![]()

As stated above, our goal through this process is to provide a more comprehensive look at concentration than when you look at these factors separately. In the example above where we compare two large cap US ETFs you can readily see that the Reverse Cap Weighted U.S. Large Cap ETF (RVRS) has a higher Holdings concentration than the Invesco S&P 500® Equal Weight ETF (RSP), which would lead you to logically conclude that RVRS is MORE concentrated. Yet when you look at the result by Sectors or Market Cap, RSP is MORE concentrated. And then, when you consider the Top 10 Holdings metric, it looks like you are back to RVRS being MORE concentrated. Because we believe all of these metrics should be considered when measuring diversification, we have developed the formula using all four of these measures to get what we believe is a truer, more complete picture — and in this illustration giving the nod to RVRS as being more diversified than RSP.

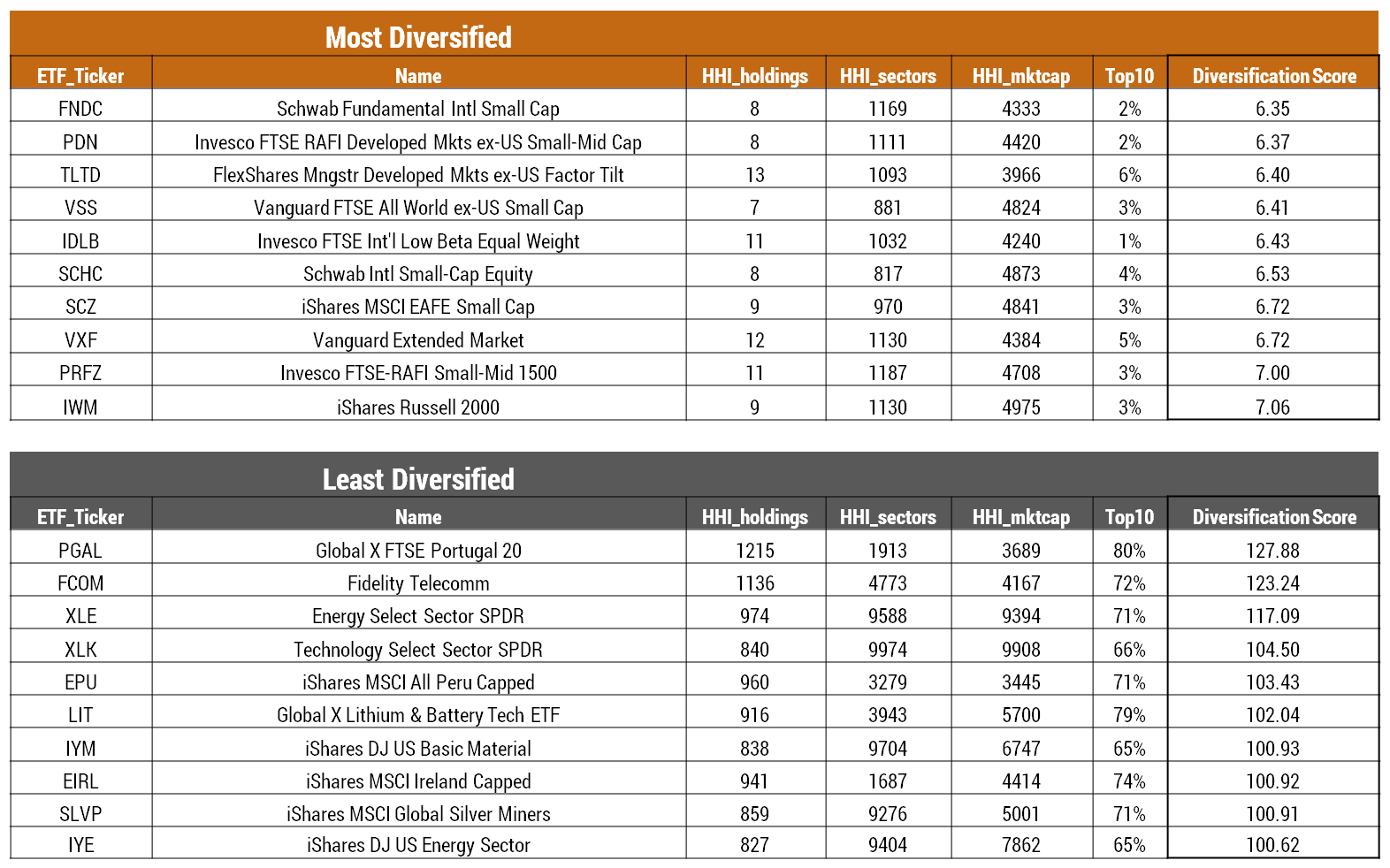

Based on this process, here are the ten most/least diversified ETFs:

As you can see, the most concentrated ETFs are sector or country specific and the most diverse are international in scope. Concentration can be a good thing for sectors or themes which makes this calculation more relevant when comparing two ETFs. As always, we are interested in incorporating your feedback into our ETF Think Tank and furthering the growth of the ETF industry.

This article was written by the team at Toroso Asset Management, a participant in the ETF Strategist Channel.