What Happened in August?

In August, equities struggled, likely due to concerns of further anticipated restrictive monetary policy. For the month, international developed equities were among the worst performers (-6.1%), followed by US growth stocks (-5.1%) and US small-caps (-4.3%). Bonds also had a challenging month as investment grade corporates declined 4.4%, high yield credit returned -4.3%, and 7-10 Year US Treasuries fell 3.9%. Commodities produced negative returns as silver was down 11.3%, crude oil fell 6.3%, gold decreased 2.9%, and broad-based commodities declined 0.4%.

Powell’s “Anti-Pivot” Speech

At this year’s annual Jackson Hole symposium, Federal Reserve Chairman Jerome Powell pushed back against investors’ expectations of a less hawkish Fed. His comments suggested that the central bank will continue to hike interest rates and that the tightening cycle will persist until inflation returns closer to the Fed’s 2% long-range target. Although inflation appears to have peaked with July CPI (Consumer Price Index), PPI (Producer Price Index), and PCE (Personal Consumption Expenditures) data all down from the prior month, Powell expressed that a month or two of improving data is not enough to convince the Fed that inflation is meaningfully declining. Moreover, his speech indicated that reestablishing price stability is more crucial than supporting growth stating, “While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses…These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.” Market participants are currently expecting a 0.50% or 0.75% rate increase at September’s FOMC meeting as the Fed assesses how high rates should be to reduce spending and hiring, and ultimately slow growth.

Will the US Soon See a Recession?

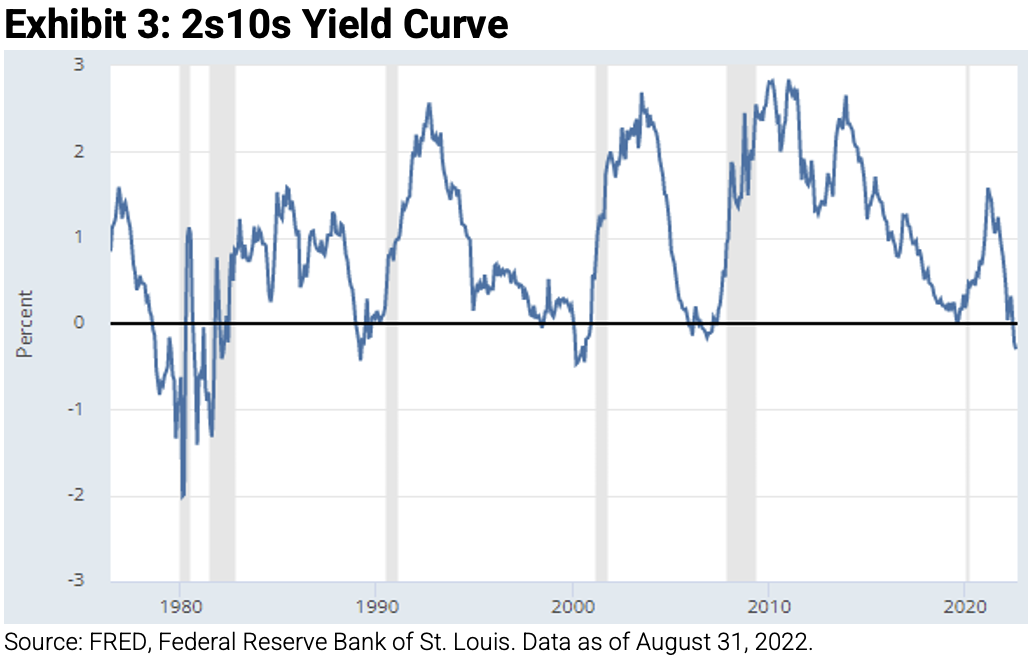

Exhibit 2 displays the spread between the Expectations Index, consumers’ short-term expectations on business conditions, employment, and income, and the Current Conditions Index, consumers’ assessment of current labor market and business conditions. This spread has reached another low, which has historically occurred just before economic downturns (represented by the blue-shaded areas). Additionally, the spread between the widely followed 2-year and 10-year Treasury yields (2s10s) is negative, which can be seen in Exhibit 3. Yield curve inversions, when spreads decline below zero, are also thought to be indicators of impending economic downturns and have historically preceded many recessions (indicated by the gray shaded areas). Will a recession soon hit the US?

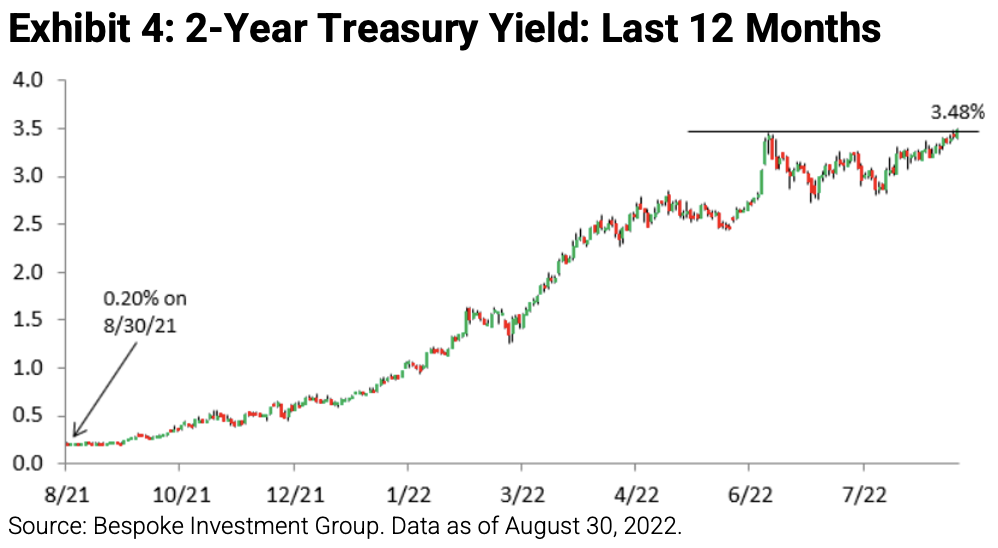

2-Year Treasury Yield Highs

As of Tuesday, August 30th, the yield on the 2-Year Treasury hit a new 15-year high as it approached 3.5%. Given recent hawkish commentary by the Fed, investors are pricing in further monetary tightening and higher interest rates, pushing up yields. Higher interest rates also translate to lower equity prices, which can be linked to why the equity market saw a decline in the second half of August.

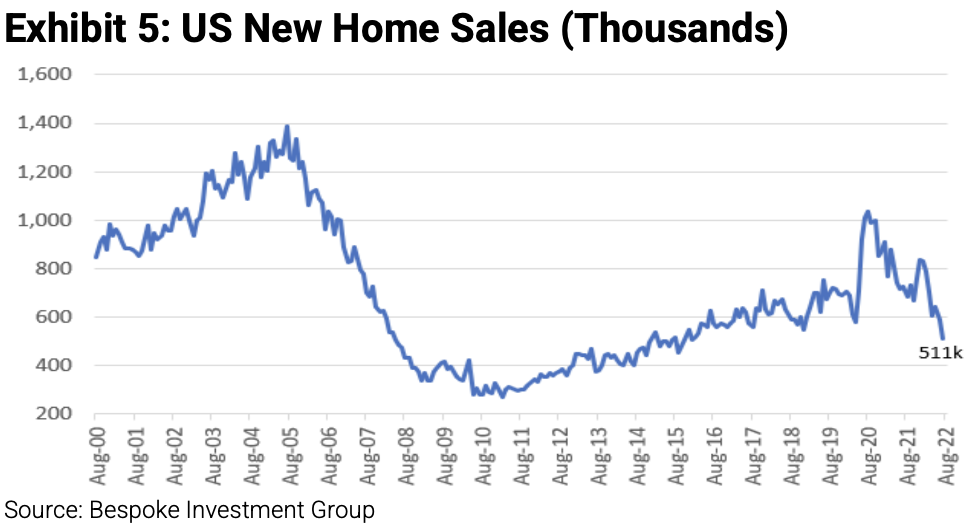

New Home Sales Lows

Amid persistently high mortgage rates and elevated house prices, US new home sales dropped to 511,000 in July, marking their lowest level since January 2016.

Invest Cautiously for the Months Ahead

We are seeing a change in market leadership. 2008-2020 was dominated by low rates, deflation, quantitative easing, and the Fed provided a floor to financial assets. What investments and strategies worked? Technology, growth, deflation-linked assets, buy and hold, long duration, and cheap beta solutions. 2021-2022 is characterized by higher rates, higher inflation, quantitative tightening, and an absence of the Fed put. What strategy will do well under this regime? Only time will tell, but our view is that shorter duration, value, inflation-linked assets, and more risk managed solutions may perform relatively better under this regime change.

Warranties & Disclaimers

As of the time of this publication, Astoria Portfolio Advisors held positions in IEMG, IVE, SPMD, SPY, SPSM, QQQ, IEFA, MUB, TIP, AGG, IEF, HYG, LQD, BCI, GLD, USO, and SLV on behalf of its clients. There are no warranties implied. Past performance is not indicative of future results. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. The returns in this report are based on data from frequently used indices and ETFs. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data, and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to the accuracy, completeness, or reliability of such information. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements.