By Michael Contopoulos

Director of Fixed Income

A quick PSA from RBA: Beware of the coming credit crunch. The key goal of tightening monetary policy is to reduce the flow of credit. It is also important to note that the weakest links always default first. This cycle is so far no different. Small, private, and flawed companies lead defaults of large, public, and seemingly financially sound companies.

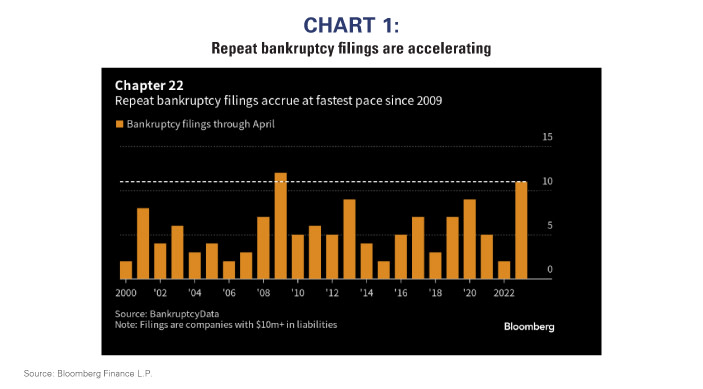

Charts 1 and 2 highlight how the weakest companies are feeling the heat of tighter lending standards and higher interest rates. The first chart clearly shows that repeat bankruptcies – those companies that have defaulted before and have now defaulted a second time – are nearly at all-time highs. An underlying poor business takes precedent over restructuring debt and wiping out equity holders. The second chart should concern private credit managers. Note that small private companies (the types of companies found in private credit portfolios) are defaulting at an alarming rate compared to larger public companies. Small companies are typically the canaries in the credit mine.

Right on cue, earlier this month (May 13/14) 7 large companies defaulted. And if RBA’s proprietary default model is any guide, bankruptcy filings should get worse.

One looming concern overhanging the corporate bond market is the structure of the Collateralized Loan Obligation (CLO) market. CLOs have historically been the biggest buyer of leveraged loans, owning upwards of 2/3 of the entire loan market. As reinvestment periods end and CLO new issuance falls, the CLO’s demand for bank debt is scaling back. The combination of decreasing demand and higher rates on floating rate debt and a profit recession imply conditions couldn’t be worse for the lowest-rated corporate debt.

The environment remains precarious for corporate debt investors. Beware the coming credit crunch.

For more news, information, and analysis, visit the ETF Strategist Channel.

Please feel free to contact your regional portfolio specialist with any questions:

Phone: 212 692 4088

Email: [email protected]

Nothing contained herein constitutes tax, legal, insurance or investment advice, or the recommendation of or an offer to sell, or the solicitation of an offer to buy or invest in any investment product, vehicle, service or instrument. Such an offer or solicitation may only be made by delivery to a prospective investor of formal offering materials, including subscription or account documents or forms, which include detailed discussions of the terms of the respective product, vehicle, service or instrument, including the principal risk factors that might impact such a purchase or investment, and which should be reviewed carefully by any such investor before making the decision to invest. RBA information may include statements concerning financial market trends and/or individual stocks, and are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially, and should not be relied upon as such. The investment strategy and broad themes discussed herein may be inappropriate for investors depending on their specific investment objectives and financial situation. Information contained in the material has been obtained from sources believed to be reliable, but not guaranteed. You should note that the materials are provided “as is” without any express or implied warranties. Past performance is not a guarantee of future results. All investments involve a degree of risk, including the risk of loss. No part of RBA’s materials may be reproduced in any form, or referred to in any other publication, without express written permission from RBA. Links to appearances and articles by Richard Bernstein, whether in the press, on television or otherwise, are provided for informational purposes only and in no way should be considered a recommendation of any particular investment product, vehicle, service or instrument or the rendering of investment advice, which must always be evaluated by a prospective investor in consultation with his or her own financial adviser and in light of his or her own circumstances, including the investor’s investment horizon, appetite for risk, and ability to withstand a potential loss of some or all of an investment’s value. Investing is subject to market risks. Investors acknowledge and accept the potential loss of some or all of an investment’s value. Views represented are subject to change at the sole discretion of Richard Bernstein Advisors LLC. Richard Bernstein Advisors LLC does not undertake to advise you of any changes in the views expressed herein.