Our work suggests that continued strength in the private sector will drive economic growth in the months to come. One of the most positive drivers of U.S. economic growth has been improvements in real, inflation-adjusted, income growth. For example, real income less transfers just reached an all-time high. That is to say, personal income in the United States has never been higher, even after adjusting for inflation and taking out government transfers. As the rate of inflation has fallen from nearly 9% to closer to 3% according to Consumer Price Index data, wage and salary gains have grown at a higher rate than inflation. This makes sense as inflation can move quickly, yet incomes take more time to change as salaries and wages are renegotiated.

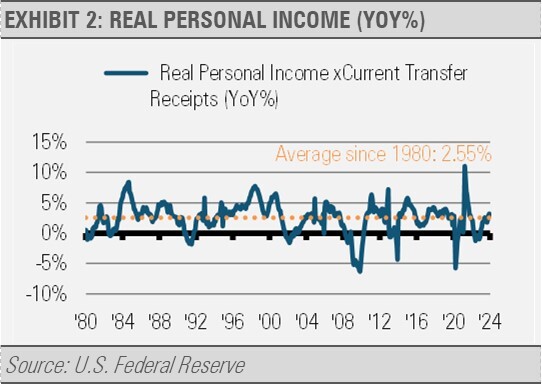

As the following graph shows, inflation-adjusted income growth is finally normalizing on a year-over-year basis after a wild ride since COVID-19 hit. After initially plummeting during the early stages of the pandemic, followed by a spike as the economy reopened and massive government stimulus took effect, and a significant decline once again as inflation eroded income gains, the most recent data shows that real personal income growth has stabilized at close to historical norms for the last several months. As inflation normalizes over time, we expect a smoother path for inflation-adjusted income growth going forward.

A big part of what is driving this persistent wage growth is the small pool of the unemployed that employers can draw from. Accounting for Americans 16 or older, the pool of available labor has never been smaller relative to the total number of nonfarm employees. Note that this measure is different from the unemployment rate, which does not count those not looking for work.

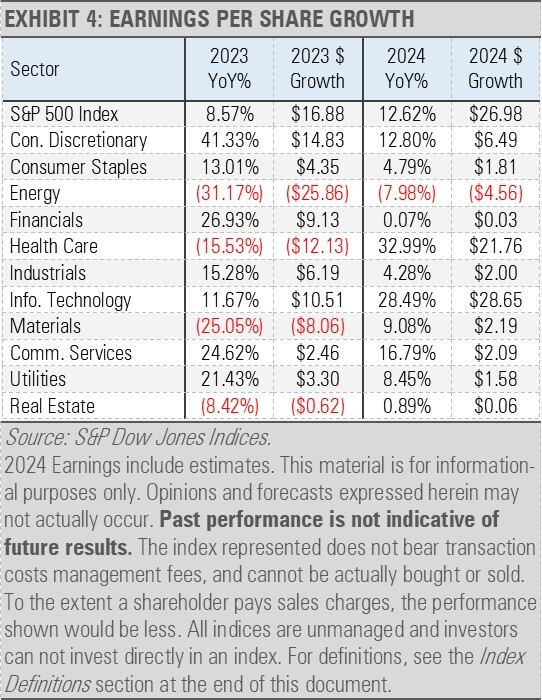

Meanwhile, on the corporate side of the private sector, earnings growth is expected to accelerate and expand across more economic sectors. As the following table illustrates, earnings growth is expected to both accelerate for the Index as a whole as well as broaden to include more sectors.

We may be starting to see these expectations for broader growth in the latest Purchasing Manager Index (PMI) data from S&P Global. According to the February PMI survey, all seven sectors covered in the report showed increases in business activity, up from just four in January. This was the broadest growth seen since May 2022.

INVESTMENT IMPLICATIONS

With a backdrop of continued economic growth, we expect to see broader equity market participation this year as earnings growth prospects expand beyond the narrow group of technology-oriented stocks that led last year’s gains. These areas include our continued emphasis on health care and dividend paying stocks, as well as Master Limited Partnerships (MLPs) and equity option overlay strategies to enhance current income from equities. Meanwhile, our tactical shifts in fixed income have focused on securing current high levels of income by emphasizing defined maturity intermediate duration holdings. Investors overallocated to money markets and T-Bills may witness a swift decline in interest income with falling interest rates. In contrast, those in intermediate duration fixed income may experience more stable income alongside potential capital appreciation as interest rates decrease. We think that diversifying across fixed income maturities can be advantageous today. In short, thoughtful allocation across asset classes will be the key to success in the months ahead in our view.

CASH INDICATOR

The Cash Indicator remains at a historically low level as tight fixed income spreads persist, and equity markets have exhibited some of the lowest volatility we have seen over the last 30 years. Periods of calm do not last forever, and we are prepared for the eventual return to more normal market volatility. With a positive economic backdrop, volatility can create opportunities for disciplined investors.

For more news, information, and analysis, visit the ETF Strategist Channel.