By Michael Paciotti, CFA

“On a go-forward basis, we believe that the fixed income market is the most attractive it’s been since 2011. People shouldn’t look at their statements to see what’s happened with their bond portfolios. They need to think forward.” – Jeff Sherman, DoubleLine Capital, Deputy Chief Investment Officer

The past eighteen months have been a bit of a roller coaster ride for investors, with both stocks and bonds declining sharply in 2022 and rebounding in 2023. Throughout this time, the overarching narrative of high inflation and a hawkish Fed who is intent on bringing inflation back to its 2% target has been operating in the backdrop. That much, I don’t think can be questioned. After that it gets quite a bit murkier, starting with the pace at which inflation can be expected to return to 2%. In fact, this macro environment is one with the most divergent set of opinions, by respected investment professionals, that I can ever remember.

From the onset, the Fed suggested that restoring inflation to 2% would be a multi-year endeavor. In my opinion, this has been one of the reasons labor markets remain strong, and in turn inflation remains sticky. That is, the Fed was late to act and not tough enough on inflation for most of its hiking campaign. While the Fed was aggressive, it failed to get in front of the market’s rate hike expectations. When the market expected 50 bps, the Fed delivered 50bps. When the market expected 75 bps, the Fed delivered 75bps. The psychological part of inflation, which is driven by a pattern of more hiring, more wages, more consumption, and more inflation, is only broken by demonstrating credibility. In that regard, they have never gotten in front of the curve by demonstrating a win-at-all-costs attitude.

By the same sense, it is the strength in labor markets fueling the remaining strength in our economy, as well as the belief that inflation can be brought into check without disrupting either. In other words, this is the soft-landing narrative. It has largely fueled the gains that we have seen in US stocks thus far in 2023, in spite of valuations that resemble those at which bull markets typically end rather than where they begin, and an earnings environment which has yet to find solid footing. High valuations, falling earnings, sticky inflation, and high (if not still rising) rates are hardly the recipe for a bull market. But, markets, as they say, are forward-looking discount mechanisms…an oft used wonky phrase that simply means that market gains depend less on where we are and more on whether tomorrow ends up better or worse than expected. The problem with lofty expectations is that they are difficult to overshoot. In this case, markets expect inflation to fall, jobs to remain robust, the economy to remain strong, earnings to improve, and rates to fall. That is, markets expect a near perfect scenario with reality being even better than expected to justify further increases.

While the narrative sounds good, there are some inconsistencies included in that rationale. First, as I wrote about in last quarter’s Market Insights, wage gains in the absence of productivity gains tend to be highly inflationary. If wages and employment remain strong while productivity remains weak, as it has been, why would inflation decline? Additionally, and along that same school of thought, why should the Fed reduce rates in a goldilocks scenario? I would argue that falling inflation will likely require some decline in consumer spending and correspondingly in labor markets. Looking forward, the burden of increased housing and consumer finance costs, along with student loan payments that are restarting and a pool of pandemic money that has largely been exhausted may become a weight too great for the consumer to bear, taking earnings along for the ride. This certainly appears to be more of a headwind than tailwind. In fact, I would argue that earnings, and correspondingly US equities, would likely do better in the short run (but only in the short run) with inflation remaining stuck at 5% rather than returning quickly to 2%. In the former scenario, GDP and nominal earnings would likely remain positive for a time. For inflation to return to 2%, I suspect it will involve some economic pain taking stocks along with it.

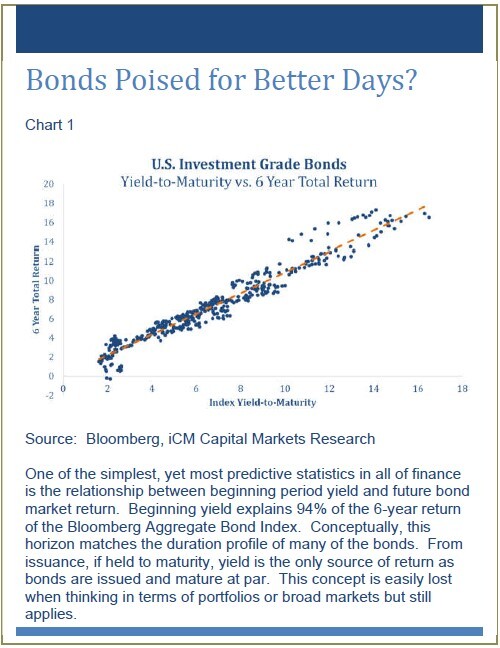

By contrast, the recent past has been rather awful for bonds. In fact, the last 8 years produced an annualized nominal gain of just 0.85% per year for the Bloomberg Aggregate Bond Index, with the last 5 years gaining almost nothing, with an annualized 0.02% gain. When one considers that beginning period yields, which are highly correlated to future returns, began at rock bottom levels, perhaps it shouldn’t be all that surprising that meager returns were the outcome?

Stating this another way, since bond prices and yields vary inversely, bond valuations were high throughout this period and returns were correspondingly low as a result. Given these meager returns and shell shock from steep losses in 2022, it does not surprise me at all that investors seem to have moved on from bonds and are likely overlooking one of the best investment opportunities available to investors today.

Why bonds? Why now?

As I mentioned a moment ago, the case for bonds probably needs to go no further than the high correlation between future bond returns and beginning yield. That alone places broad bond market returns at about 5% per year for the next 6 years. The shorter term, 1-3 years, in my opinion, are likely to be even brighter than that, with years 4-6 falling somewhat below that level. Why the near-term optimism? Well, that’s a bit of a glass half full, half empty story. The short version, as I wrote in last quarter’s Market Insights, is that the Fed must either accept higher inflation or force an economic decline to arrive at 2% inflation. The reason, inflation is no longer the result of constrained supply or for that matter a reduced workforce as we are now employing nearly 10mm more people than prior to COVID. We are simply consuming beyond our productive capacity. The cure will require a necessary decline in consumption to bring the excesses…labor scarcity, demands for wages, and finally inflation…back into balance.

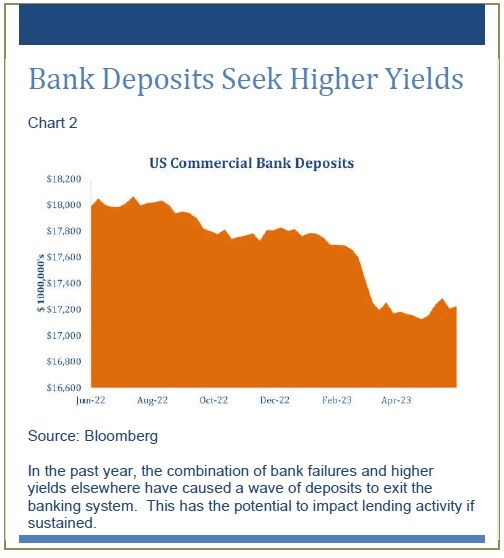

Similarly, and as previously discussed, higher rates in bonds have made yields on treasuries and other safe investments, like money market mutual funds, more attractive than bank deposits by a wide margin with the average money market mutual fund yielding over 4.59% as compared to an average bank deposit rate of 0.52%. The result has been almost $1T leaving the banking channel (Chart 2).

This represents a reduction in deposits of about 4.5%. The implication, as it relates to economic output and inflation, is that deposits are the life blood of lending activity. Without deposits there are no loans. If higher yields in treasuries and money market mutual funds continue to attract deposits away from banks, the outflow can lead to less lending activity and an overall tightening of credit conditions within the banking channel. In our view, the outcome of all of this is that the Fed will eventually need to cut interest rates to restore order. Since we are already seeing cracks (i.e., bank failures), 1-3 years seems like a reasonable assumption for rate cuts to occur.

Why exactly is this an opportunity? Take a plain vanilla 2-year coupon paying treasury bond that currently yields 4.7%. While we wait, if nothing happens and rates stay exactly as they are right now, investors are paid nearly 5% per year on their risk-free treasury investment. If the Fed is required to cut rates, the average, during prior rate cut campaigns, the Fed has reduced rates by about

80% of the beginning target rate over a period of roughly 2 years. The current target rate is 5.0-5.25%. 80% of the lower bound would take rates down by 400bps over 2 years or an average of about 200bps per year. To be conservative let’s estimate using 100-200bps as our range. The duration or interest rate sensitivity of the 2-year treasury bond is 1.88 years, meaning that for every 100bps rise or fall in rates the bond will gain or lose 1.88% in addition to its coupon. In any year where rates fall by 100-200 basis points, the return on this 2-year treasury would be 6.5% to 8.4%. By contrast, if inflation is more of an issue requiring the same 100-200bps of rate hikes, the return would be 0.9% to 2.8%. When a reasonable assumption of downside risk still results in a positive return and your upside is high single digits, this presents an excellent opportunity in just one segment of the bond market.

Before I get to other, greater opportunities within the broader bond market, allow me to address a common counter argument. The common counter argument to bonds being the best positioning for interest rate cuts is that stocks will soar if the Fed cuts rates. Allow me to debunk that claim. It is true, that stocks are long duration assets that generally benefit from falling discount rates, holding all else constant. This was the case post financial crisis. Something happens, COVID for example, the Fed as the lender of last resort provides liquidity, business happens to not be disrupted in any meaningful way, and future earnings are now discounted at a lower rate. For those that are mathematically inclined, if you discount a future value by a lower rate, the present value increases. Therefore, the counter argument to owning bonds is that one should own stocks because just like last time, stocks will go up if the Fed cuts rates. Unfortunately, those making this claim are overlooking the “all else constant” part of that statement. Earnings, and the required rate of return assigned to those earnings need to remain intact to create a similar response from equities.

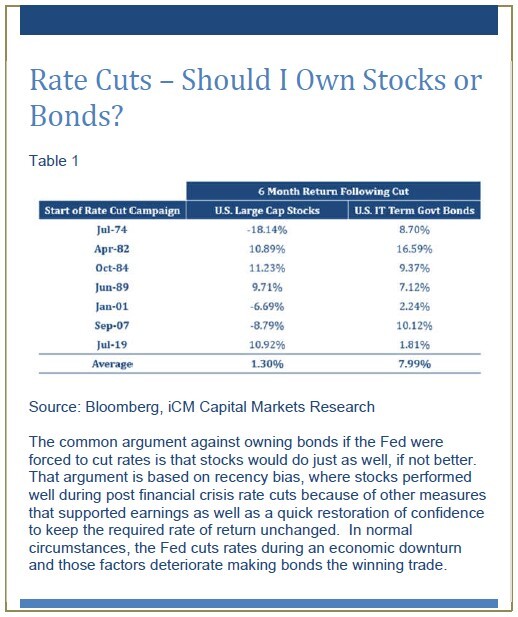

When the Fed cuts rates it is typically because it foresees some sort of economic disruption…rising unemployment, declining economic activity or both. This is generally not good for earnings, which would have likely been the case during COVID if not for the many stimulus programs. If earnings fall, or for that matter simply remain intact, but investors, being less certain about the stability of those earnings, assign a higher required rate of return to those earnings, valuations get squeezed and returns will be reduced (if not turn negative). This is illustrated in Table 1.

Here we can see the performance of stocks vs. bonds 6 months following the initial Fed rate cut. Overall, stocks tend to trail bonds by a rather wide margin. Looking at the details, stocks managed to outperform in 3 of the 7 environments with the average margin of victory being about 4.5%, skewed heavily by 2019 where stocks outperformed by over 9%. The other two victories were narrower, 1.86% and 2.59%s respectively.

Conversely, when bonds win, the average margin of victory was over 15%. Two of the four periods where bonds won were by nearly 20% margins, with the other two producing a 7% average victory for bonds. The moral, stocks typically do not outperform during rate cut cycles because earnings normally deteriorate, or fear of economic disruption causes investors to assign a higher required rate of return to the earnings stream. Even when bonds lose, the margin is typically small and the risk is much lower.

The Best Deal in Town

While the simple, yet real life example I just offered using the 2-year treasury was pretty compelling, opportunities within bonds extend well beyond that to mortgage-backed securities, investment grade credit, emerging markets local currency bonds, municipal bonds, and more. All offer varying but compelling valuations and entry points for investors to receive solid risk adjusted returns over the foreseeable future.

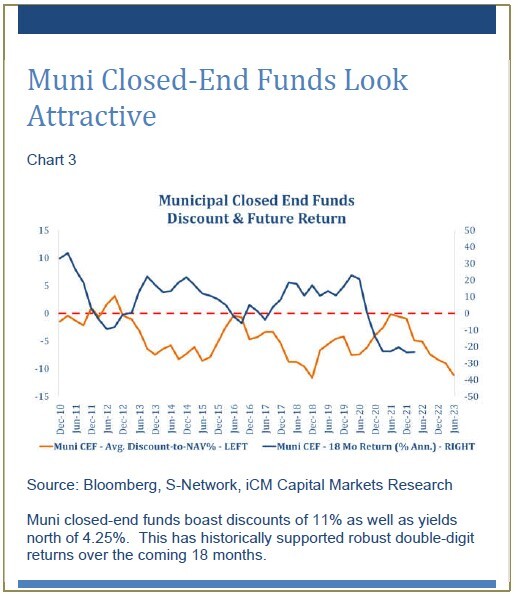

Perhaps the best opportunity that we see today extends beyond that list to municipal closed-end funds. For those that are not familiar, closed-end funds are diversified investment vehicles that look and act much like traditional mutual funds or exchange traded funds. The difference comes down to pricing.

Because closed-end funds are brought to market with a fixed supply of shares, supply and demand for the closed-end fund can push their price above or below the actual dollar amount a closed-end fund manager manages. This is called trading at a premium or discount to net asset value(NAV). The opportunity arises when shares trade below NAV. In this instance, one can essentially acquire $1 worth of assets and pay less than $1 dollar for it. Since these pricing anomalies are normally temporary, when they correct back to NAV, this creates an additional return opportunity. That being the discount moving back toward NAV on top of whatever return the asset class provides. The other positive side effect of buying discount closed- end funds is that the discount tends to amplify the yield. So, you can get this extra layer of return from the discount closing and the added yield on top of any market gains.

Today, the average discount on fixed income closed-end funds is nearly 9% on top of an average yield of more than 7.5%. When combined with normal market gains, the potential exists for fixed income closed-end funds to deliver well into double digit gains over that same 1-3 year horizon we spoke of. Chart 3 shows the current discount to NAV of the municipal bond closed-end fund universe compared to the next 18-month return, basically addressing the question of whether or not large discounts contribute to good return opportunities. As seen in the chart, since 2010 there have been two periods prior to this one where discounts even approached, much less exceeded, double digits like we have today. During each of those periods returns for municipal bond closed end funds averaged just over 15% for the next 18 months.

Summary

Over the past few years, the bloom has certainly come off the fixed income rose. Bonds have provided meager, if not barely positive returns, while stocks have grown by double digits. It’s therefore not surprising then that investors appear to be overlooking the opportunity that exists in the once popular asset. Beginning period yields indicate that medium-term returns should approach, if not exceed, 5%. When combined with a macro narrative that points to a necessary decline in economic activity to bring inflation into check, the case can be made that it is more likely than not that the Fed will need to cut interest rates in the not-too-distant future, creating even greater returns in this stable asset.

Many have argued that in such a scenario, stocks will likely do better, as they did during the post financial crisis and post-COVID rate cuts. The data seems to suggest otherwise, with bonds outperforming stocks by a margin of more than 6% in the 6 months immediately following the first rate cut. While there are many good opportunities within fixed income space, short-term treasuries, mortgages, and emerging markets local currency debt to name a few, perhaps our favorite is Muni closed end funds. Given the attractive combination of double-digit discounts and elevated yields, this would seem to suggest bright skies ahead, perhaps double-digit gains, for Muni closed-end funds.

While investors remain focused on stocks, high priced growth stocks in particular, bonds might be the forgotten asset of incredible value. Thank you as always for your continued trust and confidence.

For news, information, and analysis, visit the ETF Strategist Channel.

Market Insights is intended solely to report on various investment views held by Integrated Capital Management, an institutional research and asset management firm, is distributed for informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. Integrated Capital Management does not have any obligation to provide revised opinions in the event of changed circumstances. We believe the information provided here is reliable but should not be assumed to be accurate or complete. References to specific securities, asset classes and financial markets are for illustrative purposes only and do not constitute a solicitation, offer or recommendation to purchase or sell a security. Past performance is no guarantee of future results. All investment strategies and investments involve risk of loss and nothing within this report should be construed as a guarantee of any specific outcome or profit. Investors should make their own investment decisions based on their specific investment objectives and financial circumstances and are encouraged to seek professional advice before making any decisions. Index performance does not reflect the deduction of any fees and expenses, and if deducted, performance would be reduced. Indexes are unmanaged and investors are not able to invest directly into any index. (MMXXIII)