Prices of many services are heating up again.

But a closer look reveals that inflation is hardly up against the ropes and isn’t going down without a fight.

Case in point: The PCE index’s core services component soared by 7.2% in January from December—the largest month-to-month jump in more than 20 years.

That’s a big deal, as core services encompass areas of the economy where consumers do the bulk of their spending—housing, health care, dining, hotels, car maintenance, entertainment and the like. If prices in those sectors move higher, there’s little chance of a significant decline in the overall inflation rate.

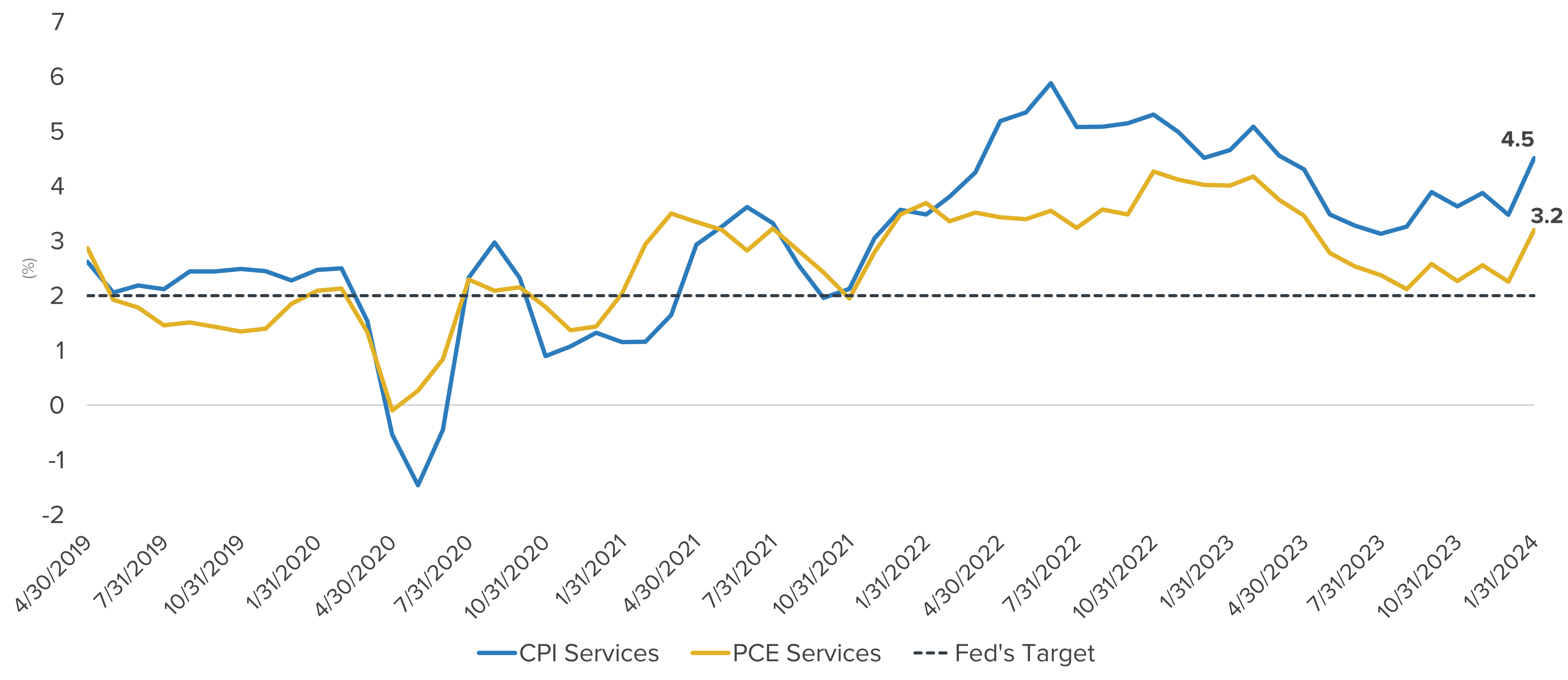

As the chart below shows, core PCE services inflation over the past three months (through January) is averaging 3.2%—while core services inflation in the Consumer Price Index (CPI) is even worse, averaging 4.5%. Both are up sharply from their recent lows.

3-Month Average Month-Over-Month (%) Annualized

Source: Bloomberg, calculations by Horizon Investments, as of 01/31/2024.

Core services inflation is heating up, and it may be affecting overall inflation. Core PCE over the most recent three-month period is averaging 2.6%, up from its three-month average of just 1.5% last month.

The upshot: We aren’t counting on the Fed to cut rates at its meeting later this month. Given this recent spike, we expect the Fed to hold off until it sees at least three consecutive months of lower core services inflation. That means June at the earliest—and later in 2024 if services inflation stays sticky.

Personal Consumption Expenditures (PCE) price index measures the change in goods and services consumed by all households, and nonprofit institutions serving households. The Consumer Price Index (CPI) measures the change in the out-of-pocket expenditures of all urban households. Both are widely used measures of inflation.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2024 Horizon Investments, LLC.

For more news, information, and analysis, visit the ETF Strategist Channel.