weaknesses persist.

For more news, information, and analysis, visit the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.