By Chris Konstantinos, CFA, Director of Investments, Chief Investment Strategist

SUMMARY

- The market thus far, this year, has been much stronger than the typical ‘sell in May and go away’ pattern.

- We believe this has to do with the strong recent quarterly earnings, which were among the best on record.

- We believe earnings will be strong again next quarter and so we remain overweight stocks in our balanced asset allocation portfolios, despite the market entering into the seasonally difficult months of September and October.

History suggests that September and October tend to be some of the most difficult and volatile months of the year for the stock market. Investors typically find themselves in an ‘information vacuum’ with second quarter earnings season wrapped up and third quarter earnings yet to be announced. Without earnings fundamentals to focus on, traders in the early autumn tend to obsess over the news headlines du jour. This fall, we have no shortage of uncertainty, with a resurgence of COVID-19, the chaotic exit from Afghanistan, the deepening divide between US and China relations, and endless chatter around taxes, inflation, and future Fed policy.

However, this year has shaped up much more positively than the typical ‘sell-in-May and go away’ seasonal pattern of the market. Some investors may be puzzled at the market’s recent consistent strength in the face of such uncertainty. Taking a step back from the noise, we think the main reason for the US market’s resilience is relatively simple: earnings power has been surprisingly strong so far this year and is likely to remain so. Supporting this, 2022 earnings expectations are currently estimated by S&P Global at $218 per share, which equates to nearly a 10% year-over-year increase, with the estimate up almost 6% since early July.

The Two Components of Stock Prices: Earnings, and How Much You Pay for Them

Generally, we think stock prices can be boiled down to two basic components:

- The future path of corporate earnings

- The valuation that investors are willing to assign to those earnings

Taking the second bullet first, we believe stock market valuation is closely linked with investor risk appetite and interest rates, topics we have discussed in our recent Weekly View on 07.12.21 concerning the importance of interest rates. To summarize, we expect interest rates will stay historically low for the foreseeable future, which is likely to keep investor demand for stocks high and the stock market’s valuation elevated. Today we’d like to focus on near-term earnings trends, both past and future.

Q2 Earnings Season: One of the Strongest on Record

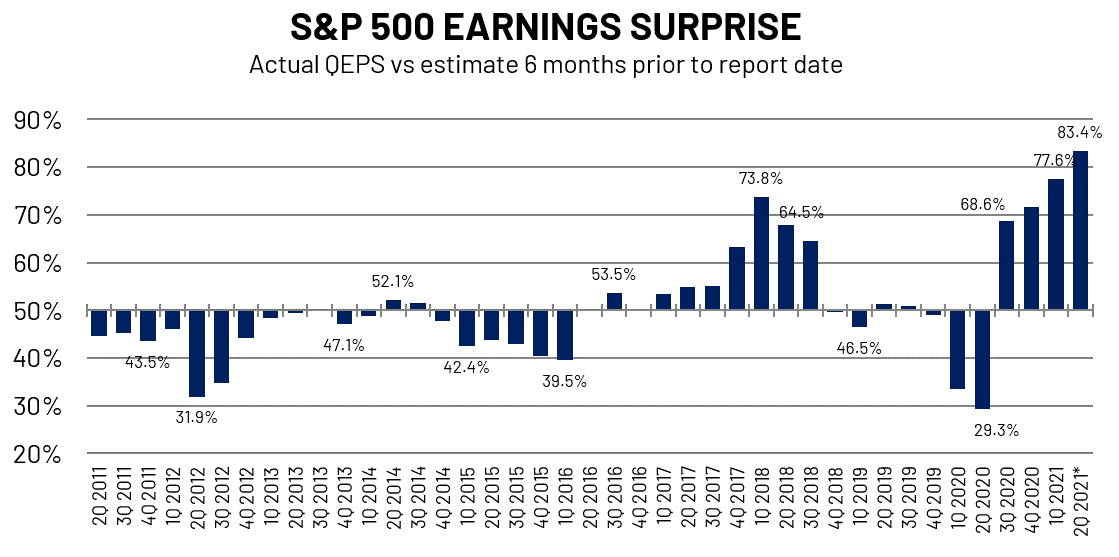

At Riverfront we like to compare actual earnings results relative to what the earnings estimates were six months prior. We think this helps minimize the bias of management teams to try to set the bar low enough that it can be easily surmounted. By taking the estimate window back half a year, we get a less biased sense of how business is trending, in our opinion.

By this measure, the second quarter of 2021 was one of the most successful earnings seasons in recent history. Over 80% of the S&P 500 beat their quarterly earnings estimates from six months prior (see chart below), the highest percentage in the decade since we’ve been tracking this. We think that earnings trends display ‘persistence,’ in that strength tends to beget future strength, absent a paradigm shift. This suggests to us that the earnings improvement we’ve witnessed since 2020 likely has staying power.

Source: Factset Data Systems, RiverFront; as of September 7, 2021. Past performance is no guarantee of future results.

Our analysis above focused on US earnings trends, but we would also note that developed international companies’ earnings – consistently lower than the US throughout the past decade – were also strong this past quarter, suggesting positive earnings trends are a global phenomenon.

Looking Forward: Leading Indicators Suggest US Earnings to Remain Solid in Q3

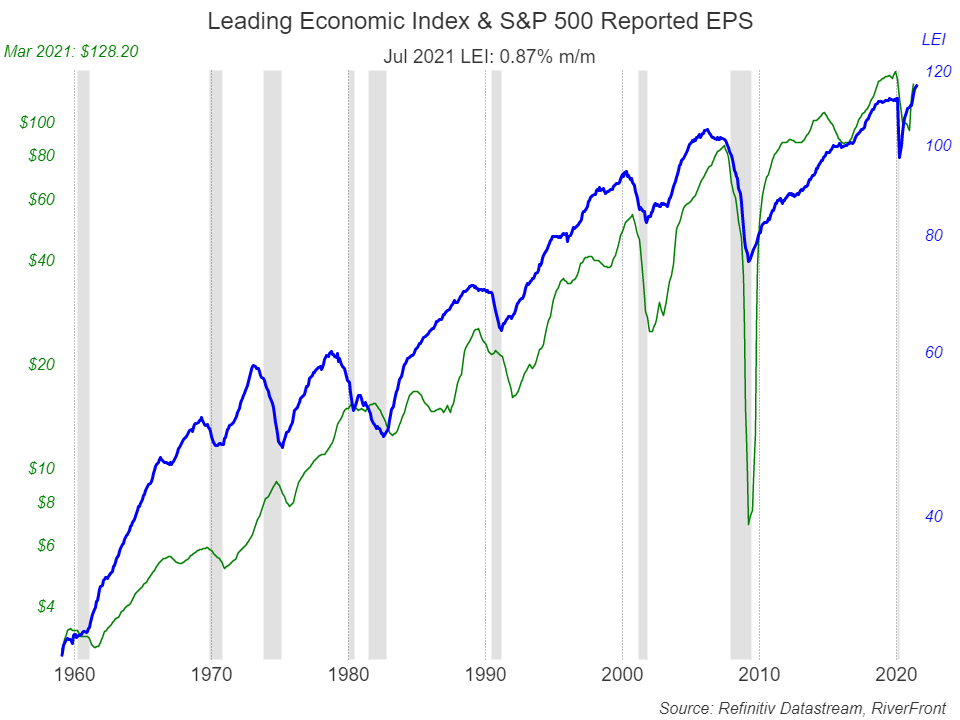

A forward look at earnings power has similarly positive messages, in our opinion. While the broad economy and US corporate earnings are not perfectly correlated, we believe there are strong linkages between the two. We have found a high correlation between the Conference Board’s monthly ‘Leading Economic Index’ (LEI) and S&P 500 reported earnings-per-share (EPS). The LEI is comprised of 10 economic components whose changes are believed to lead changes in the broader economy, including manufacturing new orders and interest rate spreads, as well as data related to consumer expectations, credit, homebuilding, and employment.

Going all the way back to the 1960s, inflections in LEI (blue line in chart) have tended to foreshadow major trend changes in earnings direction (green line), including exiting the 1991, 2000, 2008, and 2020 recessions (see shaded regions).

The strength in trend of the LEI today, with all 10 indicators in positive territory, is a rare occurrence, in our opinion. It suggests to us these strong earnings trends will remain in place, and that the upcoming Q3 earnings season should be another successful one. This is important because stock markets tend to be forward looking.

Green line: S&P 500 actual reported earnings from the Robert Shiller database as of March 2021. Blue line: LEI indicator as of July 2021. Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

Conclusion:

We believe US corporate earnings trends are strong and likely to remain so for the time being. This is one of the factors keeping us constructive on US equities, despite the market entering a historically difficult autumn season.

Looking out to 2022, we are watching inflation and Fed policy for clues regarding interest rates and thus market valuation. Our view thus far is that interest rates will stay historically low for the foreseeable future, which is likely to keep investor demand for stocks – and thus market valuation – elevated.

Given our outlook, we continue to view stocks as the best asset class for capital appreciation for the distribute, sustain, and accumulate investors. This view is reflected in our asset allocation portfolios.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For each outcome category (accumulate, sustain and distribute) RiverFront’s portfolio management team has assigned one or more RiverFront product(s) based on their assessment of the product’s investment objective as it relates to a typical client’s return and risk objectives when seeking investment outcomes of accumulating wealth, sustaining wealth and distributing wealth. The team has also designated RiverFront product alternatives for those clients looking to take more or less risk with the outcome category.

Principal Risks:

In a rising interest rate environment, the value of fixed-income securities generally declines.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

The ‘Leading Economic Index’ (LEI) is comprised of 10 economic components whose changes are believed to lead changes in the broader economy, including manufacturing new orders and interest rate spreads, as well as data related to consumer expectations, credit, homebuilding and employment.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1827751