By Chris Konstantinos, CFA

US Dollar Will Remain the World’s Reserve Currency

- We believe the US dollar will maintain its reserve currency status.

- The depth and size of the US bond market is unrivaled, in our view.

- The US is still the dominant economic force in the world, in our view.

“In the land of the blind, the one-eyed man is king.” – Erasmus, 1500 A.D

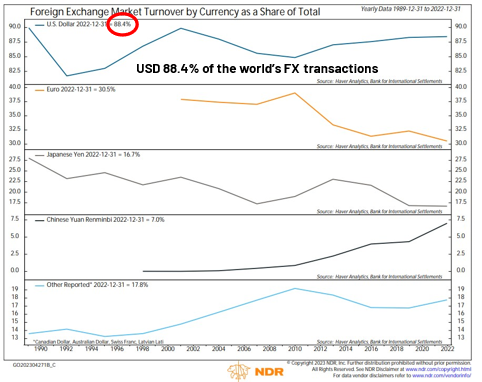

Since World War II, the US Dollar (USD) has served as the world’s preeminent ‘reserve currency’ – the means of exchange for most of the rest of the world to do business. From central bank holdings to international commerce and commodity transactions, the USD has reigned supreme, commanding between close to 90% of the world’s foreign currency exchange (FX) transactions (see chart, below).

For years we have fielded questions about how long the USD could maintain its reserve currency status, as threats emerged from both within (related to instability and high debt levels of the US economy) as well as abroad, particularly from the Chinese yuan. These questions have intensified with the latest news that China has been inking deals to use the yuan for cross-border transactions with countries like Brazil, Saudi Arabia, and Iran, as well as with controversy over the US-led sanctions on Russia. Additionally, the steady drumbeat regarding digital currencies also has investors concerned that they may be missing a future reserve currency in its infancy. Is the dominance of the USD as the world’s ‘reserve currency’ set to end?

Don’t believe the hype: We believe that the USD will maintain its reserve currency status for the foreseeable future. Despite its high debt levels and political division, the US’ superior economic transparency, openness, flexibility, and governance suggest our financial system is likely to remain at the center of global commerce. The US has problems like any economy, but potential contenders have more as we shall discuss. As Erasmus famously said, “in the land of the blind, the one-eyed man is king.”

Copyright 2023 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at ndr.com/copyright.html. For data vendor disclaimers refer to ndr.com/vendorinfo/. Past performance is no guarantee of future results. Shown for illustrative purposes.

It is Not Only About Who is the Biggest…But Also Who is the Most Trusted

Dollar skeptics point to the fact that China’s GDP is now larger than the US’s, at least in purchasing power terms (PPP). But when it comes to reserve currency status, sheer size is not everything. Bear in mind that the US became the world’s largest economy by GDP in 1916; yet reserve currency status for the USD did not really happen until after WWII.

Economists point to a mosaic of important factors for a currency’s reserve status outside of just size, including depth and openness of a country’s financial markets, ease of currency convertibility, rule of law, clarity around default resolution, the size and depth of government bond markets, and stability of domestic macroeconomic policies.

By this rubric, we think so-called contenders such as the Chinese yuan fails the reserve currency ‘test.’ Consider:

- Currency Management: The yuan is pegged to the USD, floating within a controlled 2% band, and managed by the Chinese Communist Party for domestic purposes.

- Capital Controls: Alongside currency management, China maintains strict capital controls to restrict outflows of capital outside of mainland China. China has reassured the world that it would liberalize its foreign exchange market since joining the World Trade Organization (WTO) in 2001 but has continued to fall short of that goal, in our view.

- Lack of Transparency: China’s economy is opaque to the rest of the world; data quality and timeliness lags far behind the US and western developed countries, in our opinion. There is an entire cottage industry of economic analysts (including us!), who opine on which official China economic data is the least ‘massaged.’

- High Debt Burden: China’s debt has risen significantly over the past 10 years, as the government financed a debt-fueled infrastructure boom that is now starting to fizzle. Including government debt as well as corporate and household debt, total debt-to-GDP statistics for the Chinese economy are currently at a record, at almost 280% of GDP (source: Bloomberg, 5/8/23). It is understood that China’s myriad local governments also likely have other off-balance sheet unregulated debt lurking in its ‘shadow banking’ system.

- Poor Protections for Dispute Resolution: In the 2017-18 World Economic Forum Global Competitiveness index rankings of 137 countries, China scores much more poorly than the US in areas related to investor protection and economic dispute resolution:

- Legal Rights Index: China rank 85th; US rank 4th

- Strength of investor protection: China rank 102nd; US rank 31st

- Property rights: China rank 53rd; US rank 20th

- No Liquid Bond Market for Foreigners: China lacks a robust government bond market that is widely available to international investors.

Despite its Flaws, US Still the Dominant Economic Force in the World

We will be the first to admit that the US has allowed its federal debt-to-GDP level to spiral upwards in recent decades, now close to a post-war high of 120% (source: Datastream). Deepening political dysfunction and embarrassing episodes such the constant self-inflicted debt ceiling ‘crises’ recently resulted in Fitch becoming the second rating agency to remove the US AAA rating. These episodes are also a challenge to the USD’s dominant stance with the international FX community.

It is no wonder that global central banks have sought to diversify slightly away from the USD with regard to foreign currency reserves, into large currencies like the Euro and smaller ones such as the Canadian dollar, the Australian dollar, and the Swiss Franc.

However, despite it all the US economy has proven itself to remain the most productive, flexible, and innovative of its kind in the world, in our opinion. As evidence of that, the US has managed to stay out of recession over the last 12 months, despite the US Federal Reserve’s historic monetary tightening regime and a banking mini crisis.

The Euro is arguably the closest thing the world has to a legitimate alternative to the USD; the Euro commands the second-highest share of worldwide transactions after the dollar (though it is a very distant 2nd). However, we would cite the Eurozone’s lack of a common Euro-wide government bond market as one significant drawback for potential reserves status, as compared to the ubiquity and ease of transaction for US Treasury securities. Furthermore, the deep structural economic, demographic political and geopolitical issues facing Europe and north Asia…make the Euro and Japanese Yen useful alternatives but no real threat to the USD’s dominance.

What about alternatives to fiat currency, such as gold or cryptocurrencies? There is not enough depth or liquidity in the physical gold market to replace the USD as the global reserve store of value, in our view. And in their brief history, cryptocurrencies have been much too prone to high price volatility to be relied upon as a store of value. Most importantly, crypto currently lives well outside the regulatory system, with few governments willing to recognize cryptocurrencies as legal tender, especially with their propensity to be utilized for extralegal ‘black-market’ purposes.

Finally, there is military might. The US is a trading nation and, like Britain before it, controls the major oceans and thus critical trade routes. China would like to dominate the South China Sea but the major economies of the region outside China such as S. Korea and Japan support the US Pacific Fleet’s role. Beyond the seas, the US is still the dominant global military force. The G7 countries from Europe plus Japan and Canada all seek the protection of the US in a crisis and their governments have no desire to challenge the dollar’s status.

Source: Refinitiv Datastream; data weekly, as of August 2, 2023. Chart shown for illustrative purposes only. Past performance is not indicative of future results. An investment cannot be made directly in an index.

CONCLUSION: THE US DOLLAR ISN’T GOING ANYWHERE

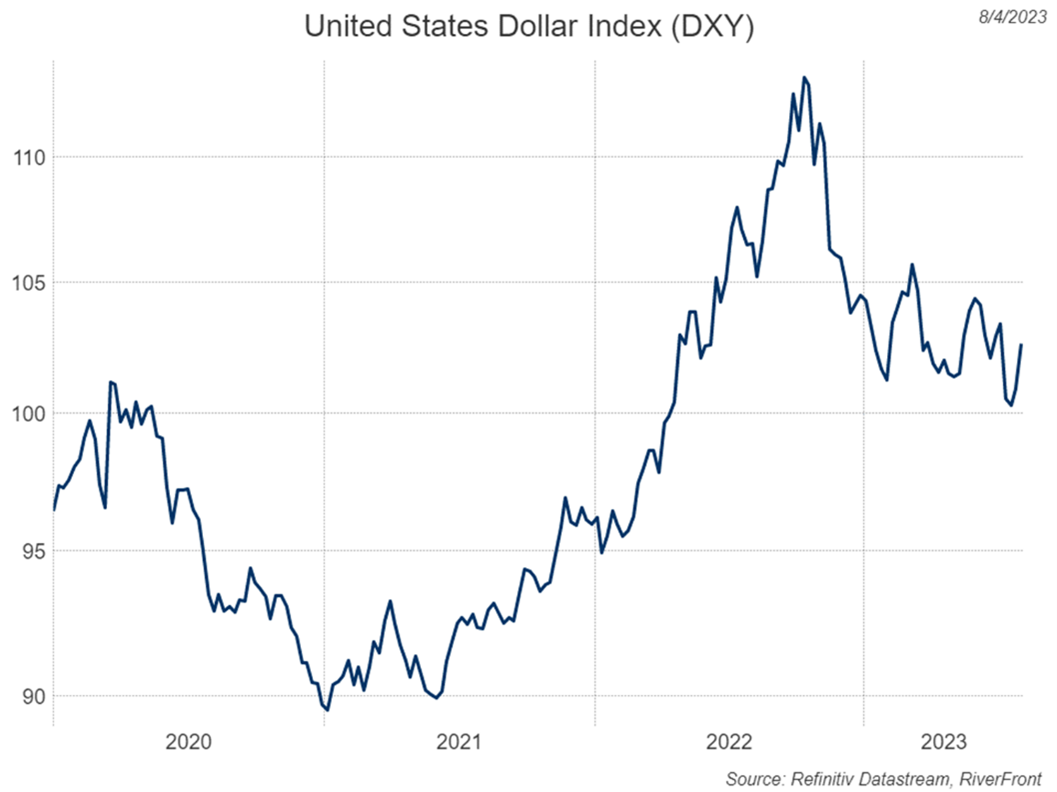

If there was ever a time for the dollar to be superseded it would have been in the last few years as COVID spending drove the Federal deficit ever higher. Yet… the USD appreciated versus major trading partner currencies from 2020-2023 (see chart) This speaks volumes to us about the lack of feasible contenders to the USD’s reserve currency status. To paraphrase Mark Twain: the reports of the US dollar’s death are greatly exaggerated.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Ned Davis Research (NDR) is a global provider of independent investment research, solutions and tools. Founded in 1980, NDR helps clients around the world make objective investment decisions.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to a basket of foreign currencies.

Definitions:

A reserve currency is a large amount of currency held by central banks and major financial institutions to use for international transactions.

Buying commodities allows for a source of diversification for those sophisticated persons who wish to add this asset class to their portfolios and who are prepared to assume the risks inherent in the commodities market. Any commodity purchase represents a transaction in a non-income-producing asset and is highly speculative. Therefore, commodities should not represent a significant portion of an individual’s portfolio.

Foreign exchange is the conversion of one country’s currency into another. In a free economy, a country’s currency is valued according to the laws of supply and demand. In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies. A country’s currency value may also be set by the country’s government.

Purchasing power parity (PPP) is a popular metric used by macroeconomic analysts that compares different countries’ currencies through a “basket of goods” approach.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2023 RiverFront Investment Group. All Rights Reserved. ID 3046703

For more news, information, and analysis, visit the ETF Strategist Channel.