ELECTION IN DECEMBER; LIKELY POSITIVE FOR THE UK BUT WE STILL PREFER OTHER REGIONS

By RiverFront Investment Management

Halloween came and went this past week, and with it another missed chance for the UK to finally move past the horror show known as ‘Brexit’. Up against the October 31 deadline for leaving the UK, Parliament voted in favor of Prime Minister Boris Johnson’s EU-approved exit plan, at least in principal. However, this vote came with strings attached; the PM was forced by Parliament to ask the EU for another extension to debate amendments, something Johnson once said he’d rather ‘be dead in a ditch’ than agree to. In response, the PM put forth a bill for a general election to be held in the UK on December 12, to determine support for Johnson’s government, and by proxy, his exit plan.

In our first ‘Brexiternity’ piece in March, we said Brexit had plenty of plot twists to go before its finale (see our March 19, 2019 Weekly View). Sadly, that proved to be more accurate than we could’ve guessed. At this point global investors are forced to watch the sequel to an awkward tragicomedy that most would’ve preferred to skip the first time. Despite all the dramatic political intrigue of the last few months, our opinion of the probabilities around final outcomes for Brexit actually haven’t changed that much since March. We still believe the following:

- The probability of a catastrophic no-deal ‘Hard Brexit’ continues to drop below 10%. This is a positive for European and global markets. However, as remote as this risk is, the tail risk of a ‘hard Brexit’ does lower the attractiveness of UK assets relative to other international regions, in our opinion.

- The probability of a 2nd referendum vote on the merits of Brexit has also increased. In fact, we now place close to even odds between this outcome and a managed Brexit led by Johnson early next year.

On the face of it, Johnson and the Conservative party are in a solid position, benefiting from deft political maneuvering and likely ‘Brexit fatigue’ among UK and EU policymakers. However, we believe the outcome of the December election is still too close to call; while Johnson’s Conservative Party is polling well (according to recent Wall Street Journal polling), investors would be wise to recall the particularly fallible track record of recent UK polling.

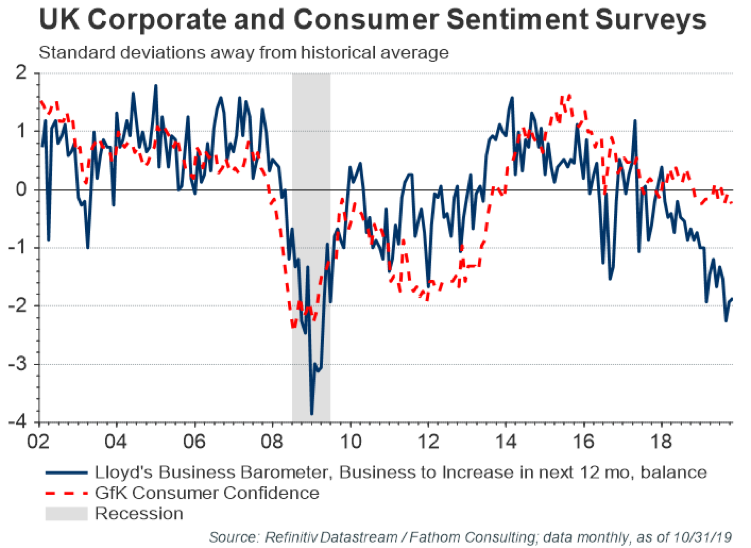

The original Brexit referendum was polling strongly in the Remain camp before the actual vote shocked the world in 2016. In fact, one could argue that this election may be setting up Johnson to fall into the same fatal overconfidence trap of his predecessors David Cameron and Theresa May. In addition, the recent deterioration of both business and consumer sentiment within the UK (see chart below) may hurt the Tories (Conservative Party) at the ballot box.

Shown for illustrative purposes.

WHAT DOES THIS ALL MEAN FOR GLOBAL MARKETS?

From a U.S. stock investor’s perspective, we are not sure that the difference between a managed Brexit sometime early next year and a 2nd referendum is ultimately all that meaningful. A managed Brexit locks Britain into years of negotiating a host of complex bilateral trade deals, including an acrimonious one with the EU, their single largest trading partner. But the positive is that an exit strategy gives the region some much needed clarity, giving businesses better insight into how to manage for the future. We suspect this outcome would be welcomed by markets and by much of the continent, yielding modest further upside for large-cap UK stocks and the British pound from current levels.

If a 2nd referendum is called, we think that UK and European stocks and the pound may perform meaningfully better than in the managed Brexit scenario discussed above, at least initially. However, this initial boost could be eroded over time by two countervailing factors. First, a further delay, by perhaps as much as a year to get the necessary referendum logistics in place, would likely cause further economic damage to a UK and European economy that is already struggling under poor sentiment. Second, it is not altogether clear that in a referendum redux, the result would be any different than 2016’s close vote for ‘Leave’…leaving the UK in the same morass they find themselves in today.

A 2nd referendum followed by a definitive vote to remain in the EU would deliver a resounding blow to Brexit in its entirety – a watershed moment for European unity with powerfully positive implications for the entire region. But many things have to fall in place in order for this happen; investors won’t have any idea whether this is possible for quite some time, making an investment thesis built solely on this prediction quite risky, in our view.

WHAT DOES IT MEAN FOR RIVERFRONT’S VIEW ON GLOBAL MARKETS?

Due to the low probability we give to a hard Brexit, the outlook for the region and the pound appears modestly positive going forward. While this is encouraging, we continue to have a preference for the U.S. over international. Within international, we prefer Japan to European stocks with the ongoing uncertainty of Brexit.

Across our asset allocation portfolios, we remain modestly overweight stocks versus bonds, a positioning that is bolstered by last week’s breakout above key technical resistance levels for both U.S. and developed international stocks, with U.S. large-caps breaking out to fresh all-time highs and developed international breaking up through multi-year technical resistance. We would note that during the strong global stock market gains of the last month, the UK in local currency terms was noticeably a laggard to both U.S. and international indices.

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

It is not possible to invest directly in an index.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

United Kingdom, Consumer Surveys, Lloyds Business Barometer, Business Activity to Increase in the Next 12M, Balance: The Lloyds Business Barometer is a monthly survey of UK businesses, designed to provide an indicator of business performance and economic expectations. UK businesses with a turnover of £1 million and over are interviewed every month about their trading prospects/business activity in the next year (increase, decrease or stay the same) and about their optimism regarding the economy generally compared with three months ago (more optimistic/pessimistic or neither).

United Kingdom, Consumer Surveys, GFK Consumer Confidence Index: The components are calculated as the difference between positive and negative answers to the questions asked. Their value can theoretically vary between minus 100 and plus 100 points. The value zero represents the long term average.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 1002139