Key Takeaways:

- From supercore to mainstream measures and lagging indicators to preemptive cuts before inflation hits target;

- the U.S. Federal Reserve (Fed) may finally have changed its focus from lagging indicators that are akin to driving forward while looking in the rearview mirror, to looking ahead through the windshield.

- This is good news for the U.S. as it increases the chances that the Fed’s policy tightening will not cause a recession.

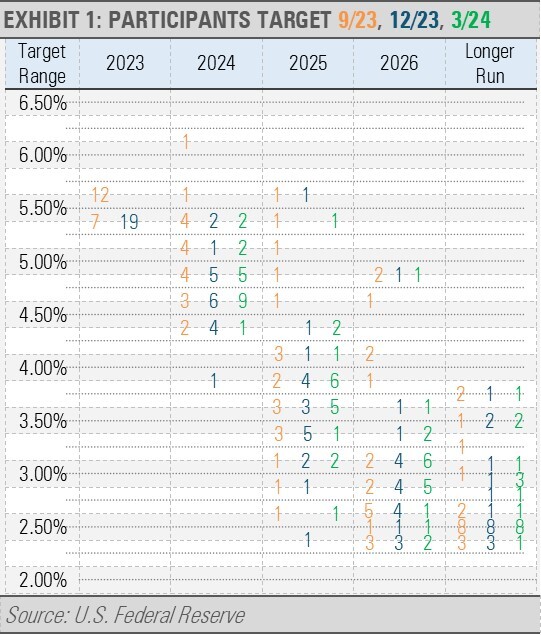

In December of last year, the Fed moved from discussing supercore inflation, which is core services inflation excluding housing, to focusing on more mainstream inflation measures including the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE). Both of these measures have shown more progress on taming inflation than supercore. At the same time, the Fed announced that it was expected to reduce short-term interest rates by 0.75% during 2024. This shift became known as the Powell Pivot, named after Fed Chairman Jerome Powell, who stated that the Fed will begin reducing short-term interest rates before the Fed’s 2% average inflation target is met.

With its latest policy announcements, the Fed has followed through on the Powell Pivot by announcing that it continues to expect to reduce interest rates by 0.75% this year while at the same time mildly increasing its expectations for inflation and GDP growth this year as recent CPI and PCE data showed some reliance while offering no mention of supercore inflation.

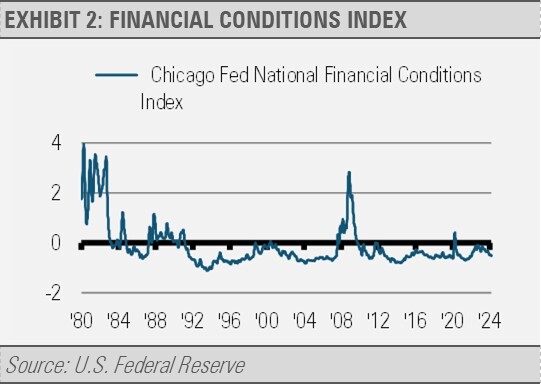

In effect, the Fed has signaled that it will tolerate some variation in the rate and trajectory of inflation, chalking it up as statistical noise. All of this has happened while broader measures of financial conditions have loosened, which further supports continued economic growth.

Since inflation, especially core inflation, tends to lag the business cycle, the Fed’s Pivot indicates to us that they have moved from looking in the rearview mirror to drive monetary policy and influence the economy to finally looking at the road ahead. By following through this shift in policy, we think that the Fed has made the case for an economic soft-landing and avoiding a recession while taming inflation more likely.

For more news, information, and strategy, visit the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.