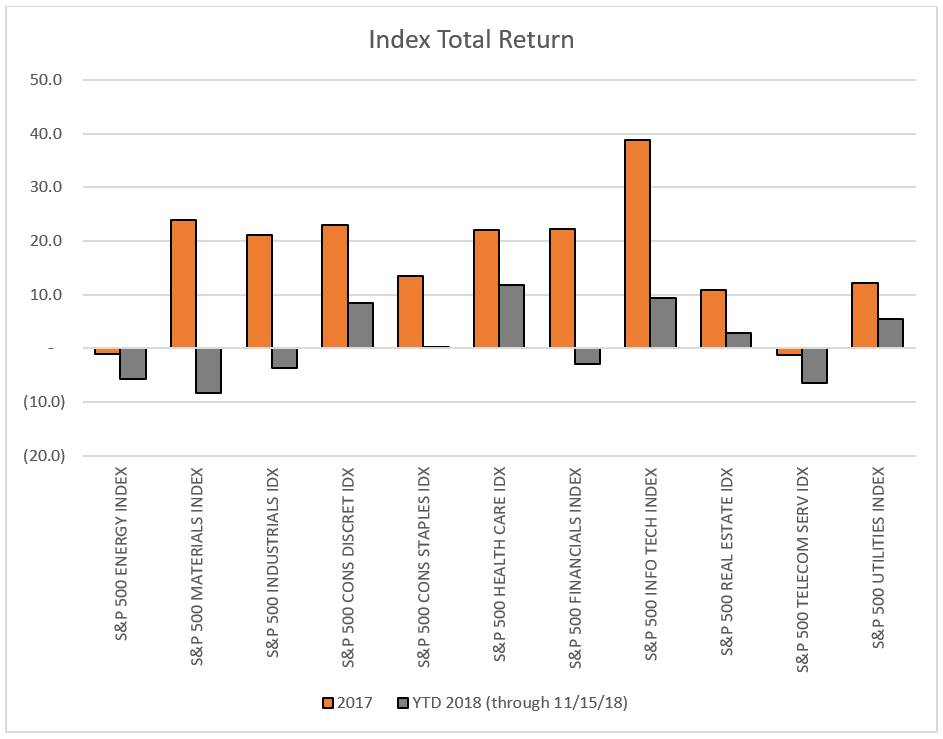

If the markets have an unusually stellar year, that’s awesome. However, it should not be considered the norm. On average, the S&P 500 experiences a -14% drawdown every year. In 2017 we experienced none, this year we have had two -10% drawdowns. If this market has you spooked, or your advisor thought 2017 would last forever, you may consider revisiting your expectations to match up with what history has taught us. Check out the chart below, which puts last years returns in each S&P 500 sector against 2018 YTD through 11/15.

Last year’s heroes are now today’s villains as performance chasing, particularly in tech has eaten a healthy slice of humble pie. Unfortunately, last year’s heroes will almost ALWAYS be next year’s villains. If you rely on sellers to set a price for you, instead of figuring out the value of each position yourself, then you’re in for a (Marvel Cinematic) Universe of hurt (Oh Snap!).

Know what your goals are, set a plan, and stick to it. Jumping from an aggressive portfolio to a conservative one and back again has been shown to be one of the worst ways to build wealth.

One of the biggest takeaways I have from Stan Lee’s legacy is that we are the authors of our future and although there are plenty of unknowns out there, mitigating them can be a factor of choice more than fate. The adage goes that luck = preparation + opportunity. In the words of Stan Lee, “the greatest superpower is luck.” Therefore, get prepared for some opportunity and your super power will revealed.

Excelsior!

Nyle Bayer

Helios Quantitative Research provides financial advisors with the ability to offer state-of-the art, algorithm-driven asset management solutions to their clients on any platform. This allows advisors to:

- Provide clients a better asset management experience

- Reduce client fees by up to 30%

- Drive higher revenues by up to 50%