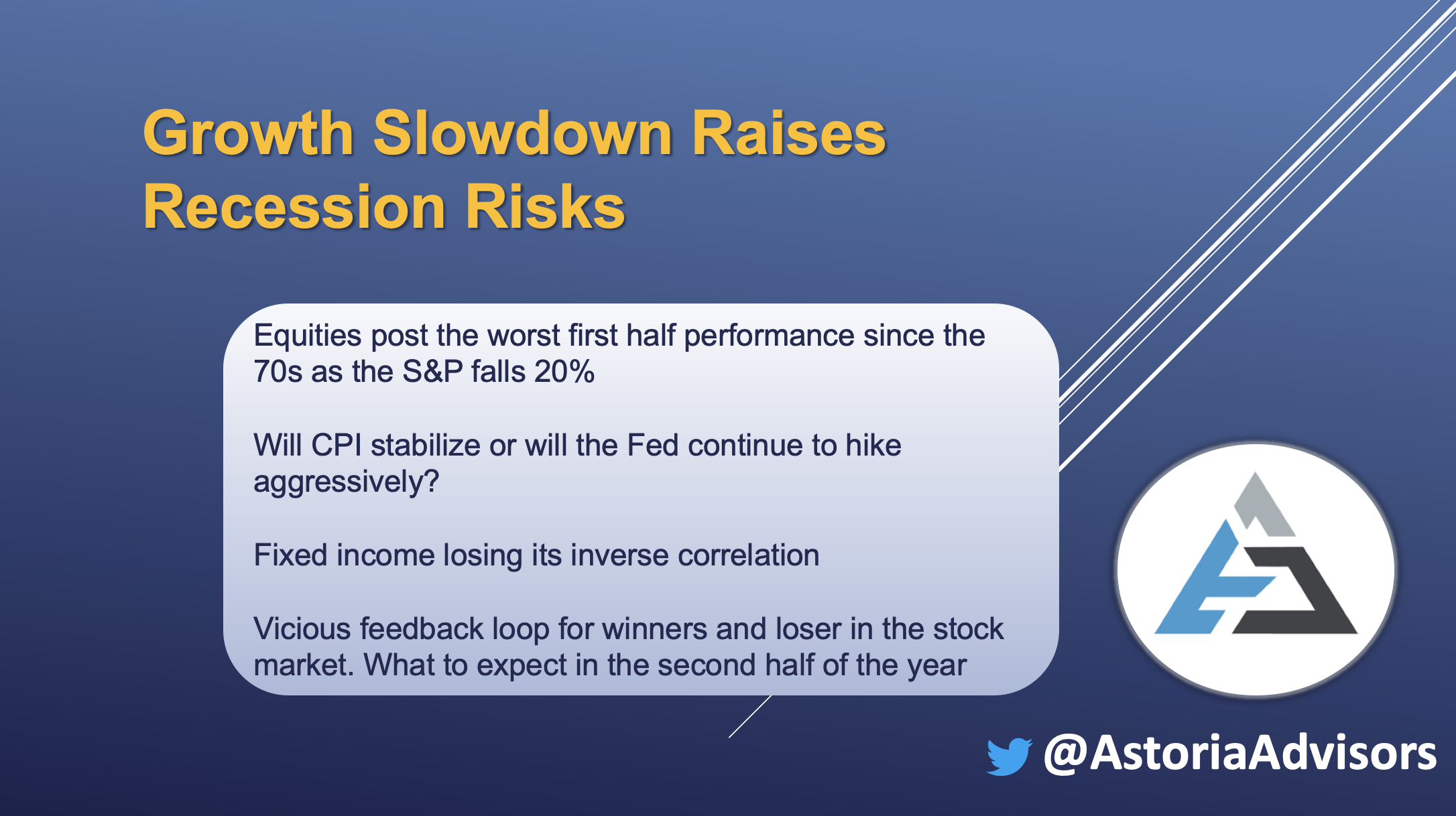

Equities Post Worst First Half Performance Since the 1970s

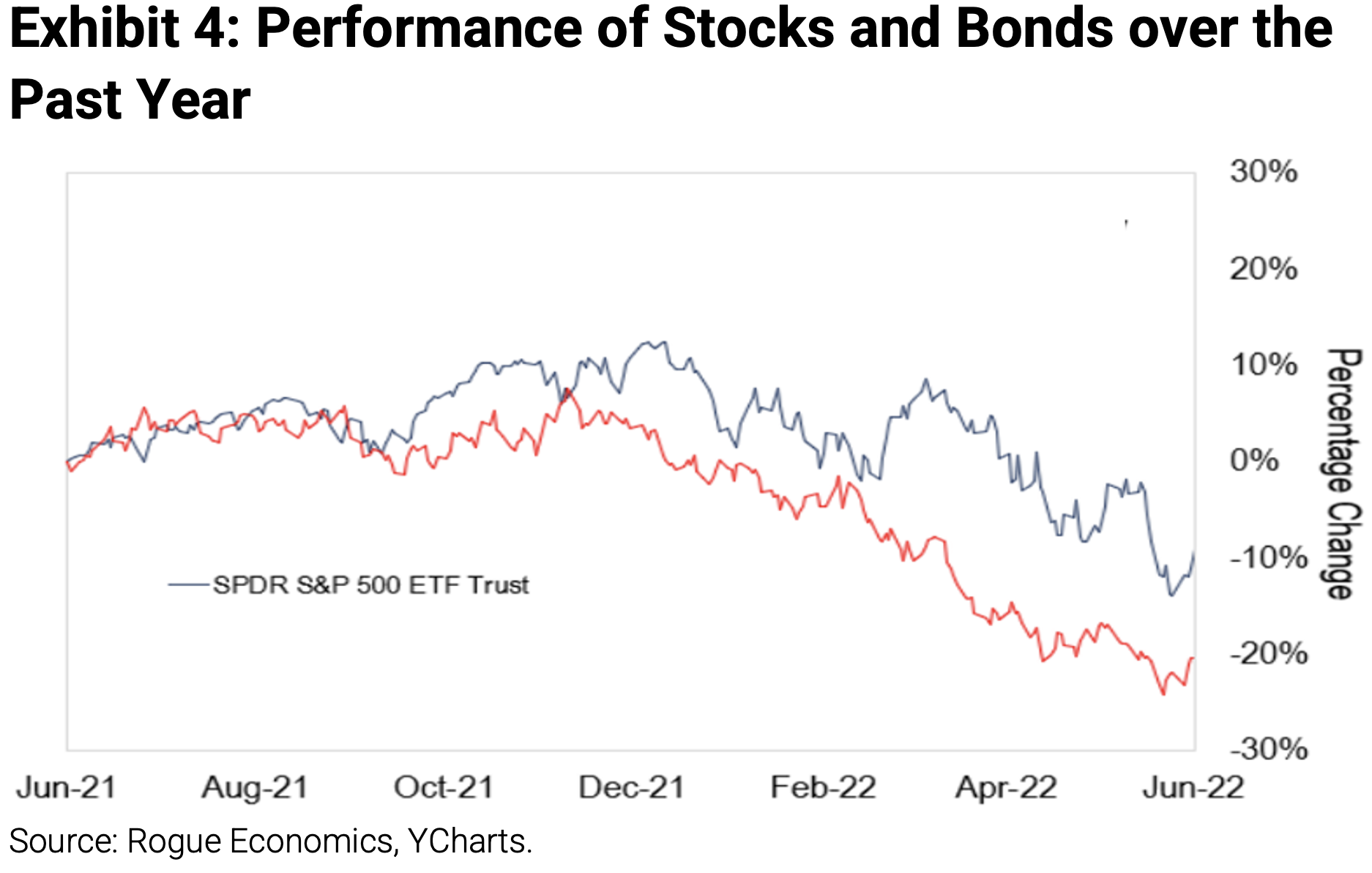

Amid rising recession fears, inflation & interest rate concerns, and slowing economic growth, equities had their worst first half of the year in decades as the S&P 500 fell 20%. While value and broad-based emerging markets were only down 11% and 17%, respectively, growth stands to be the worst performer, given its 29% decline. Bonds also posted negative returns ranging from municipal bonds down 8% to investment grade corporates declining 16%. However, both crude oil and broad-based commodities were up, gaining 48% and 18%, respectively.

The Fed’s Fight Against Inflation

Shortly after annualized May CPI (Consumer Price Index) hit a new 40-year high, the Federal Reserve raised interest rates by 75 bps at the June FOMC meeting, marking its most aggressive hike since 1994. In the past week, Fed Chairman Jerome Powell expressed that he is more concerned about failing to control inflation than sparking a recession in the US, given his comment, “Is there a risk we would go too far? Certainly, there’s a risk. The bigger mistake to make would be to fail to restore price stability.” Accordingly, it seems inflation readings will have to peak and turn downward for the Fed to slow its aggressive tightening pace. The PCE (Personal Consumption Expenditure), the Fed’s preferred measure of inflation, for May was just released, coming in at 6.3% year over year but remaining steady with the previous month’s reading. Close attention will be paid to next month’s CPI and PPI (producer Price Index) announcements. Ultimately, another 75 basis point hike may continue to pressure all asset classes, while a 50 basis point hike may show market participants that the Fed is acknowledging the pain being felt across asset classes.

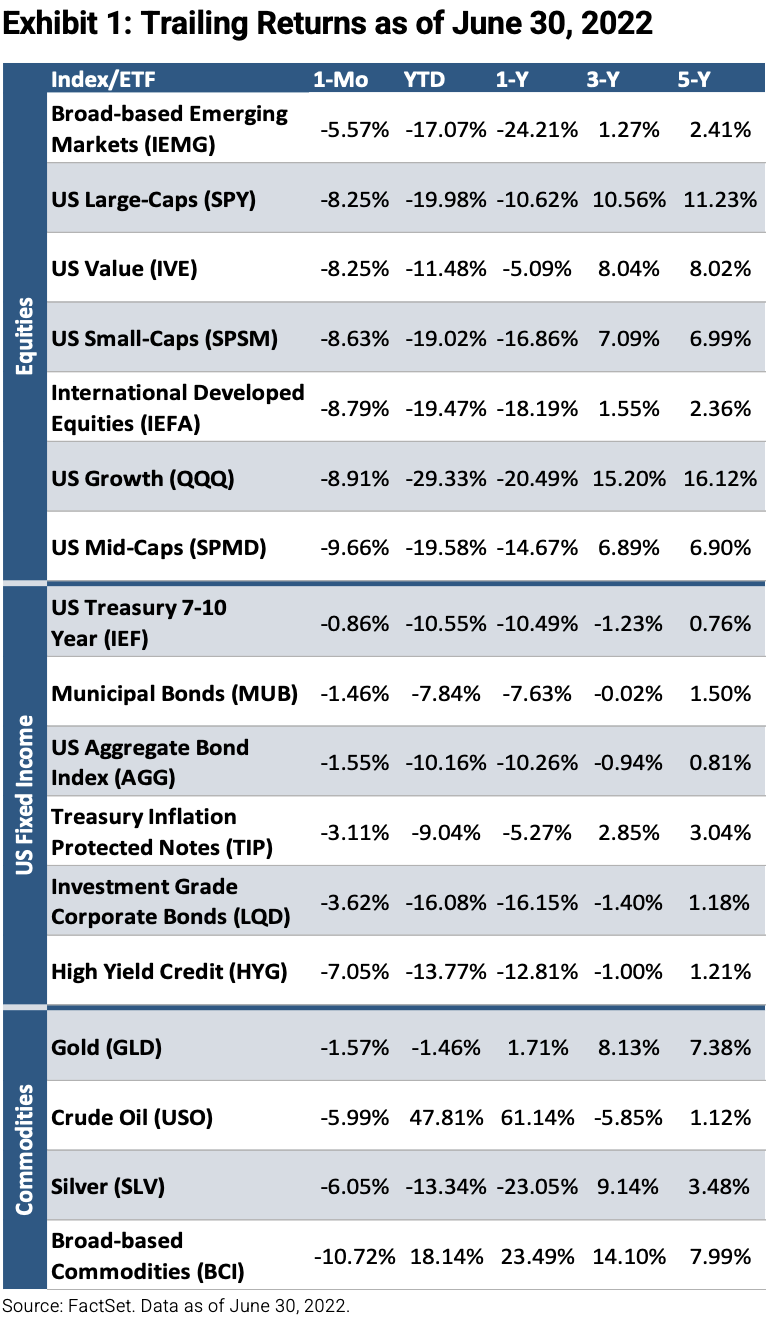

Leading Indicators Point Downward

As seen below, recessions have historically occurred after many instances when the Composite Index for Leading Economic Indicators turned downward as it has recently.

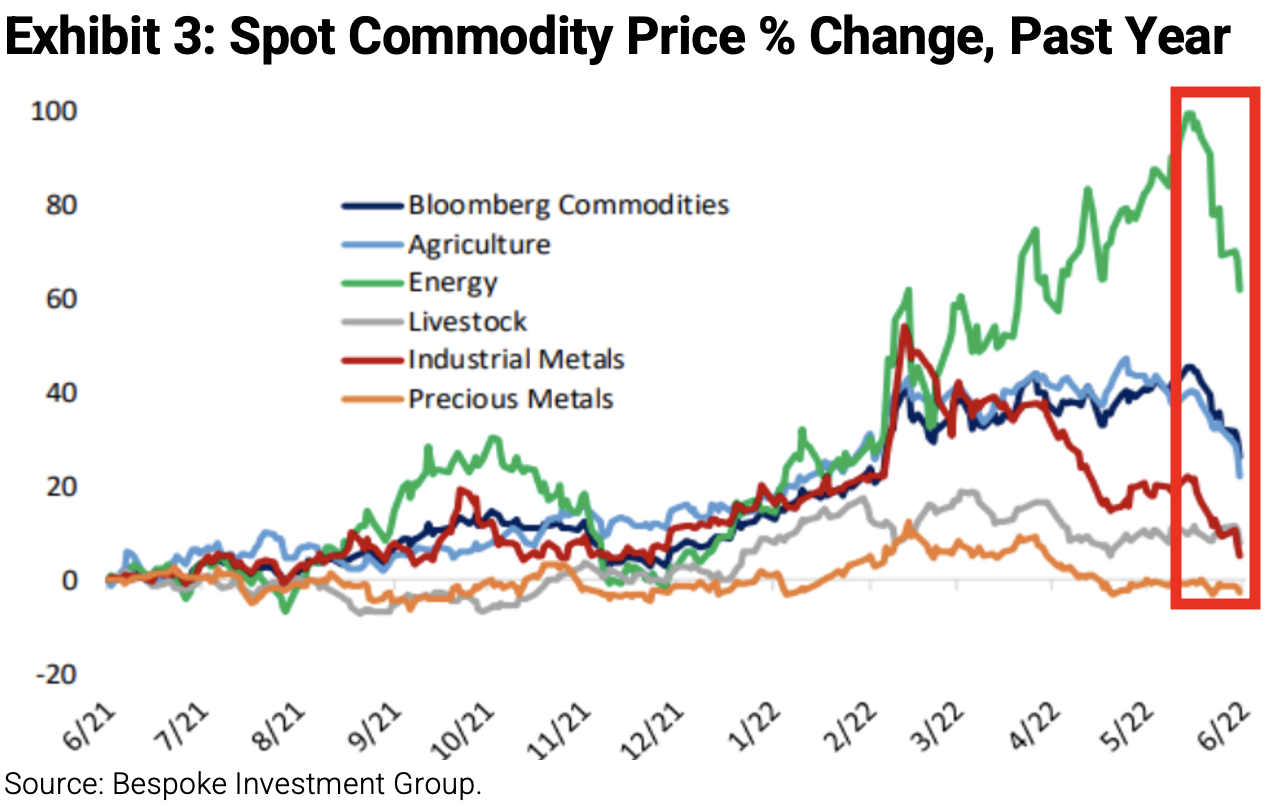

Commodity Price Fall

In recent weeks, commodities have tapered off, likely on the back of decreased demand, which is often associated with increasing recession risks.

Correlations Increase

Historically, a portfolio of 60% equity and 40% bonds has been relied on for its diversification benefits. Recently, however, their inverse relationship has started to break down as the Fed began hiking rates, and both stocks and bonds correlations have increased. As seen in the chart below, both assets have moved on a similar path over the past year. This demonstrates that bonds have not provided as meaningful of a hedge to stocks as they traditionally have, bringing down the performance of a 60/40 portfolio.

Outlook for Second Half of 2022

Markets are experiencing a vicious negative feedback loop. Higher inflation stemming from supply chain shocks lingering post-Covid, excessive stimulus, plus tight labor markets has forced the Fed to be draconian in its rate hikes. Higher rate hikes have pressured longer duration assets. Significant downturns in growth, speculative technology, and cryptocurrency have caused investors to unwind their books. The biggest year-to-date winners are being sold to bring risk levels down. In recent weeks, this has led to a significant downturn in commodity and inflation sensitive assets, and there are no places to hide anymore. In summary, we believe there are three notable risks that the economy faces: 1) the Fed continues to be behind the curve and is stepping hard on the gas pedal 2) the Fed is looking to unwind its balance sheet at the same time it’s hiking interest rates 3) inflation has not peaked. Will the broader economy be able to withstand these risks without entering a recession? The stock market has already discounted the recession, in our view. There are a number of high quality growth stocks that are down 30-35% year to date. Crypto assets are down as much as 75%, and unprofitable technology stocks are down as much as 75% from their all-time highs. Historically, buying stocks in a recession has proven to be a good risk/reward as your margin of safety is usually wider. It seems sensible for investors to start buying if they are long-term and strategic, as these opportunities may not last long. We continue to advocate that broadly owning a portfolio of diversified sets of asset classes, as well as owning multiple factors, inflation hedges, and alternatives, will be paramount for the remainder of 2022.

Best,

Nick Cerbone

As of the time of this publication, Astoria Portfolio Advisors held positions in IEMG, SPY, IVE, SPSM, IEFA, QQQ, SPMD, IEF, MUB, AGG, TIP, LQD, HYG, GLD, USO, SLV, and BCI on behalf of its clients. There are no warranties implied. Past performance is not indicative of future results. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. The returns in this report are based on data from frequently used indices and ETFs. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data, and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to the accuracy, completeness, or reliability of such information. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements.