S&P 500 Hits New All-Time High in January

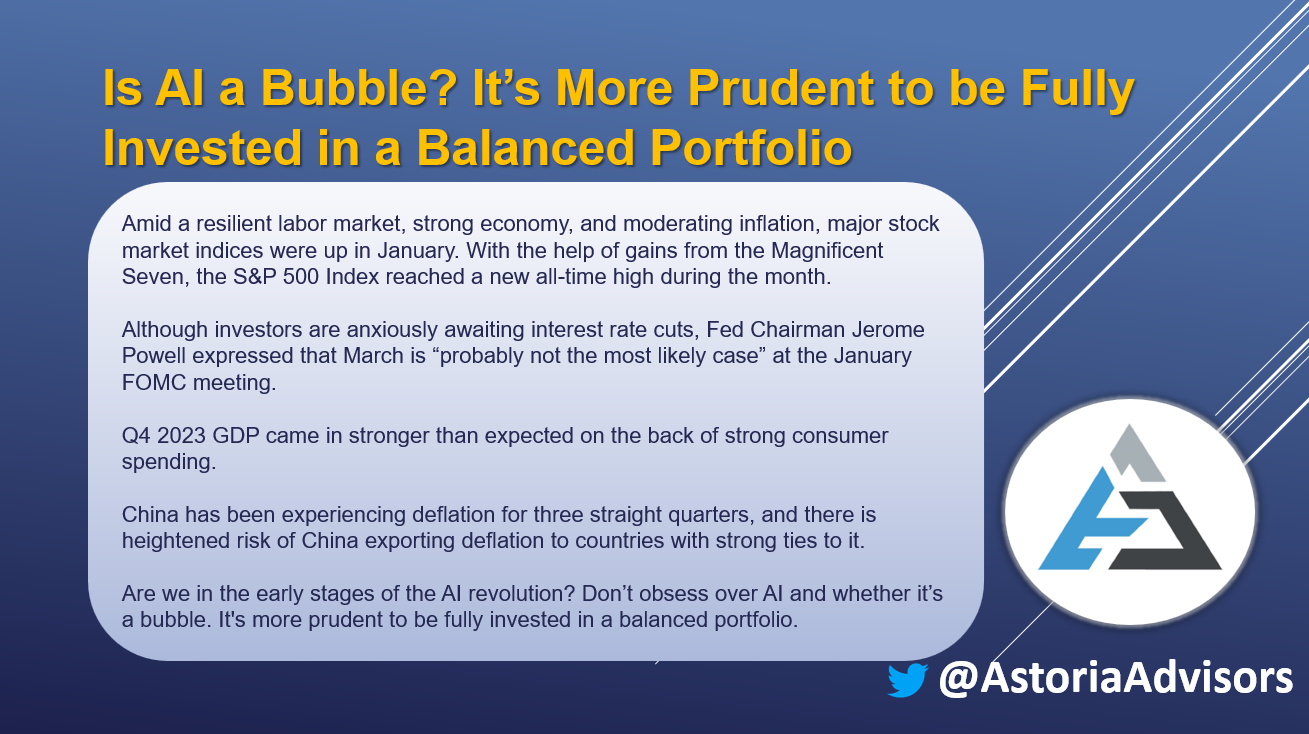

Amid a resilient labor market, strong economy, and moderating inflation, major stock market indices were up in January. With the help of gains from the Magnificent Seven, the S&P 500 Index reached a new all-time high during the month. US growth (+2.9%) and US large-caps (+1.6%) were among the best performers, while US small-caps (-4.0%) and emerging market equities (-3.6%) struggled. Bonds were mixed with Treasury Inflation Protected Notes up 1.0%, while the US Aggregate Bond Index was down 0.3%. Commodities also produced mixed returns as crude oil and broad-based commodities rose (+6.4% and +0.4%, respectively) while silver and gold fell (-4.0% and -1.4%, respectively).

Fed Says March Rate Cut Not Likely

The Federal Reserve kept interest rates unchanged at the January FOMC meeting, leaving the fed funds rate at the 5.25–5.50% range. Both annualized core PCE and CPI have softened (3.9% and 2.9% for December, respectively), but inflation is still above the Fed’s 2% target. Although investors are anxiously awaiting interest rate cuts, Fed Chairman Jerome Powell expressed skepticism on cutting rates in the near term. “We’re trying to get comfortable and gain confidence that inflation is on a sustainable path down toward 2%,” he said. When asked specifically about the first cut occurring in March, Powell stated, “…I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting.” He also added that March is “probably not the most likely case.” According to the CME FedWatch Tool, the probability of a 25 bps rate cut at the March meeting declined from north of 60% prior to the meeting to below 40%. Stocks were already down for the day after unsatisfying earnings releases, but news from the meeting sent them even lower, with the technology-heavy Nasdaq leading the decline.

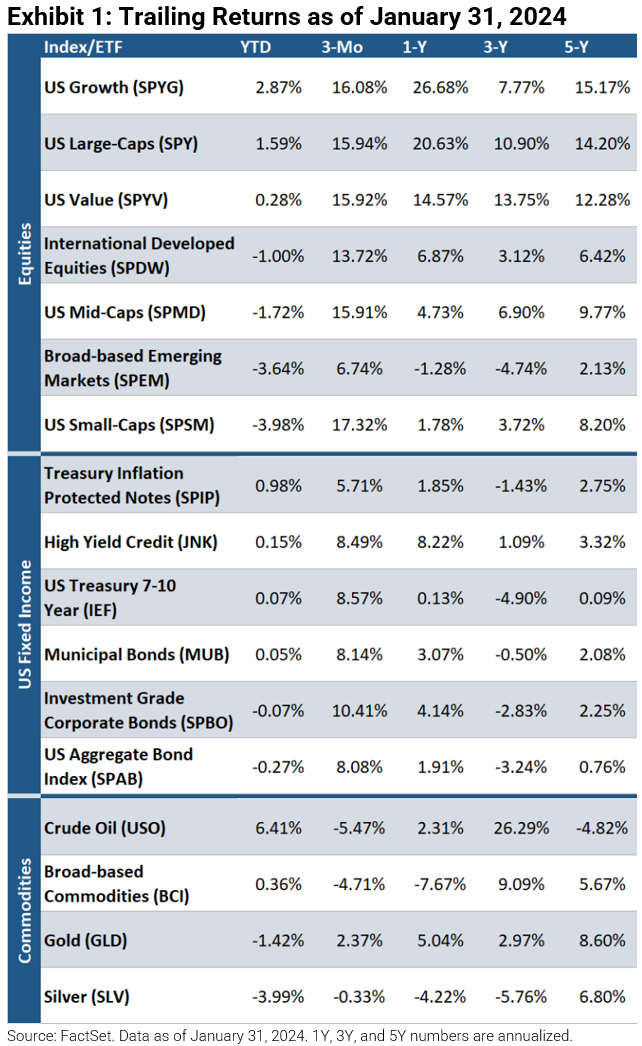

GDP Growth Tops Estimates

Q4 2023 GDP came in at an annualized 3.3%, well above the 1.7% forecast. Strong consumer spending was the main driver of the better-than-expected print. Although this, combined with a resilient labor market and declining inflation, has increased the probability of a soft landing, it could also push back rate-cut expectations.

Time to Increase US Equity Allocations?

China has been experiencing deflation for three straight quarters, the longest streak in over two decades. As a large portion of Europe is tied to China, there is heightened risk of China exporting deflation to such countries. Compared to those in Europe, the risk/reward for US equities is becoming more attractive as China’s economy struggles.

Are We Experiencing an AI Bubble?

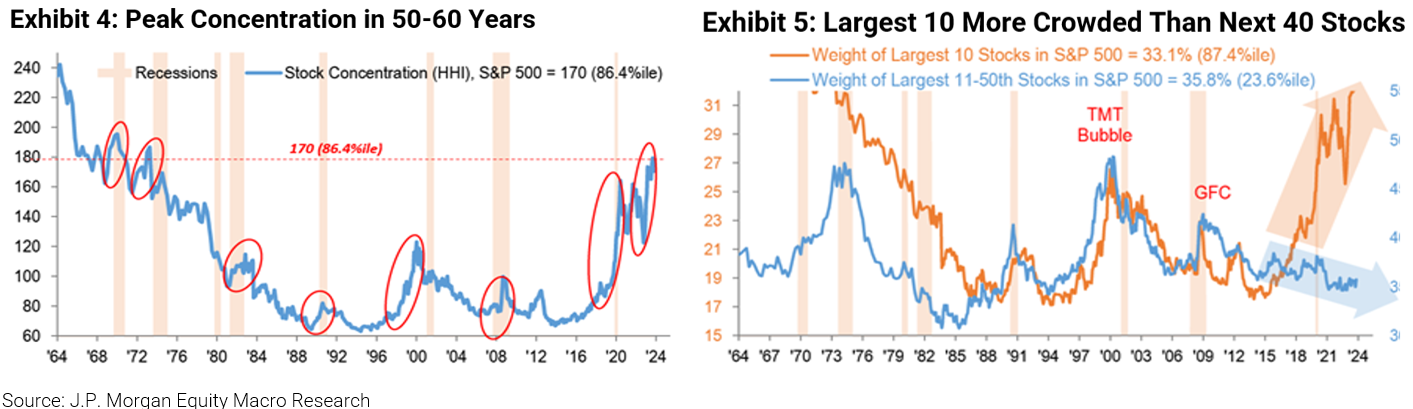

Per J.P. Morgan, the chart in Exhibit 4 shows the stock concentration in the S&P 500 dating back to the 1960s. Unfortunately, concentration risk can worsen, as we saw in the Nifty Fifty era. We still argue that there is a once-in-a-decade opportunity to own the non-Magnificent Seven stocks. We entered 2024 more bullishly than in the past two years.

This week is peak reporting week for the Q4 2023 earnings season, with many large-cap technology stocks scheduled to reveal results. Thus far, this earnings season has been underwhelming. The bar was lowered as estimates for the quarter have come down approximately 7% over the past three months, and beats were weaker than in previous years. There’s been a wide variance (big misses are being punished while notable beats are being rewarded), which has had a “zero-ing out effect.” If some big technology leaders report favorable earnings, the concentration risk will likely worsen.

We believe we are only in the 2nd or 3rd inning of the AI revolution and prefer to avoid being underweight semiconductors or technology as a whole.

To mitigate concentration risk, equal weighting seems like a prudent risk management approach, given how stretched valuations are for select top stocks. We’re not suggesting portfolios exit all their market cap-weighted exposure but migrate a third of market cap exposures to an equal-weighted strategy.

This cycle will likely be defined as the one that was stronger and longer than anyone envisioned. Markets reached an all-time high last week. Contrary to popular opinion, markets have historically trended higher when they reach an all-time high. Don’t obsess over AI and whether it’s a bubble. It’s more prudent to be fully invested, own a balanced portfolio, spread your factor risk, and have a more constructive game plan for wealth accumulation. $1 trillion went into money markets last year. We think now is an appropriate time for that money to find its way into corporate credit and equities.

For more news, information, and analysis, visit the ETF Strategist Channel.

Warranties & Disclaimers

As of the time of this publication, Astoria Portfolio Advisors held positions in SPYG, SPY, SPYV, SPDW, SPMD, SPSM, SPEM, JNK, SPBO, SPAB, MUB, IEF, SPIP, GLD, SLV, USO, BCI, TLT, and LQD on behalf of its clients. There are no warranties implied. Past performance is not indicative of future results. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. The returns in this report are based on data from frequently used indices and ETFs. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data, and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to the accuracy, completeness, or reliability of such information. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements.