Home Prices Look Overvalued, But Major Decline Unlikely

What a Difference a Year Makes

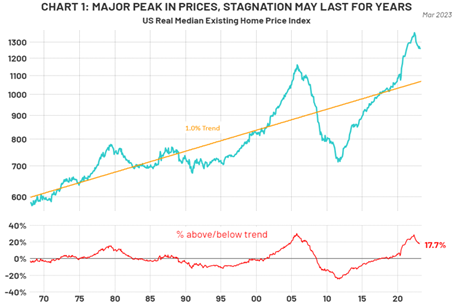

A year ago, we wrote about the housing market. At that time, it was still ‘hot’. House prices were close to record levels above their long-term trend (see Chart 1, below), and homes were selling above asking and getting snapped up in days. We suggested that the rise in interest rates would change that environment…and it has. We also said that a housing bust was unlikely, and we still hold that view. Our outlook is for prices to ‘rust’, i.e., go through a long period of stagnation, not ‘bust’ like they did in 2008/2009.

While house prices are greatly influenced by local supply demand issues, as Chart 1 below shows, house prices nationally rose to more than 20% above trend in 2022 driven, we believe, largely by the collapse of mortgage rates. They now seem to have peaked and started falling. This begs the question of whether they will follow the pattern of the 2007 to 2011 price collapse. We will outline the reasons why we think a major decline is unlikely this time.

Housing affordability measures US income and interest rates to determine if a median-income family could qualify for a mortgage on a median-priced home (see chart, next page). To interpret the indices, a value of 100 means that a family with the US median income has exactly enough to qualify for a traditional 30-year fixed-rate mortgage on a median-priced home. An index above 100 signifies that a family earning the median income has more than enough to qualify for a mortgage loan on a median-priced home, assuming a 20% down payment. Home buyers are being forced to scale back on the purchase price relative to a year ago due to higher interest rates increasing the overall monthly payments.

The combination of ‘above trend’ home prices and falling affordability might suggest…that prices could decline more rapidly, but there are some structural factors that we believe will support home prices.

Rust, not Bust: There is a Shortage of Supply

The first structural factor is a shortage of supply, especially for existing homes. Many homeowners refinanced their mortgages as rates fell to record low levels. This means they are unaffected by the rise in rates as long as they don’t sell. There are also fewer forced sellers, as low interest payments mean household debt service, as a percentage of disposable income, has fallen from a 40-year high of 18% in 2007 to a below average rate of 14.5% today. Chart three (below) shows the stark contrast between today’s housing supply and that which was available during the housing crisis. During the crisis there were 10-12 months of available supply of existing homes, today there is less than 3.

…And Millennials (The Boomers Kids) are Now Forming Households

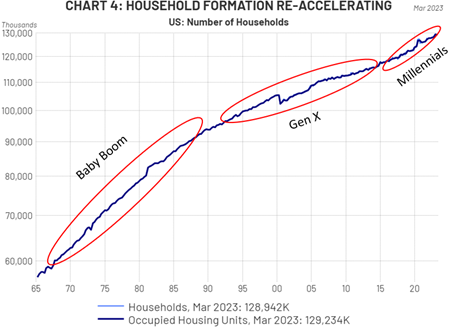

The second structural factor that may lead to a ‘rust, not bust’ dynamic is on the demand side; the ‘millennial’ generation are now in their household formation years. The oldest millennials are turning 40 and the youngest are turning 26. According to the US Census Bureau there are 71 million millennials, and they make up 21% of the US population and 35% of the workforce. Millennials are getting married later but now household formation is picking up, providing a source of structural demand. Chart 4 (next page) shows an acceleration in the pace of household formation since about 2017. This more closely reflects the pace when the millennials’ parents -the ‘baby boomers’- were forming households. As such, we expect it to last a long time. In addition, buyers are likely to spend more on homes and less on other things in our view, due to the pandemic’s shift to flexible schedules and the need for more space.

When you combine these factors, the likelihood of a sustained period of house price stagnation seems high, but a collapse in house prices seems unlikely.

Some Final Advice

Buying a home is more than a pure financial decision. Unlike a stock portfolio which is purely an investment, you get to live in your house and there are all kinds of intangible emotional factors involved in buying a home. Since we all need somewhere to live, the choices are buying or renting, and owning a home just feels different, in our view. Owning a home also allows you to add value to your home by improving it. The advantage of renting is flexibility, and a lack of repair costs but rents are also rising rapidly. Generally, the longer you plan to live in a home, the more advantageous it is to buy.

Given our views on home prices, we suggest the decision be based on personal preferences, not on the expectation of further significant price increases in the next few years. As our chart on page one shows, home prices only increase on a trend basis of 1% over inflation and have big price swings. This suggests that the main financial advantage of home ownership is the ‘forced savings’ process of increasing your ownership stake by paying off a mortgage over time.

For more news, information, and analysis, visit the ETF Strategist Channel.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Definitions:

An affordability index is a measure of an average person’s ability to purchase a particular item, such as a house in a particular region, or to afford the general cost of living in the region.

The National Association of Realtors (NAR) is a national organization of real estate brokers, known as realtors, created to promote the real estate profession and foster professional behavior in its members. The association has its own code of ethics to which it requires its members to adhere.

The U.S. Census Bureau is a principal agency of the U.S. Federal Statistical System that is responsible for conducting the national census at least once every 10 years. The population of the U.S. is counted in the census. The Bureau is responsible for producing data about the American people and the economy. The U.S. Census Bureau is a division of the United States Department of Commerce.

Interest rate sensitivity is a measure of how much the price of a fixed-income asset will fluctuate as a result of changes in the interest rate environment. Securities that are more sensitive have greater price fluctuations than those with less sensitivity. This type of sensitivity must be taken into account when selecting a bond or other fixed-income instrument the investor may sell in the secondary market. Interest rate sensitivity affects buying as well as selling.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2023 RiverFront Investment Group. All Rights Reserved. ID 2890617