By Chris Konstantinos, CFA

SUMMARY

- China’s prominence appears to be fading, due to both cyclical and structural issues, in our view.

- We do not foresee an imminent Chinese invasion on Taiwan.

- We remain cautious on China investment but remain optimistic on U.S. stocks.

Deflation, Default Risk, Demographics and Dominion Difficulties Dim the Dragon

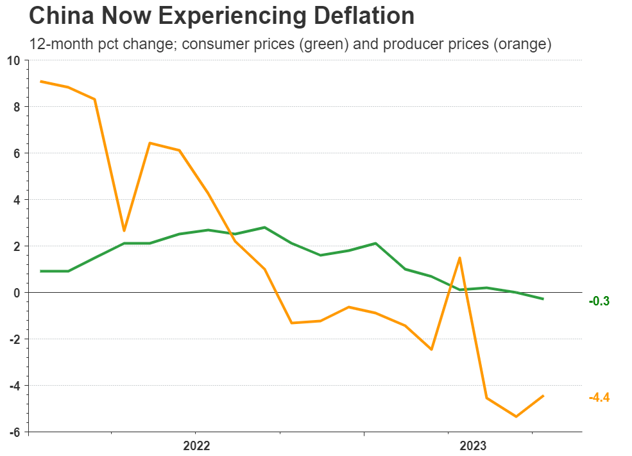

In the Chinese zodiac calendar, 2023 is the ‘Year of the Rabbit’ – a year of prosperity and hope, according to astrologists. However, hope is rapidly turning into despair as it relates to Chinese economic prosperity, in our view. Consumer and producer prices are now falling into deflation (chart, below), suggesting to us that the economy is underperforming the U.S. and other global superpowers. Reflecting this, the Chinese yuan is close to a decade-plus low relative to the U.S. dollar and Chinese stocks have underperformed their U.S. counterparts. Along with deflation, fears over widespread property manager defaults have resurfaced.

Source: LSEG Datastream, RiverFront. Data monthly as of July 14, 2023. Chart shown for illustrative purposes.

‘China Reopening’ Has Fizzled

Despite the ending of COVID-19 restrictions late last year, investor optimism appears misplaced as China’s economy is now sputtering. Real GDP growth is struggling to meet the Chinese Communist Party’s (CCP) lowered target of 5%. As official GDP data tends to be heavily ‘massaged’ to meet policymaker aims, in our view, the reality on the ground is almost assuredly worse. For example, a data series we track for a more ‘real-time’ window into China’s economy suggests growth is currently annualizing at close to zero percent year-over-year. This is in stark contrast to the Atlanta Fed’s ‘GDPNow’ tracker, which is suggesting the U.S. economy is growing at close to a 6% annualized rate.

China Growing More Opaque

For Western economists and investors, understanding China’s economy has always represented a bit of a ‘guessing game’, given the opacity of statistics emanating from China’s National Bureau of Statistics (NBS). However, we believe the problem is worsening, reflecting not only internal sensitivities around projecting economic weakness, but also the growing geopolitical divide between China and its peers.

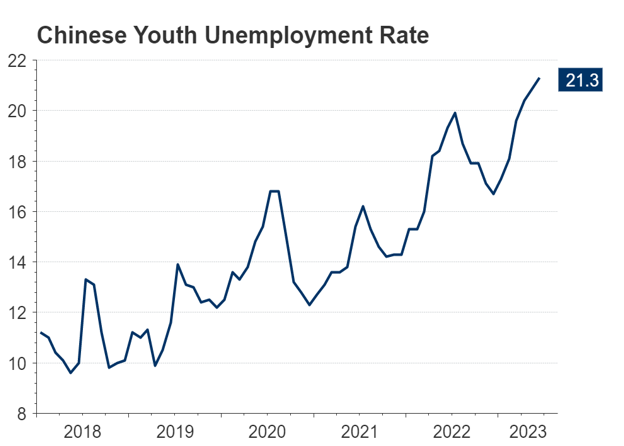

Two weeks ago, China announced that they would no longer be publishing data on urban unemployment for youths ages 16-24, citing the need to improve its methods of calculation. Coincidentally or not, this came not long after the number hit a record high in June, suggesting about one in every five young urban Chinese job seekers is out of work right now (see chart, right).

This wouldn’t necessarily be so concerning if it didn’t fit a growing pattern of disappearing Chinese information. A recent Bloomberg article highlights that information on land sales, private bond transactions, and number of human cremations (a proxy for COVID-19 related deaths) – all data trending in unflattering directions– has also disappeared from public view over the past year.

Source: LSEG Datastream, RiverFront. Data monthly as of June 15, 2023. Chart shown for illustrative purposes. Data now discontinued.

Demographics: Time No Longer on China’s Side

While the above data paints a concerning picture of the near-term economic outlook, the focus of this Strategic View, however, focuses more on how internal factors endemic to China itself – a concerning lack of economic vitality and transparency – may not just be cyclical but structural. These longer-term factors include China’s aging demographics, rising debt, and geopolitical tensions. Regarding demographics, China’s population is now declining year-over-year for the first time since the era of Chairman Mao’s ‘Great Leap Forward’ in the early 1960s (see chart, right), partially a byproduct of its’ ill-advised ‘one child’ policy.

While a declining demographic is not rare in north Asia – Japan and Korea have similar issues – China’s is over a much larger population base, and thus holds greater implications for the region and for the world. For other emerging nations in Asia, South and Central America, as well as for emerging rival India – who is set to take over as the most-populous country in the world – China’s demographic woes could represent an opportunity to fill the void in supplying global workforce and manufacturing. For China, an aging, shrinking demographic means a greater economic burden at home, as the demands for a larger social safety net may outstrip economic productivity and growth. It may also be negative for China’s consumer spending and housing market, both of which represent significant portions of its overall economy.

Source: Refinitiv Datastream, RiverFront. Data annually as of June 30, 2022. Chart shown for illustrative purposes.

China: Debt Buildup a Growing Concern

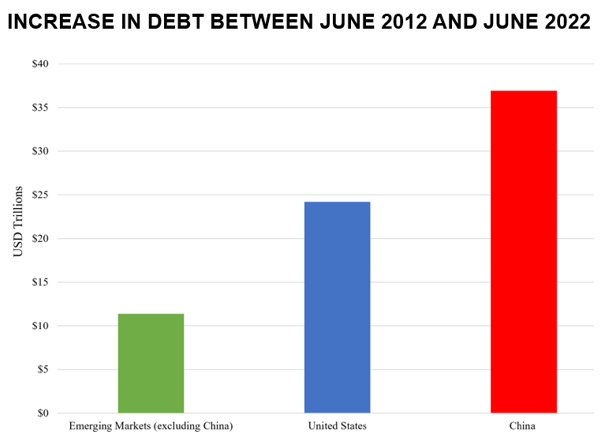

Similar to many other economically powerful nations with aging demographics, China is laden with debt. Including government as well as corporate and household debt, total debt-to-GDP statistics for the Chinese economy are nearly 280% of GDP as of the first quarter of 2023 (source: Bloomberg, 5/8/2023). Concerningly, this debt has grown quickly over the past decade or so, as the Chinese government financed a debt-fueled infrastructure boom. According to analysis from March by China expert Nicholas Borst, China’s total debt has increased more quickly over the past decade than in the US or all other emerging market nations combined (see chart, right).

Chinese advocates will note that, unlike some other similar emerging countries, China can deal with a large debt load as it is largely financed internally, with little China debt held outside the country. Unlike most other nations, however, most of China’s internal debt exists off-balance sheet in a lightly-regulated, decentralized ‘shadow banking’ system that escapes both internal and external scrutiny – harkening back to China’s opacity issues addressed earlier.

China’s vast amounts of opaque debt makes the country particularly vulnerable to banking crises and is likely to lower the structural growth potential of their economy over time. These types of crises can lead to more lasting deflationary effects, which could mute animal spirits and disincentivize growth investment, both from within China as well as externally.

Source: Bank for International Settlements. Chart: “China’s Balance Sheet Challenge”, Nicholas Borst, China Leadership Monitor, Spring 2023, Issue 75, March 1, 2023. Chart shown for illustrative purposes.

Geopolitical Saber-Rattling to Intensify…but No Taiwan Takeover Imminent

While the sour geopolitical rhetoric between the U.S. and China is likely to continue to heat up – nothing takes the minds of a populace off problems at home like a common foe abroad – we do not believe an active military takeover of Taiwan by China is likely any time this decade. Our view is not driven by naïve optimism, but rather by power dynamics. Despite great strides in the last 20 years, China’s military remains, by most accounts, technologically inferior to U.S. and Western forces, especially in crucial areas like naval power, cyber-warfare and nuclear capability.

Experience also plays a role. Unlike the U.S., China has very little actual combat experience since the Cultural Revolution. China has not engaged in a ‘shooting’ war since a brief conflict with Vietnam in 1979. Taiwan is also not as easy a target as it may appear: the country consists of over 100 islands heavily fortified by high-tech missiles, rockets and artillery. China is watching Russia’s progress (or the lack of it) in Ukraine closely. The Ukrainian War has exposed Russia’s army to be much weaker – and the West’s willingness support Ukraine stronger – than was assumed. Russia’s struggles are a sobering reminder to China of the risks of naked aggression towards a Western ally.

Lastly, it is worth noting that, for all the vitriol, the U.S. and China still are highly economically linked. According to a recent Wall Street Journal article referencing an analysis from the Center for Strategic and Internal Studies, China has at least a 70% dependence on more than 400 items, from luxury goods to raw materials, imported from the U.S. and allied countries, at a value of roughly $47 billion annually. China’s economy is also deeply tied to the other Asian countries like Japan and to the Taiwanese semiconductor industry, where the vast majority of the world’s chips are made. An assault on Taiwan would lead to economic chaos at home for China, at a time when improving standards of living at home are the highest priority for the CCP. To sum up, for the foreseeable future, we believe the China/Western ‘war’ will be of the ‘cold’ variety, not ‘hot’.

Investment Implications: Cautious on China, Constructive on the U.S., Inflation to Trend Higher

It likely goes without saying that the U.S. and China are now locked in a downward-spiraling relationship, whether the issues are over the sovereignty of Taiwan, intellectual property theft, or something as seemingly trivial as a ‘weather’ balloon. We have written at length in the past on what we see as an ongoing ‘Cold War 2.0’ dynamic[1]. While there is room for reconciliation in areas of shared interest, such as climate change and trade, our opinion is that the relationship is likely to deteriorate further before improving. We see 3 major takeaways from this deterioration:

- RiverFront Remains Cautious on Direct Investment in China, and Emerging Markets in General.

- Long-Term View: We find it hard to be bullish on emerging markets with China being the single largest country represented. For this reason, we remain less optimistic than many of our peers as it relates to long-term asset returns in emerging markets (EM), though we see pockets of attractive opportunities. We remain constructive on parts of EM (like Southeast Asia, India, Korea and Mexico) that are likely net beneficiaries of China’s tension with the U.S., as well as on regions that are commodity net-exporters.

- Short-Term View: While we continue to be wary of Chinese equities as a long-term strategy, valuations are so inexpensive relative to history and sentiment is so negative that any good news could trigger a near-term counter-trend rally. We would recommend using any sustained rally in Chinese stocks as an opportunity to lighten exposure.

- RiverFront Remains Constructive on U.S.

- Deflation in China: The 2nd largest economy in the world- is a concerning trend for global economic growth. However, a potential offset is that China ‘exporting’ deflation may actually push down the price of certain goods in the near-term, helping the U.S. Federal Reserve and other Western central banks in their fight against inflation. We don’t believe China’s struggles are a reason yet to be bearish on the U.S. market. In our balanced asset allocation portfolios, RiverFront remains overweight U.S. stocks relative to our strategic asset allocation targets.

- Global Inflation May Trend Higher Than in Recent Decades.

- One indirect implication of geopolitical turbulence, in our view, may be higher longer-run global inflation. This could happen as nations move manufacturing capacity closer to their own borders. This reorientation can be costly and may drive the cost of goods sold higher over time. One relevant example is semiconductors, given Taiwan’s global dominance in that industry. These threats have already forced chip buyers to begin building semiconductor fabrication facilities outside China/Taiwan, and escalating tension will only accelerate their exodus.

- This is a topic that informs our longer-term asset allocation views and one we touched on in our 2023 Long-Term Forecasts for Stocks and Bonds piece in March. We maintain core inflation forecasts that are higher than the Consumer Price Index (CPI) average of the last couple of decades.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

[1] RiverFront’s 2023 Long-Term Forecasts

China: Hot Summer, but an Increasingly Cold War

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Dividends are not guaranteed and are subject to change or elimination.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Buying commodities allows for a source of diversification for those sophisticated persons who wish to add this asset class to their portfolios and who are prepared to assume the risks inherent in the commodities market. Any commodity purchase represents a transaction in a non-income-producing asset and is highly speculative. Therefore, commodities should not represent a significant portion of an individual’s portfolio.

Definitions:

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

Interest rate sensitivity is a measure of how much the price of a fixed-income asset will fluctuate as a result of changes in the interest rate environment.

Securities that are more sensitive have greater price fluctuations than those with less sensitivity. This type of sensitivity must be taken into account when selecting a bond or other fixed-income instrument the investor may sell in the secondary market. Interest rate sensitivity affects buying as well as selling.

The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

The Producer Price Index (PPI) measures the average change in sale prices for the entire domestic market of raw goods and services. These goods and services are bought by consumers from their primary producers, bought indirectly from retail sellers, or purchased by producers themselves.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2023 RiverFront Investment Group. All Rights Reserved. ID 3085180

For more news, information, and analysis, visit the ETF Strategist Channel.