By Doug Sandler, CFA

SUMMARY

- High short-term rates have incentivized long-term investors to park assets in cash equivalents.

- Paying for long-term liabilities with short-term assets is a mismatch.

- Funding mismatches can lead to investment disappointments later, in our view.

Bringing a Knife to a Gunfight: Cash Lacks Long-Term Firepower

We are worried that today’s relatively high short-term interest rates have attracted large sums of money to cash equivalents like CDs, money-markets, and T-Bills. This is because cash equivalents have historically been poor funding vehicles for large, long-term liabilities like college and retirement. Saving to fund a large long-term liability can be a formidable challenge and the struggle can be compounded by two formidable opponents: inflation and volatility. To win, one must accurately identify the target (the liability) and arm oneself with the appropriate weapon (the asset).

In the investment world, choosing the right weapon is formally called ‘asset-liability matching’. Asset-liability matching is a popular and effective institutional strategy used by many of the country’s largest insurance companies, asset managers and pension plans. The goal is to match the growth rate and the maturity of a liability – like retirement – to an asset like stocks or bonds. When done effectively, the asset will have grown and matured at the same rate and time as the liability. When done poorly, or ‘mismatched,’ the asset will fall short of the liability and unexpected additional cash outlays will be necessary.

The ‘Right’ Weapon for Hitting the ‘Target’ Depends on 1. Accuracy and 2. Power

1. Accuracy: ‘Accuracy’ is our ability to home in on the target. Some targets are more variable than others. Fixed mortgage payments, for example, are less variable since they have known payment dates and amounts. As a result, accuracy is high, and the weapon of choice can be bonds with fixed coupons and set maturity dates. Many municipalities practice this strategy when they defease (pre-fund) a municipal bond obligation. Other targets, such as sending a kid to college or funding retirement, can be extremely unpredictable, making accuracy more difficult. For example, would anyone have anticipated that the average tuition at a private college rose from $20,000 in 2004 to over $46,000 today, according to US News and World Report? When accuracy is low, weapons like stocks are a better choice in our view, since their returns are not fixed and can rise to offset the more inflationary environment.

Source: LSEG Datastream, RiverFront; data monthly, as of 11.30.2023. Chart shown for illustrative purposes only. Past performance is no indication of future results.

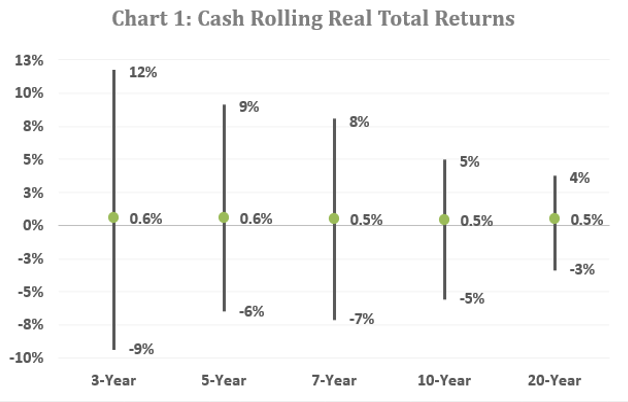

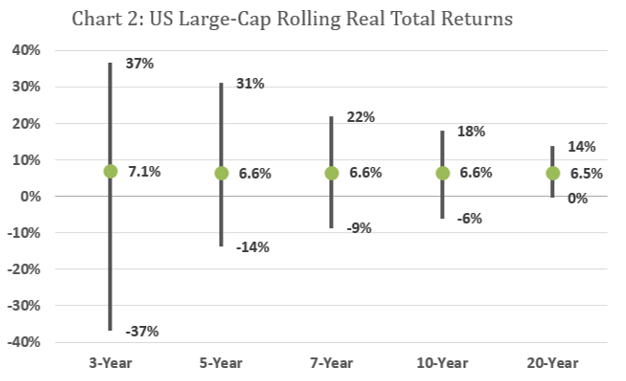

2. Power refers to the ‘stopping power’ of a weapon. In the world of investing, we think of this as an asset’s ability to grow. Since 1926, assets like cash have historically grown at about 0.5% over inflation (Chart 1, bottom of first page) while US stocks have grown at about 6.5%. Cash can be an extremely effective weapon against a target where significant growth is not required. However, when a target is large, few weapons are as effective as stocks, which have historically delivered returns 10X larger than cash over time (Chart 2, below). Essentially, the size of tomorrow’s liability relative to today’s assets should be an important determinant when choosing an appropriate weapon.

Source: LSEG Datastream, RiverFront; data monthly, as of 11.30.2023. Chart left shown for illustrative purposes only. Past performance is no indication of future results.

The risk of using an underpowered weapon can be significant. For example, from 2008 to 2022 the Fed Funds (cash) rate spent much of the time below the inflation rate, as measured by the Consumer Price Index (CPI). Retirees holding too much cash over this 14-year period lost a significant amount of purchasing power and faced the difficult choice of cutting back their living standards or tapping into their savings to make up the difference.

Consider…The Fed is not Always the Cash Investors ‘Friend.’

The yields on cash equivalents are set by the US Federal Reserve, which means they have no connection to the required rates of return for most investors. Rather, cash rates are a tool that the Fed uses to implement monetary policy. Often Fed policy goals run counter to the goals of an individual. For example, during tough times, when investors need the highest returns, the Fed is motivated to lower the returns on cash to stimulate the economy.

Conclusion: Cash Equivalents are a Poor ‘Match’ for Long-Term Liabilities

Funding a long-term liability with a short-term asset like cash, in our view, is the equivalent of bringing a ‘knife’ to a ‘gunfight.’ While we expect interest rates to remain above inflation in the near term, our specific concern arises when cash is earmarked for longer-term obligations. Cash can be an effective funding source for those liabilities that are less than three years, like a down payment on a house or to fund a year-end tax bill. That is because the returns on cash are relatively certain over the short term. However, beyond three years, cash returns are unknown and have historically only offered a modest pick-up over inflation. For this reason, cash can be an imperfect match to fund long-term liabilities.

Good Time to Rectify Cash Mismatches

The Fed has put holders of cash and cash equivalents on alert: high short-term rates now have an expiration date, and that date is likely sometime in 2024. For this reason, we have lengthened maturities in the fixed income portion of our balanced portfolios and remain overweight stocks.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

The comments above are subject to change and are not intended as investment recommendations. There is no representation that an investor will or is likely to achieve positive returns, avoid losses or experience returns as discussed for various market classes.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Definitions:

A certificate of deposit (CD) is a type of savings account that pays a fixed interest rate on money held for an agreed upon period of time. Offered by both banks and credit unions, CDs differ from standard savings accounts in that CD funds must remain untouched for the entirety of their term—or you’ll incur a penalty. CDs usually pay a higher interest rate than savings accounts as an incentive for giving up your withdrawal flexibility.

A money market fund is a kind of mutual fund that invests in highly liquid, near-term instruments. These instruments include cash, cash equivalent securities, and high-credit-rating, debt-based securities with a short-term maturity (such as U.S. Treasuries). Money market funds are intended to offer investors high liquidity with a very low level of risk. Money market funds are also called money market mutual funds.

A Treasury bill (T-Bill) is a short-term U.S. government debt obligation backed by the Treasury Department with a maturity of one year or less. Treasury bills are usually sold in denominations of $1,000. However, some can reach a maximum denomination of $5 million in non-competitive bids. These securities are widely regarded as low-risk and secure investments.

The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2024 RiverFront Investment Group. All Rights Reserved. ID 3425755

For more news, information, and analysis, visit the ETF Strategist Channel.