By RiverFront Investment Group

IT ALL DEPENDS ON YOUR PERSPECTIVE

Gold’s value is not an enigma in our view, once its history is understood: Gold coins were first struck on the order of King Croesus of Lydia (an area that is now part of Turkey), around 550 B.C. (source: thebalance.com). It has been a treasured store of value that has facilitated commerce ever since. Emperor Augustus, in addition to ordering the census that coincided with the birth of Jesus, established the first formal value for gold when he decreed that a pound of gold could be made into 45 coins around 30 B.C. From 30 B.C. until A.D. 1971 gold was the basis of most global currency transactions, often through the ability to convert government issued notes into gold at a fixed rate. It is therefore no wonder that gold has a very special place in the history of finance. Since gold no longer is the backing for currencies, what is its role today?

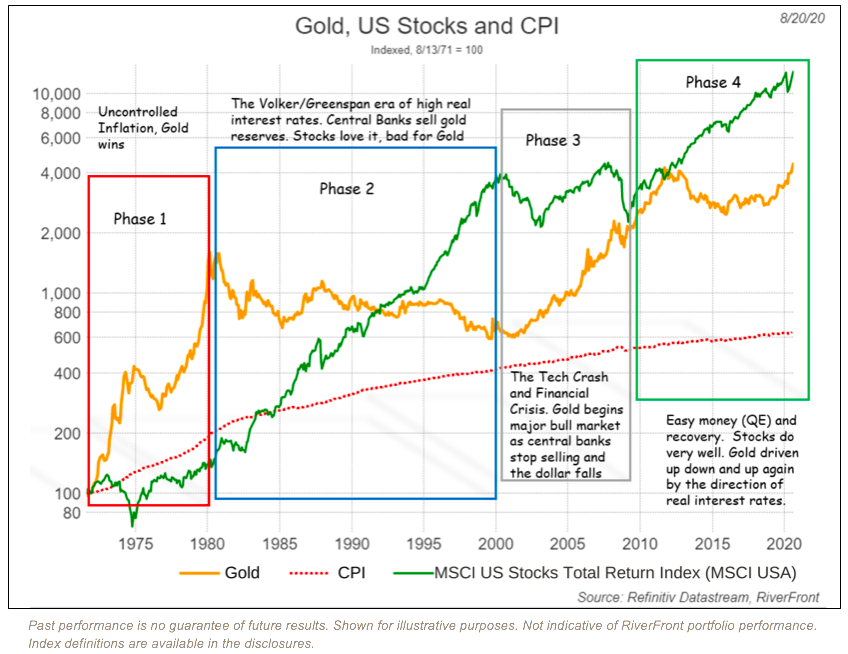

From a long-term return perspective, gold has consistently held its value relative to inflation and has risen considerably more than inflation over the last 50 years. However, in successfully managed economies, investing in the shares of growing businesses has generally been much more rewarding, in our view. Institutionally, the role of gold in a 21st century investment portfolio has all but disappeared and it rarely, if ever, features in a strategic benchmark. This is probably because gold pays no stream of income, it is hard to determine what it is worth and, as our chart on page 2 shows, as measured by the MSCI US Stocks Total Return Index (MSCI USA), stocks have ultimately risen more than gold since 1971.

GOLD SINCE 1971 – Gold Beats Inflation, but US Stocks Beat Gold

In 1971 the US formally abandoned the ‘gold standard’ – whereby notes and coins were redeemable for gold bullion at a fixed rate. Today, all major currencies are fiat currencies. ‘Fiat’ is a Latin word for an order or decree and is translated into English as “let it be done”. Thus, a fiat currency is simply one that is declared legal tender by a government but has no intrinsic or fixed value and is not backed by any tangible asset. All paper currencies are only as valuable as the belief or faith in the issuer. The difference between paper money and gold is that there is no physical limit on the supply of notes and coins. The US dollar’s value is thus a reflection of peoples’ faith in the US economy and the institutions that control its supply.

We believe gold has significant value to some investors as a perceived insurance policy, either for an investor worried about the long-term debasing of the value of their paper currency, or a potential refuge from economic mismanagement, political upheaval, or civil crisis. Despite its inconsistent price behavior, we believe there are monetary conditions which determine when gold prices tend to rise or fall.

WHEN DOES GOLD TEND TO DO BETTER THAN STOCKS?

Gold has its own unique heartbeat. The chart above shows the price of gold since it was untethered from the dollar in 1971. It might surprise you that $100 invested in gold at that time caught up with the price of the MSCI Total Return US Stock Index in 2011, with both up 40 times their 1971 level. That price inflation, as measured by the Consumer Price Index (CPI) rose six-fold over the 50-year period shows how inflation can erode purchasing power over long periods. We also think the chart shows the benefits of price growth plus compounded dividend reinvestment for the total return of US stocks (as measured by the MSCI index in the chart above), which today have risen over 100 times 1971 levels. Finally, we draw your attention to the way gold is mostly uncorrelated with stocks, can spend years going sideways, moves in big spurts and has often risen during some tough times for stocks.

Since 1971, we believe the history of gold and stocks can be understood in three distinct phases, highlighted in the chart above: Phase 1: Uncontrolled inflation, Phase 2: The Volker/Greenspan era of high real interest rates, central banks sell gold reserves; Phase 3: The end of central banks reducing reserves, strict supply control by gold miners and a prolonged decline in the dollar; and Phase 4: The post-2008 policy of quantitative easing with the Federal Reserve buying financial assets and expanding its balance sheet, which some have descriptively called ‘printing money’. During phase 4, the Fed has deliberately kept short term interest rates below the level of inflation, giving savers no government-assured way to keep up with rising prices. Think about it this way: if a government will pay you more than the rate of inflation to own their currency, then gold becomes a lot less attractive. This was the case throughout phase 2.

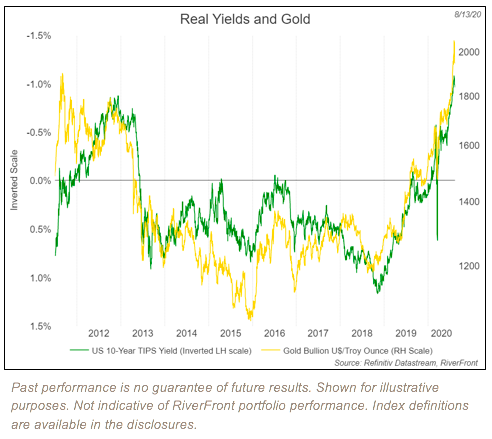

Since 2011, we think real interest rates also explain much of gold’s price performance. Our chart to the right shows the price of gold and the yield on Treasury Inflation Protected Securities or TIPS. The green line (darker) is the yield on TIPS but we have reversed it so that it is easier to see that gold goes up when the yield on TIPS is falling and turns negative such as from late 2018 to today. Gold also tends to be considered a ‘safe haven’ during times of political, economic, and now COVID-19 uncertainty.

SHOULD YOU OWN GOLD?

We believe gold is a personal choice, not a strategic asset. Some investors own gold as a diversification strategy at a time when government bond yields are low and potentially offer much less safety. For others it is an insurance policy against an unhappy end to the period of Federal Reserve balance sheet expansion and rapidly rising government debt. Their concern is that easy money and debt might result in unchecked inflation. Warren Buffet’s Berkshire Hathaway recently bought small position in a gold mining company for the first time. Given Buffet’s consistent disdain for gold, it is not surprising that Berkshire bought a mining stock rather than the metal, or that observers of his actions are intrigued.

If you do choose to own gold, do not expect it to perform like stocks or bonds and recognize it may prove to be unnecessary insurance or may not behave like insurance at all; that is RiverFront’s current tactical view. RiverFront has owned gold in the past but to include it in our portfolios again, we would need to be convinced that there is a strong fundamental case for its outperformance over a sustained period against either stocks or bonds. We do not currently believe that is the case. Also beware that for many traders, gold is a speculative asset and thus prone to big swings in price making the timing of buying and selling difficult. What we can probably all agree on is that the fascination with gold is not likely to go away for a long time.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Treasury Inflation Protected Securities (TIPS) are Treasury securities that are indexed to inflation in an effort to protect investors from the negative effects of inflation. The principal value of TIPS is periodically adjusted according to the rate of inflation as measured by the Consumer Price Index (CPI), while the interest rate remains fixed. TIPS will decline in value when real interest rates rise. Portfolios that invest in TIPS are not guaranteed and will fluctuate in value.

Buying gold (bullion or coin) allows for a source of diversification for those sophisticated persons who wish to add precious metals to their portfolios and who are prepared to assume the risks inherent in the bullion market. Any bullion or coin purchase represents a transaction in a non-income-producing commodity and is highly speculative. Therefore, precious metals should not represent a significant portion of an individual’s portfolio.

Real yield refers to yields above the prevailing inflation rate as measured by the Consumer Price Index (CPI).

You cannot invest directly in an index

The MSCI USA Index is designed to measure the performance of the large and mid cap segments of the US market. With 616 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the US.

Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1311794