One active approach to risk management is currently beating the market.

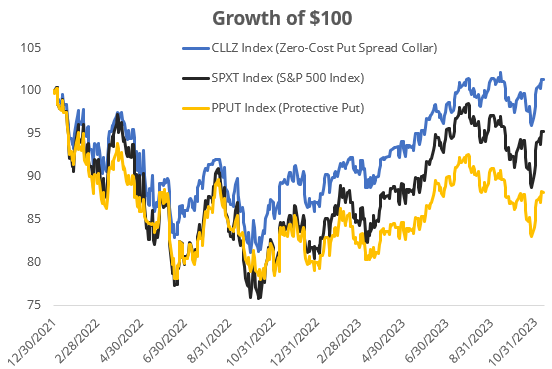

Case in point: Stock investors have been well-served lately by an options strategy for mitigating risk known as a zero-cost put spread collar. This type of collar—an active option strategy—has beaten the S&P 500 index by six percentage points since the end of 2021 (see the chart).1

Source: Bloomberg, as of 11/15/23.

Indices are unmanaged and do not have fees or expense charges, which would lower returns. It is

not possible to invest directly in an unmanaged index. Past performance is not indicative of future

results.

Bonus: Over that period, this zero-cost put spread collar approach has significantly outperformed a monthly put protection strategy 2 (another risk management method) by more than 13 percentage points. Clearly, not all risk reduction techniques work in the same environment.

The difference is that a zero-cost put spread collar involves buying one protective S&P 500 put option while covering the cost by selling other call and put options. By design, unlike the protected put protection strategy, the zero-cost put spread option strategy enables investors to guard a long position in stocks for no explicit cost. Nothing is free; however, the implicit cost of the zero-cost strategy is foregone participation in market gains above the sold call option.

The protective puts tend to perform better when the market drops sharply and quickly. In slow and grinding markets, as has generally been the case over the past two years, the zero-cost protective put strategy may perform better.

In today’s market environment, we believe investors in need of risk mitigation strategies may want to consider zero-cost put option strategies.

1 As represented by the CBOE S&P 500 Zero-Cost Put Spread Collar Index.

2 As represented by the CBOE S&P 500 5% Put Protection Index.

The Cboe S&P 500 Zero-Cost Put Spread Collar IndexSM (CLLZ) is a variation of the Cboe S&P 500 Collar Index (CLL) that hedges negative S&P 500® stock returns more selectively than the CLL at zero upfront cost. First, the long 5% SPX put in the CLL is replaced by a less protective 2.5% – 5% put spread with a lower premium. Second an SPX call is sold with a strike such that the call premium offsets the cost of the put spread. The CLLZ portfolio is rebalanced monthly after SPX options expiration, typically at 11 am ET every third Friday. New SPX options are then bought and sold.

The Cboe S&P 500 5% Put Protection IndexSM (PPUT) tracks the value of a hypothetical portfolio of securities (PPUT portfolio) designed to protect an investor from negative S&P 500 returns. The PPUT portfolio comprises S&P 500® stocks and has a long position in a one-month 5% out-of-the-money put option on the S&P 500 (SPX put).

This commentary is written by Horizon Investments’ asset management team.

The risk management strategies mentioned are not a guarantee against loss or declines in the value of a portfolio. Options are not suitable for all investors and carry additional risks. Options used in a strategy to reduce volatility and generate returns may not perform as intended and could expose the strategy to losses, e.g., option premiums, to which it would not have otherwise been exposed. All investing involves risk of loss, and in periods of market growth, risk mitigation strategies can be expected to lag in performance behind equity strategies that do not focus on risk mitigation.

Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves risk of loss.

The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. Reference to an index does not imply that any account will achieve returns, volatility, or other results similar to that index. An index’s composition may not reflect how a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Individuals cannot invest directly in any index. Indices are unmanaged and do not have fees or expense charges, which would lower returns.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money.

This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. Opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2023 Horizon Investments LLC

For more news, information, and analysis, visit the ETF Strategist Channel.