SUMMARY

Although the NDR Catastrophic Stop Loss Model is fully invested, a volatile short-term environment still exists unless/until Small Caps take the baton and don’t falter.

OVERSOLD READINGS NOT WASTED

During my webinar on 9/21/21, following an almost 1000-point intraday decline by the DJIA, which led to the S&P 500 (SPX/4443.11) retesting the rising 100-day MA support level, I stated, “It is critical that the market not waste these OS (oversold) readings and either starts to stabilize and/or exhibit very strong demand.” Aided by cyclical/value stocks, equity indices rallied sharply and ended marginally higher last week—a victory when viewed in the context of Monday’s decline, the Fed news, Congress, China/China Evergrande, etc. NYSE Advancing Volume as a percentage of total NYSE volume was supportive and suggests the SPX’s intraday low of 4305 and rising 100-day MA are critical support levels—Figures 1 and 2.

Figure 1: I would prefer some sort of retest given the negative breadth divergences that exist with the All Issues and Common Stock Only NYSE A/D Line. Regardless of whether a retest (partial or full) occurs or doesn’t occur, please use the resistance and support levels shown below accordingly.

Figure 2: Please note the importance of the recent low at 4305, and the rising blue 100-day MA support line.

NO STRESS IN CREDIT MARKETS SUPPORTS EQUITIES

Don Hagan has done, and continues to do, an excellent job discussing the importance of the credit markets and their effect on equities. To paraphrase Don, historically, we would expect credit spreads to widen if risks were accelerating and starting to negatively impact financial markets. And that isn’t happening right now.

Figure 3: Credit spreads on Corporates; High Yield and Agency bonds remain near historically low levels. This indicates that the risks of a large financial dislocation (China Evergrande contagion) aren’t yet deemed a systemic risk by U.S. fixed income investors. If credit spreads do start to rise, consider playing “defense,” especially if it occurs with a reversal to a defensive posture by the NDR Catastrophic Stop Loss Model.

Note 1: Mortgage spreads (third frame down) may be reacting to a potential taper of Mortgage-Backed Security purchases by the Fed.

Note 2: Bespoke Investment Group also addressed the topic of stress in the credit markets. Their take on credit default swaps (“a credit default swap [CDS] pays out its holders when a company defaults so the pricing of these credit instruments is a proxy for default risk. Higher spreads indicate greater risk of default, generally speaking”):

- Bank CDS spreads soared during the global financial crisis and also ripped wider during the Eurozone debt and U.S. debt ceiling crises of 2011. Since then, they’ve been very well-behaved, even during recession scares like 2016 and 2019.

- The risk premium for default implied by CDS has risen over the past week, but only by the slightest of margins, and has even reversed lower in the second half of the week.

- So far, these areas of the credit market aren’t showing much concern over the impacts of a potential default for Evergrande.

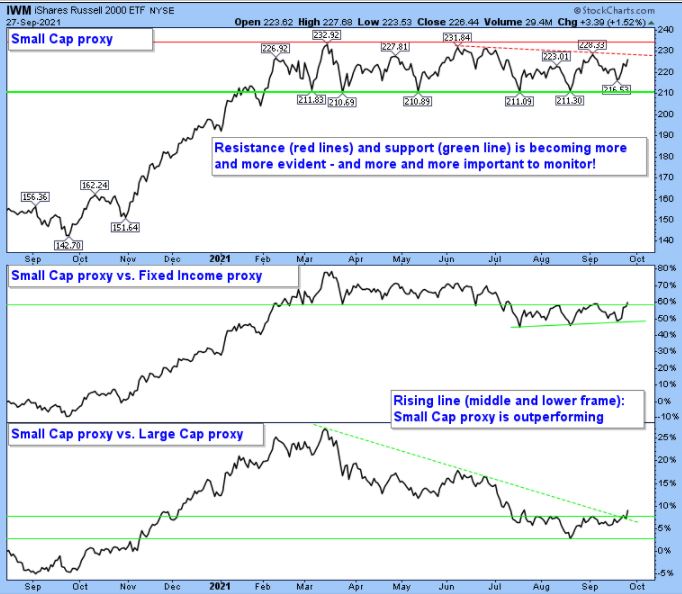

CRITICAL RELATIONSHIPS TO FOLLOW GOING INTO YEAR-END

Figure 4: Aided by rising interest rates (please reach out if you would like to see a chart), Small Caps (and cyclical/value stocks) are exhibiting some relative strength—more of this and for a longer period is important as it will play a role in overcoming the breadth divergences so often alluded to in these reports/webinars.

Day Hagan Asset Management appreciates being part of your business, either through our research efforts or investment strategies. Please let us know how we can further support you.

Art Huprich, CMT®

Chief Market Technician

Day Hagan Asset Management

—Written 09.27.2021. Chart and table source: Stockcharts.com unless otherwise noted.

UPCOMING EVENTS

- Day Hagan Market Update Webinar with Donald Hagan, CFA, October 6, 2021, at 4:15 PM ET

- Day Hagan Technical Analysis Webinar with Art Huprich, CMT, October 13, 2021, at 4:15 PM ET

- Day Hagan/Ned Davis Research Smart Sector with Catastrophic Stop with Art Day, October 20, 2021, at 1:15 PM ET

- Day Hagan/Ned Davis Research Smart Sector with Catastrophic Stop with Art Day, October 20, 2021, at 4:15 PM ET

Disclosure: The data and analysis contained herein are provided “as is” and without warranty of any kind, either express or implied. Day Hagan Asset Management (DHAM), any of its affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Day Hagan Asset Management literature or marketing materials. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before investing. DHAM accounts that DHAM or its affiliated companies manage, or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. The securities mentioned in this document may not be eligible for sale in some states or countries, nor be suitable for all types of investors; their value and income they produce may fluctuate and/or be adversely affected by exchange rates, interest rates or other factors.

Investment advisory services offered through Donald L. Hagan, LLC, a SEC registered investment advisory firm. Accounts held at Raymond James and Associates, Inc. (member NYSE, SIPC) and Charles Schwab & Co., Inc. (member FINRA, SIPC). Day Hagan Asset Management is a dba of Donald L. Hagan, LLC.