STILL A TROUBLED REGION, BUT SOME IMPORTANT RECENT POSITIVES

By Riverfront Investment Group

Last week, our longer-horizon, more risk-tolerant portfolios increased their weighting to European stocks, including a specific allocation to Germany. While this only brought the portfolios up to a roughly neutral weighting in Europe relative to our global benchmarks, it represents a meaningful evolution in our view on European stocks.

While we have long believed European assets possess attractive long-term mean reversion potential relative to US stocks, our cautious view in recent years has centered on what we view as compromised fundamentals. Structurally, many headwinds remain in Europe, including the Brexit fight between the UK and the European Union, and national political strife in Italy, Spain and others. Europe also must contend with low levels of productivity, high tax rates, rigid labor laws, and other structural issues– an issue we wrote about extensively in the ‘Reform – The 4th R’ section of our 2020 Outlook. This underachievement has led to anemic corporate earnings throughout Europe for the last decade, leading to disappointing relative stock performance to the US. Despite these longer-term issues, several tactical factors have conspired recently to turn our nearer-term view on Europe more constructive, including significant action from Europe’s policymakers.

EUROPE GETS HIGH MARKS ON COVID-19 CONTAINMENT

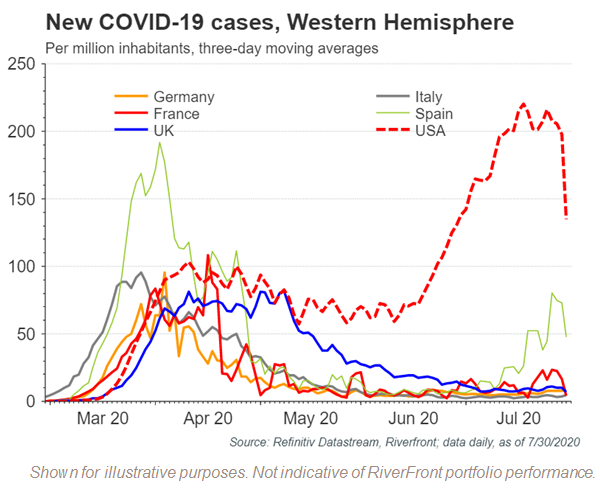

First, Europe continues to fare relatively well on COVID-19 containment measures, despite being the early virus epicenter of the Western hemisphere. We believe that this may allow European economies to open faster than in the US, where COVID-19 transmission rates are still unfortunately much higher.

COVID-19 CRISIS HAS MANAGED TO DRIVE EURO GOVERNMENT COLLABORATION

While the European Central Bank has long sought to underwrite a Euro recovery via aggressive monetary policy – which continues unabated – the recent COVID-19 relief funding announcement from the EU suggests a greater commitment to the European experiment by the national governments themselves.

The recovery fund – which includes grants to poorer countries as well as loans, funded under the auspices of an EU bond – is an important step forward for the region, in our opinion. The stimulus size is meaningful – roughly 5% of EU GDP, according to research from Alpine Macro – but the signal it sends around shared responsibility for the financial health of the EU is perhaps more important than its size. The structure of this recent announcement may eventually pave the way towards pan-European debt issuance, the lack of which has been a partial cause of the rolling crises that have engulfed the Eurozone numerous times since 2008. We believe these actions, necessary but politically unpopular in northern Europe, demonstrates that the ‘rich’ countries of the Eurozone are incrementally more willing to help underwrite the rest of the region than before.

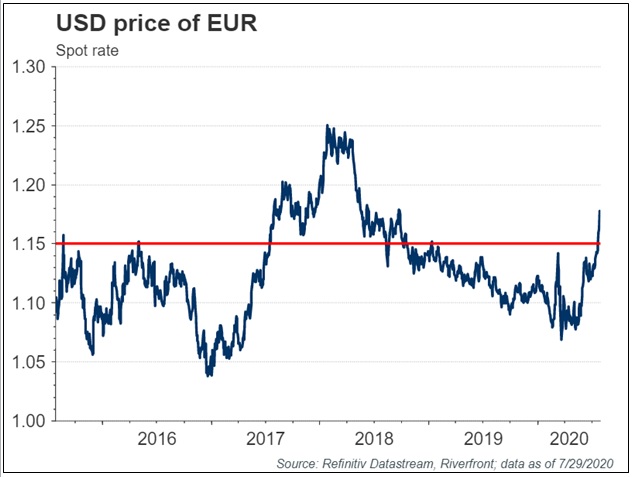

Some of these positive near-term fundamental signals are manifesting themselves in the recent strength of the euro (EUR) relative to the US dollar, which has in our opinion broken important technical support to the upside around 1.15 (see red line on chart, right). While too much strength in the EUR could prove to be a headwind for Euro stocks in local terms, as US dollar-denominated investors we benefit from a stronger Euro. So far, we believe the EUR is not nearly strong enough for that tailwind to become a headwind for European companies exporting outside the region.

It’s worth noting that we remain more constructive on the Euro area than the UK, where continued Brexit-related uncertainty threatens to bog down the region economically as well as put pressure on the pound.

WHY WE PREFER GERMANY WITHIN EUROPE

Germany, in our view, represents one of the more stable parts of the Euro area. Germany boasts a budget surplus, low overall levels of debt relative to GDP, relatively low unemployment and more stable politics compared to most other euro bloc countries. In a world still fraught with pandemic uncertainty, Germany has also been a standout, with a very low current viral transmission rate as compared to the US and Latin America. We also believe that Germany’s economy is disproportionately exposed to the Chinese and global economic cycle via the export orientation of its many of its companies– we view this as a positive given the recent rebound in the Chinese economy.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1291169