In this week’s ETF Think Tank research note, we continue our journey through ETF nomenclature. Over the past few weeks, we have covered assets categories, corporate structure, and investment approach. Today, we move to specific exposures provided through ETFs by looking at Sectors.

The Past, Present, & Future of Sector ETFs

The first nine sector ETFs were launched by SSGA in December of 1998. These were the early days of ETF innovation coming on the heels of SPY and the country ETFs. Today, there are 11 sectors with 328 ETFs tracking these sectors. Within the Toroso ETF Security Master, we define sector ETFs as:

ETFs with a mandate to hold equities that are at least 80% in one sector or sub-sector.

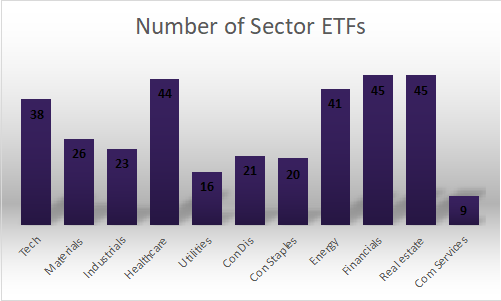

Communication services have the least ETFs dedicated to this sector which is not surprising since this sector is less than a year old. Technology, Financials, and Healthcare are the largest components of the S&P 500 by market capitalization, so it makes sense that relatively more ETFs would focus on these sectors. The outliers are Energy and Real Estate, which both have over 40 ETFs each dedicated to these sectors while both are quite small as a percentage of S&P 500 market capitalization.

The Ownership Influence of Sector ETFs

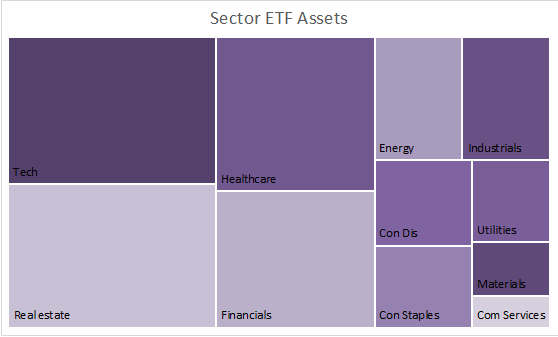

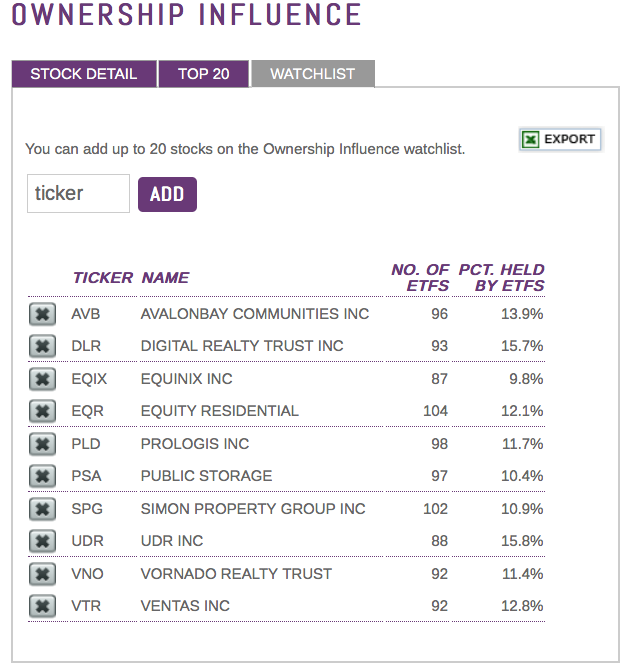

ETF assets allocated by sector mirrors the products listed with Technology, Healthcare, Financials, and Real Estate commanding the most assets. Real Estate is still the outlier. Despite being one of the smallest sectors of the S&P 500 by market capitalization, it is the second largest sector allocated to by ETF investors. Within the ETF Think Tank, we have often discussed the ETF ownership of Real Estate securities being much higher than the 6.8% average for US equities. Below, we show the ETF ownership influence score from our ETF Think Tank App.

Sector ETFs; Assets, Structure, & Investment Approach

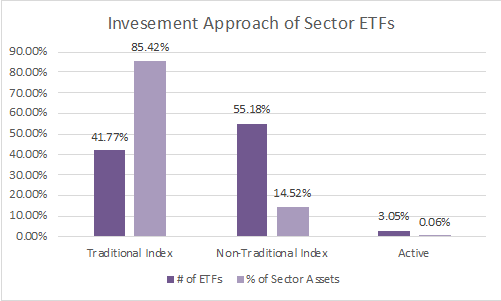

As we have noted in previous ETF Think Tank research notes, Advisors need to know all ETFs, including sectors, by asset category, corporate or tax structure, and investment approach to provide value to clients. In terms of asset category, all sector ETFs, by our definition, are focused on equities but 82 of them are leveraged or inverse Sector ETFs representing $8.5 billion in assets. Sector ETFs are almost exclusively 1940 Act Investment Company in terms of corporate structure, with the exception of 11 ETNs that primarily focus on banking and energy micro-sectors from Rex ETFs. Finally, the investment approach of the $380 billion in sector ETF assets is heavily tilted toward traditional passive index-based ETFs with only 10 active sector ETFs like Davis Select Financial (DFNL) and Reaves Utilities ETF (UTES).

More Choices, Requires More Research

An advisor that knows and readily uses the ETF tools that are out there in order to help build portfolios designed to meet his or her client’s goals can be a clear differentiator for future growth. Sector ETFs have been a core building block in ETF portfolios for over 20 years, but when the options expanded from 9 to 328, we realized a more thoughtful and comprehensive tool was in order. We developed the tools and research within the ETF Think Tank to help advisors select ETFs that will allow them to grow through client alignment!

This article was contributed by the team at Toroso Investments, creators of the ETF Think Tank and a participant in the ETF Strategist Channel.

Click here to see disclosures.