Author: Veronica A. Fulton Research Analyst

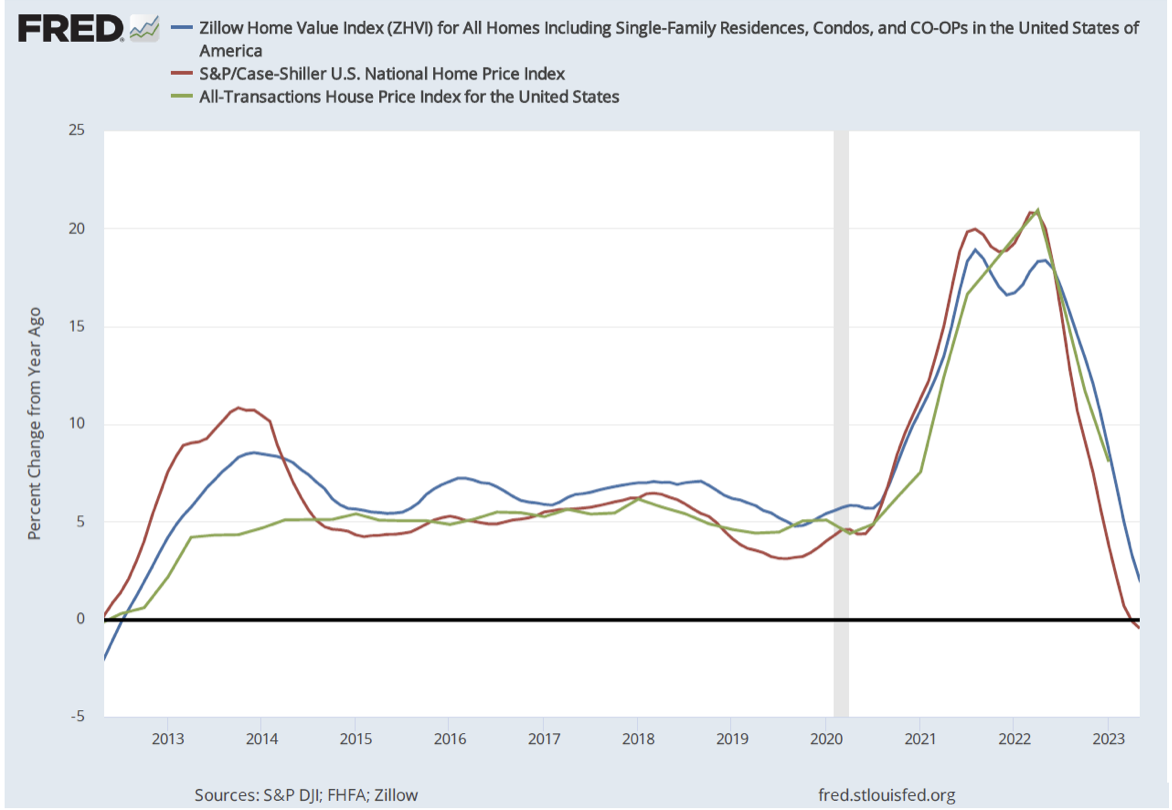

The U.S. economy has been resilient despite both the pace and level of monetary tightening. A notable pocket of this resiliency has been housing market activity. Below is a chart of the year over year change in three indices that measure home prices: The Zillow Home Value Index (ZVHI), the S&P/Case-Shiller US National Home Price index, and the All-Transactions House Price Index for the United States. All three measures show a decline in the growth of home prices. The ZVHI and Case-Shiller indices show home prices today are relatively flat from a year ago, which indicates on an absolute basis prices haven’t budged from last years’ elevated levels.

Traditionally as monetary policy tightens and interest rates rise, banks respond by tightening lending standards. Additionally, higher interest rates reduce mortgage affordability. These two things work in tandem to dry up demand consequently bringing home prices down, all else equal. But as we know, price exists where supply and demand meet. So, despite affordability being near record-low levels and tight lending standards, we still have not seen a contraction in home prices that is typically consistent with restrictive monetary policy. This has everything to do with the supply side of the equation. Historically, the bulk of transaction volume in home sales comes from existing homes. This time around, millions of U.S. homeowners that previously locked in record-low mortgage rates are sidelined. This isn’t surprising, as the rate on a new loan today is nearly double the rate being paid by existing homeowners. As the inventory of existing homes remains tight, more home buyers have flocked to the new home market, boosting new home sales and creating a tailwind for construction activity.

As the job market remains buoyant and wage growth steady, even the slightest decrease in mortgage rates could send more homebuyers rushing into the market. Assuming inventory stays low, this would bid up home prices even further. We’ve known for some time now that bringing inflation under control without crushing the economy would be a delicate task, much akin to the goldilocks situation. Not too hot. Not too cold. But just right. At present, economic data at the margin disproves the “too cold” scenario as the unemployment rate remains historically low and the economy is steadily growing. Some market participants have sounded the bell on the “just right” scenario as the aforementioned economic conditions combined with lower inflation support a soft landing. But as demand remains robust, we would be remiss to not consider the “too hot” scenario. This includes key pockets of the economy, such as housing, re-accelerating giving rise to inflation risks once again. Although, we believe good progress has been made on taming inflation and are constructive on the U.S. economy for the remainder of 2023, declaring an outright victory could be premature.

For more news, information, and analysis, visit the ETF Strategist Channel.

GLOBALT is an SEC Registered Investment Adviser since 1991 and, effective July 10, 2013, remains a Registered Investment Adviser through a separately identifiable division of Synovus Trust N.A., a nationally chartered trust company. This information has been prepared for educational purposes only, as general information and should not be considered a solicitation for the purchase or sale of any security. This does not constitute legal or professional advice and is not tailored to the investment needs of any specific investor. Registration of an investment adviser does not imply any certain level of skill or training. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information may be required to make informed investment decisions, based on your individual investment objectives and suitability specifications. Investors should seek tailored advice and should understand that statements regarding future prospects of the financial market may not be realized, as past performance does not guarantee and/or is not indicative of future results. Content may not be reproduced, distributed, or transmitted in whole or in part by any means without written permission from GLOBALT. Regarding permission, as well as to receive a copy of GLOBALT’s Form ADV Part 2 and Part 3, contact GLOBALT’s Chief Compliance Officer, 3400 Overton Park Drive, Suite 200, Atlanta GA 30339. You can obtain more information about GLOBALT Investments and its advisers via the Internet at adviserinfo.sec.gov, sponsored by the U.S. Securities and Exchange Commission. The opinions and some comments contained herein reflect the judgment of the author, as of the date noted. Investment products and services provided are offered through Synovus Securities, Inc. (SSI), a registered Broker-Dealer, member FINRA/SIPC and SEC Registered Investment Adviser, Synovus Trust Company, N.A. (STC), Creative Financial Group, a division of SSI. Trust services for Synovus are provided by STC. Regarding the products and services provided by GLOBALT: NOT A DEPOSIT. NOT FDIC INSURED. NOT GUARANTEED BY THE BANK. MAY LOSE VALUE. NOT INSURED BY ANY FEDERAL AGENCY