By Komson Silapachai

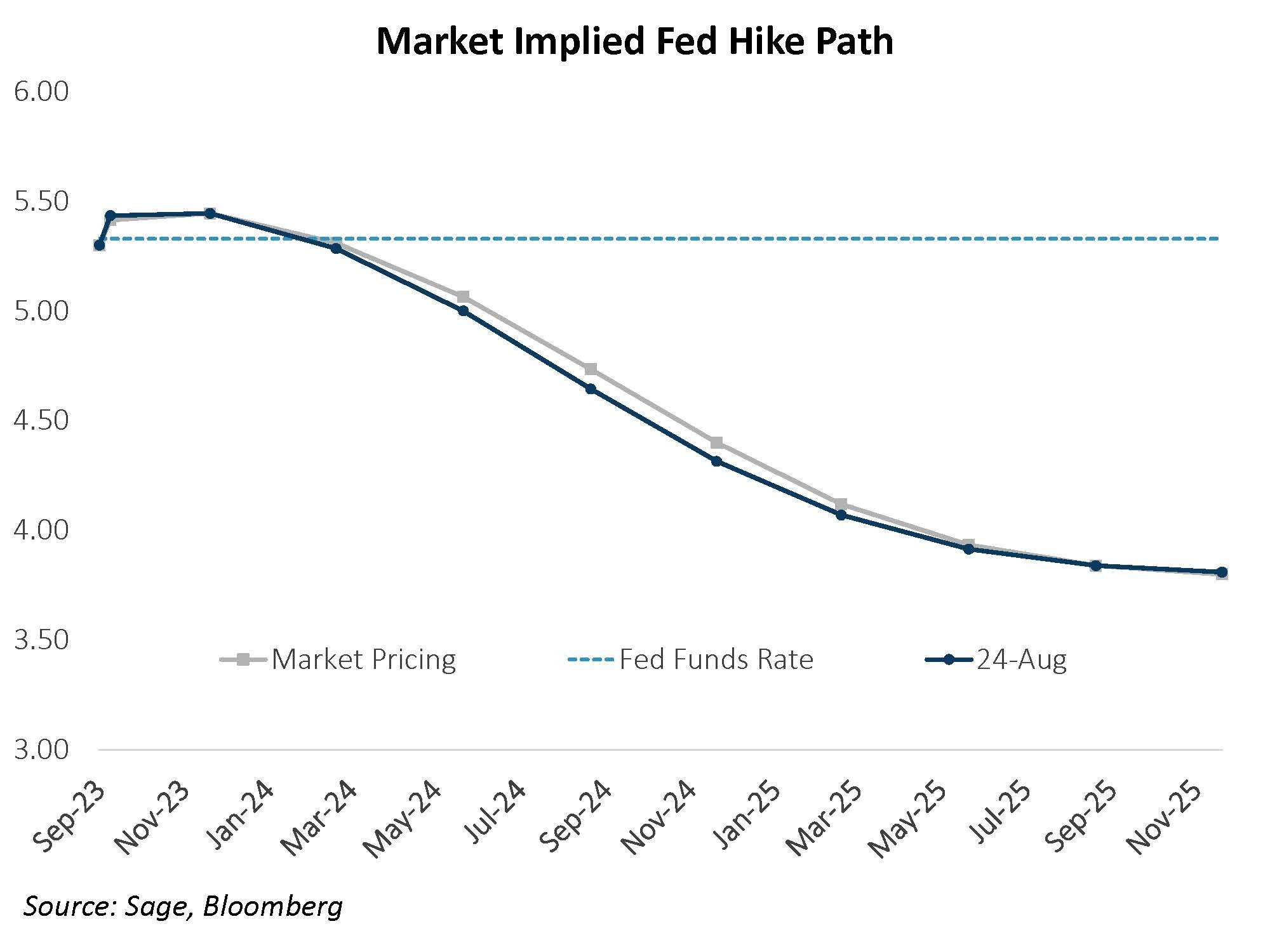

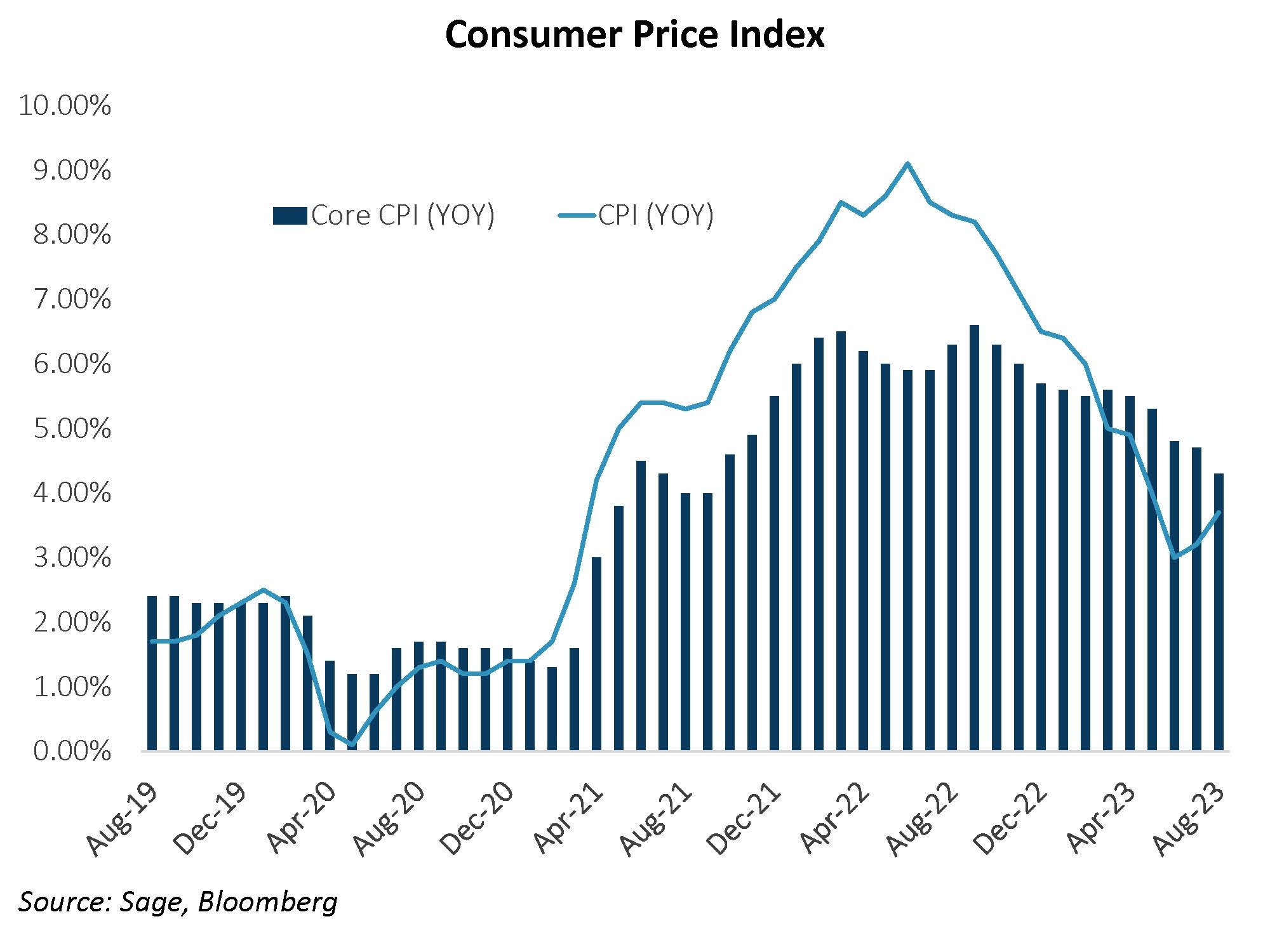

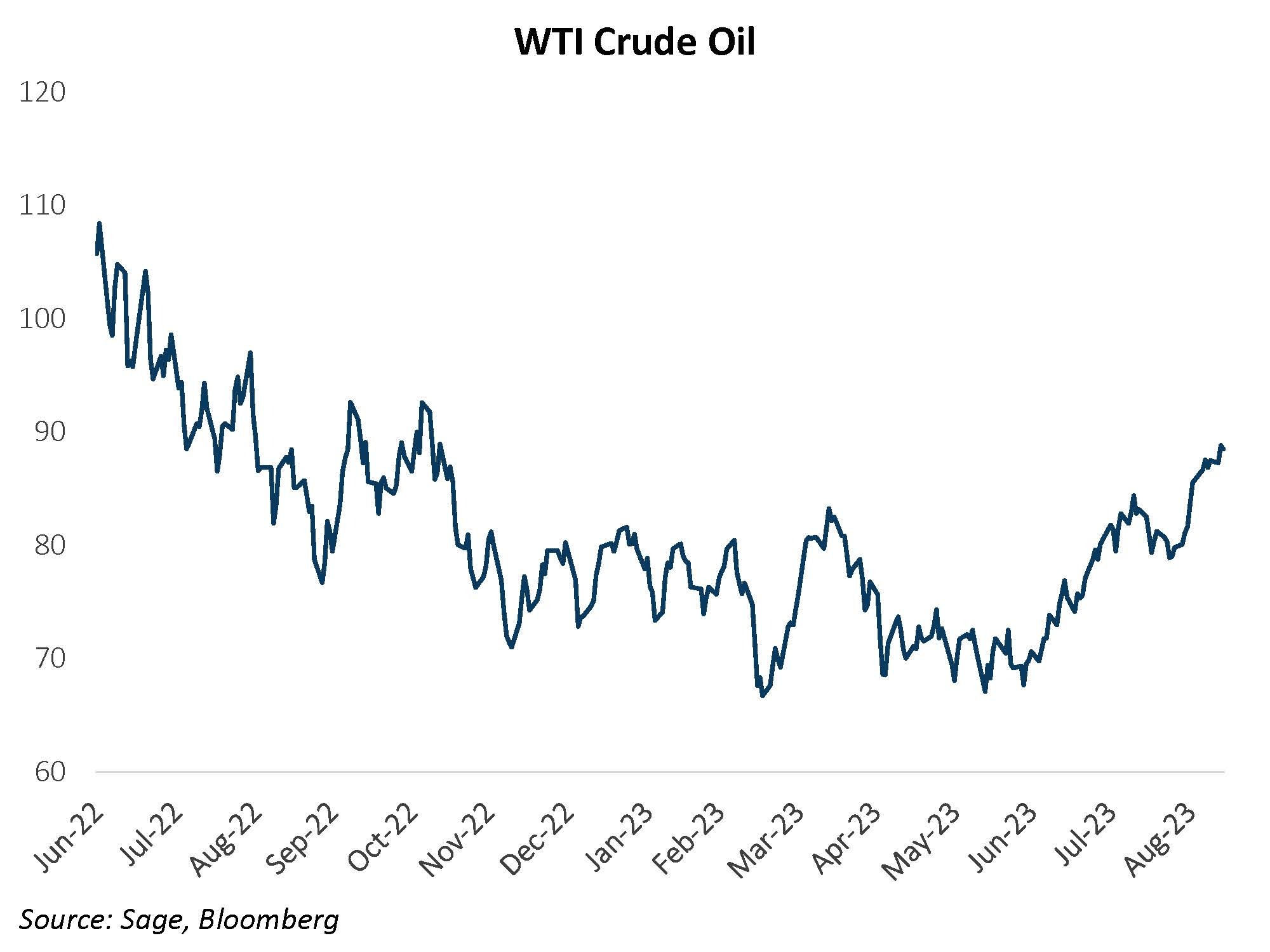

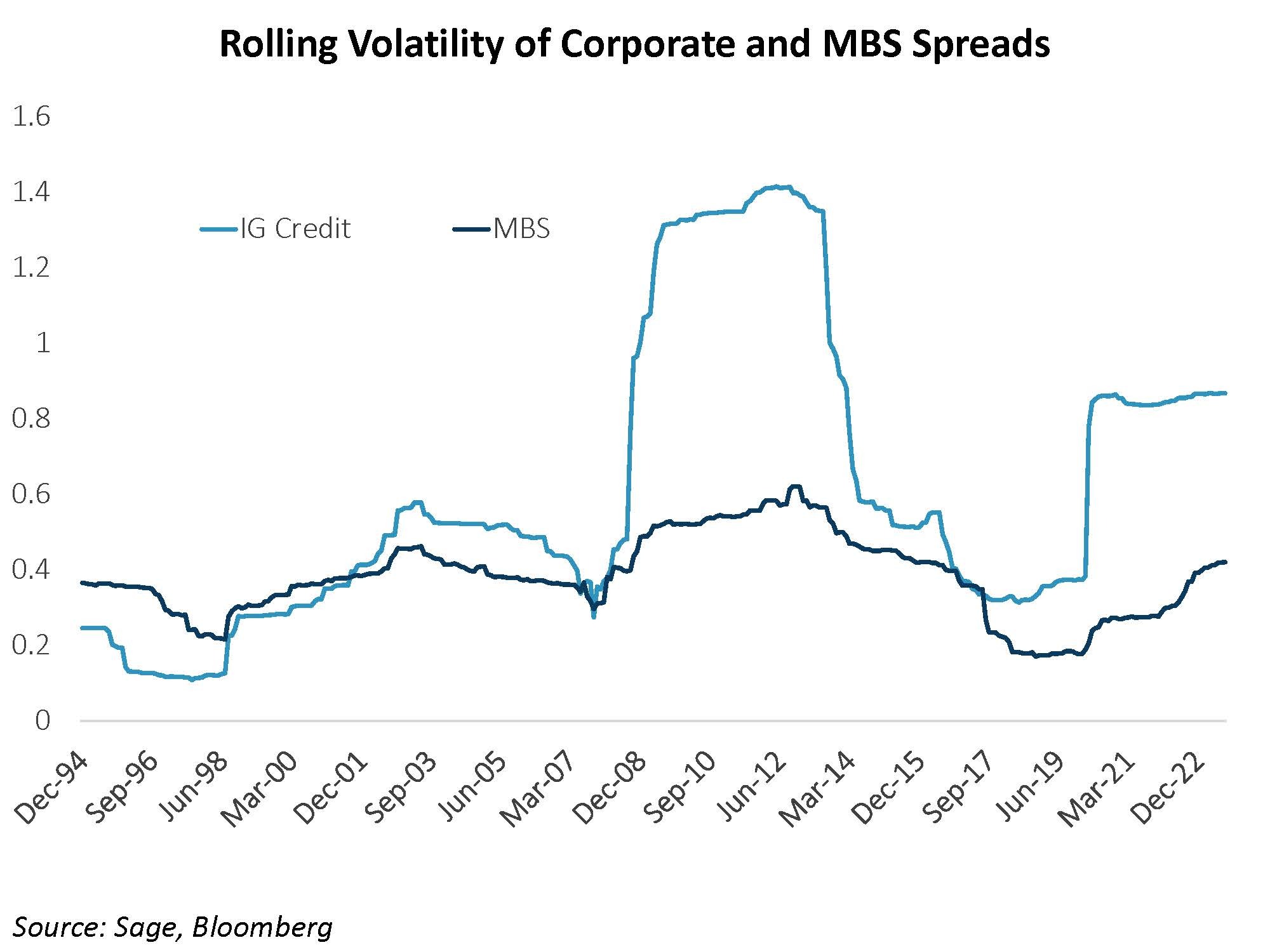

A resilient labor market and slowing inflation suggests that the FOMC is done hiking rates. While the growth and inflation picture looks like a soft landing, we believe it is not yet “mission accomplished,” as new risks come to the surface. A large fiscal deficit has contributed to the economic expansion thus far in 2023 but investors are showing concerns around fiscal sustainability. Interest rate volatility has shifted to longer maturities given expectations of additional Treasuries issuance. Additionally, a resurgence in oil prices threatens the disinflationary trend over the next 6 months. Given high starting yield, fixed income should present attractive risk/reward over the next 12 months. Regarding spread sectors, credit spreads are fully pricing in a “soft-landing” scenario while we favor MBS, which offers a great option for “quality spread” over corporates with much less risk historically.

2) Inflation is Falling, but Not “Mission Accomplished” Yet: Inflation measures continue to trend in the right direction but remain well above the Fed’s long-term target.

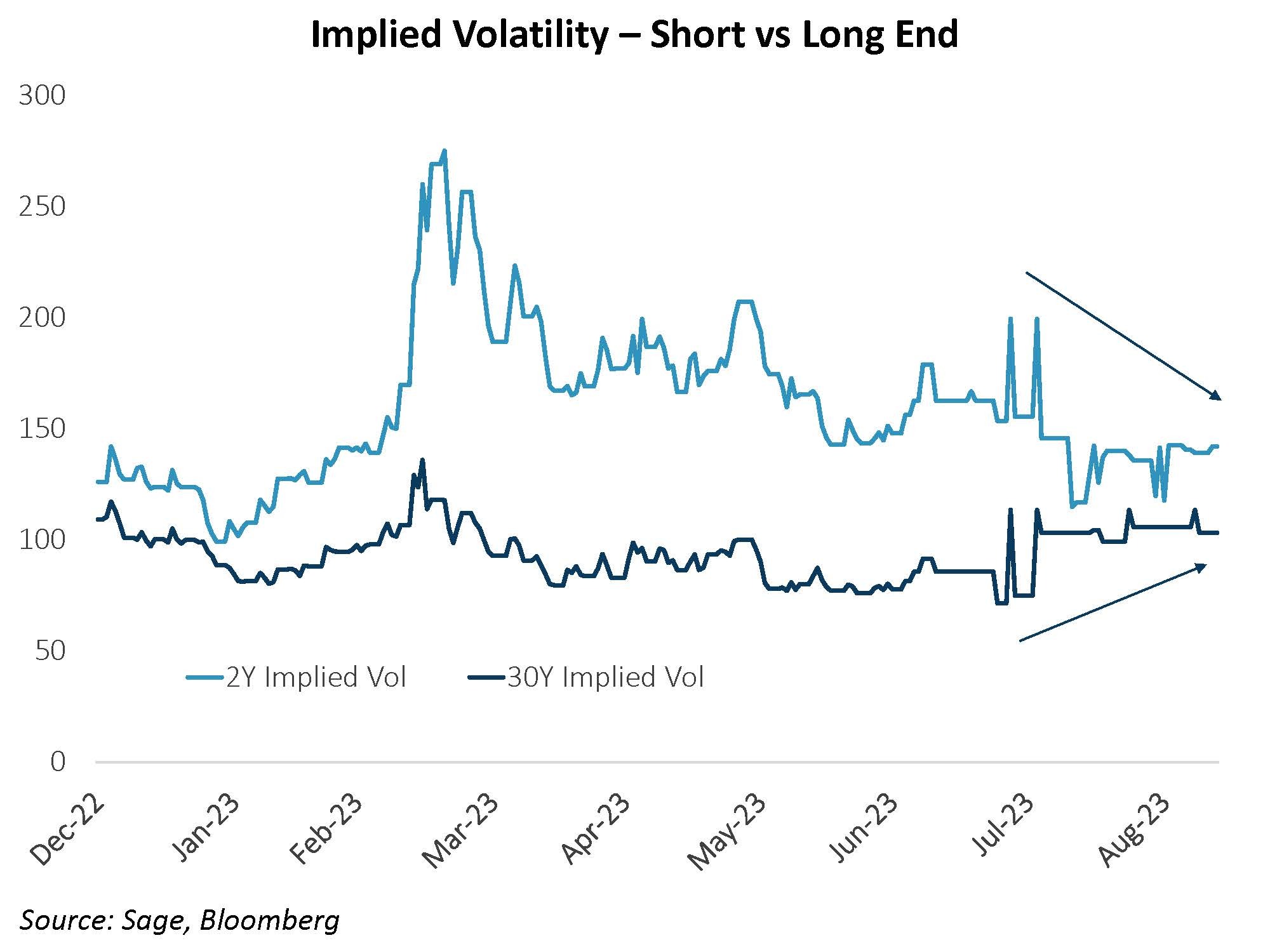

3) Fiscal Sustainability Concerns Come to the Fore: The US budget deficit is high relative to past economic expansion with no end in sight according to the Congressional Budget Office. Given the rise in planned Treasury Issuance, uncertainty is starting to manifest through higher volatility in the long end of the yield curve.

4) Oil Prices Could Prove a Headwind to Economic Expansion: WTI crude rallied sharply to the highest levels of the year as Saudi Arabia and Russia extended their output cuts by 3 months to the end of 2023. The market did not expect this, so oil rallied on the news. As energy prices move higher, it could serve as a “tax” on the private sector and affect future consumption, serving as a headwind to economic growth.

5) We Continue to Favor MBS Over Corporates: MBS provides a spread pickup versus corporate bonds. The sector provides attractive risk reward as MBS spread volatility is typically much lower than corporates over time.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.