By Roman Chuyan, CFA

- This recession is likely the most severe in 74 years. GDP is expected to contract 25-30% in Q2.

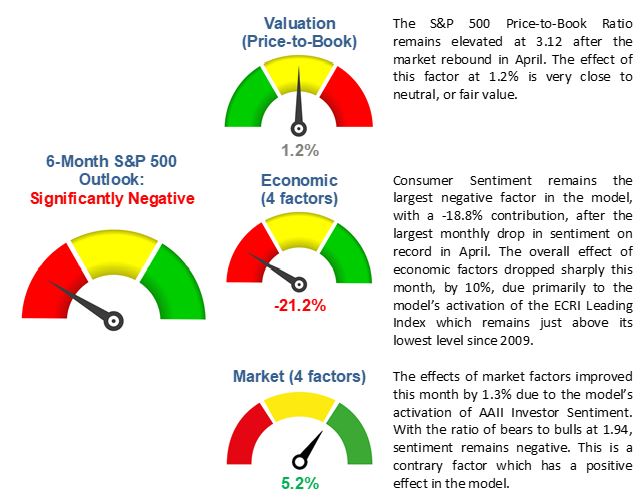

- Our outlook for the S&P 500 dropped sharply to -15% on negative economic factors.

- The model’s -15% forecast is a fair warning – this is an opportunity to reduce risk exposures.

At the March-23rd low point, the S&P 500 closed down 30% for the year to date. The index has since rebounded by a remarkable 28.4%, paring its year-to-date loss to only 10.7%, and now returned to a positive in 12-month performance. The rebound is fueled by optimism about the Fed’s stimulus and the impending economic reopening. However, the US economy has entered a severe recession, and we don’t yet know if March-23rd was the bottom or a protracted bear market has begun. In this article, I examine some of the evidence.

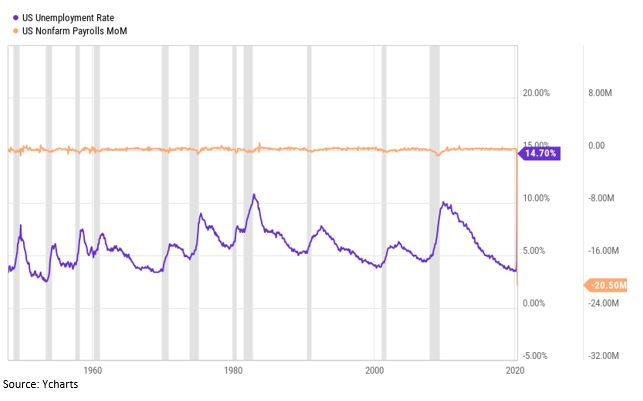

The US economy has entered a recession, likely the most severe in 74 years, since 1946. Corporate earnings dropped by 13.8% in the first quarter (see my Earnings Overview article, and bookmark and revisit our ETF Strategist page for more analysis like this) and are expected to be worse this quarter. In two months, 22% of the entire US labor force claimed jobless benefits, and the unemployment rate shot up to 14.7% (see chart below). Unemployment is already at its highest since modern records began in 1948, and it is projected to reach 20% – the highest since the Great Depression. Both retail sales and industrial production slumped last month by the most in 74 years. A 10% cumulative peak-to-trough GDP contraction is expected this year, which would be 2.5 times the size of the 2007-09 Great Recession when GDP contracted by a cumulative 4%.

Our equity model’s forecast for the S&P 500 just dropped sharply to -14.8% on deteriorating economic numbers, primarily consumer confidence. The forecast was similarly negative: -13.4% in Apr-2019 (which was remarkably accurate, as the S&P dropped by 12.7% in 6m). The model isn’t a single-variable equation – it’s based on a total of 24 factors, 11 of which are currently active. Some factors have a positive effect, such as AAII Investor Sentiment, but the sum-total of all factors is very negative:

It is true that the stock market isn’t the economy – the market looks forward. But future earnings and the economy are unknown. That’s why the market oscillates widely in a bipolar fashion. When financial experts say that negative fundamentals are “priced in” and point to positive 2021 earnings or economic projections, all they’re really saying is, “The market’s up.” Sometimes the market’s “view” of the future is depressed, and other times it’s euphoric. The market being down less than 10% YTD and positive in 12 months is euphoric, inconsistent with an economy in a recession more severe than in 2007-09 (when the S&P 500 dropped by 50%). Yes, the Fed went all-out to bridge the economy, but spending and production are down by the most in 74 years including the Fed’s stimulus. When it seems too good to be true, it usually is. Our equity model’s latest -15% forecast for the S&P 500 is a fair warning – this may be the final opportunity to reduce risk exposures.

We at Model Capital follow a fundamentals-based approach. This process helped us protect clients against this entire market downturn, and despite being defensive, all our tactical strategies gained more than 4% YTD due to the gains we generated in credit. In a separate paper, I compare the performance of fundamental and technical approaches in this-year’s downturn – we will publish it shortly, or please contact us via our ETF Strategist page.

When it comes to investing, models beat people. Our process is based on fundamental data processed by models, not on opinions. This commentary is just my way to add color to the models. We’re not perma-bears. If our primary equity model were positive, I would be presenting a positive argument. When it does turn positive (perhaps when stocks are very cheap), I will. But for now, the bearish outlook remains intact.

About Model Capital Management LLC

Model Capital Management LLC (“MCM”) is an independent SEC-registered investment advisor and is based in Wellesley, Massachusetts. Utilizing its fundamental, forward-looking approach to asset allocation, MCM provides asset management services that help other advisors implement its dynamic investment strategies designed to reduce significant downside risk. MCM is available to advisors on AssetMark, Envestnet, and other SMA/UMA platforms, but is not affiliated with those firms.

Notices and Disclosures

- This research document, article, or newsletter and all of the information contained in it (“MCM Research”) is the property of MCM. The Information set out in this communication is subject to copyright and may not be reproduced or disseminated, in whole or in part, without the express written permission of MCM. The trademarks and service marks contained in this document are the property of their respective owners. Third-party data providers make no warranties or representations relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages relating to such data.

- MCM does not provide individually tailored investment advice. MCM Research has been prepared without regard to the circumstances and objectives of those who receive it. MCM recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of an investment adviser. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. The securities, instruments, or strategies discussed in MCM Research may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them. The value of and income from your investments may vary because of changes in securities/instruments prices, market indexes, or other factors. Past performance is not a guarantee of future performance, and not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized.

- MCM Research is not an offer to buy or sell or the solicitation of an offer to buy or sell any security/instrument or to participate in any particular trading strategy. MCM does not analyze, follow, research, or recommend individual companies or their securities. Employees of MCM may have investments in securities/instruments or derivatives of securities/instruments based on broad market indices included in MCM Research.

- MCM is not acting as a municipal advisor and the opinions or views contained in MCM Research are not intended to be, and do not constitute, advice within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

- MCM Research is based on public information. MCM makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to tell you when opinions or information in MCM Research change.

- MCM DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THIS MCM RESEARCH (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, MCM HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE).

- Index returns referenced in MCM Research, if any, are gross of any advisory fees, fund management fees, and trading expenses. Fund or ETF returns referenced, if any, are gross of advisory fees and trading expenses. Returns will be reduced by fees and expenses incurred.