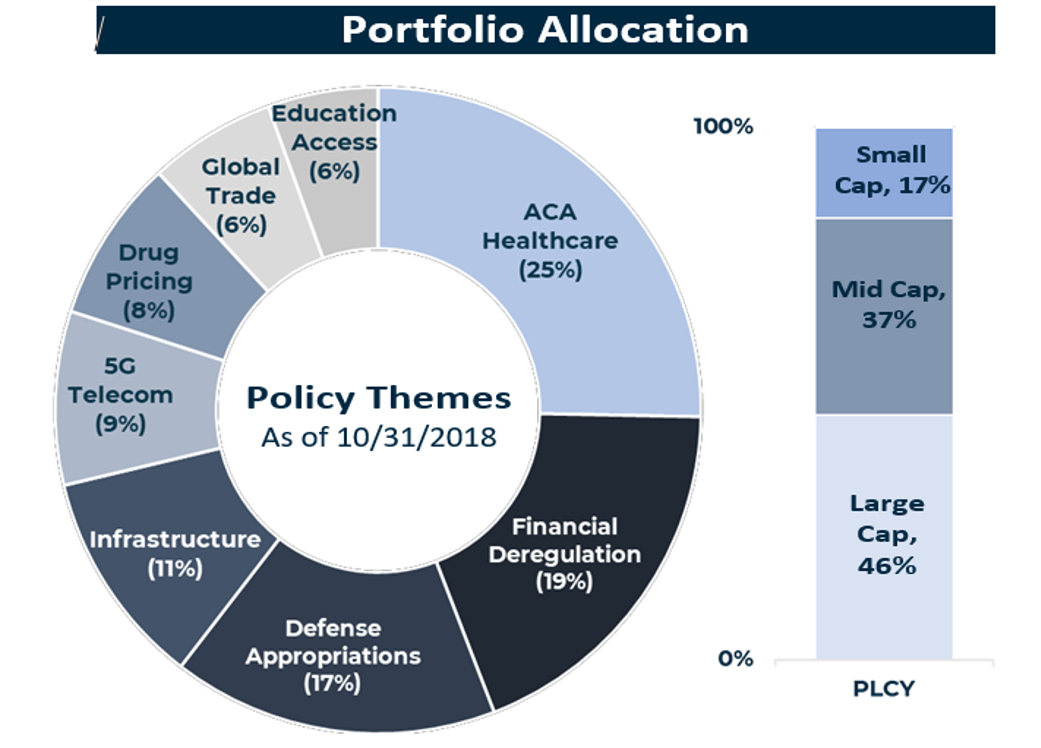

However, because the political process led by President Trump will remain dynamic and fragile, a broader actively managed strategy is helpful to follow in defining investment research and arguably a neat package as a solution. Therefore, we highlight EventShares Policy (PLCY) and encourage readers to listen and attend the webinar today, November 13th @ 2:00pm. Coming into the election, the portfolio held about 5% cash and looked as follows:

PLCY PORTFOLIO: CURRENT ALLOCATION | POLICY THEMES

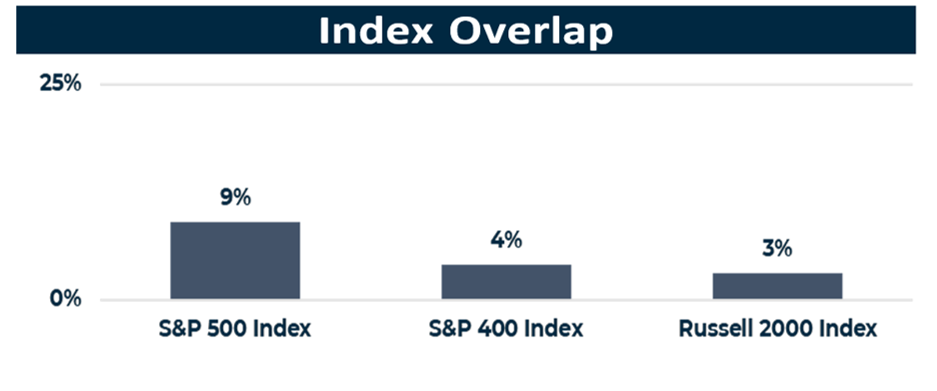

The most interesting part about the portfolio is the small overlap it provides across asset classes (See above diagram). Active share is clearly defined in this portfolio. The active fund was tilted towards Small-Midcap stocks, so it did pullback hard with the market. Despite concerns about the trade war and the election outcome, the portfolio managers did not pull the trigger on their option to go short so their remains a level of optimism.

Alternatively, a straight infrastructure ETF may be the more obvious way to play the midterm election outcome. Admittedly, those investing in this thesis have often been disappointed, but regardless, gridlock can’t last forever. Time is not in favor of a continued delay in infrastructure spending and politicians will need to demonstrate to their constituencies that they are doing something to solve this inevitable problem. How the funding is raised may remain the key question, but further delays will not make fixing the problem less expensive. There are multiple ETFs that bear the name infrastructure, but ETF investors know that sometimes a name can be misleading. Thus, our choice is the Global X Infrastructure Development ETF (PAVE), which only has a 2% overlap to the S&P500, so active share is high. Many of the other choices, apart from the iShares US Infrastructure ETF (IFRA), have utility exposure and or are globally diversified.

Thank you again veterans for your service! We are proud to be Americans and hope that investors embrace impact investing with the intent of making your sacrifice more than an annual remembrance.

This article was written by the team at Toroso Asset Management, a participant in the ETF Strategist Channel.

Click here to see disclosures.