While we believe the S&P 500 will have a harder time in the near-term breaking through the various resistance levels (see chart below), the trajectory, breadth and strength of this technical bounce has been encouraging. With the 200-day around 2750, we expect stocks to consolidate in a range between 2600-2800. We think it will take a breakthrough on the US/China trade front to push through this resistance.

Rates: Market Receives A Late Christmas Gift From The Fed This Week

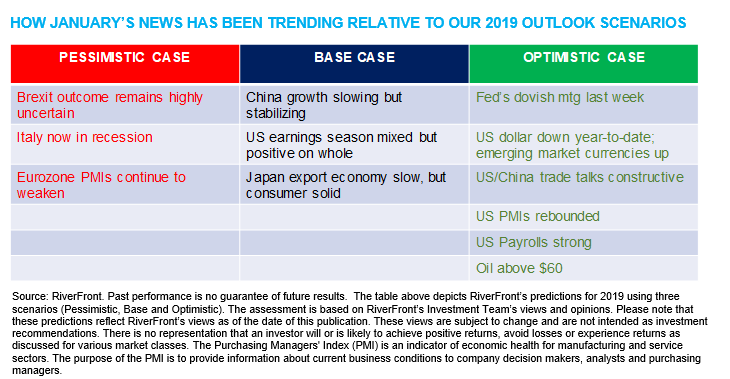

The US Federal Reserve surprised many in their meeting last week by deemphasizing the likelihood of future interest rate hikes. While bond markets had been increasingly anticipating fewer rate hikes since December (see our Weekly View from 1/22/19 for more on this), even ultra-doves were surprised when the Fed inserted language suggesting that they are open to lowering rates in ’19, should a worsening of US or global economic conditions call for it.

This ‘dovish’ (accommodative) turn is an important positive for risk markets, in our opinion. Our first rule of tactical asset allocation is ‘Don’t Fight the Fed’, and it appears that Jay Powell and company are actively trying to ease financial conditions to offset heightened global political or economic risks. Easing financial conditions are generally good for stock markets. We believe a lot of 2018’s major valuation drop was due to the market recalibrating its view towards more restrictive Fed policy going forward. This suggests that stock multiples may be able to elevate from here if a higher probability of an accommodative Fed is repriced. A more dovish Fed has also helped halt the rise in the US dollar, which we believe is particularly positive for emerging market stocks and currencies.

Resolution Of Trade: Us/China ‘Body Language’ Continues To Improve

In our Outlook, we stated that “Despite profound ideological differences that run much deeper than just trade, both sides have something to gain from a face-saving agreement”. Last week witnessed potentially improving ‘body language’ around this all-important trade dynamic. The Chinese Vice-Premier travelled to Washington to meet with top US officials, including US Trade Representative Robert Lighthizer, a noted China skeptic, as well as President Trump. Judging from the tone of POTUS’s tweets about ‘good intent and spirit’ and comments from Lighthizer after the meetings that ‘significant progress was made’, we believe that legitimate attempts are being made by both sides to find a face-saving agreement in ‘19. Treasury Secretary Steve Mnuchin and Lighthizer are expected to travel to China in mid-February for more talks, while President Trump and Chinese President Xi are likely to meet later that month, increasing hopes that the outlines of a deal can be reached before the March 1 trade deadline.

Recession Risk: Us Solid, Asia Stabilizing…Europe Still The Weak Spot

We stated in our Outlook that risk of recession is the central fear for markets. We continue to believe the fear of this is overblown. With last week’s big upside surprise in both nonfarm payrolls and the ISM manufacturing surveys, the US continues to trend towards a low probability of recession in the next 12 months, in our opinion. US earnings season is also shaping up well so far, particularly off of lower expectations since the fall; roughly three-fourths of companies have beaten most recent earnings estimates. Outside of the US, the export-oriented parts of Japan and China continue to struggle with trade uncertainty, but both nations’ consumers and service economies appear in better shape. Our view continues to be that China will stabilize in the 2nd half of this year on the back of fiscal stimulus, and that Japan’s domestic economy and consumer is more stable than many appreciate, due to rising wages, a tight labor market, and strong housing and tourism trends.

Clearly, the softest major economy in the world continues to be Europe, and the continued chaos around Brexit, France’s ‘yellow vest’ protests, and Italian political intrigue is not helping. Despite cheap valuations, we remain underweight European stocks. In particular, we believe markets are not currently focused enough on the tail risk of a no-deal Brexit happening, though we believe in the 11th hour the UK and EU will likely kick the can down the road further than the end of March.