By Komson Silapachai

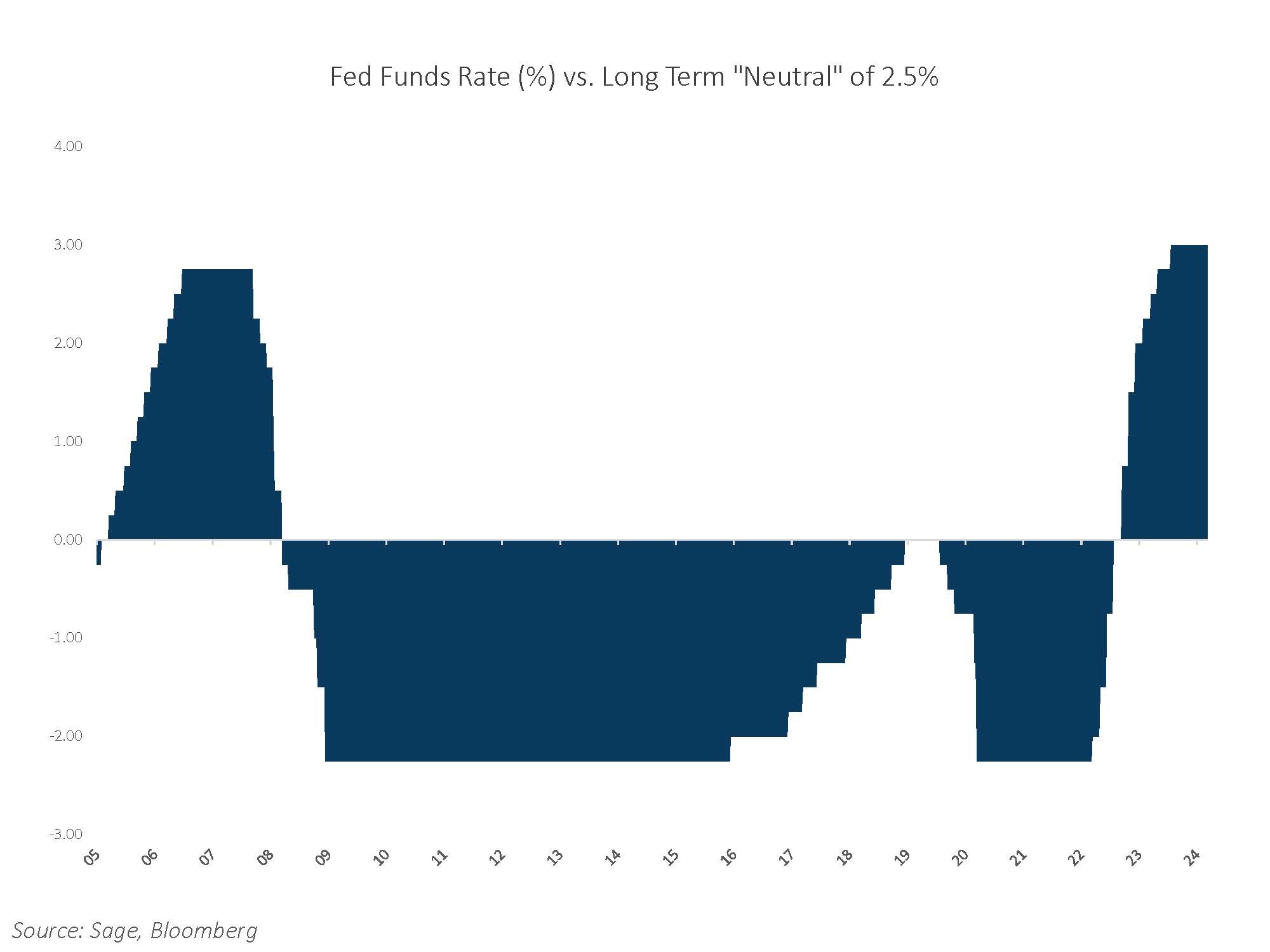

Strong economic data, particularly inflation readings that have been stickier than expected, resulted in a shift higher in the path of the expected federal funds rate going into the March FOMC decision. As expected, the meeting did not result in any policy shifts, and the median “Fed dots” were similar to December’s outlook, which forecasted three cuts in 2024. Coupled with the continued economic expansion, the Fed’s determination to cut rates was interpreted as dovish by markets, which responded positively and continued to price in a “Goldilocks” environment.

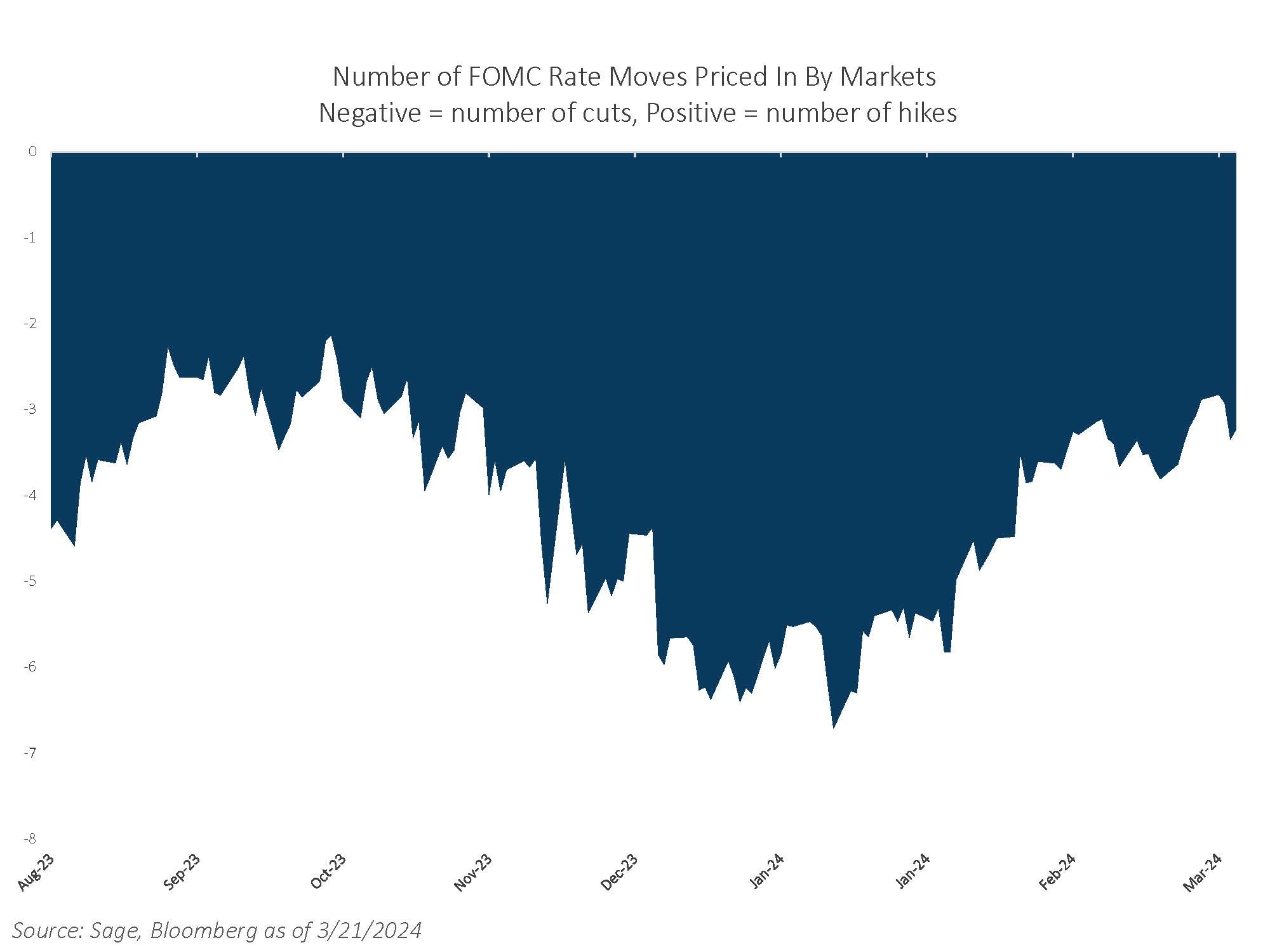

- The Rate Cut Round Trip. Fed funds futures are now pricing in three rate cuts for 2024 after discounting as much as seven cuts in January. The most recent FOMC median “dot plot” also shows a forecast for three cuts for this year.

- The Federal Funds Rate is Still Highly Restrictive versus the FOMC’s Long Term Neutral Policy Rate. The FOMC is determined to close the policy rate gap, which is defined as the current federal funds rate versus the FOMC’s estimated long-term neutral policy rate of 2.5%. The focus on the policy rate gap amid strong growth and inflation has resulted in “Goldilocks” pricing for markets, providing a strong tailwind for credit.

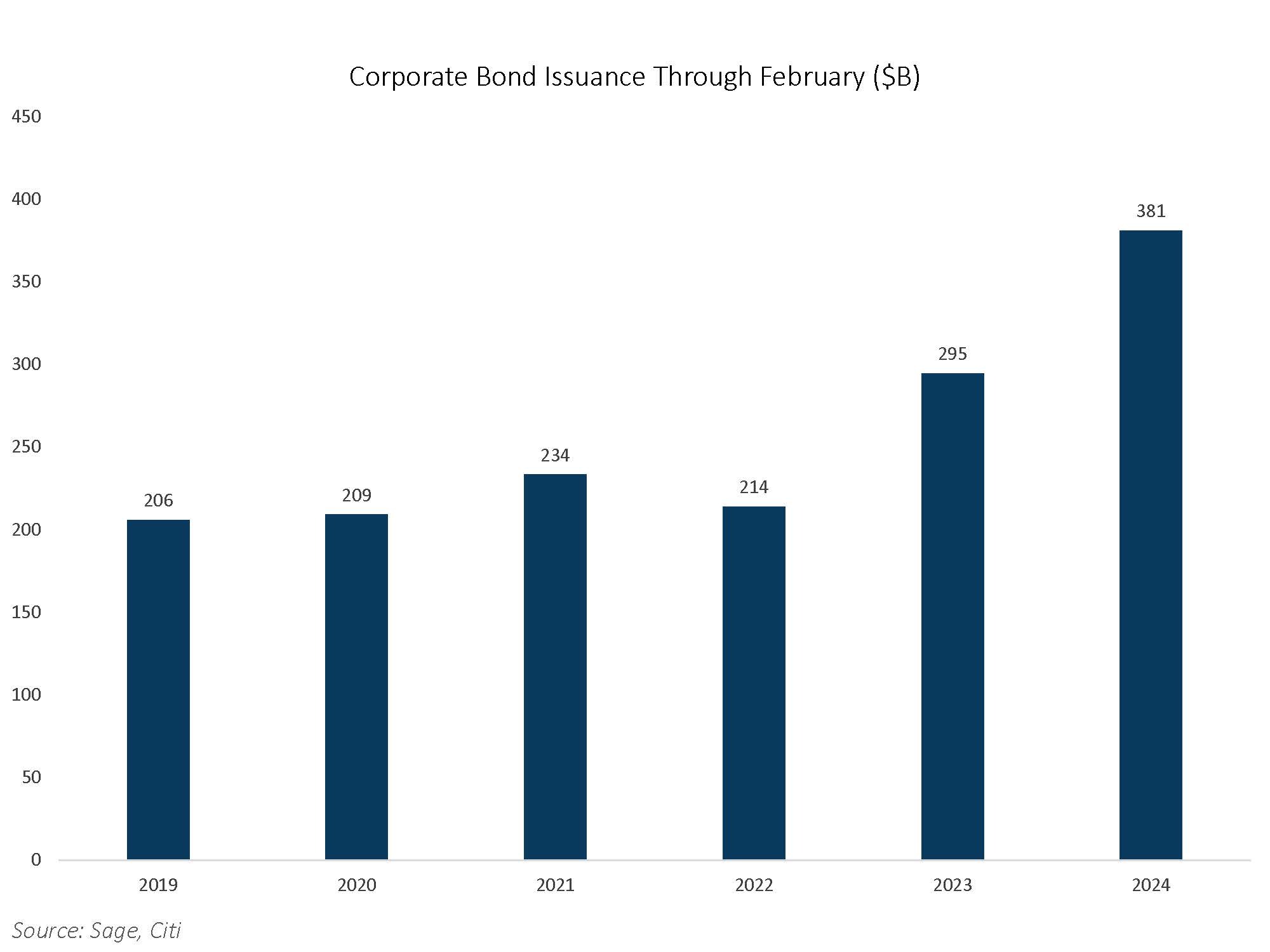

3. Record Corporate Debt Issuance. High-quality corporate borrowers have issued bonds at the highest pace in history to start the year.

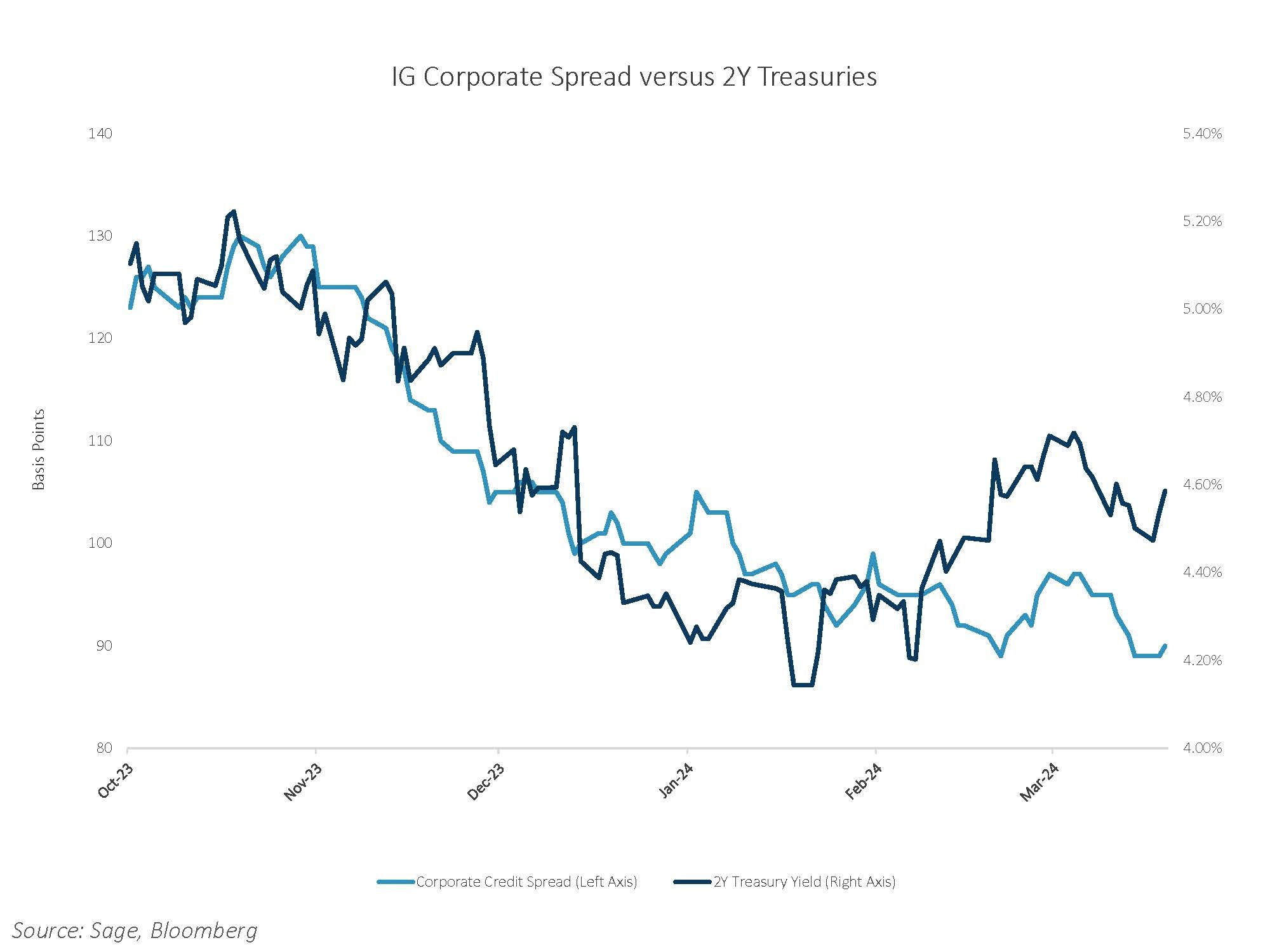

- Spreads Continue to Grind Tighter. Despite record supply and a shift higher in rates, spreads continue to grind tighter as investor appetite shows no signs of slowing for credit. Both investment grade and high yield credit spreads are near post-Covid lows and fully priced for a “Goldilocks” scenario.

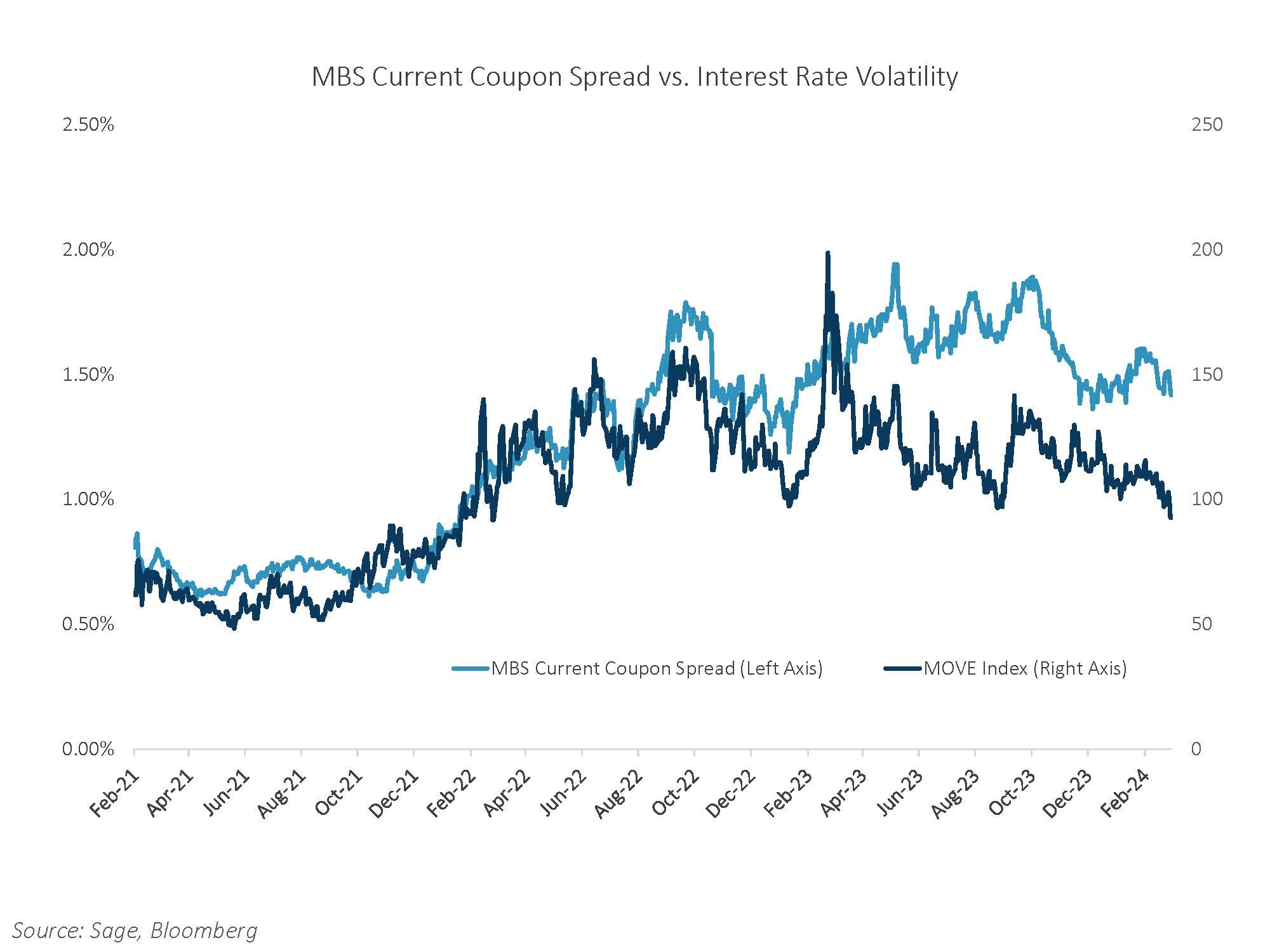

- Interest Rate Volatility is Normalizing. The MOVE Index, which represents the level of implied volatility for interest rates, is now below the level seen at the onset of Fed policy rate hikes in March 2022. The normalization in rate volatility should be a tailwind for agency MBS, which we believe continues to present relative value among investment bond sectors.

For more news, information, and strategy, visit the ETF Strategist Channel.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.