This past weekend, we expressed to our followers that one of the tell-tale signs of a market bottom is when central banks START to panic (here). Our message was well received, so we wanted to follow up with some additional thoughts, especially on the back of some Draconian measures from 2 central banks since our Saturday post.

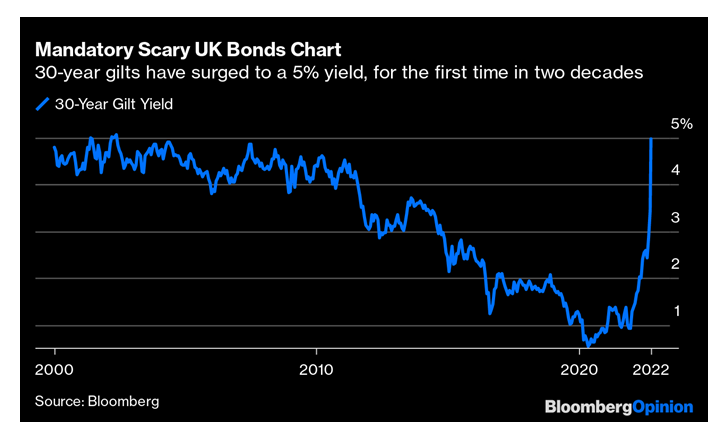

The BoJ and BoE both stepped into the market to defend their currency (BoJ) and bond markets (BoE). The chart below portrays the 30-year gilts recently turning parabolic. The BoE simply wouldn’t let their bond yields go to the moon. No one expected the BoE to reengineer QE, but such is unpredictable when dealing with soaring inflation, currency wars, and skyrocketing yields.

Other signposts of capitulation to watch:

- a full-blown earnings recession

- the highest quality large cap stocks collapse

- a Fed acknowledgment that forward looking inflation indicators have fallen (the irony here is that most of them have fallen significantly, i.e., money supply, gasoline, timber, housing market, etc.). Look at the dollar: it is at a 20 year high. There are a multitude of signs showing that inflation on the margin is declining. What is the Fed looking at!

Regarding which high quality stocks to potentially watch, Apple was one of the market’s darlings through this past market cycle. It checks all the boxes: everyone understands its business; it is a high quality stock; it produces significant free cash flow; and it was never grossly expensive throughout the previous cycle. How could you berate a Portfolio Manager for owning such a high quality stock?

However, based on our tenured investing careers, we know that bear markets don’t end until the grizzly mauls stocks in every corner of the market. If Apple were to significantly decline, that could be a sign that this bear market is nearly complete: a healthy sign. We need this bear market to end; this downturn which began in February 2021 (when speculative tech stocks peaked) is getting long in the tooth for many.

Yesterday, the S&P 500 was up 1.9% while Apple was down 1.3%. This is a rare performance differential given that Apple is a top stock in the index.

If you are looking for green shoots, yesterday’s market rally, Apple’s decline, and 2 major central banks implementing Draconian measures are all constructive steps toward the return of these grizzly bears to hibernation.

Astoria will be hosting our initial market outlook call in a couple of weeks. Keep an eye out for more details soon to come.

You can view the fact sheets of our strategies on the Strategies page of our site.

Astoria Portfolio Advisors Disclosure: Past performance is not indicative of future performance. Please note, as of September 29, 2022, Astoria holds AAPL on behalf of its clients, as well as in select Astoria Portfolio Advisors stock portfolios. Any third-party websites provided on www.astoriaadvisors.com are strictly for informational purposes and for convenience. These third-party websites are publicly available and do not belong to Astoria Portfolio Advisors LLC. We do not administer the content or control it. We cannot be held liable for the accuracy, time-sensitive nature, or viability of any information shown on these sites. The material in these links is not intended to be relied upon as a forecast or investment advice by Astoria Portfolio Advisors LLC and does not constitute a recommendation, offer, or solicitation for any security or investment strategy. The appearance of such third-party material on our website does not imply our endorsement of the third-party website. We are not responsible for your use of the linked site or its content. Once you leave Astoria Portfolio Advisors LLC’s website, you will be subject to the terms of use and privacy policies of the third-party website. Refer here for more details.