By Chris Konstantinos

A Rough Week for Stocks, Interest Rates and Foreign Currency

Last week there was no rest for weary investors, as restrictive central bank policy, negative economic data, and political troubles overseas underscored the difficult fundamental backdrop that investors face. The S&P 500 fell close to another 5% last week, bond prices dropped, and market volatility as measured by the VIX spiked back to the upper end of its 2022 range on Friday. The Federal Reserve raised the fed funds target rate by 75bps for a third consecutive time, downgraded their forecasts slightly for the US economy, and increased the Council’s aggregate estimate for future interest rates. Taken individually, none of these decisions were surprising… but during the Q&A session Chairman Jay Powell reiterated his willingness to sacrifice everything -including the economy and employment – in order to tamp down inflation. Powell’s actions were mirrored by a host of other central banks also raising rates last week.

Our number one tactical trading rule here at RiverFront is ‘Don’t Fight the Fed.’ While we applaud Powell’s clarity and conviction, we concede that a restrictive fed funds rate is likely to remain a headwind for both stocks and bonds in the near-term. US economic data last week was also negative, as the Atlanta Fed’s GDPNow GDP forecast for Q3 decreased to +0.3% year over year as housing data continued to decrease.

Unusual Foreign Currency Weakness Points to Further Volatility

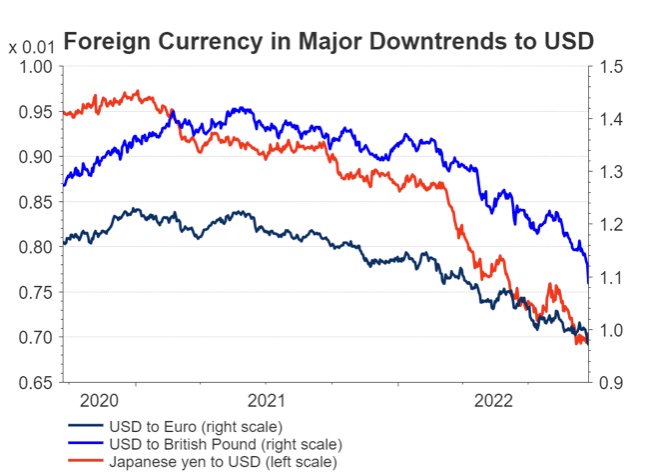

Adding to the global feeling of ‘doom and gloom’ was the continued weakness of European currencies and the Japanese yen relative to the US dollar (see chart, right). Concerns on Friday around the new UK government’s aggressively stimulative economic plan, at odds with Bank of England’s mission to rein in inflation, sent the British pound down to under $1.09, its lowest level since the 1980s.

Source: Refinitiv Datastream, RiverFront. Data daily, as of 09.23.22. Chart shown for illustrative purposes.

The Euro, for its part, is now meaningfully below ‘parity’ with the dollar as it continues to hit record lows. Finally, the Japanese yen failed to stabilize even as Japan’s Ministry of Finance (MoF) directly intervened in currency markets for the first time since 1998, in what may prove to be a futile attempt at stabilizing the yen.While there are some economic advantages for the US, a strong dollar can be a headwind for corporate earnings for US companies who have meaningful revenue exposure overseas. Outside the US, the sheer magnitude of the moves could create contagion risks for the entire global economy. We believe these moves uniquely place various European economies at risk for deeper, longer recessions. Since energy and commodities are generally priced in US dollars, huge foreign currency drops are effectively ‘exporting’ inflation into these commodity-importing nations, making an already difficult inflation situation for Europe even worse. This dynamic also increases the likelihood of financial dislocation in Europe and Asia, in our opinion, making us increasingly concerned about contagion risk spilling over to an already uneasy US economy.

Just to add an exclamation point to the already unsettling geopolitical landscape, Euro risk appetite is also being impacted by the increasingly desperate rhetoric from Vladimir Putin and his army’s poor performance in Ukraine. While we have taken prior steps to help shield our portfolios from foreign currency weakness, including underweighting foreign assets and hedging currency, we may further reduce exposure if these forces continue.

Technical Update: Double Bottom, Or Continuation of the Downtrend?

The powerful summer rally of the S&P 500 that began in June is now at risk, with previous support at 3900 and now 3750 (see red lines on chart, right) now broken. Friday’s closing level of 3679 is now uncomfortably close to June’s closing low of 3,667. If this level is materially breached on a closing basis, then the market downtrend will be clearly reestablished, decreasing the odds of establishing a durable market bottom in the near-term, in our view. The fact that international markets and the Dow Jones Industrial Average have eclipsed their 2022 lows makes a violation of support on the S&P 500 more likely. For this reason, all our balanced portfolios are therefore keeping risk management on high alert.

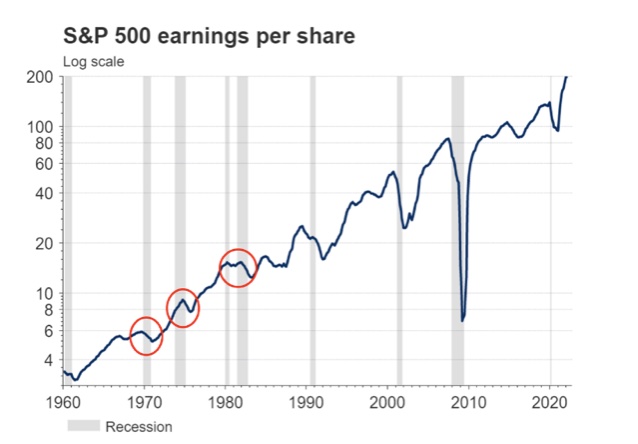

Source: Refinitiv Datastream, RiverFront. Data monthly, as of 09.26.22. Chart shown for illustrative purposes. Past performance is no guarantee of future results. Not indicative of RiverFront portfolio performance.

Volatility makes Risk Management Moves Especially Difficult

Stocks are down significantly for the year and, not surprisingly, so is investor sentiment, which is now at pessimistic extremes. Given such pervasive pessimism among both stock and bond investors, we believe the risk of swift reversals are extraordinarily high, putting undue influence on timing of any risk moves. To place this in context, crowd sentiment as defined by NDR Research’s Crowd Sentiment Poll is currently on one of its longest streaks of pessimism since data started in 1995 (source: NDR Research).

In other words, a lot of bad news has been built into prices. For this reason, a rally in the near future – even if it is just a bear market rally – is increasingly probable. This complicates any sort of risk management strategy, and so we plan to move portfolio risk levels methodically but incrementally to try and mitigate timing errors. No risk discipline is foolproof.

Source: Refinitiv Datastream, Professor Shiller, RiverFront. Data monthly, as of 03.31.22. Chart shown for illustrative purposes. Past performance is no guarantee of future results. Not indicative of RiverFront portfolio performance.

Counterpoints to Ponder: All About Earnings from Here

At a 16.8x forward price-to-earnings multiple, large cap US stocks have shed roughly five multiple points since the beginning of the year. This is an increasingly attractive valuation in our opinion, but valuation in and of itself is not a timing signal; things may very well get worse before they get better. However, since there is so much pessimism, it’s important to not lose sight of what could go right. In our mind, the biggest mitigating factor is that corporate earnings in the US have so far remained relatively resilient, whether you look at S&P 500 earnings-per-share (see chart, right). Shading represents historical recessions) or broader data from public and private businesses from the Bureau of Labor Statistics. It suggests earnings may be boosted by inflation and prove more resilient than bears believe. As you can see in the chart to the right, the ‘inflation recessions’ in the 1970s and early 1980s (see red circles) saw relatively mild downturns in corporate earnings, compared to the much starker drops in earnings in the 2000 and 2008 recessions. Importantly, in contrast to the 1970s, we do not expect a collapse in P/E multiples or a significant rise in bond yields from these levels.

We are analyzing corporate earnings closely via both our team’s ‘bottom-up’ research of individual companies, as well as tracking what we believe to be macro leading indicators of future corporate earnings. Earnings growth may be slowing, but if earnings can deliver a positive surprise in Q3, we believe the market may be able to find some footing, though volatility is likely to remain high.

Conclusion: Weighing Short Term Risks against Long Term Opportunities

Our message this week is nuanced. We must balance the meaningful risks presented by the current situation with the possibility that both stocks and bonds are playing out the final act of this bear market, thus presenting long-term opportunities.

For all the reasons outlined in this piece, our shorter-horizon portfolios, which tend to be more risk-adverse, maintain an underweight positioning to both equities and interest rate sensitivity. These shorter-horizon portfolios also maintain a slight overweight to cash for tactical flexibility. With interest rates now at higher levels, we may look to reinvest this cash opportunistically by extending maturities on the fixed income side. Since our risk management disciplines are on high alert, any further deterioration in stock prices may prompt additional risk mitigation efforts on our part, even though our intermediate-to-long term view on markets remains positive, particularly in the US.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

Dow Jones Industrial Average Index – measures the stock performance of thirty leading blue-chip U.S. companies.

Volatility Index (VIX) is created by the Chicago Board Options Exchange (CBOE). It is a real-time market index that represents the market’s expectation of 30-day forward-looking volatility. Derived from the price inputs of the S&P 500 index options, it provides a measure of market risk and investors’ sentiments.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health

Basis Points (bps) – A basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. (bps = 1/100th of 1%)

The Price/Earnings Ratio or P/E Ratio is a valuation metric that assesses how many dollars investors are willing to pay for one dollar of a company’s earnings. It’s calculated by dividing a stock’s price by the company’s trailing 12-month earnings per share from continuous operations.

Buying commodities allows for a source of diversification for those sophisticated persons who wish to add this asset class to their portfolios and who are prepared to assume the risks inherent in the commodities market. Any commodity purchase represents a transaction in a non-income-producing asset and is highly speculative. Therefore, commodities should not represent a significant portion of an individual’s portfolio.

Using a currency hedge or a currency hedged product does not insulate the portfolio against losses.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period , along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Don’t Fight the Fed – ‘Supportive’ means the Fed’s monetary policy regarding inflation and employment is in what we believe based on our analysis to be the investors’ best interest; ‘Against’ means the Fed’s monetary policy, in our view, is going against the investors’ best interest; ‘Neutral’ means the Fed’s monetary policy is neither supportive or against the investors’ best interest in our view. Don’t Fight the Trend – Terms correlate to the 200-day moving average as it relates to the equity indexes: ‘Positive’ means that the trend is rising, ‘Flat’ means the trend is flat, ‘Negative’ means the trend is falling. Beware the Crowd at Extremes – Terms correlate to the NDR Crowd Sentiment Poll and its measurement of Extreme Optimism (Bearish), Neutral, or Extreme Pessimism (Bullish).

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2443355