By J. Keith Buchanan, CFA, Portfolio Manager

The market is on the cusp of another riveting earnings season that has every investor on the edge of one’s seat. I know, I know. I can see your eyes roll or glaze over when this quarterly ritual is mentioned in this moment. I get it. It’s not because of any disdain or disrespect toward the examination and understanding of corporate profitability. But there are so many more developments that are more sensational, historic, and, some would argue, interesting than getting an update on how well corporations can generate revenue and produce income. The return of inflation, a suddenly hawkish Federal Reserve, fiscal policy with countless moving parts, and the “Great Resignation” all seem like much more interesting topics, don’t you think? Yet, all of the aforementioned collide when we ponder the landscape of opportunities for corporate profits and what the market is willing to pay for said profits.

When the Federal Open Market Committee(FMOC) manipulates the target Federal Funds rate, it does so pursuant to its dual mandate of stable prices and maximum employment. When it lowers rates, the FOMC is acting to spur the growth of aggregate demand by injecting liquidity. The opposite is also true. When the FOMC deems it necessary to restrain the growth of aggregate demand, and ultimately inflation, it removes liquidity by raising rates.

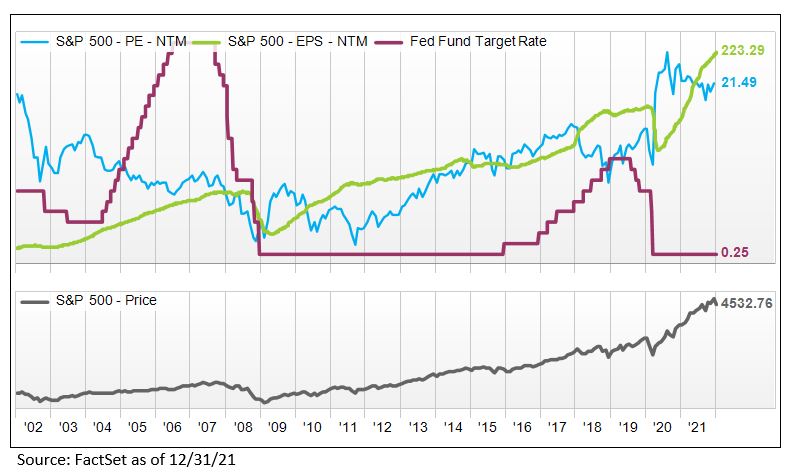

The Fed Funds futures market has fully predicted that 2022 will bring with it the initiation of a rate tightening cycle. As you can see in the chart above, the S&P 500 Index moved higher throughout the previous two tightening cycles in 2004-2006 and 2015-2018. However, the positive move was driven by forward earnings in both instances. In both cycles, the price the market was willing to pay for said earnings, the forward price-to-earnings multiple, was actually lower at the end of each cycle than at the onset.

This all makes intuitive sense. When tightening monetary policy, the FOMC intends to curb demand which, in turn, has the effect of discouraging risk-taking. Declining risk tolerance manifests itself as declining forward valuations in risk markets. Still, the S&P 500 Index ended each of the previous two tightening cycles higher because strong earnings growth overwhelmed declining valuations due, at least in part, to the FOMC placing its foot on the brakes.

Which brings me back to why this first earnings season in 2022 sets the stage for an earnings year which feels like a make-or-break moment for the equity markets. Earnings expectations increased well beyond analyst initial projections throughout 2021 while valuations drifted lower. Earnings performance as the market enjoyed in 2021 is difficult to duplicate even in the most accommodative monetary environment. As we embark on less accommodative, then perhaps more restrictive, monetary policy actions this spring, we see the environment for contracting valuations becoming more plausible. Therefore, equity market returns in 2022 may be more dependent on corporate earnings than any other time in recent memory.

GLOBALT is an SEC Registered Investment Adviser since 1991 and, effective July 10, 2013, remains a Registered Investment Adviser through a separately identifiable division of Synovus Trust N.A., a nationally chartered trust company. This information has been prepared for educational purposes only, as general information and should not be considered a solicitation for the purchase or sale of any security. This does not constitute legal or professional advice, and is not tailored to the investment needs of any specific investor. Registration of an investment adviser does not imply any certain level of skill or training. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information may be required to make informed investment decisions, based on your individual investment objectives and suitability specifications. Investors should seek tailored advice and should understand that statements regarding future prospects of the financial market may not be realized, as past performance does not guarantee and/or is not indicative of future results. Content may not be reproduced, distributed, or transmitted in whole or in part by any means without written permission from GLOBALT. Regarding permission, as well as to receive a copy of GLOBALT’s Form ADV Part 2 and Part 3, contact GLOBALT’s Chief Compliance Officer, 3400 Overton Park Drive, Suite 200, Atlanta GA 30339. You can obtain more information about GLOBALT Investments and its advisers via the Internet at adviserinfo.sec.gov, sponsored by the U.S. Securities and Exchange Commission.

The opinions and some comments contained herein reflect the judgment of the author, as of the date noted.

Investment products and services provided are offered through Synovus Securities, Inc. (SSI), a registered Broker-Dealer, member FINRA/SIPC and SEC Registered Investment Adviser, Synovus Trust Company, N.A. (STC), Creative Financial Group, a division of SSI. Trust services for Synovus are provided by STC.

Regarding the products and services provided by GLOBALT:

NOT A DEPOSIT. NOT FDIC INSURED. NOT GUARANTEED BY THE BANK. MAY LOSE VALUE. NOT INSURED BY ANY FEDERAL AGENCY