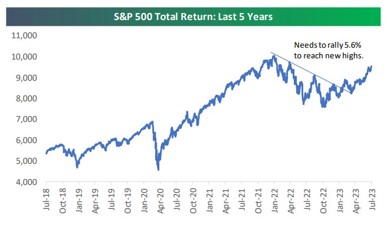

As we enter the second half of 2023, the S&P Total Return Index is up 16.9% and is now just 5.6% from making a new all-time high. Looking at the chart to the right (Chart1), ever since the top of the bear market downtrend channel was broken and then tested back in January, it has been off to the races for bulls.

But as we look towards the second half of the year, is the market glass half full or half empty?

Global stocks and other risk assets have brushed off regional bank failures, the arrest of a former president (and favorite for challenging candidate in 2024), fears of a US recession, the gating of large real estate funds, disappointment in China’s reopening, and further interest rate increases from the US Federal Reserve, the European Central Bank and other major developed world central banks. In short, stocks have done an impressive job of climbing the proverbial “wall of worry.”

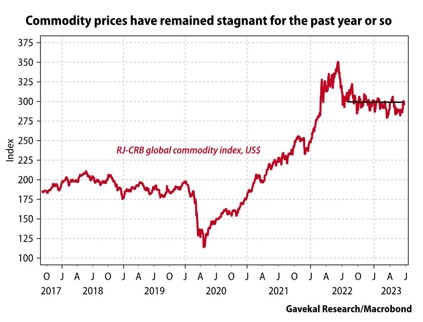

There are a number of factors that can explain this rally. Better-than-expected economic conditions in the first half of 2023 have contributed to this dynamic. Another obvious one is hopes of large productivity gain from artificial intelligence. And finally, tamer inflation numbers, thanks in part to stable energy prices (Chart 2).

Investor’s confidence in a “soft landing” has powered gains across risk assets, leading to a historic first half of the year. But are they right? And more importantly, going forward will the rally continue?

It would be very on brand for stocks to melt up into recession, right before a hard landing. Just as investors start piling into stocks because of the “fear of missing out” on returns. While we believe a recession has likely been delayed, we do not think a harder landing is properly priced into asset markets. The economy is still digesting the effects of lagging monetary policy, and the Fed is likely not done raising rates. The Fed still highlights risks that the market has written off as ambivalent.

While there is scope for economic data to remain resilient over the near-term and continue to support equities over a tactical investment horizon, we doubt that this resilience can be sustained over the longer term. Instead, the elevated likelihood of a recession over a 12-month horizon will eventually weigh on the performance of equities. Moreover, recovering stock prices suggest that equities are not priced for recession, making them more vulnerable to the downside in the event of an economic downturn.

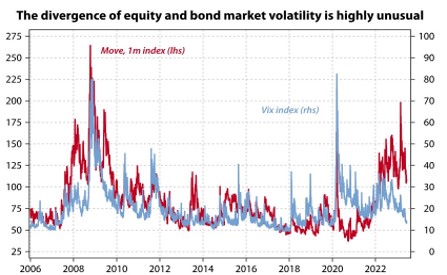

The Bond market is much more reflective of this dynamic. After moving in tandem with stocks for the past several years, they have meaningfully diverged in 2023 (Chart 3). Additionally, the yield curve remains inverted and bond volatility significantly higher than equity.

Whatever the reason, the divergence of bond and equity volatility still raises the fear that equity market volatility will play catch-up with the signal being sent by the bond market (Chart 4).

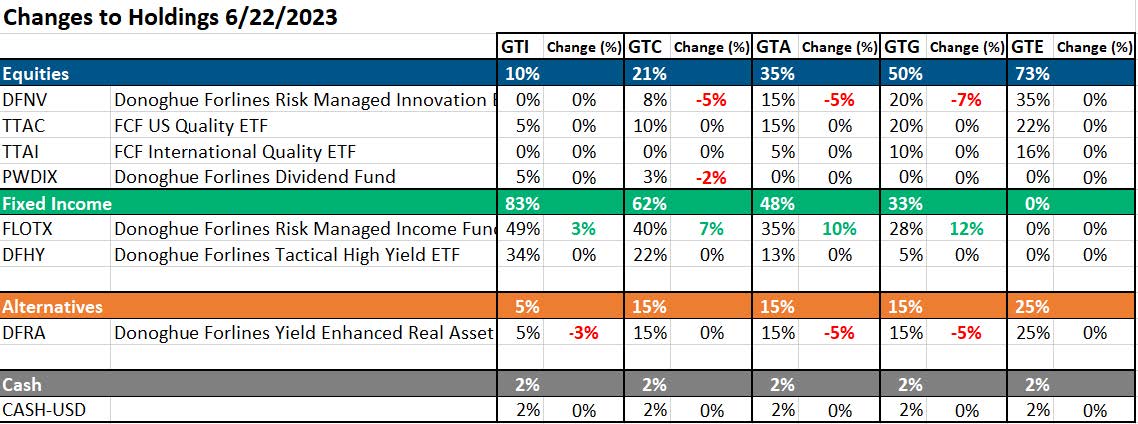

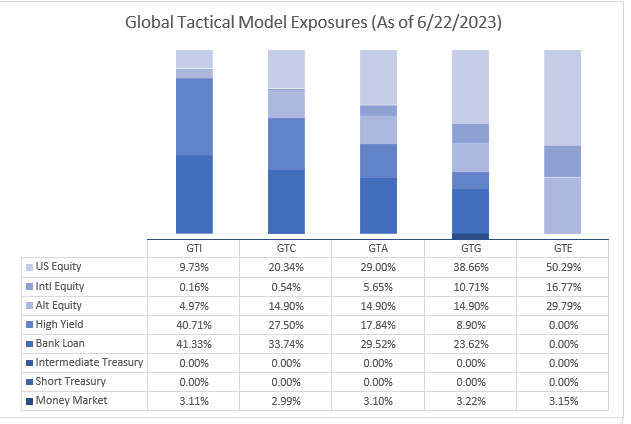

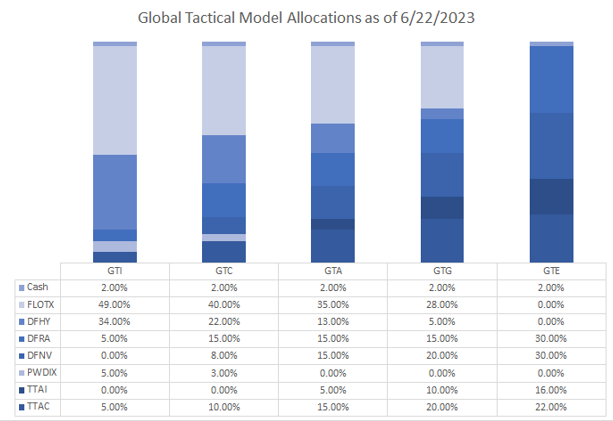

Therefore, after remaining neutral in our broader asset allocation in 2023, we have reduced equity exposure to be prudent to underrealized risks. We have increased allocations to our fixed income positions, which we feel provide better risk/reward dynamics. Ultimately, we believe

risk management is the most important factor to wealth accumulation and preservation. We build portfolios with the objective of minimizing downside capture. After an incredible rally to start the year, we believe it’s prudent to begin to underweight risk assets in our portfolios. We will continue to monitor our portfolios as the facts change and will remain tactical as the situation evolves.

Recent Portfolio Changes

For more news, information, and analysis, visit the ETF Strategist Channel.