The last two months have been a difficult period for everyone around the globe due to the economic lockdown imposed to fight COVID-19. Millions of US workers have found themselves furloughed or laid-off from their jobs and some lack the savings to manage through a multi-week or multi-month period of being unemployed. For these individuals, it is important to have access to a source of income, whether assistance from the government or access to credit from banks in the form of home equity lines or credit cards, to manage through the period of uncertainty.

Corporations are in a similar position as individuals. Revenue has dried up but payroll, rent, interest payments, and other fixed expenses still need to be paid. With the liquidity issues of the Great Financial Crisis on their minds, the Federal Reserve (Fed) has stepped in to fill the void for corporations much like the government did for small businesses with the Paycheck Protection Program. Over the last two months, the Fed has introduced several credit facilities to help corporations gain access to capital. Two such facilities were the Primary Market Corporate Credit Facility (PMCCF) and the Secondary Market Corporate Credit Facility (SMCFF).

Investment Grade Corporates:

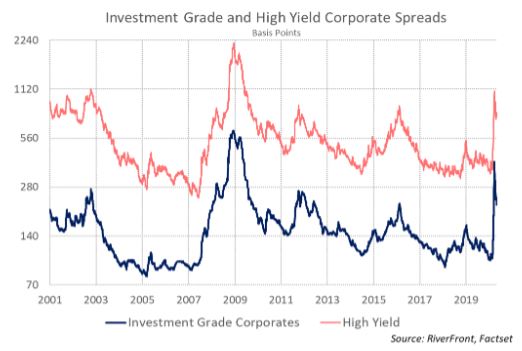

The Fed created the $500 billion PMCCF and the $250 billion SMCCF to unclog the fixed income capital market pipes. The announcement of the two programs has helped the new issue market to re-open for investment grade corporations as well as facilitating transactions in the secondary market. These actions have lowered the credit risk premium that investors require to buy corporate bonds by approximately 167 basis points since March 23rd (as of April 29). Although neither program has been officially launched, the mere announcement seems to have thawed a corporate bond market that was beginning to freeze-up and allowed $409 billion of new corporate debt to be issued over the last month. This compares to just $202 billion between February 3rd and March 22nd according to Bloomberg.

Prior to the crisis, investment grade corporates had been our preferred asset class within the fixed income arena. Our confidence in the asset class has grown with the Fed’s latest commitment to keep capital flowing to US corporations. In addition to policy support from the Fed, we like investment grade corporate bonds for the following reasons:

- Investment grade companies are less levered in general and are expected to maintain access to credit through banks and capital markets.

- Yields relative to Treasuries are elevated and offer an opportunity for price appreciation as the credit risk premium declines to more normal levels.

Hence, in the RiverFront Moderate Growth and Income Portfolios we currently hold approximately 21% in short to intermediate corporate bond exposure and are overweight versus the benchmark.

High Yield Bonds:

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

The high yield credit risk premium has also come down since the Fed announced that the SMCCF could purchase high yield ETFs and individual bonds of ‘fallen angel’ companies. ‘Fallen angel’ bonds are those issued by former investment grade-rated companies that have been downgraded to double-B (the highest rated category in high yield). However, the SMCCF’s provision only covers a small subset of the high yield universe and is more implicit than the explicit backstop provided for investment grade corporates. Currently, high yield credit risk premiums are hovering near recessionary levels and we believe that if there is not a facility put in place specifically for high yield bonds rated below double-B there is a chance that default rates will rise.

Historically, high yield default rates have averaged around 4% since 1981 and have spiked to around 10% during recessions. As of May 1, 2020, the high yield index, as measured by ICE BofA, is yielding 8.04% while investment grade corporates, as measured by ICE BofA are yielding 2.78%. At first glance, investors might prefer high yield over investment grade corporates and not consider the differences between the two vehicles in order to get this additional yield pick-up. However, we believe investors must consider default and recovery rates when comparing the two asset classes rather than focusing on yield alone.

Eventually, we believe that the current high yield market dynamics could offer an appropriate risk/ reward to investors if there is further economic clarity surrounding the pandemic. Since it is anyone’s guess where default rates will end up for 2020, we continue to prefer investment grade corporates over high yield in the short-term but will look for opportunities to add additional yield in the portfolios when we believe the economic and viral outlook is more certain.

Important Disclosure Information

The comments above refer generally to financial markets. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent

to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

A basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. (bps = 1/100th of 1%)

Moderate Growth and Income Composite Benchmark and Conservative Growth Composite Benchmark (Benchmark): The Composite Benchmark is currently a blend consisting of 40% S&P 500 Total Return Index TR, 10% MSCI EAFE Net Total Return (NR) USD Index and 50% Bloomberg Barclays US Aggregate Bond Index TR that is rebalanced monthly. The S&P 500 Index TR measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market. MSCI EAFE Net Total Return (NR) USD Index: The index captures large and mid-cap representation in 21 develop markets around the world, excluding the US and Canada. The index covers approximately 85% of the adjusted free- float market capitalization in each country. For Net returns, the regular cash dividend is reinvested after deduction of withholding tax by applying the maximum rate of the company’s country of incorporation applicable to institutional investors. The Bloomberg Barclays US Aggregate Bond Index TR is an unmanaged index that covers the investment grade fixed rate bond market index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

You cannot invest directly in an index

ICE BofAML High Yield Index (ICE Bof A) monitors the performance of below investment grade US dollar-denominated corporate bonds publicly issued in the US domestic market.

ICE BofAML US Corporate Index is an unmanaged index comprised of US dollar denominated investment grade corporate debt securities publicly issued in the US domestic market with at least one year remaining term to final maturity.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership

interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1173686