Click here for original publication

There has been enough written about SIVB and what led to the point where the government stepped in to backstop it. Let’s talk about what happens next, which arguably is more important. Why is it more important?

- The damage has already been done with 500bps of rate hikes in 1 year (so much for the Fed trying to navigate a soft landing!). Being concerned about what has already unfolded may not do much good.

- Having worked at a bank in 2008 that was acquired in the 11th hour, avoiding a collapse, I am generally sensitive to the situation; I don’t want to take things lightly. But we have a vantage point to offer about why the Fed should pause.

We have received countless questions like those below. Feel free to ask more. We’re here to help.

- Why suddenly did we see a run on the bank? This is complicated, but we have excellent writeups we can share. Two issues:

- Improper risk management by a few specific banks, i.e., poor loan management and miscalculated duration bets.

- Improper stress testing by regulators

Remember, bonds have convexity. The more rate hikes (or cuts), the greater the potential PnL in either direction. In general, many investors pulled money out of banks of late and bought money markets/T bills. Banks losing deposits, going farther out on the duration curve, and not considering the impact of higher rates on their loan portfolios cam lead to a perfect storm. We can share writeups if you want them. However, let’s focus on what happens next.

- What happens to the broader equity market if contagion risk spreads? The banking sector is crucial to the lifeline of the US economy. We think the Fed and government will continue to step in to alleviate pressure on other struggling regional banks. KBWB, KRE, and KBE (you’ll want to watch these tickers for sentiment in the bank space) were down around 12% today. The Fed communicating no more rate hikes would drastically increase sentiment.

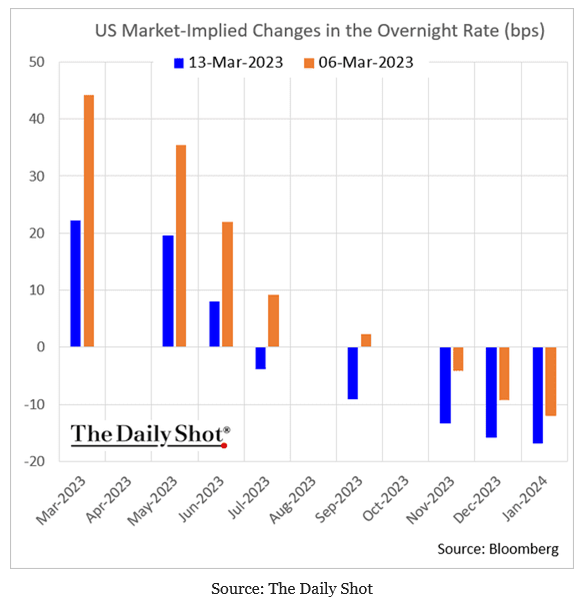

- What does the Fed do? The damage is already done with the 500bps in 1 year. Our view is that the Fed should pause. But what the Fed does and what it should do are two entirely different things. The market has drastically repriced interest rate hikes, as you can see on the chart below from the Daily Shot.

-

- Between the implosion of various cryptocurrencies, the demise of the disruptive growth cohort, the collapse of bonds last year, and now the implosion of a few large regional banks, it seems like the Fed ought to pause.

-

- Monetary policy works with a lag. The economy will slow naturally (if it hasn’t already), given the impact of

- lower home prices,

- the erosion of purchasing power from elevated inflation for the past 12-15 months,

- job layoffs in the tech sector,

- and a decline in profit margins and corporate profits.

- Monetary policy works with a lag. The economy will slow naturally (if it hasn’t already), given the impact of

- What changes are you making to your ETF models? Nothing in our Core Risk Based ETF models as of Friday/today. In January, we added SPTL (long-dated US treasuries) to our ETF models in case the economy went into recession. SPTL was up 50bps today, softening some of our portfolio volatility. Earlier in January, we lowered our equity exposure as we had become increasingly worried about the global economy; we also extended our duration (which usually helps during a recession). The ability to be active/dynamic and own multiple asset classes is helpful for us. We perpetually own alternatives for rainy days like today (figuratively and literally, as it’s raining in NY today). Tax loss harvest is a hot topic during market meltdowns, and we will continue to focus on that.

- Do you anticipate making changes to your models? We are getting this a lot. The most important thing we have to say is that we prepared earlier this year for an economic slowdown. We were worried about expensive valuations in US tech/growth stocks. The good news is that once you strip this segment out, the rest of the market doesn’t look bad (10-13x PE ratios for international, US value, US dividends, cyclicals, EM equities, etc.). The main issue right now is that the risk-free rate is quite high, creating a lot of competition between stocks and bonds. We made it abundantly clear that we preferred bonds over stocks in our year-ahead outlook. Our 10 ETFs for 2023 had more bonds than stocks for the first time in the decade we’ve been writing this report (Click to view 10 ETFs for 2023).

- Should you be worried about markets? If you are reacting to day-to-day moves, then your risk tolerance is off-balance. If you have a multi-year time horizon, we would focus on the fact that valuations are generally attractive outside of the US large cap index, and bonds are now finally attractive. We’d argue that having a long-term time horizon is important and advise trying to avoid the day-to-day noise.

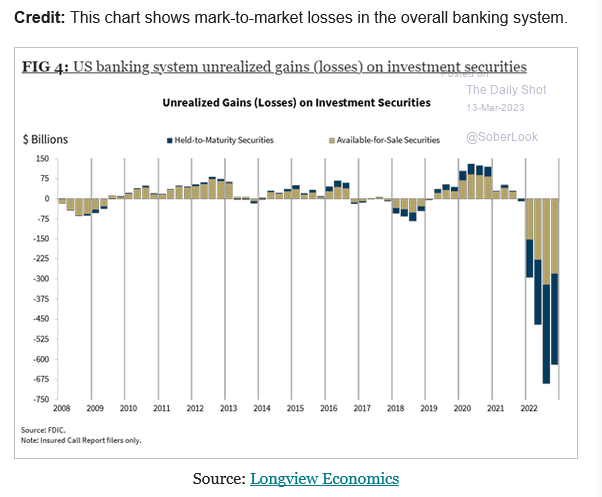

- Is there any good news to glean from this weekend? The good news is that we now have a process for backstopping the banks (thanks to the 2008 crisis). We are happy to see that the govt stepped in yesterday to backstop SIVB. More importantly, we think the Fed has opened its eyes to the idea that they have slowed the economy enough with 500bps of rate hikes. Are we surprised regional banks were down as much as they were today with the government backstop? Yes, but we must remember that the unrealized mark-to-market losses for the banking system are quite large at the moment (again, see the chart below from the Daily shot using data from Longview Economics). Again, more of a reason for the Fed to pause.

The good news is that rate cuts which usually imply the start of a new cycle, aren’t that far away. We’ll be communicating more of our thoughts via LinkedIn and Twitter (@AstoriaAdvisors), so be sure to follow us there.

Additionally, you can view our CNBC interview from earlier today live at the NYSE with Bob Pisani and the CEO of the Standard and Poor’s index. The segment covered everything from active vs passive, how the ETF ecosystem handled the extreme volatility of the banking sector, and the upcoming GICS sector classification rebalances. Click to view

Astoria Portfolio Advisors Disclosure: Past performance is not indicative of future performance. Please note, as of March 13, 2023, Astoria Portfolio Advisors holds SPTL, KBWB, KRE, and KBE on behalf of its clients. Any third-party websites provided on www.astoriaadvisors.com are strictly for informational purposes and for convenience. These third-party websites are publicly available and do not belong to Astoria Portfolio Advisors LLC. We do not administer the content or control it. We cannot be held liable for the accuracy, time-sensitive nature, or viability of any information shown on these sites. The material in these links is not intended to be relied upon as a forecast or investment advice by Astoria Portfolio Advisors LLC and does not constitute a recommendation, offer, or solicitation for any security or investment strategy. The appearance of such third-party material on our website does not imply our endorsement of the third-party website. We are not responsible for your use of the linked site or its content. Once you leave Astoria Portfolio Advisors LLC’s website, you will be subject to the terms of use and privacy policies of the third-party website. Refer here for more details.