By Dan Suzuki, CFA, Deputy Chief Investment Officer

At the start of the bull market, nobody wanted to invest in the US

Our firm began managing assets in 2010, in the wake of the Global Financial Crisis. Being the epicenter of the crisis, investor pessimism towards the US was extreme. Confidence in its financial institutions was shaken, and the all-powerful US consumer was facing the dual balance sheet pressures of excessive debt coupled with big declines in asset values stemming from the stock and housing markets. The US was coming off a decade of lost returns, and the US tech sector had underperformed the global stock market by the widest margin on record. As a result, the US traded at a steep discount and its share of global stock markets was at an extreme low.

People preferred to invest in the new engine of global growth

Emerging markets had supplanted the US as investors’ most favored stock market, supported by healthier demographics, superior growth, and seemingly better government debt burdens. Emerging markets had also outperformed the rest of the world over the past decade by nearly the widest margin ever (94th percentile). All signals were aligned.

The tides have turned

Thirteen years later, the narrative could not be more different. The dominance of US tech has resulted in one of the best absolute and relative decades of performance in history, with nearly every other major category (especially emerging markets) lagging significantly. The US has had superior earnings growth, and its companies dominate almost every major industry. The tech sector is a juggernaut of innovation and growth, and its dominant profit margins have resulted in some of the strongest balance sheets in the world, with plenty of cash to buy up-and-coming technologies, future rivals and buy back their own shares.

Be careful when Wall Street starts to feel like Easy Street

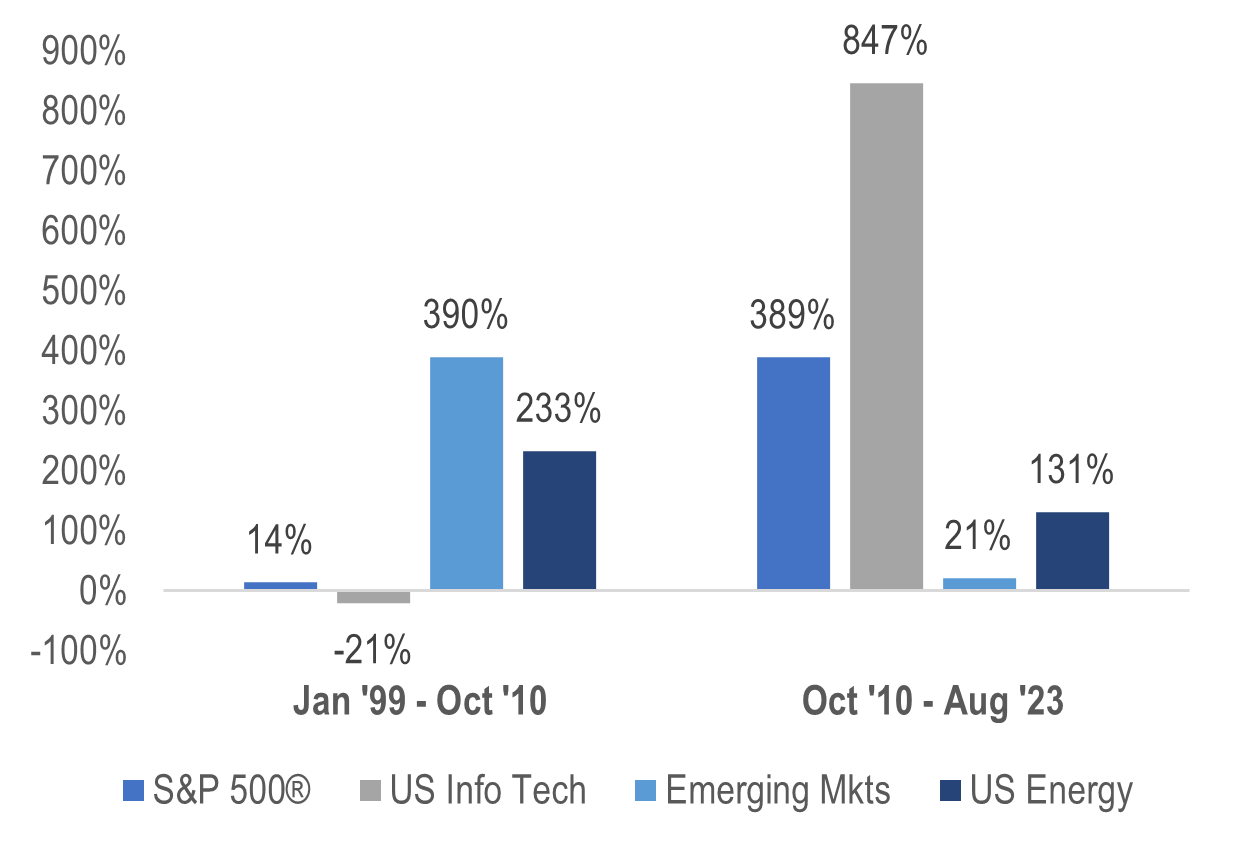

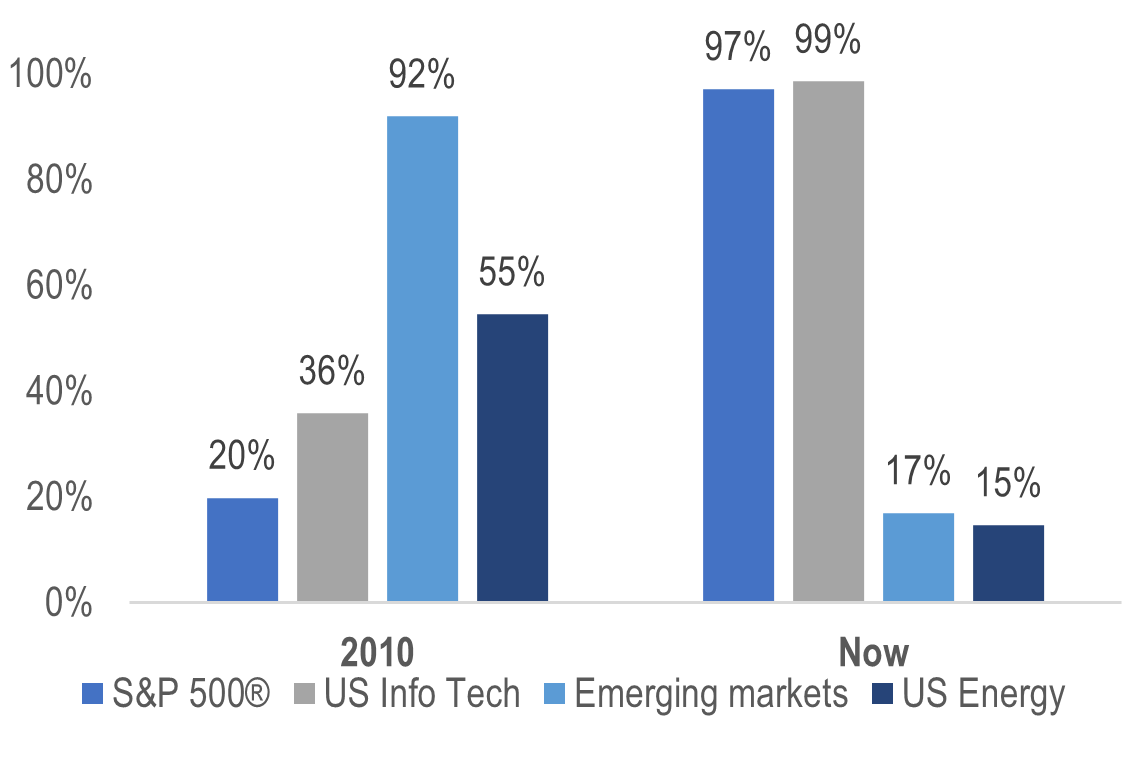

Since 2010, the S&P 500® and US Tech sector have returned 389% and 847% (14% and 21% per annum), respectively (Chart 1), with valuations (Chart 2) and household equity allocations now near all-time highs, suggesting that investors are positioned for more of the same. What concerns us about investors doubling down on the best trade of the past decade are the numerous historical precedents suggesting that a continuation of these extreme returns is unlikely. Either these time-tested rules no longer apply, and investing is now as easy as simply buying what has worked, or investors are improperly allocated for the next market cycle.

- Returns are greatest when capital is scarce: Extremes in performance and valuations tend to reverse, as it becomes increasingly difficult for results to keep pace with the hype driving expectations. Conversely, investment opportunities that have been left for dead tend to have an easier time exceeding low expectations.

- New market cycles come with new leadership: Major shifts in macroeconomic fundamentals tend to come with new market leadership. This changing of leadership across cycles tends to be accompanied by significant market volatility.

- It’s never too early to sell a bubble: It can be difficult to time major market reversals and leadership changes, but the unique aspect to a bubble is that it’s never too early to sell. Even if you bought the Nasdaq-100 index a full year before its peak, initially doubling your money, it still took you roughly a decade to recoup your subsequent losses.

Chart 1: Select total returns: 1999 – 2010 vs. 2010 – Now

Source: Richard Bernstein Advisors LLC, Bloomberg, MSCI, S&P

Chart 2: Relative P/E vs. ACWI (%ile of history since 2005)

Source: Richard Bernstein Advisors LLC, Bloomberg, MSCI, S&P Note: Percentile of history since 2005 of the forward P/E of each index relative to the forward P/E ratio of the MSCI ACWI index of global stocks.

For more news, information, and analysis, visit the ETF Strategist Channel.

Nothing contained herein constitutes tax, legal, insurance or investment advice, or the recommendation of or an offer to sell, or the solicitation of an offer to buy or invest in any investment product, vehicle, service or instrument. Such an offer or solicitation may only be made by delivery to a prospective investor of formal offering materials, including subscription or account documents or forms, which include detailed discussions of the terms of the respective product, vehicle, service or instrument, including the principal risk factors that might impact such a purchase or investment, and which should be reviewed carefully by any such investor before making the decision to invest. RBA information may include statements concerning financial market trends and/or individual stocks, and are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such. The investment strategy and broad themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information contained in the material has been obtained from sources believed to be reliable, but not guaranteed. You should note that the materials are provided “as is” without any express or implied warranties. Past performance is not a guarantee of future results. All investments involve a degree of risk, including the risk of loss. No part of RBA’s materials may be reproduced in any form, or referred to in any other publication, without express written permission from RBA. Links to appearances and articles by Richard Bernstein, whether in the press, on television or otherwise, are provided for informational purposes only and in no way should be considered a recommendation of any particular investment product, vehicle, service or instrument or the rendering of investment advice, which must always be evaluated by a prospective investor in consultation with his or her own financial adviser and in light of his or her own circumstances, including the investor’s investment horizon, appetite for risk, and ability to withstand a potential loss of some or all of an investment’s value. Investing is subject to market risks. Investors acknowledge and accept the potential loss of some or all of an investment’s value. Views represented are subject to change at the sole discretion of Richard Bernstein Advisors LLC. Richard Bernstein Advisors LLC does not undertake to advise you of any changes in the views expressed herein.