By Komson Silapachai

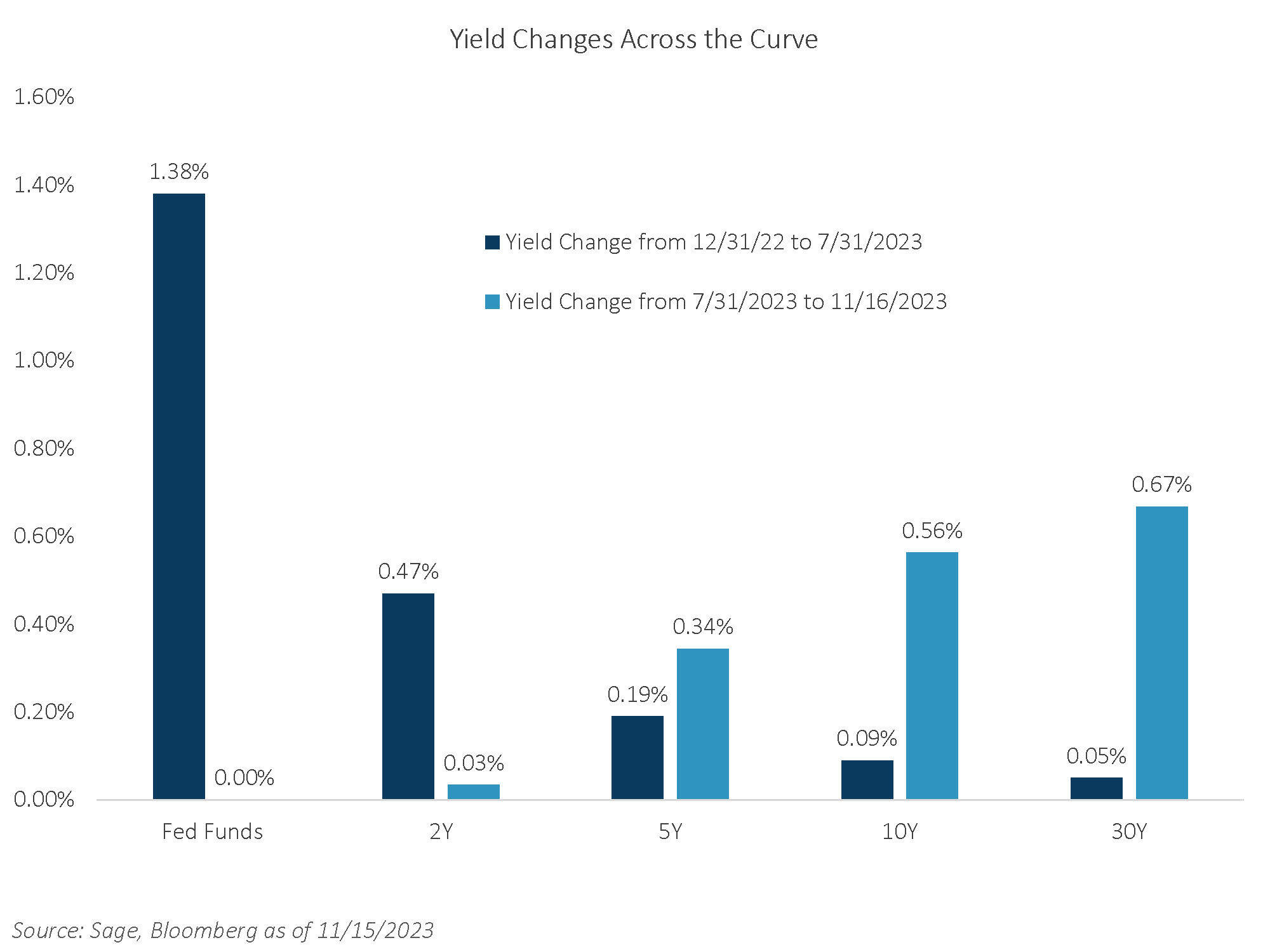

1. The Focus Has Shifted to Long-Term Interest Rates. After being in the driver’s seat for much of the year, short-term rates have largely been stable since July, while longer-term yields have shot higher due to concerns around rising term premium due to increased bond issuance.

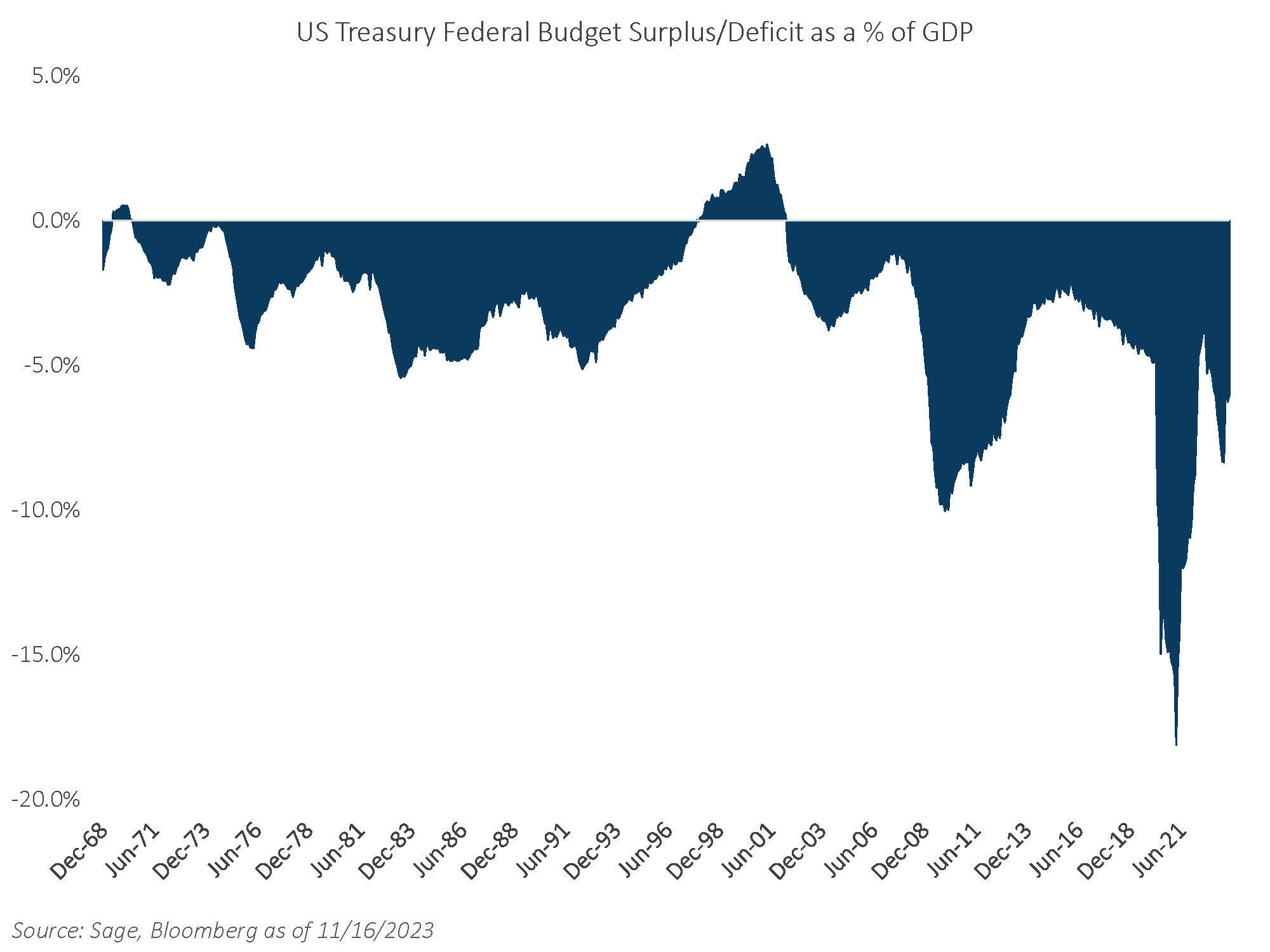

2. Issuance Concerns Have Abated but Deficit Overhang Remains. While the main story in rates has centered around fears of increased bond issuance, the Treasury’s most recent quarterly projections were less than forecasters had expected, which provided relief for financial assets. The structural issue of fiscal sustainability remains, as the Federal Budget surplus stands at 6% of GDP, which is elevated outside of crisis periods, let alone during an economic expansion.

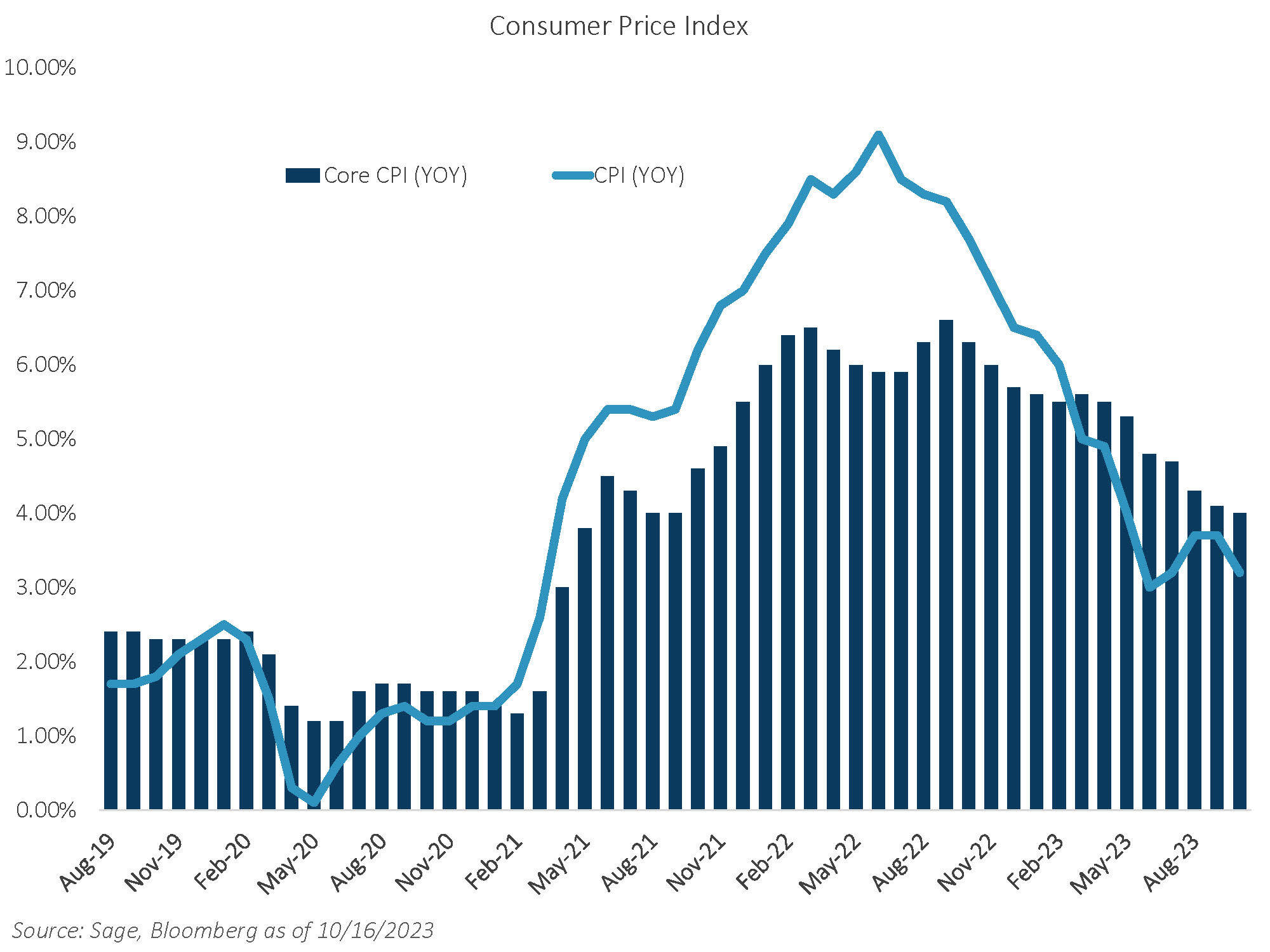

3. The Latest CPI Report Surprised to the Downside. October’s inflation showed signs of cooling, with core CPI rising by 0.23% versus expectations of 0.3%. The annual rate of core CPI now stands at 4%, down from 4.1% in September. Components were largely softer across the board, with owner’s equivalent rent decelerating after a sharp increase last month. Core Services were softer than expectations nearly across the board. Fears of a resumption of Fed hikes in December were all but eliminated while the market focused on the timing of the next interest rate cuts.

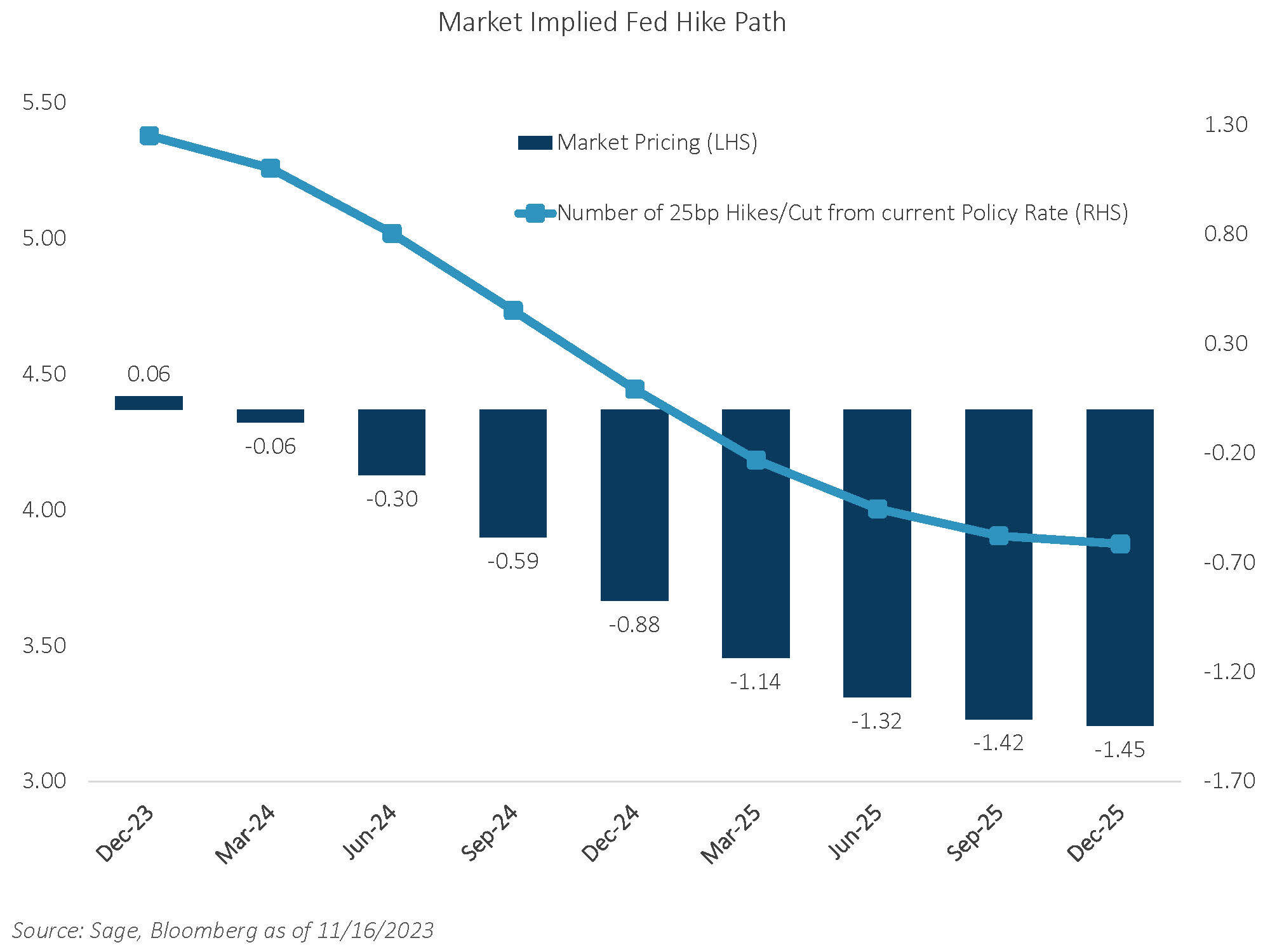

4. Rate Cuts Expected in 1H 2024. Interest rate markets priced in rate cuts starting in the first half of 2024, with a 30% probability that a rate cut could be coming in March. Given the level of inflation, which is well above the Fed’s target, we believe the bar is high for the Fed to cut rates in March, unless the labor market weakens sharply.

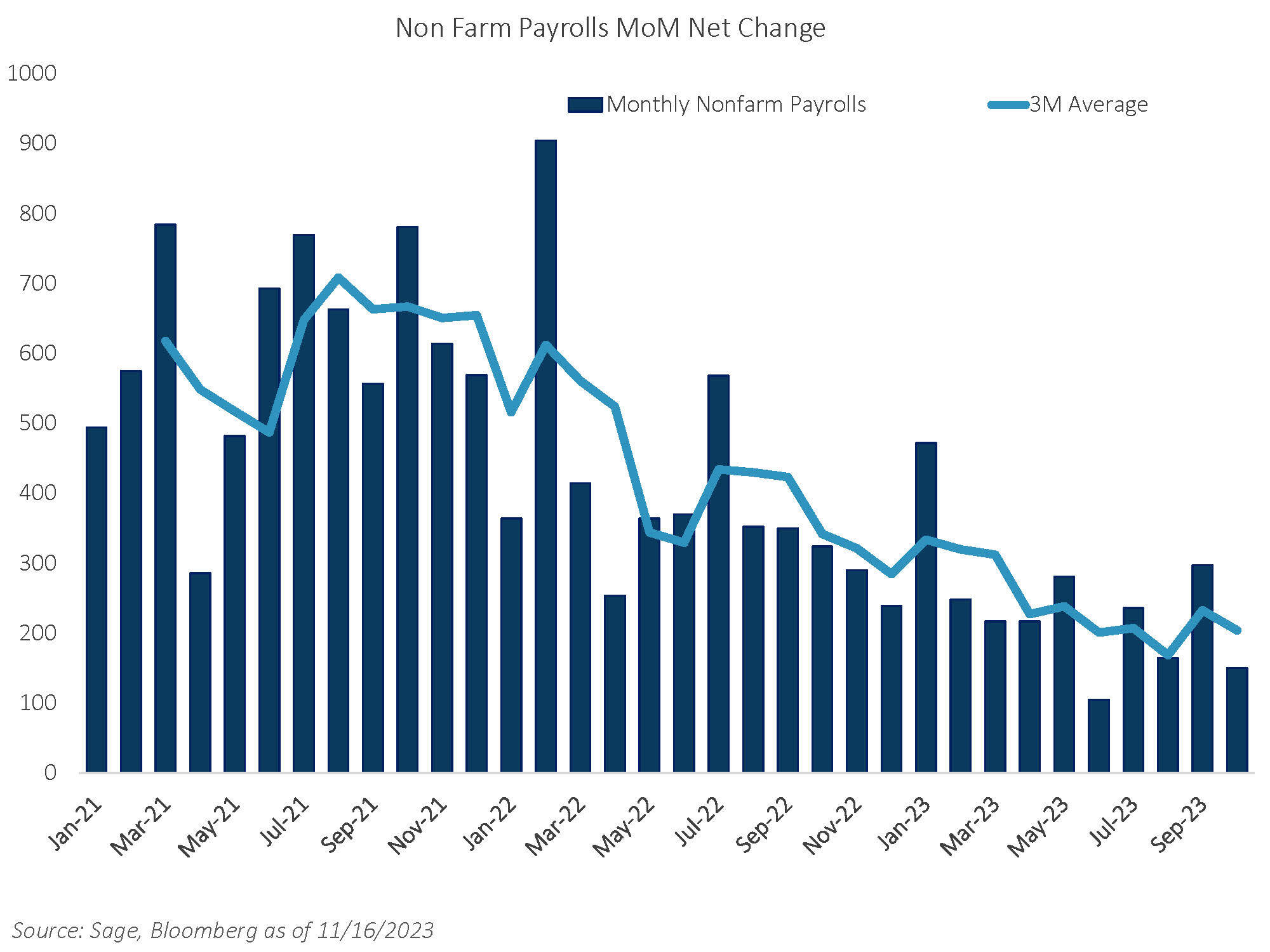

5. Labor Market Continuing to Slow. The labor market, which has been one of the most resilient areas of the economy, is continuing to cool, with the unemployment rate creeping higher to 3.9% and only 150k jobs added as of the November release. The evolution of labor markets in the next six months will be crucial to determining Fed policy and depth of any economic slowdown in the US.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.