Market Uneasiness Returns in February

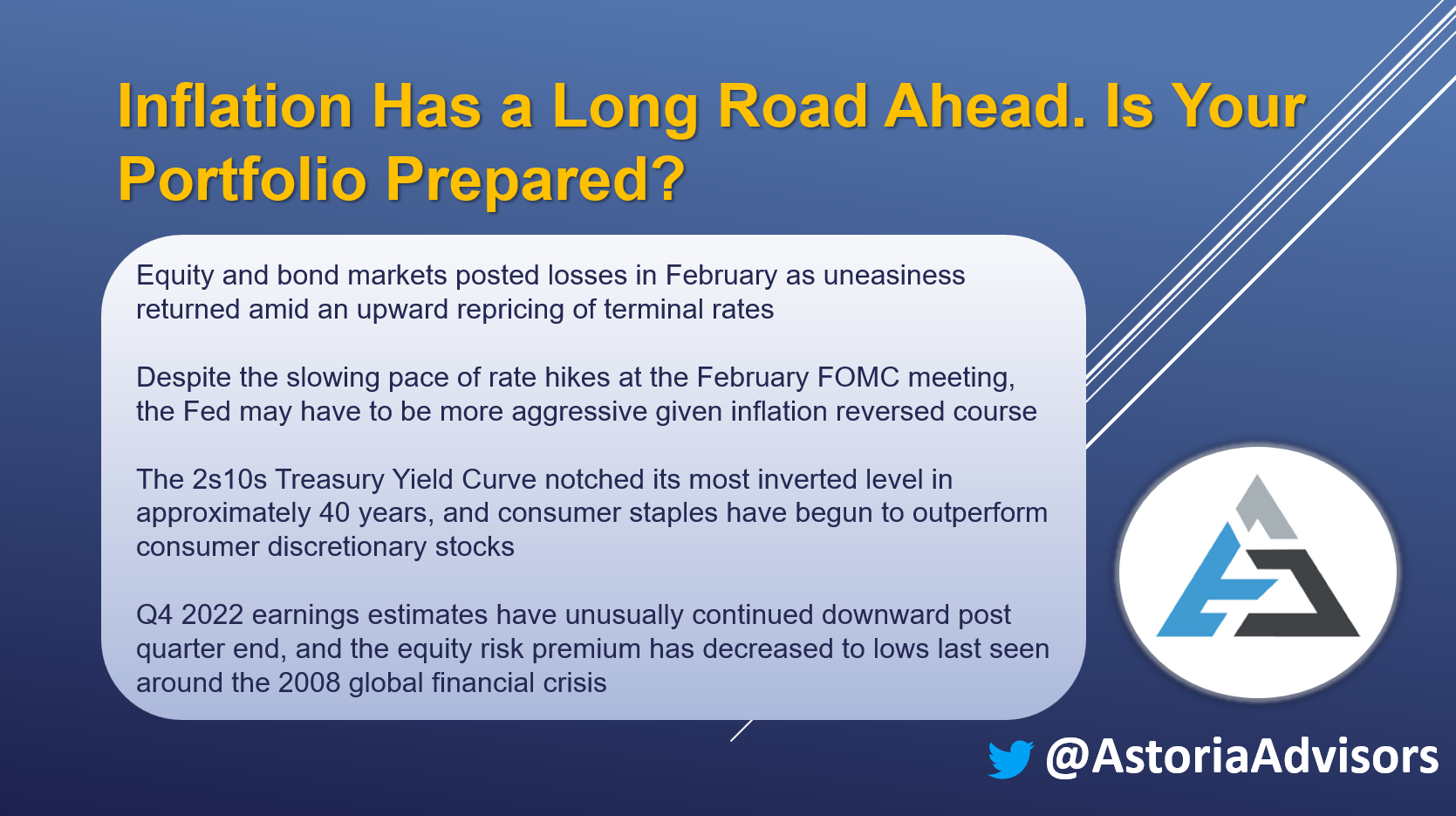

Amid restored inflation worries and an upward repricing of terminal rates, equities posted losses in February. For the month, broad-based emerging market equities were among the worst performers (-6.9%), followed by international developed equities (-3.0%) and US value (-3.0%). Bonds also declined as investment grade corporates were down 4.2%, 7-10 year US Treasuries fell 3.3%, and the US Aggregate Bond Index decreased 2.7%. Similarly, commodities produced negative returns: silver dropped 12%, gold declined 5.4%, broad-based commodities decreased 5.0%, and crude oil down 3.0%.

Additional Fed Rate Hikes Anticipated as Inflation Reverses Course

At the February FOMC meeting, the Federal Reserve raised interest rates by 25 bps, leaving the federal funds rate at the 4.50–4.75% range. This marked a further slowing of the pace of rate hikes as the Fed implemented a 50 bps increase at the December meeting and 75 bps hikes at each of the prior four meetings. However, inflation’s pace of softening seems to have moderated according to elevated January CPI (Consumer Price Index) and PPI (Producer Price Index) prints released shortly after February’s rate increase. Moreover, PCE (Personal Consumption Expenditure) data, the Fed’s preferred inflation gauge, reversed course in January and rose from the prior month’s readings, indicating that the Fed may have to be more aggressive regarding monetary policy. As a result, the bond market has repriced terminal rates to peak at approximately 5.4%, up 60 bps from expectations in recent weeks. Additionally, most of the previously anticipated 50 bps of rate cuts are no longer seen occurring in the back half of 2023. Traders have also begun pricing in a 50 bps hike at the upcoming March FOMC meeting, but the odds are currently only 23% via the CME FEDWatch tool.

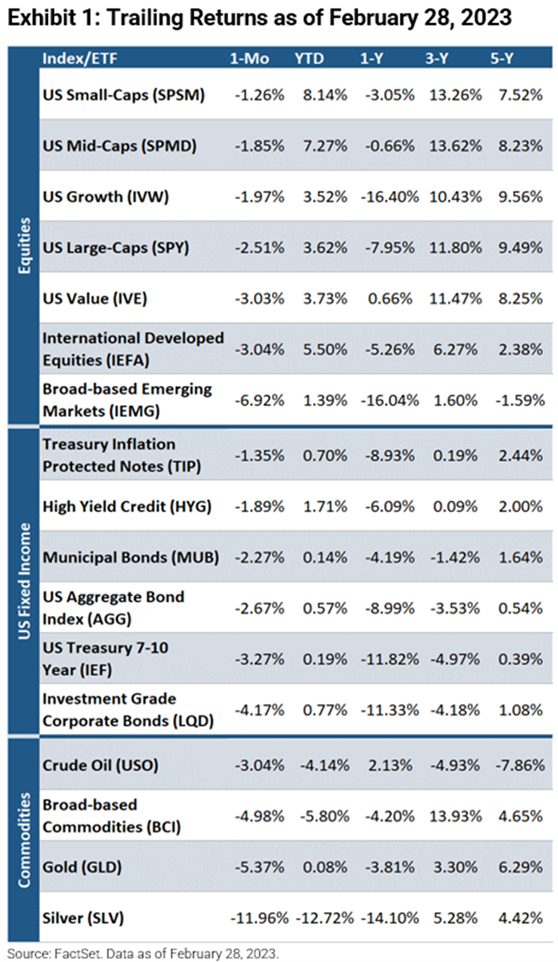

Deepest Yield Curve Inversion in 40 Years

One of the economy’s most renowned leading indicators, the yield curve, continues to invert. Such inversions have historically preceded recessions. As pictured below, the spread between the 2-year and 10-year US Treasury yields recently notched its most inverted level in approximately 40 years.

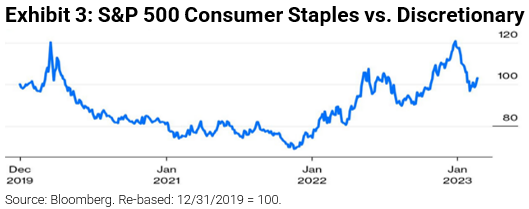

From Discretionary to Staples

Discretionary stocks tend to perform well when consumers have more disposable income, while staples traditionally rise as economic uncertainty increases. As seen by the ratio of the S&P 500 Consumer Staples Index relative to the Consumer Discretionary Index, staples underperformed discretionary stocks at the start of 2023 amid abating interest rate hike fears and increasing soft landing hopes. However, staples have begun to outperform as inflation remains stubbornly high, suggesting monetary policy may have to be more aggressive and that the economy may face additional headwinds in the months ahead.

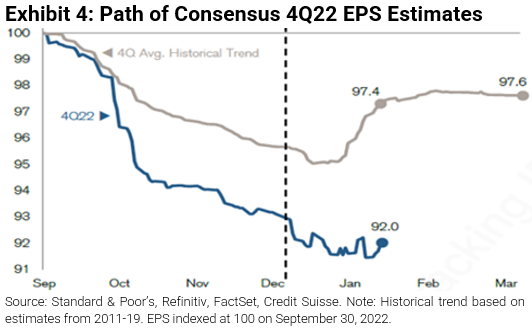

Earnings Estimates Continue Downward

Generally, companies downplay expectations to benefit from lower earnings forecasts, and analysts tend to increase estimates to more plausible levels at the end of the quarter. However, Q4 2022 has seen a different path as estimates have been lowered since its end. Such negative revisions are unusual and have historically only occurred during economic downturns. Will consumers remain strong enough to ward off an earnings recession?

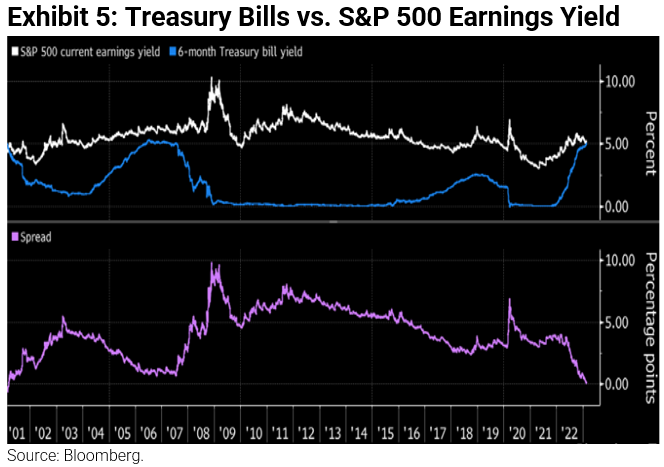

Little Compensation for Equity Risk?

After a series of aggressive rate hikes, the equity risk premium, known as the excess return over the risk-free rate that investors expect to earn from taking on risks associated with equities, has decreased to lows last seen around the 2008 global financial crisis. As the 6-month US Treasury yield has recently topped just over 5% while the S&P 500’s current earnings yield lies at 5.2%, this leaves little compensation for assuming additional equity risk. Hence, receiving essentially risk-free payouts of a comparable amount makes fixed income seem more appealing than equities.

Inflation Has a Long Road Ahead. Is Your Portfolio Prepared?

We are in a tricky part of the cycle. Some macroeconomic data has improved, indicating the economy is running hot. Simultaneously, inflation is well above trendline as CPI and PPI prints stay elevated, while PCE data rose, implying inflation is sticky and will remain higher for longer. Real rates have increased, the terminal rate has been repriced higher, and recession risks have been pushed out. Keep in mind that economic turnovers have historically occurred after the Fed pauses. Between the 1970s and ’80s, CPI stayed north of 5% for a decade. Thus, we think pro-inflation strategies will be the portfolio drivers in the years to come. Our current positioning is more defensive, though not as extreme as in 2022. We have lengthened our bond duration, maintain a healthy allocation to alternatives, and remain titled away from growth and towards value/quality-centric assets.

For more news, information, and analysis, visit the ETF Strategist Channel.

Warranties & Disclaimers

As of the time of this publication, Astoria Portfolio Advisors held positions in IEMG, IVE, SPMD, SPY, SPSM, IVW, IEFA, MUB, TIP, AGG, IEF, HYG, LQD, BCI, GLD, USO, and SLV on behalf of its clients. There are no warranties implied. Past performance is not indicative of future results. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. The returns in this report are based on data from frequently used indices and ETFs. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data, and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to the accuracy, completeness, or reliability of such information. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements.