By Komson Silapachai

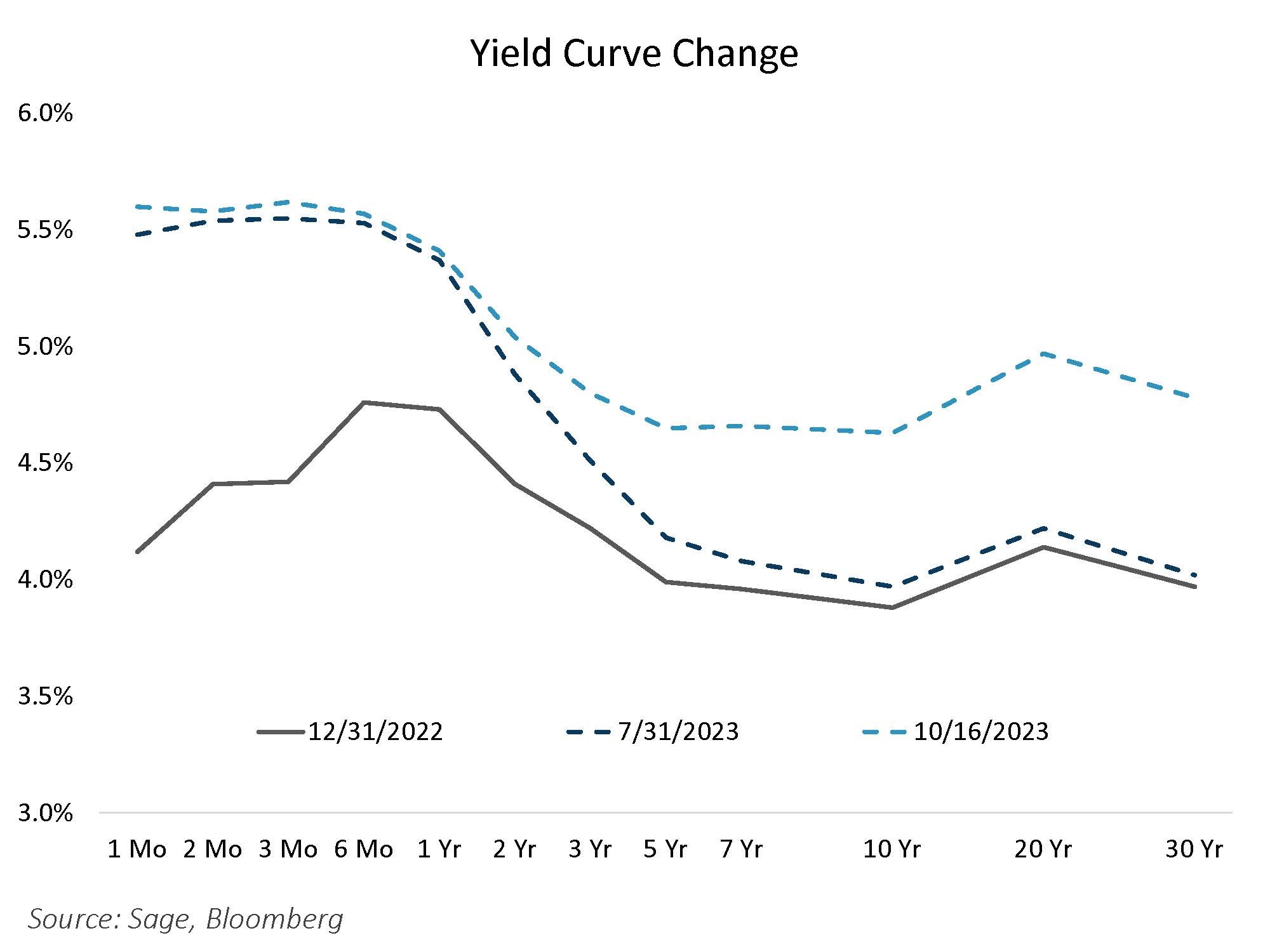

After the increase in Treasury issuance in July, and concerns around the sustainability of the fiscal deficit, investors spoke loudly, demanding a higher compensation (term premium) for taking on duration risk. To that end, the focal point on the US yield curve has shifted from the front end, as the Fed has indicated they are largely done, while long-term interest rates have risen to a level unseen for over 15 years. We believe that the issuance profile along with the level of rates will constrain investing and economic activity from the private sector, weighing on risk appetite as well as economic growth.

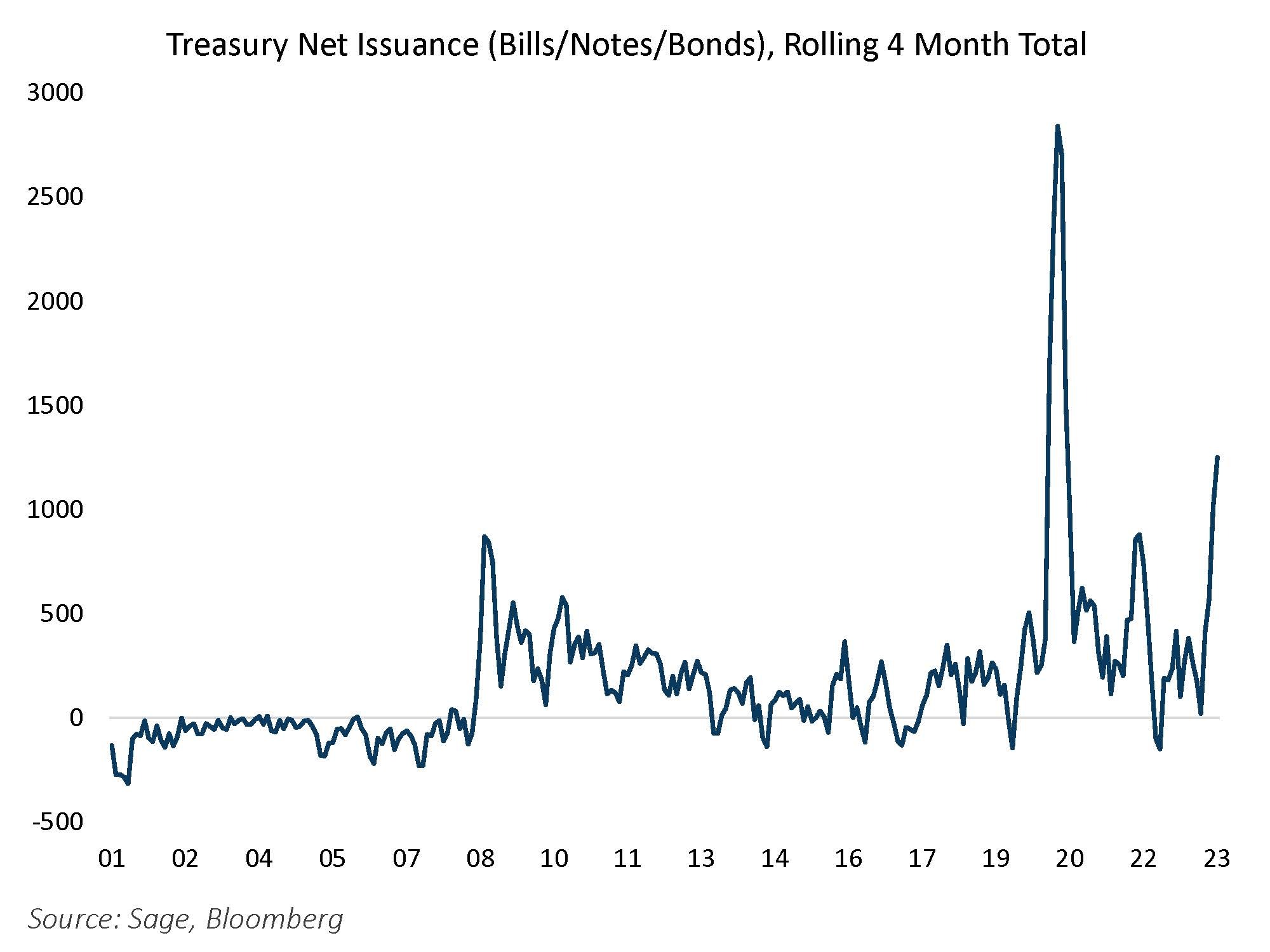

2) Treasury Issuance Highest Since COVID-era: The US Treasury has issued a large amount of Treasuries in recent months to fund spending, eclipsed only by the COVID era. The bulk of the issuance has taken place through T-bills, although coupon issuance has increased as well.

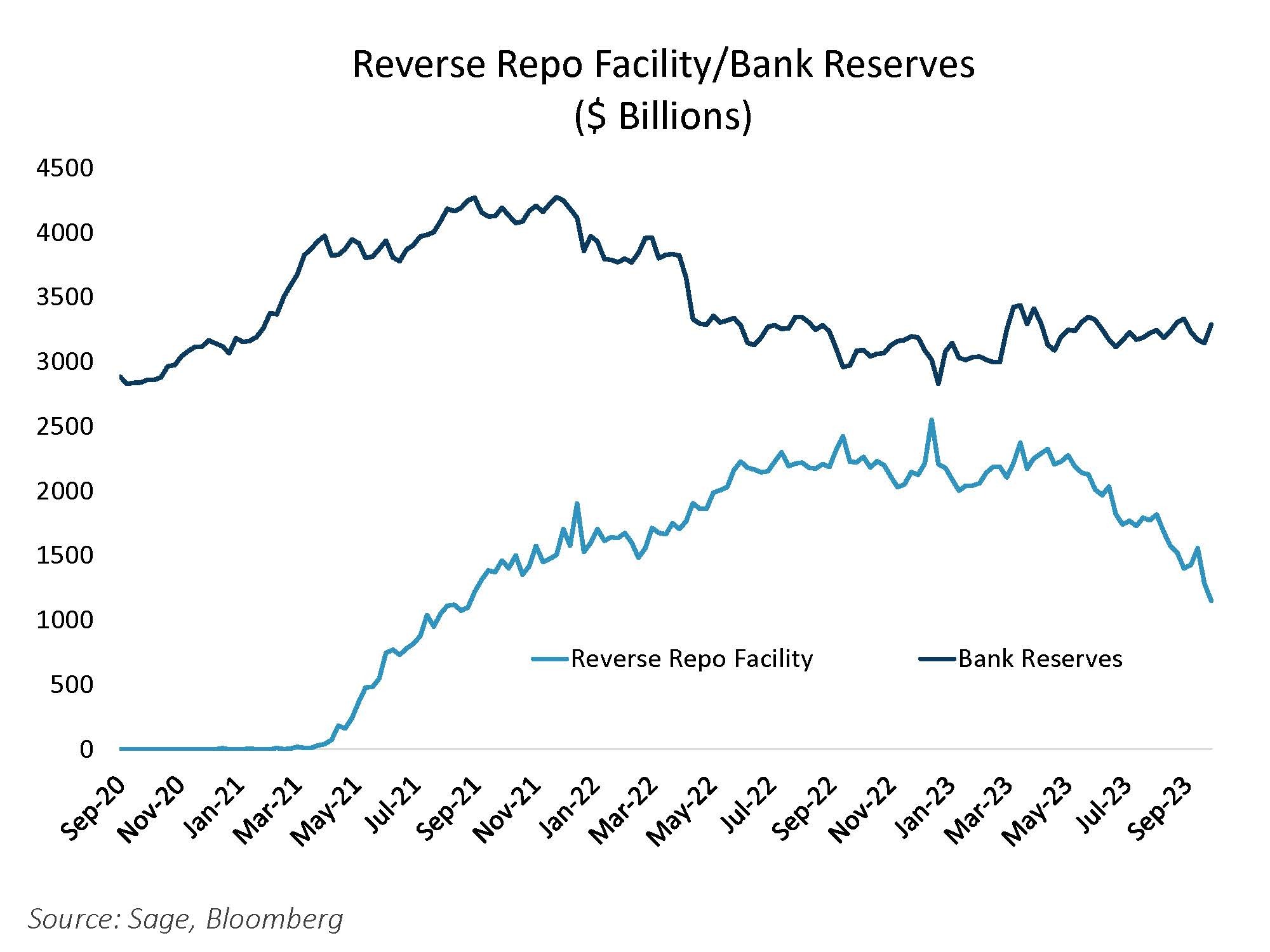

3) T-Bill Issuance Absorbed by Money Market Funds Shifting from Reverse Repo at the Fed: Money market funds have shifted from the Fed’s reverse repo facility to T-bills during the current issuance episode in which the Treasury has issued $1.2T of T-bills since June. This has softened the effect that issuance would have on the broader market as bank reserves have remained largely stable. However, the capacity for more issuance continues to dwindle.

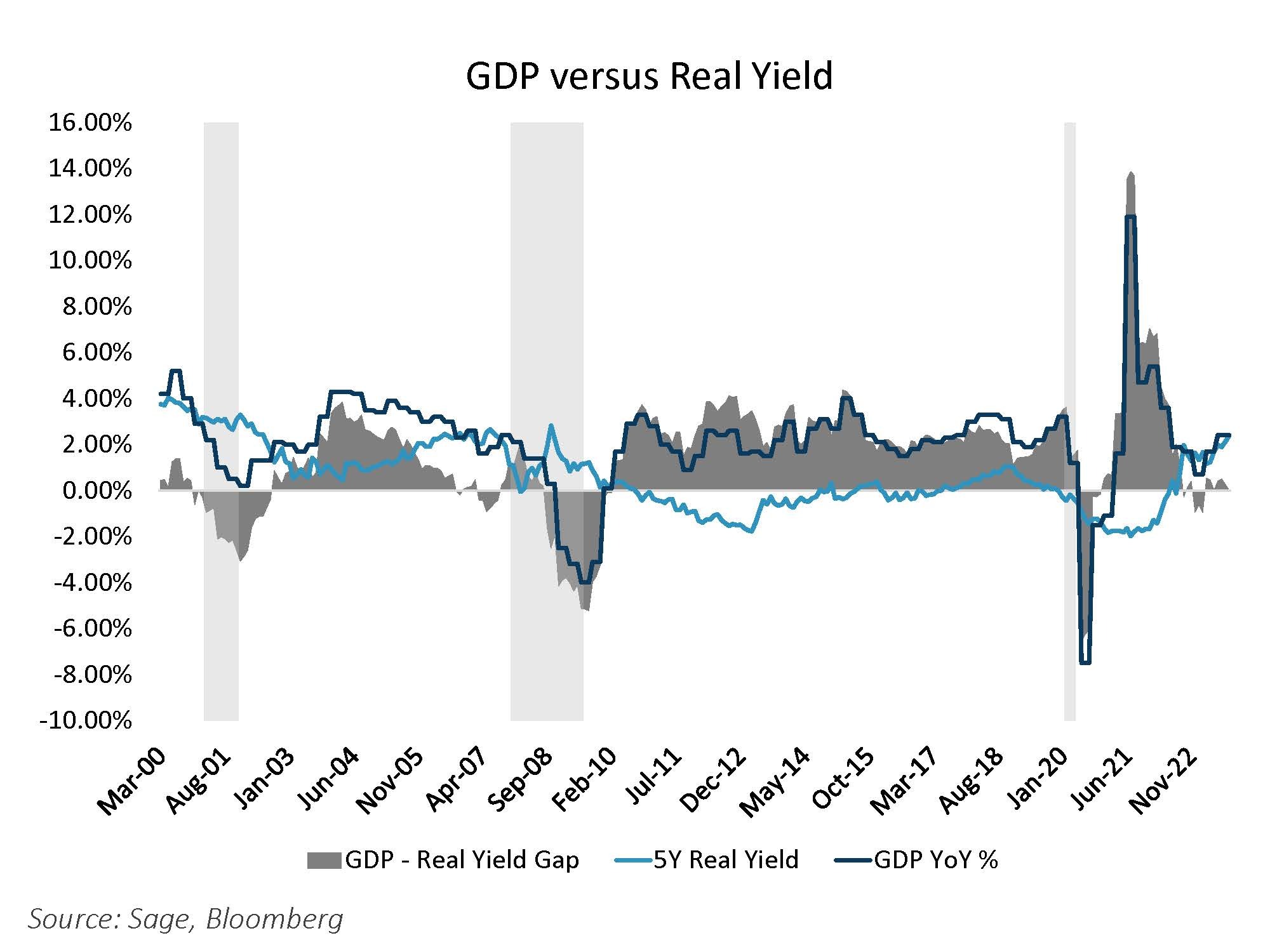

4) Interest Rates Rising to Restrictive Levels: Real interest rates are hovering at restrictive levels compared to GDP as the differential is near zero. We think the rise in term premium along with the elevated issuance profile amidst a fiscal deficit could “crowd out” broader investment by the private sector as well as economic activity and result in an economic slowdown in 2024.

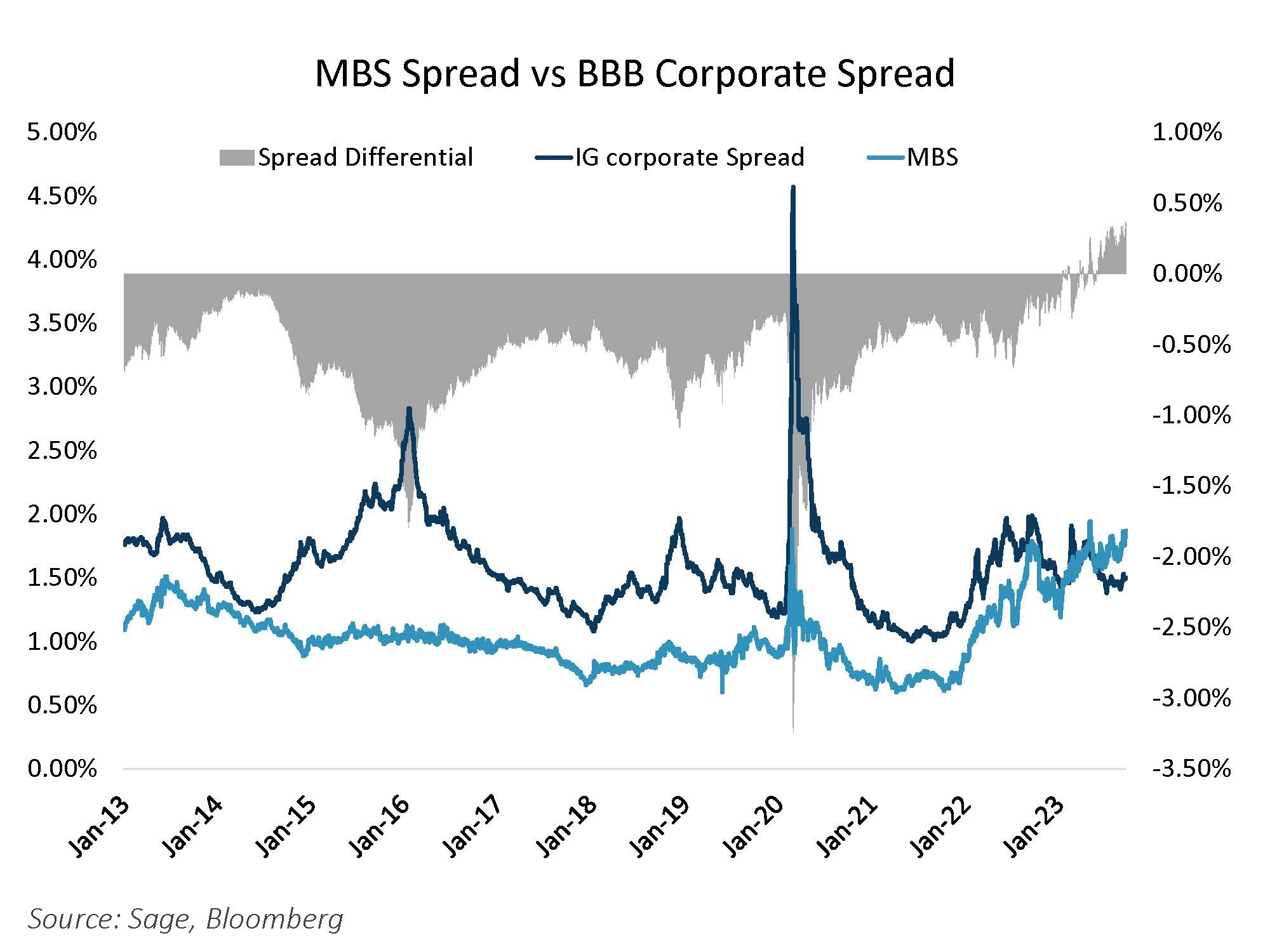

5) Very Little Value in Spread Sectors Outside of MBS: MBS continues to provide an attractive relative value versus corporates, with the MBS basis now trading above BBB corporates despite being AAA-rated.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.