By Komson Silapachai, Partner, Research & Portfolio Strategy

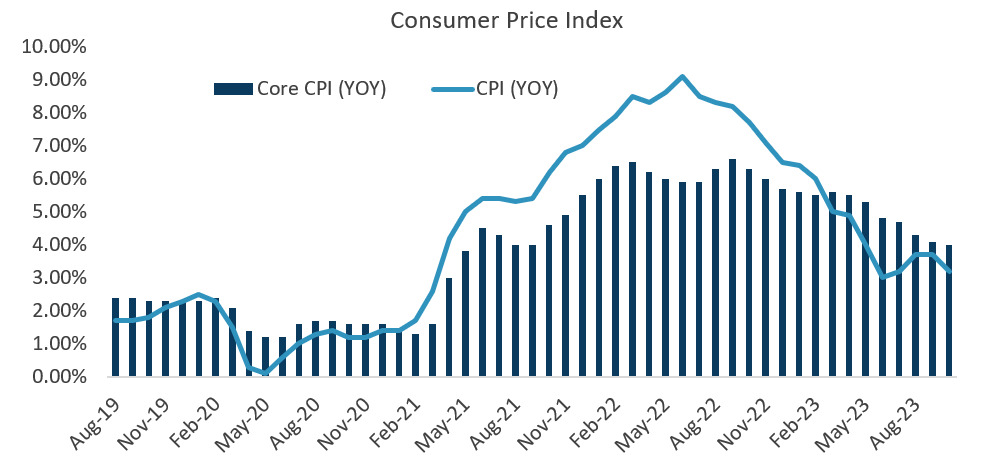

October’s inflation prints showed signs of cooling prices. Core CPI rose by only 0.23%, lower than the Street’s expectations of a 0.3% increase. The annual rate of core CPI now stands at 4.0%, down from 4.1% in September. Notably, auto-related categories experienced declining prices despite the recent auto strikes. Core services was softer across the board, with owners’ equivalent rent decelerating after a sharp increase in September. CPI including food and energy was unchanged in October and up 3.2% YoY. Producer prices also surprised to the downside, which added to the slowing inflation narrative.

Source: Sage, Bloomberg

Retail sales were not as bad as expected. Retail sales were not as bad as feared, falling 0.1% for the month versus Street forecasts of down -0.3%. Gasoline, auto sales, and building materials were the main negative contributors, while core retail sales grew by 0.2%. While the economy is showing signs of cooling, the pace has been slower than expected heading into the holidays.

Interest rates fell sharply in response to a downside surprise in US CPI data, and the yield curve shifted lower across the board. The 2Y treasury yield fell 16 basis points, while the 10Y treasury yield fell 21 basis points. Credit spreads compressed alongside the rally in risk assets, with IG corporate spreads tightening by 5 basis points to 1.17%. High yield spreads remained unchanged last week. The Barclays Aggregate Index turned positive on the year, with a +0.38% total return.

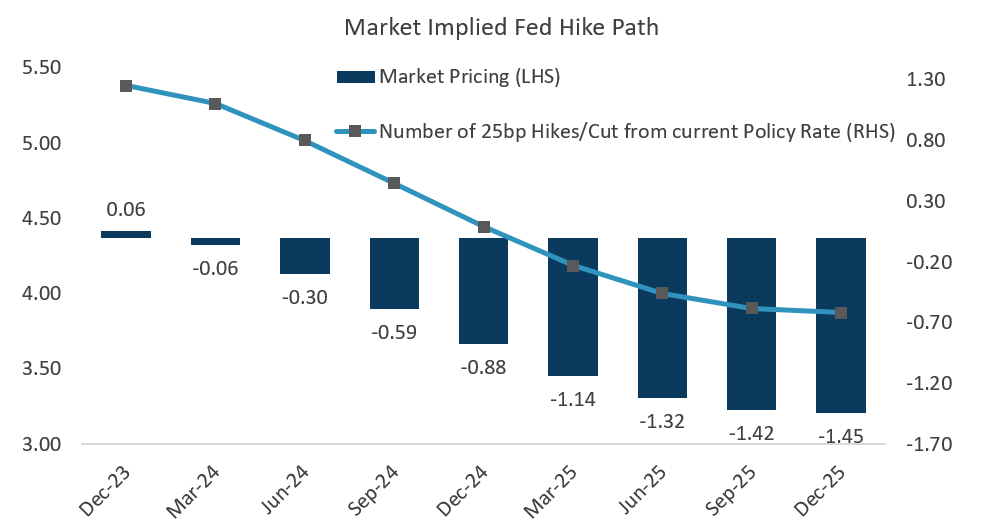

Rate cuts in early 2024? Coupled with the indication from the FOMC that the Fed could be done with hikes, the data above supports the notion that the last rate hike was in July 2023, and cuts could come sooner. Interest rate markets priced in a 35% probability of a rate cut in March 2024 and four rate cuts total next year. We see rate cuts in the first half of 2024 as unlikely, as inflation will probably remain above the target rate of 2% for much of next year. The cost of being “ahead of the curve” and cutting rates too early, risking a reacceleration in inflation, would outweigh the potential benefits. We believe the FOMC will tolerate weaker data for longer, which should result in rate cuts beginning later than the market expects.

Source: Sage, Bloomberg

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.