By Henry Ma, CIO, Julex Capital Management, LLC

Weakening economic data, tightening monetary and liquidity conditions, elevated inflation, declining corporate profits and unattractive market valuations support a bearish outlook for US stocks.

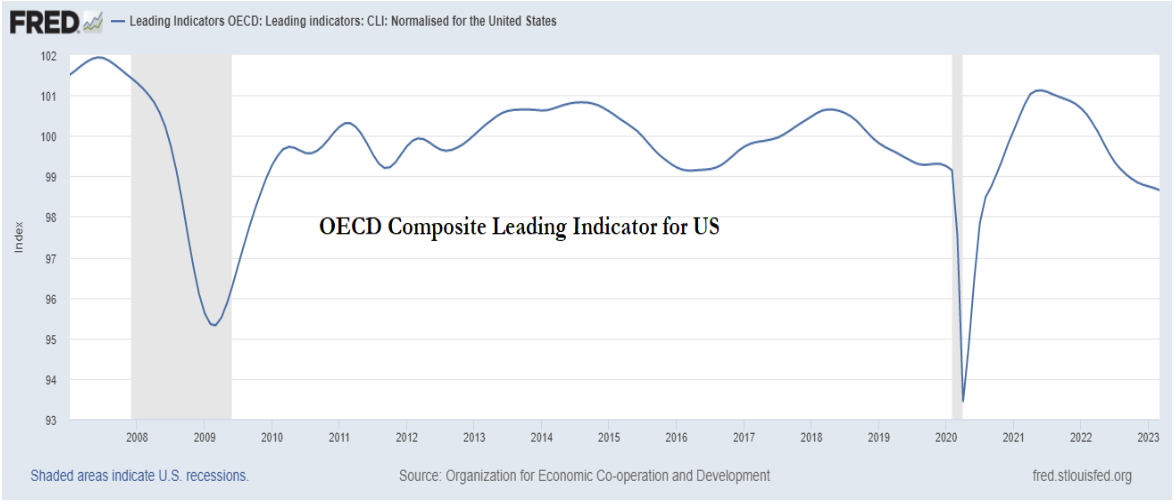

Leading and high frequency economic data continue to point to weaker growth and a potential recession.

The Composite Leading Economic Index (CLI) has been showing weakness. The leading economic indicators like new orders, average hours worked, raw material prices, business surveys, money supply growth, and consumer confidence have been weakening.

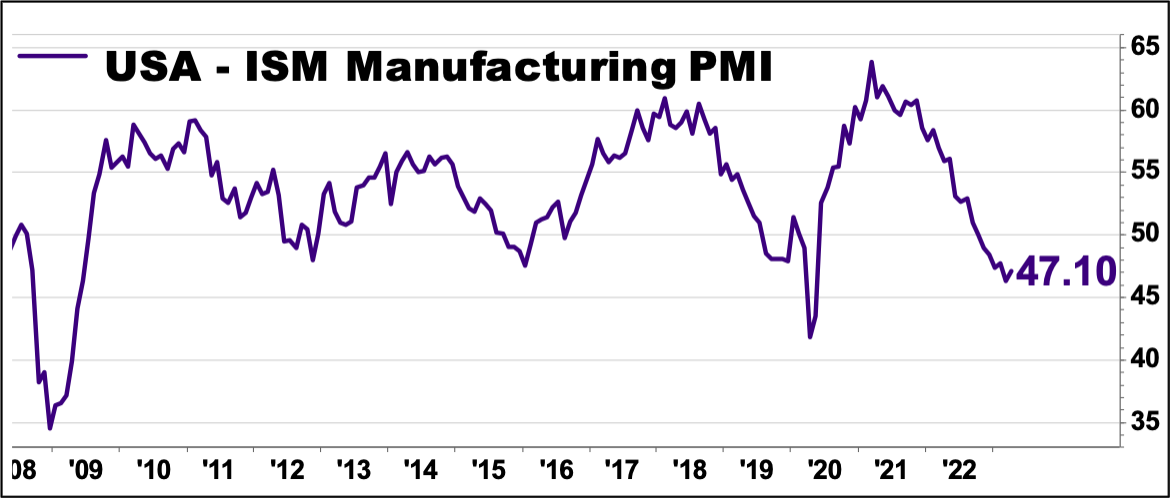

Manufacturing activities have been contracting for six months consecutively.

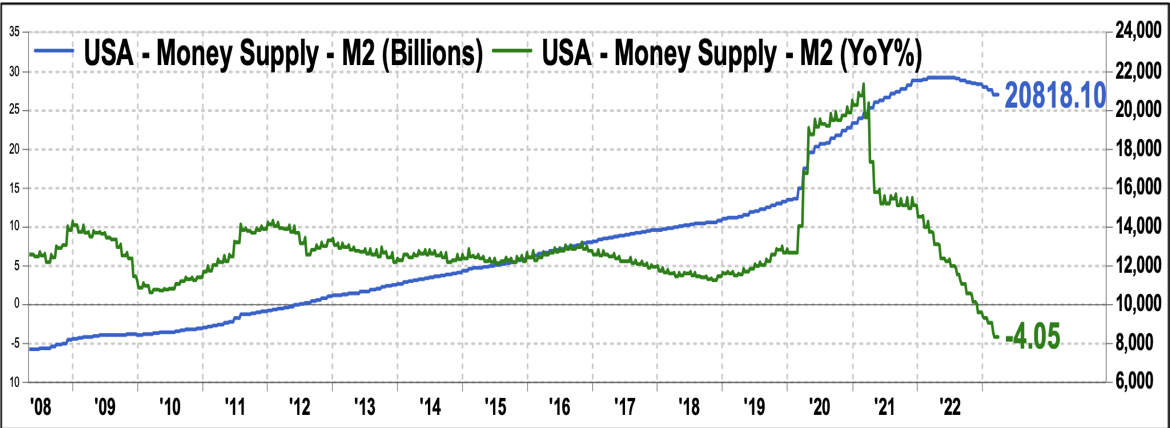

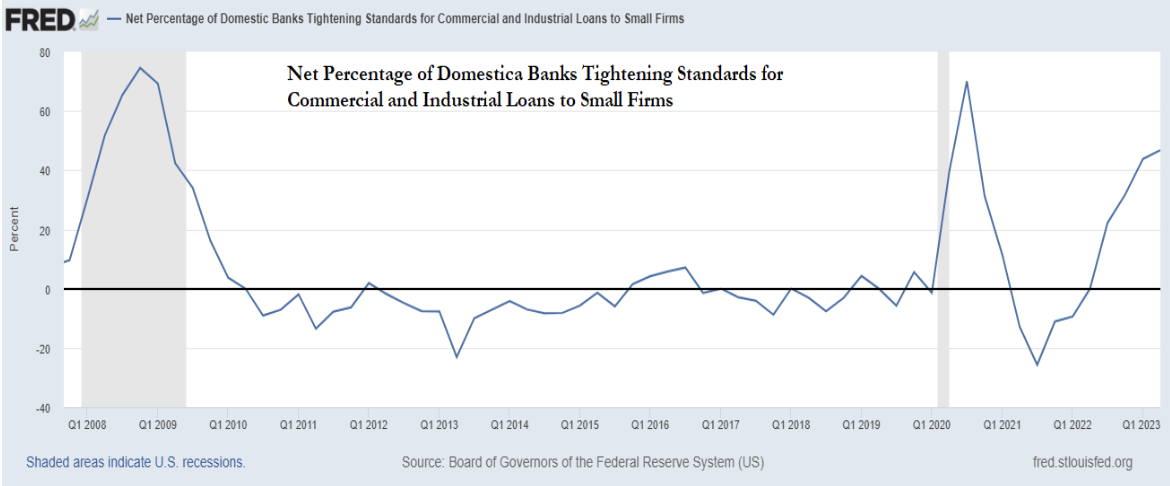

Monetary and liquidity conditions have been tightening.

Higher interest rates and quantitative tightening have resulted in a decline in money supplies.

Banks are tightening lending standards dramatically after the SVB crisis.

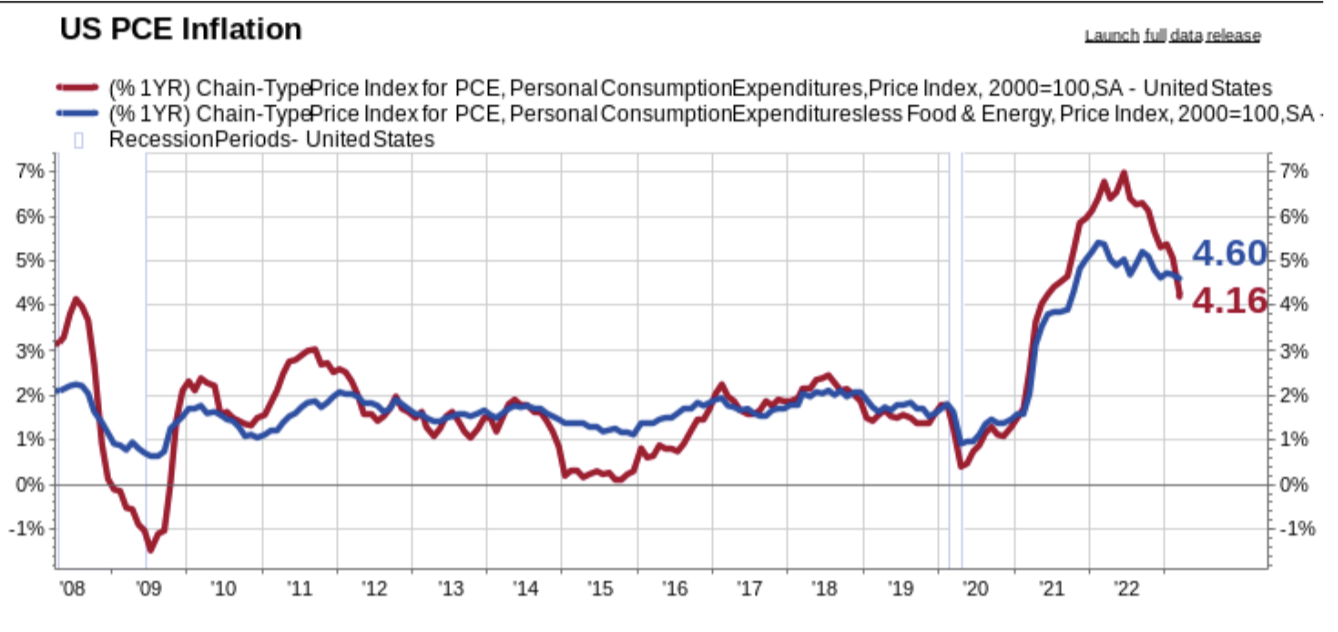

The inflation rate excluding food and energy remains elevated.

The inflation rate excluding food and energy remains elevated.

Headline inflation is trending down, but core inflation remains high. The Fed must keep interest rates high for a long while to move the inflation rate down to its 2% target. Investors who hope for rate cuts before the year end are likely to be disappointed.

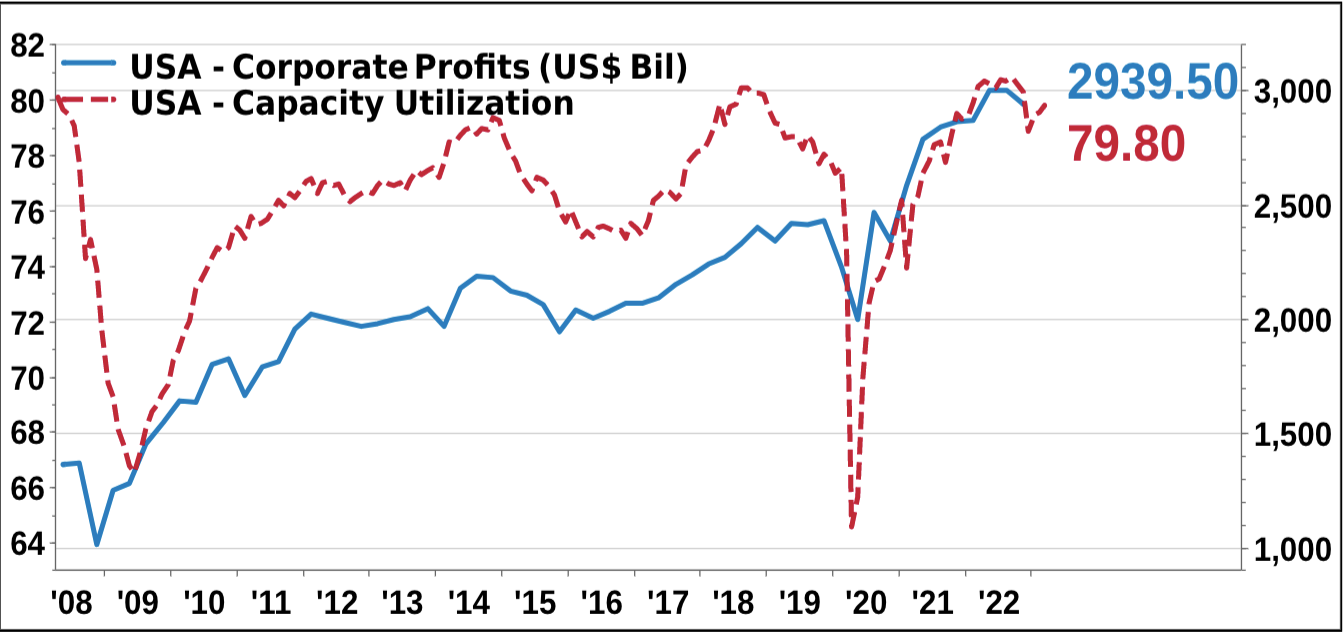

Corporate profits have been declining.

Corporate profits have been declining.

Corporate profits have declined for two quarters in a row. The jumps in earnings because of the pandemic stimulus and cost-savings have ended. According to FactSet, the Q1 earnings of S&P 500 companies dropped by 2.2% from one year earlier.

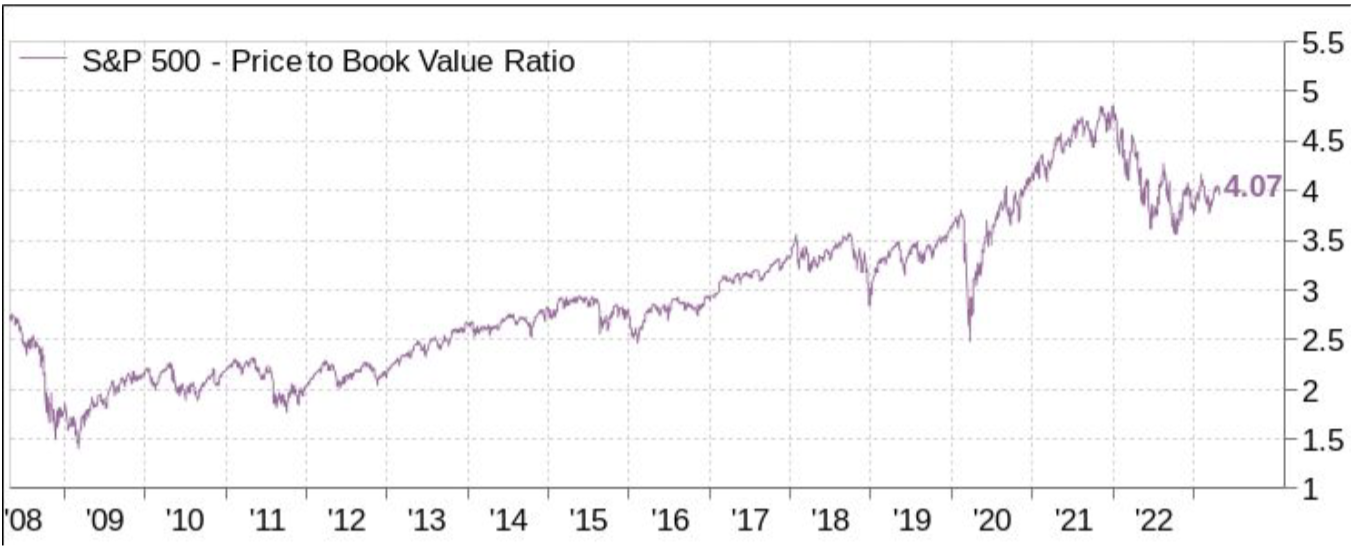

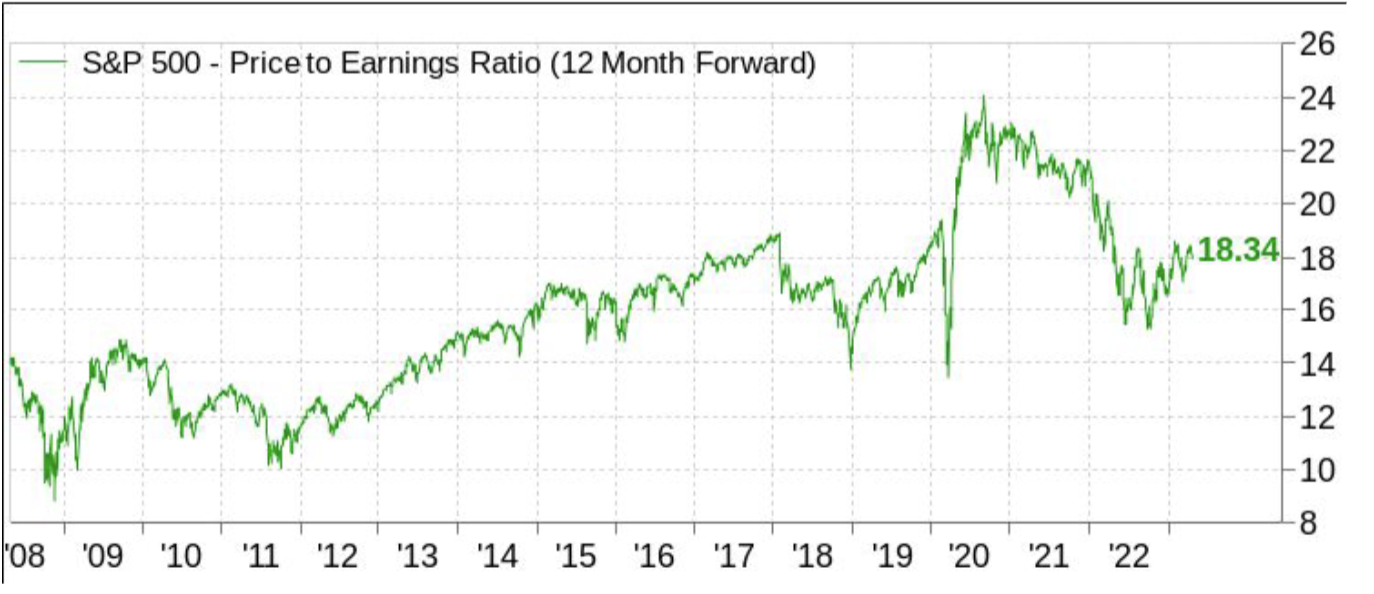

US stock valuations are still expensive.

Market valuations remain elevated compared to the historical average despite the selloff last year and rising interest rates and borrowing costs. The 5% short-term interest rates make money market funds an attractive investment alternative.

The market price to book ratio is higher than the pre-pandemic level though interest rates are much higher now.

The market price to earnings ratio remains high though earnings have been declining. It will be hard for stocks to rise through PE expansion if the Fed keeps interest rates at current levels.

For more news, information, and analysis, visit the ETF Strategist Channel.

Disclosure: The views expressed by any such person are the views of only that individual as of the time expressed and do not necessarily represent the views of Julex Capital or any other person in the Julex Capital Management organization. Any such views are subject to change at any time based upon market or other conditions, and Julex Capital Management disclaims any responsibility to update such views.