By Herb W. Morgan, III, Efficient Market Advisors

Over the last two weeks, I have had dozens of conversations with investors, industry peers and colleagues about what caused equity markets to so aggressively decline. There is no shortage of theories ranging from theories about pending presidential impeachment to an imminent recession. The one theory that holds the most water is that electronic program trading has to be primarily to blame.

The genesis for what was an orderly market decline was no doubt the confluence of a myriad of factors. For starters, the US Federal Reserve is implementing two powerful tightening tools by simultaneously raising the Federal Funds Rate while pulling $50 billion of liquidity from the system each month through balance sheet run off. The European Central Bank (ECB) has announced the end of its bond-buying program, without implementing fiscal reforms to its structural deficiencies. China’s economy is downshifting while it is in the midst of a trade war with the world’s most powerful nation.

Any one of these things could have easily paused the otherwise powerful stock market advance. Even a 10% correction after a long run-up and in advance of corporate earnings reports would have been entirely normal and would not have caused panic.

On Christmas Day 2018, the Wall Street Journal published a story stating, “85% of all trading is on autopilot – controlled by machines, models, or passive investing formulas”. To me, that number appears exaggerated by lumping in passive investing. Still, the number is frighteningly high even at half of the Wall Street Journal assertion.

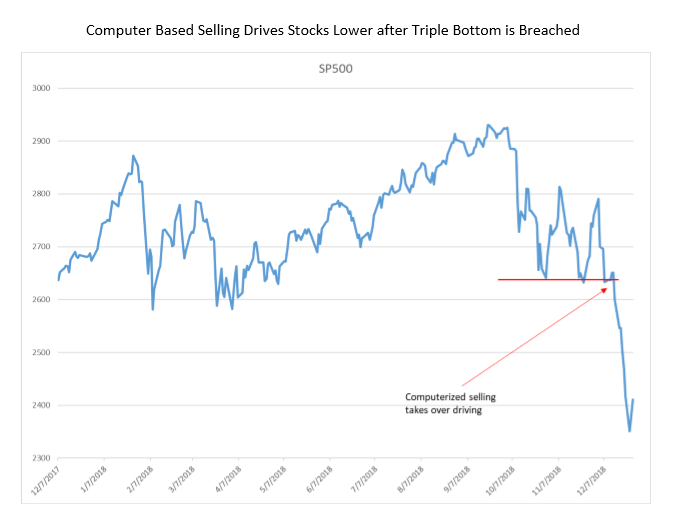

Most technicians of the market were looking at 2630 on the S&P500 as a potential triple-bottom technical support level earlier in December. When the market went through the triple bottom of 2630 on the opening December 14, the sell programs kicked in. The programs drove stocks lower and through 2600, creating even more momentum based computerized selling.