By Dan Weiskopf, the ETF Professor at the ETF Think Tank

Just because Andy Reid, the Chief’s Winning Head Coach of Super Bowl LIV Champions still drive the car his Dad bought in 1940 for $25 does not mean he should hold onto the mutual fund he inherited at the same time.

Taxes and High Fees!

The Triple Threat: Cap gains, High Fees and Underperformance

- In 2019, many active US equity strategies continued to “suffer from capital gains, underperformance and/or high fees and while holding onto Dad’s Model A as a collectors item may work when you have rightfully earned your $7.5 million salary it wont work if you are simply saving for retirement and are a normal “Dan Saver”.

- Per Mathew’s editorial – while assets have grown by $1.9 trillion over this past decade $1.3 trillion has been redeemed.

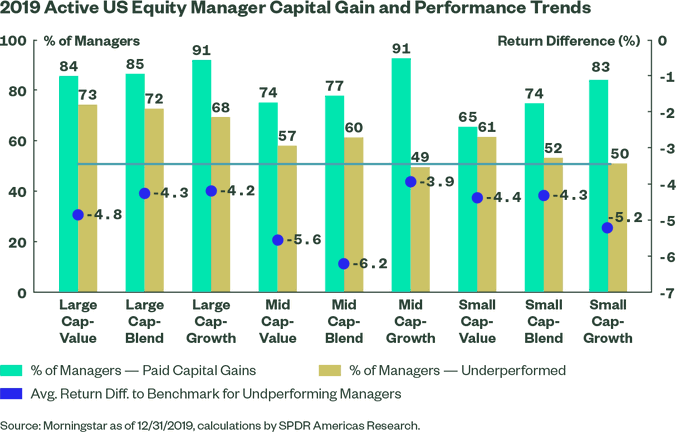

- The article may highlight sadly the fact that “50% of managers underperformed their prospectus benchmark in 2019”, but this does not mean that Active Non-Transparent (ANT) won’t work. I would expect that large cap ANTS may be the road less traveled unless they have a new Tesla (TSLA) like design.

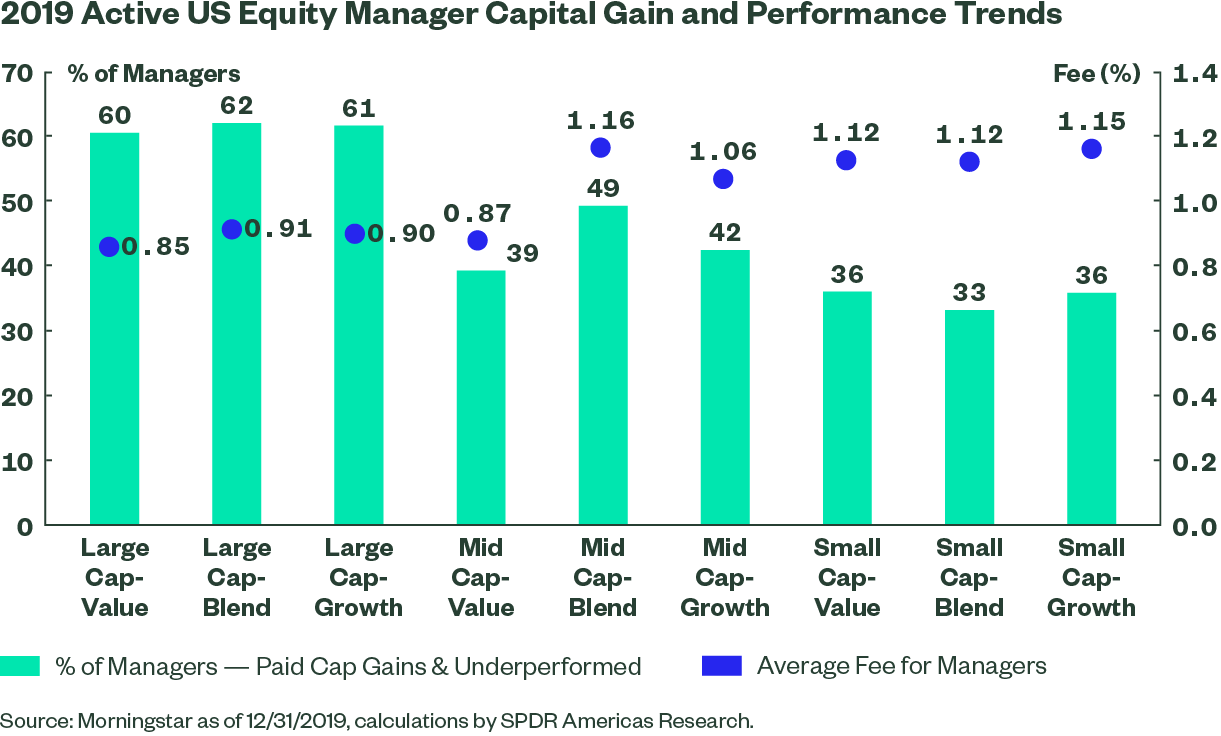

- A new design involves offering investors the opportunity to pay less capital gains and a lower fee. It is sad that more than two-thirds of the active US equity funds – according to this data 83% of the funds paid capital gains vs a similar ETF category of just 5%. High capital gain percentages are not unique to 2019, as it’s a persistent trend for mutual funds in general.

As a Portfolio Manager who believes in active management – both in terms of the active management of passive funds as well as in active management in certain categories and assets classes – it may be of no surprise to anyone that according to this analysis I highlight that 60 to 67% of the asset managers outperformed. Meaning – that if “30% were below their benchmark” the majority were above. Here lies the opportunity for Active Non-Transparent ETFs (ANT), but arguably this also means that fees will have to come down. Let’s be honest – while the investment processes may be similar the track records will not always truly be transportable. Moreover, investors deserve something for taking a risk on a new fund or at least a new fund structure.

There are a lot of moving parts in this data set, but regardless of your analysis if you are not one of the portfolio managers benefiting from the $22 billion in fees paid out to managers that both paid a capital gains and underperformed by over 4% you are probably not POSITIVELY excited by investing along side of this data set.

Coming back to Andy Reid. You can’t expect to win the Super Bowl by playing the same way that the average investor plays. You need to take different risks with your strategy for a different outcome. Don’t be over confident when you come on the field. No coach is complacent and past performance is no guarantee of future outcomes.

Lastly, you can afford to be nostalgic about old cars when when you are comfortably ahead and your goals have been achieved. However, if a Tesla is offered to you and you are driving an out dated car why would you not change and go with the new model? There is nothing super complicated or mysterious about ETFs – they are simply the modern version of the mutual fund. Why not go with the better model if you will get there faster, safer and pay less in energy?

To learn more about the ETF Think Tank, please email the ETF Professor at [email protected].

This article was contributed by the team at Toroso Investments, creators of the ETF Think Tank and a participant in the ETF Strategist Channel.