Strong economic data and technical factors have tested markets to start the year. Last week doubts crept in around the degree of FOMC dovishness given incoming economic data, and technical factors, such as outsized issuance of corporate bonds and crowded positioning in “soft-landing” trades, caused markets to reverse course.

- Bond yields rose across the curve, with the 10Y Treasury yield up 18 bps, closing the week at 4.05%. No big moves in the shape of the yield curve, with the 2s10s curve steepening by 4 bps to start the year – the curve remains inverted at -34 bps. Despite the deluge of corporate bond issuance, credit spreads widened slightly; the spread on investment grade corporates widened by 4 bps to 103 bps over treasuries.

- The reversion from the dovish pricing in December reverberated across markets. Equities defied the “January Effect,” with the S&P 500 falling by -1.5%, breaking its 9-week winning streak. In concert, the USD strengthened by 1% versus other major currencies. Rising geopolitical tensions sent WTI crude 3% higher to $73.81.

The mix of factors that drove macro markets last year are largely the same to start this year. The main difference is that markets are now priced for perfection. The consensus view is that the US economy will be in Goldilocks state, in which the economy doesn’t fall off a cliff into recession but doesn’t expand strongly enough for the FOMC to maintain a high level of interest rates.

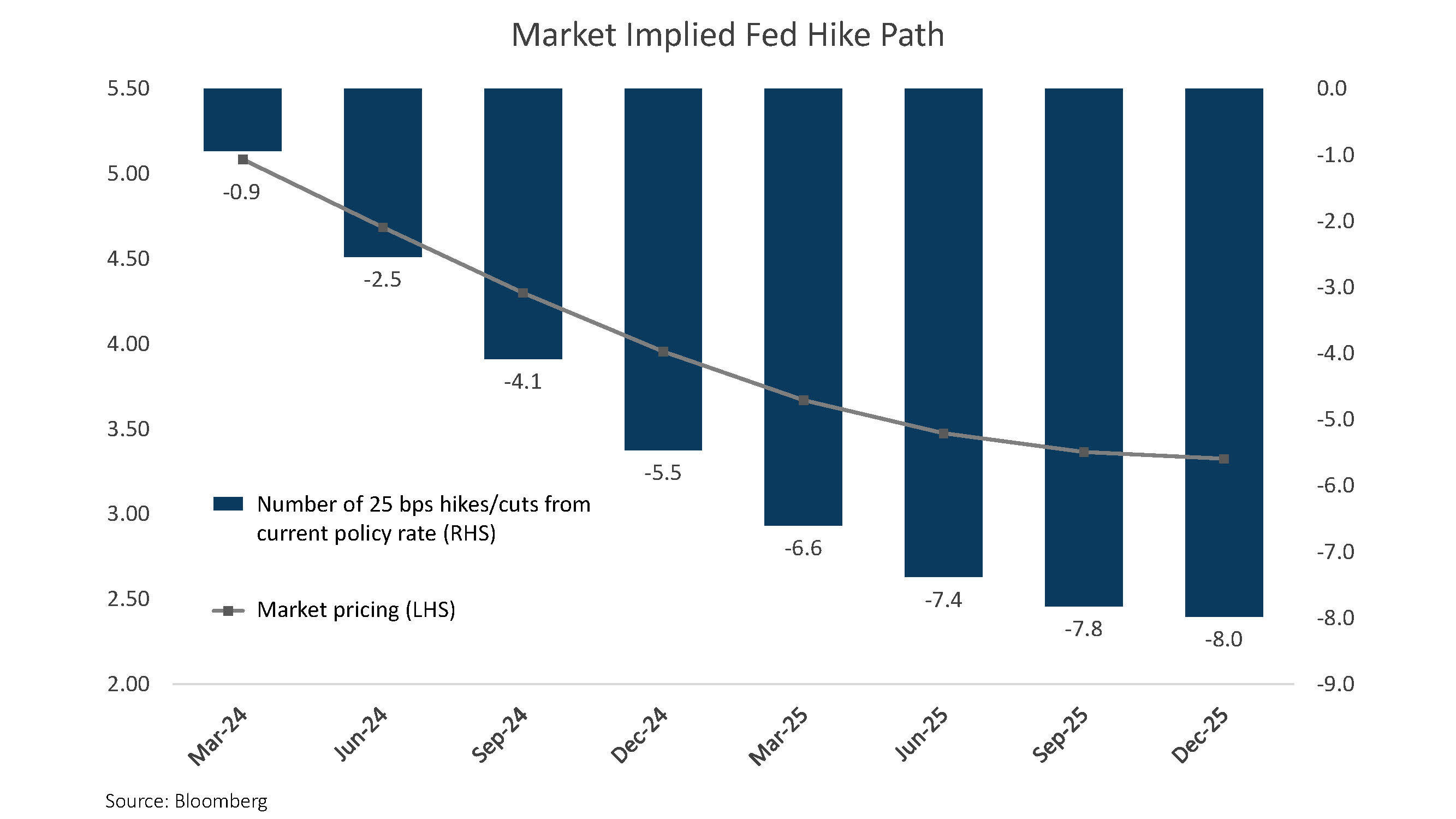

The market is pricing in at least five rate cuts this year, with a 60% probability that they will commence in March. While economic data and the Fed’s communication point to multiple rate cuts in 2024, the FOMC must weigh many moving parts in deciding the timing and degree of rate cuts.

- Inflation is moving in the right direction and is expected to trend lower throughout the year, which gives the FOMC the green light to focus on the other component of its dual mandate: economic growth.

- Relative to historical Fed cycles, the economy is typically stronger than would typically warrant rate cuts. Last week’s labor market data painted a picture of a resilient labor market: job openings decreased while more jobs were added during December than were expected. Nonfarm payrolls increased by 216k jobs, much higher than the 175k expected by forecasters. The unemployment rate, which had been expected to rise, stayed put at 3.7%.

- In the coming months, the FOMC must weigh its credibility as an inflation fighter (inflation is not expected to reach the Fed’s 2% target until at least 2025) against the magnitude of a potential economic slowdown.

Our view is that the current path of the federal funds rate is too aggressive in its timing – inflation and growth will not slow enough to warrant a March rate cut, which could see interest rates rise modestly in the near-term.

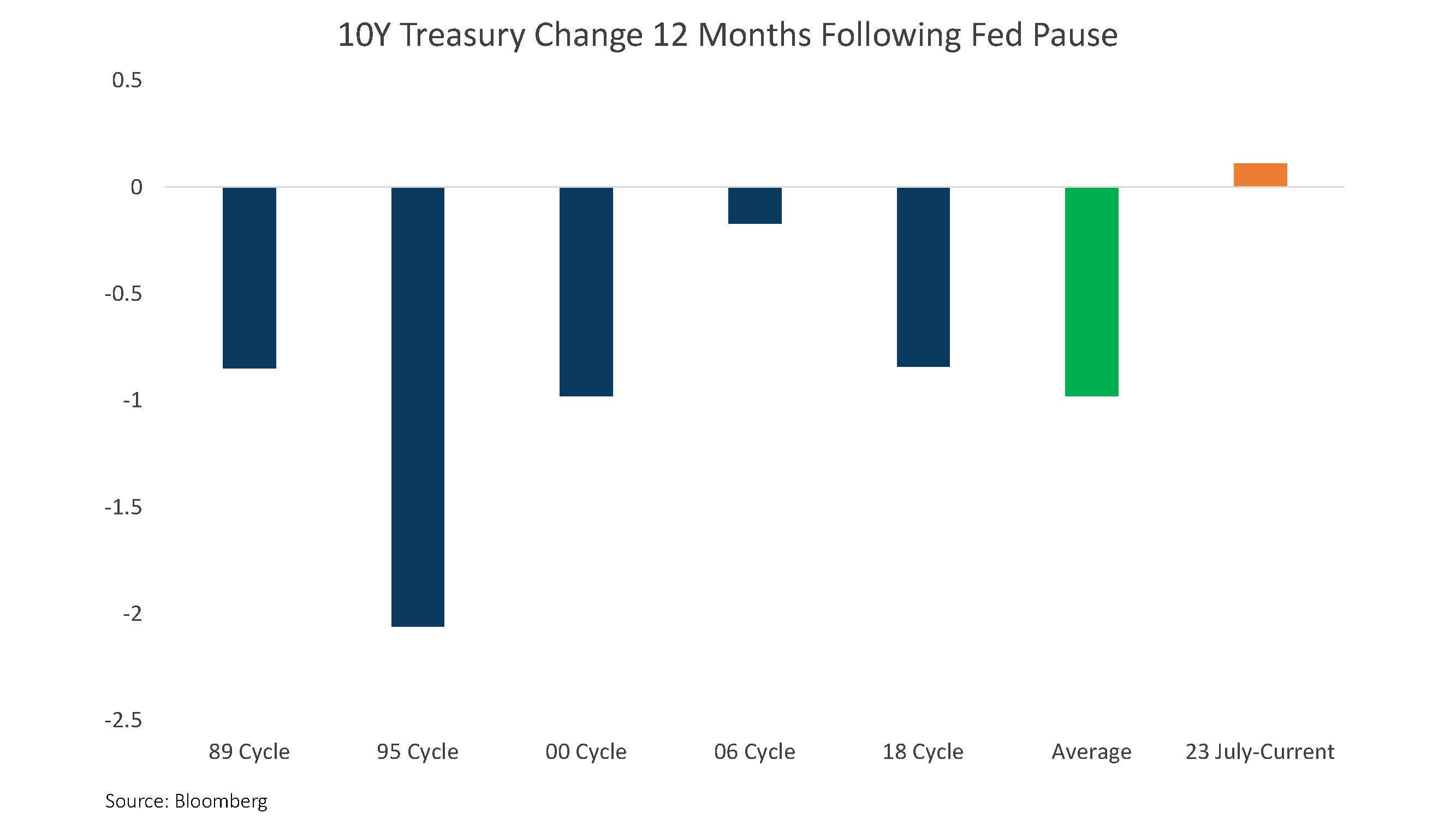

However, we believe that over a longer-term horizon, fixed income remains one of the best risk-adjusted opportunities across markets given its historical performance post-rate hiking cycles, as well as its asymmetric outcomes in an economic expansion versus a recession (if the US economy moves into a recession, we believe yields could fall more than the market is priced).

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.